CANADA ECONOMICS

Global Affairs Canada. May 14, 2017. Minister of Foreign Affairs and Minister of National Defence to visit Washington, D.C.

Ottawa, Ontario - Canada and the United States enjoy one of the closest, most peaceful and mutually beneficial relationships of any two countries in the world.

The Honourable Chrystia Freeland, Minister of Foreign Affairs, and the Honourable Harjit S. Sajjan, Minister of National Defence, will visit Washington, D.C., on May 15 and 16, 2017. Minister Freeland and Minister Sajjan will have meetings with Rex Tillerson, Secretary of State, James Mattis, Secretary of Defence, and Wilbur Ross, Secretary of Commerce, as well as with important stakeholders, to discuss Canadian priorities and cooperation between the two countries.

StatCan. 2017-05-15. Supply and disposition of refined petroleum products, February 2017

Refinery receipts of crude oil

7.8 million cubic metres, February 2017

7.1% increase (12-month change)

Refinery production

8.7 million cubic metres, February 2017

-0.6% decrease (12-month change)

Refinery domestic sales

7.7 million cubic metres, February 2017

-4.7% decrease (12-month change)

Source(s): CANSIM table 134-0004

Refinery receipts increase

Canadian refineries received 7.8 million cubic metres of crude oil in February, up 7.1% from the same month in 2016.

Chart 1 Chart 1: Refinery receipts of crude oil and equivalent products

Refinery receipts of crude oil and equivalent products

Domestic crude oil receipts decreased 3.9% compared with February 2016 to 5.0 million cubic metres.

Crude oil imports increased 34.9% from February 2016 to 2.8 million cubic metres. Imports represented 35.6% of total crude oil received at refineries in Canada.

Crude oil inventories held at refineries totalled 4.2 million cubic metres in February, up 12.4% compared with the same month the previous year.

Crude oil used in refinery production up

Total crude oil and equivalent products used in refinery production increased 1.4% from February 2016 to 7.5 million cubic metres. The increase was entirely attributable to refineries' greater use of synthetic crude oil, up 9.7% compared to February 2016. The increased use of synthetic crude oil in refinery production was partially offset by the lower use of crude bitumen (-10.6%), conventional light crude oil (-1.0%) and heavy crude oil (-2.7%).

Chart 2 Chart 2: Crude oil used in refinery production

Crude oil used in refinery production

Refinery production and sales down

Refinery production decreased 0.6% to 8.7 million cubic metres in February compared with the same month last year.

Chart 3 Chart 3: Domestic sales of refined petroleum products, by product

Domestic sales of refined petroleum products, by product

Domestic sales of refined petroleum products decreased 4.7% to 7.7 million cubic metres. Sales of motor gasoline were down 2.8%, while sales of diesel fuel oil were up 2.0% compared with February 2016.

Imports down, exports up

Canada imported 0.8 million cubic metres of refined petroleum products in February, down 15.3% from the same month in 2016.

During the same period, exports of refined petroleum products increased 0.6% to 2.2 million cubic metres.

Inventories decrease

Closing inventories of refined petroleum products held at refineries decreased 2.0% year over year to 7.8 million cubic metres in February.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170515/dq170515a-eng.pdf

StatCan. 2017-05-15. New motor vehicle sales, March 2017

New motor vehicle sales data for Canada and the provinces are now available for March.

The New Motor Vehicle Sales Survey collects data on monthly sales (in dollars and units) of new motor vehicles in Canada, by type of vehicle and by country or region of manufacture.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170515/dq170515c-eng.pdf

________________

REAL STATE - HOUSING BURBLE

The Globe and Mail. The Canadian Press. May 15, 2017. REAL ESTATE. Canadian home sales cool in April; GTA leads decline

OTTAWA — The Canadian Real Estate Association says home sales cooled in April after setting a record the previous month.

The industry trade group says home sales over the MLS system fell 1.7 per cent last month compared with March.

The decline was led by the Greater Toronto Area, and sales were down in nearly two-thirds of all local markets across the country.

Compared with a year ago, sales in April were down 7.5 per cent across Canada.

The actual average price for a home sold last month was $559,317, up 10.4 per cent from a year ago, boosted by the Greater Vancouver and Greater Toronto markets.

The Globe and Mail. May 12, 2017. Realtors see buyers pull back in Toronto market

RACHELLE YOUNGLAI

Over the past few weeks, realtors have witnessed some unusual activity in Toronto’s fiery housing market: Buyers are hesitating.

Properties are listed for longer than a week. Two to three offers are being made on a house instead of 10 to 15. Homeowners are agreeing to conditional offers. Some sellers are not getting the prices they expected and are yanking their properties off the market to relist them at higher prices.

“Sometimes properties are not selling right away,” said Elli Davis, a realtor with Royal LePage, who has worked in Toronto real estate for more than three decades. “Some are still a week. But some of them now I am seeing over 14 days, 20 days.”

“I would not say this market has fallen apart or anything like that,” she said. “I think it is just normalizing and levelling off.”

Realtors in the Greater Toronto Area started to notice a shift in consumer behaviour earlier this year, around the time Ontario’s Liberal government began talking about ways to cool Toronto’s housing market. The province brought in a tax of 15 per cent on foreign buyers in the area on April 20 to stop speculators who are believed to be snapping up houses, and unveiled other measures designed to make homes more affordable.

It is too early to tell whether the foreign-buyer tax will dampen enthusiasm in the Toronto region. But for now, some people are waiting to see whether real estate prices will fall.

“Some buyers are skeptical or on the fence of buying because of the recent changes that the Liberals made,” said Raj Hunjan, a sales representative with Century 21, who sells homes in the Toronto area. “They are waiting to see what kind of evolves around it.”

For years, policy makers have warned that the housing markets in Vancouver and Toronto were overheated and could cause people to take on more debt than they can manage. Several housing policies rolled out to slow the market, including stricter mortgage rules the federal government brought in last October, appeared to have little effect.

As Ontario’s government threatened to act earlier this year, more homeowners decided to put their properties up for sale.

The number of new listings jumped by a third over April, 2016, according to the Toronto Real Estate Board, flooding the market with fresh properties and giving buyers more choice.

“You have a lot more inventory,” Mr. Hunjan said. “You are starting to see a lot less of those bidding wars. Last year, stuff was selling regardless of what season you were in.”

Total sales for April dropped 3 per cent from the previous year, with the biggest declines just outside of the City of Toronto, according to the Toronto real estate board. Sales fell in detached houses, semi-detached houses and townhouses, and increased in condos.

Real estate prices continued to climb, however, with the average price of a detached house in the city of Toronto jumping 25 per cent to $1.58-million in April.

Realtors agree that prices are not going to drop, even if their clients believe otherwise.

“They think they can time the market if it slows down a bit,” said Karen Law, a sales representative with Keller Williams Referred Urban Realty, who specializes in Toronto. “There is some speculation that the market might slow down, they might be able to get in at a slightly better price.”

Ryan Roberts, who has been selling residential property for a decade in Toronto, said he is constantly reminding his clients that prices are not going to fall, because not enough houses are available to meet demand.

“They are all saying, ‘We are hearing the market is going to drop.’ No professional realtor feels that there is anything that is going to impact a seller’s market. It is still going to charge up,” said Mr. Roberts, who is with Bosley Real Estate.

“I have no question in my mind that if there is a slowdown right now, it will be very short. It won’t be dissimilar to Vancouver,” he said.

The Vancouver region got its own foreign-buyer tax last August, which helped push sales volumes to a multiyear low in January and dragged down the average price of a detached house in Greater Vancouver, although prices for other types of housing, such as condos and townhouses, continued to climb.

But sales activity has started to rebound, with the number of transactions reaching 3,553 in April compared with 1,523 in January, according to the Real Estate Board of Greater Vancouver. Although that is still down from a record high of 5,173 transactions in March, 2016.

“The pile-on of the two announcements dented consumer sentiment,” said Gregory Klump, chief economist with the Canadian Real Estate Association, referring to Vancouver’s foreign-buyer tax and the changes to federal mortgage rules.

“There was very much a stalemate going on,” he said. “People believed the hype that the housing market was going to crash and so buyers were giving lowball offers to sellers who were in no distress to sell, and they said: ‘Nah, I am not taking your lowball offer.’ And that would have been a bit of a stalemate. That logjam is beginning to break, it would appear.”

Of course, no one knows whether the Vancouver market will resume its frenetic pace or whether Toronto’s real estate sector will turn. April could have been a lull. Previously, when Ottawa tried to calm the housing sector by slashing maximum mortgage amortization periods in 2012, there was a period of weaker sales before it picked up again. “Typically, in the aftermath of tighter federal regulations, what we have seen is that after six months, the market begins to recover,” Mr. Klump said.

What is known is that signs of a slowdown are also appearing in nearby Hamilton, one of the cities in the Golden Horseshoe area covered by the foreign-buyers tax. Hamilton has experienced a boom in real estate prices as buyers have fled Toronto in search of cheaper homes.

“We are still seeing purchases go through,” said Brian Hogben, a mortgage broker in Hamilton. “We are still seeing bidding wars. But we are not seeing as many.

“When I am talking to my realtors, instead of having 10 to 12 offers on a property, they are only getting two or three. So, there is a bit of a slowdown right now.”

The Hamilton broker also said realtors are now accepting conditional offers on properties. “It used to always be cash, right? You didn’t win the deal unless you paid cash,” Mr. Hogben said.

The Globe and Mail. May 12, 2017. Economists change tune on foreign-buyers tax in Ontario

JUSTIN GIOVANNETTI

TORONTO — The Ontario government moved ahead with a foreign-buyers tax after earning the approval of Canada’s top bank economists in private meetings that officials say were critical to shaping a new housing policy.

The advice received at the closed-door meetings between Ontario Finance Minister Charles Sousa and economists representing Canada’s major banks and other industry stakeholders shifted in the six months before the April announcement, according to government and industry insiders who spoke with The Globe and Mail. The gathered panel moved from near unanimous opposition to a tax on foreign buyers in the Greater Toronto Area to virtually universal support.

Premier Kathleen Wynne and Mr. Sousa told government officials that they needed the approval of the major banks to pursue the tax, according to senior officials, who asked not to be identified because they are not cleared to speak with reporters.

Mr. Sousa sat down with the economists in confidential conferences in early October, 2016, and late March, 2017. Along with the banks were economists representing private think tanks such as the Conference Board. He also held a number of meetings with developers and members of the real estate industry during the six-month span. The get-togethers coincided with a near-record increase in real estate prices and a heated public debate on housing affordability.

Between October and the following spring, real estate sprang to the top of the political agenda in Ontario. As officials debated what to do, prices in Toronto’s housing market continued a rapid upsurge that started in March, 2016, and showed no signs of abating. In neighbourhoods throughout the city, prospective homeowners were getting into bidding wars that sent prices ever higher and tenants were reporting unusually harsh rent increases.

In early October, Mr. Sousa assembled private-sector economists to discuss a budget update he would deliver during the third week of November. At the top of his mind was the near-record prices of homes from Niagara to Peterborough, a region centred on Toronto and known as the Greater Golden Horseshoe. Only three months earlier, British Columbia had levied a tax on foreign buyers in Vancouver and Mr. Sousa was weighing whether to follow B.C.’s lead.

The advice that day was muddled when it came to why prices were so high, but it was nearly unanimous when it came to a foreign-buyers tax: Don’t do it.

“None of them, not a one, said we should follow suit. They were all concerned about the consequences and noted that the Vancouver market was tapering down as the tax came in,” Mr. Sousa told the Globe and Mail. “Then those economists who said, ‘Don’t do this, don’t do this,’ all of a sudden they were telling us to do it. They suddenly changed their tune.”

Within six months, a nearly identical group of private-sector economists reversed itself and supported a tax. That change of opinion was considered essential by Ms. Wynne to go ahead with the foreign-buyers tax, dubbed the Non-Resident Speculation Tax.

The tax became the centrepiece of a plan in response to the province’s red-hot housing market that was released on April 20. Along with the tax, the government’s strategy included 16 measures meant to increase the supply of homes, reduce demand and strengthen ethics in a real estate industry struggling with questionable sales practices.

The last measure added to the 16-point plan before its release was the foreign-buyers tax, several officials confirmed.

“We were going to have a plan, but there was just a question of whether the tax was going to be part of it. For months we had this space left empty at the top of the plan that said either ‘Yes or no’ to a tax,” said a senior government official.

While the foreign-buyers tax came last, one of the most controversial planks of the government’s strategy came first: re-establishing full rent control.

Ending a rule that allowed rentals built after 1991 to be exempt from rent control first came up among senior officials in the summer of 2016 and worked its way through the province’s finance and housing ministries by the end of that year. The measure was adopted by cabinet in February.

Beyond rent control, the Finance Minister’s biggest concern in late 2016 was whether speculation was tipping the market into the red-hot growth it was experiencing. He was concerned that speculators were crowding out families.

While economists, both in the private sector and government, were split on their verdict about speculation, views started to change in March when the Toronto Real Estate Board reported that prices had soared by 27.7 per cent the previous month compared with the last year. The increase was even higher the following month. The data, showing skyrocketing prices, marked “a turning point” for the government another senior official said.

In early April, Bank of Canada Governor Stephen Poloz said the increases were being driven by something more than typical home buyers, suggesting that speculators were at play in the market. Mr. Sousa’s public statements about speculators grew louder and he soon began calling them property scalpers.

Only three weeks before the government’s housing plan was unveiled in April, Mr. Sousa got the endorsement from a room of bank economists to go forward with a tax on foreign buyers. TD Bank chief economist Beata Caranci wrote a report on March 20 that several officials said was effective at swaying opinions around that table. Ms. Caranci was not at the subsequent meeting.

“We were getting the data and it was like a Rubik’s Cube, all the sides were lining up. That’s when we realized that we had something more material at hand,” she told The Globe of the price increase in Toronto. “There was exuberance building that was divorced from fundamentals. I don’t know who on the street would forecast 30-per-cent growth.”

The position adopted in support of a foreign-buyers tax echoed one long maintained by Bank of Montreal chief economist Douglas Porter who had called on the government to slow the market and not slam on the brakes.

“The wait was a little long, but better late than never,” he told The Globe. Mr. Porter was at the October meeting, but he sent a lieutenant to the March gathering. “I suspect many economists realized that something needed to be done.”

With foreign buyers making up a small part of the Toronto market, estimated at between 3 per cent and 8 per cent of sales, the tax’s impact is expected to be more psychological than direct, he added. The tax is expected to communicate that the government is concerned enough about the market to take action when needed.

The tax lined up with Ms. Wynne and Mr. Sousa’s thinking on the housing market and worry that more drastic action could cause house values to plummet. “We knew that if we pulled on one thread it would pull something else. The Premier was adamant, she didn’t want us to burst a bubble, only to bend the curve on prices,” another senior official told The Globe.

The Globe and Mail. May 14, 2017. Home Capital risk contained, but ‘unsustainable’ housing market a primary concern: Poloz

ERIC REGULY - EUROPEAN BUREAU CHIEF

BARI, ITALY — Breaking his silence on Home Capital, Bank of Canada Governor Stephen Poloz said the mortgage lender’s problems are contained but the sharp rise in house prices and their potential effects on the financial system have emerged as a primary concern.

In a weekend interview on the sidelines of the Group of Seven meeting of finance ministers and central bankers in Bari, Italy, Mr. Poloz said the Bank of Canada sees no signs that Home Capital’s rapid deterioration has triggered contagion.

“We’d be looking for signs that there are problems with the [financial] system as opposed to preoccupying ourselves with individual institutions,” he said. “The question would be: What caused this? Is it something unique to the institution itself, or is it something in the system? … I think this situation [Home Capital] is pretty clear on that; it’s idiosyncratic.”

Investigation: Home Capital mortgage lender was mere hours away from collapse

At the Bari G7, Finance Minister Bill Morneau had a similar message, concluding that Home Capital’s problems were not spreading to the financial system as a whole.

The Globe and Mail reported on Saturday that Home Capital came close to collapse in late April, as a run on deposits and vanishing capital threatened to close the lender’s doors. The mortgage company was apparently spared from oblivion by an emergency, $2-billion private line of credit offered under punitive terms, including a 10-per-cent interest rate.

Mr. Poloz said that the Office of the Superintendent of Financial Institutions and the Canada Deposit Insurance Corp. are closely monitoring Home Capital while the Bank of Canada monitors the overall health of the financial system.

He would not say whether the Bank of Canada came close to offering emergency liquidity assistance (ELA) – a collateralized loan of last resort – to Home Capital or whether it might do so if Home Capital’s private-sector funding proves insufficient to stabilize the company. “I won’t comment on what our conversations have been [though] the Bank of Canada is always ready to use its tools.”

He gave no hint that Home Capital might still request ELA, noting that “the private sector was able to create a solution for this firm, so that’s good – the system in action.”

Some analysts had encouraged the Bank of Canada to issue a statement to counter any concerns that Home Capital might be the start of a wider mortgage problem. Ben Tal, deputy chief economist at Canadian Imperial Bank of Commerce, last week said “it’s clear that the Home Capital situation is not the ultimate test of Canadian housing. The situation is contained and the quality of the assets is solid. Any reference to that reality from the [central] bank will carry a lot of weight.”

Mr. Poloz has in the recent past called the soaring property values in some Canadian cities, notably Vancouver and Toronto, “unsustainable” and said so again in Bari. But he did not predict a property collapse even though prices in Toronto climbed by 25 per cent or more in the last year and speculation was no doubt playing a role in the galloping increases.

Unsustainable, he said, “does not mean we’re going to get a major retracement in prices. … It just means that they can’t continue to go up at these rates. Often, when you have a truly unsustainable housing market, you will see very rapid price increases [and] very rapid credit growth. … But we don’t see that in the credit side, so I do think a significant amount of this that is fundamental, but layered on top, is a speculative element.”

Still, the Bank of Canada is concerned that a shock to the Canadian economy, such as a 2008-style deep recession or a steep rise in unemployment, could stress the financial system if it meant that over-leveraged Canadians suddenly would have trouble servicing their mortgage debt.

“Well, that’s a topic quite high on our list, in fact it’s at the top of our list at the FSR,” he said, referring to the bank’s twice-a-year Financial System Review, which tests the system’s ability to absorb shocks. “The bank is on record for two or three years, talking about increased urgency around that risk to the system.”

The bank’s FRS statement from December noted that the ratio of debt to household disposable income climbed to almost 170 per cent last year from about 150 per cent in the latter part of the last decade.

Mr. Poloz said, “People who are unable to service their mortgages would put the banks’ books at risk and give rise to a more manifested risk to the financial system.”

But he pronounced the system strong, noting that the banking system carries high liquidity and capital levels and that mortgage rules for home buyers, which were already robust, are being tightened up. For instance, home buyers need at least a 20-per-cent down payment to obtain an uninsured mortgage. “The kinds of scenarios and tests that we run suggest we have a very resilient system,” he said.

REUTERS. May 15, 2017. Canada home resales fall in April as market cooling begins: CREA

By Andrea Hopkins

OTTAWA (Reuters) - Resales of Canadian homes fell 1.7 percent in April from record highs in March as new listings spiked, the Canadian Real Estate Association said on Monday in a report that suggested a long-awaited slowdown in housing had begun.

The industry group said actual sales, not seasonally adjusted, were down 7.5 percent from April 2016, while home prices surged 19.8 percent from a year ago, according to the group's home price index.

Sales declined in close to 70 percent of markets, led by Toronto, where skyrocketing home prices had sparked fears of a bubble and prompted the provincial government to introduce new measures in April to rein in the market.

“Home buyers and sellers both reacted to the recent Ontario government policy announcement aimed at cooling housing markets in and around Toronto,” CREA Chief Economist Gregory Klump said in a statement.

He said the number of new listings spiked to record levels in and around Toronto and far-flung suburbs, where a severe shortage of listings had helped drive prices higher.

"It suggests these housing markets have started to cool," Klump said.

New listings rose 36 percent in the Greater Toronto Area and were up 10 percent nationally, the report showed, helping to ease the national sales-to-new listings ratio to 60.1 percent in April from 67.3 percent in March.

A ratio between 40 and 60 percent is considered balanced, and Canada's housing market had been firmly in seller's market territory for months.

There were 4.2 months of inventory at the end of April, up slightly from 4.1 months in March, CREA said.

Sales rose in Vancouver, which has mostly cooled since a foreign buyers tax was introduced last August, but remained down from record levels before the tax.

While sales slowed, prices continued to rise at a double-digit pace, according to the group's Home Price Index, which is used to ease the distortion caused by the expensive Toronto and Vancouver markets compared to the rest of the country.

The actual national average price was up 10.4 percent at C$559,317 ($410,749) compared to a year earlier, the report showed.

(Reporting by Andrea Hopkins in Ottawa and Fergal Smith in Toronto Editing by Bernadette Baum)

BLOOMBERG. 2017 M05 14. Home Capital’s ‘Unique’ Woes Are Contained, Poloz Says

by Gerrit De Vynck and Kim Chipman

- Central banker says the lender’s situation ‘idiosyncratic’

- High housing prices remain concerns, he tells Globe and Mail

Bank of Canada Governor Stephen Poloz said Home Capital Group Inc.’s troubles are unique to the mortgage lender and there’s no evidence they’re spreading to other parts of the country’s financial system.

Home Capital’s situation is “idiosyncratic,” Poloz told the Globe & Mail in a weekend interview in Italy. His comments echoed Canadian Finance Minister Bill Morneau’s remarks in the newspaper a day earlier. Morneau said Home Capital’s risk has been contained and that financial checks and balances are working as they should. The mortgage lender said Monday that deposit levels have stabilized.

“The question would be: what caused this?” Poloz said. “Is it something unique to the institution itself or is it something in the system. I think this situation is pretty clear on that, it’s idiosyncratic.”

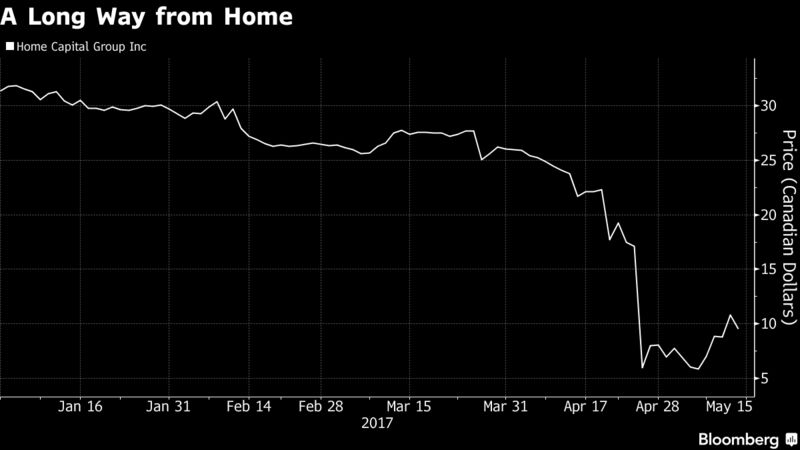

Home Capital shares rose 7.2 percent to C$9.65 at 9:33 a.m. in Toronto after jumping as much as 13 percent at the open.

Investors in Canada, where home prices jumped roughly 30 percent in the past year in its largest city of Toronto, have been anxiously watching Home Capital’s struggles in recent weeks. The company faced a run on deposits after Ontario’s securities regulator alleged it failed to properly disclose an internal probe into fraudulent mortgage applications. Executives warned May 12 that the reputational hit could threaten the firm’s viability.

The market still hasn’t cooled, with home prices climbing a further 5 percent in April from March, the Canadian Real Estate Association said in a new report Monday.

Home Capital said as of May 12 its high interest savings deposit balances stood at about C$125 million ($92 million), roughly the same as the day earlier, according to a statement on Monday. Available liquidity and credit capacity totaled about C$1.51 billion, including an undrawn C$600 million under the company’s C$2 billion credit facility.

GIC Flows

Home Capital’s GICs, or guaranteed income certificates, stood at C$12.44 billion, down from C$12.49 billion the previous day.

The company needs to attract GIC deposits to stay in business, GMP Capital Inc. analysts Stephen Boland and Mark Kearns said in a research note.

“HCG’s ability to continue as a going concern remains dependent on its ability to fund through broker GICs,” they said. “Without GIC funding, a run off scenario or sale/breakup is possible.”

The earlier comments from Poloz and Morneau, the two most powerful government officials in Canada’s financial system, solidify the government’s position that Home Capital doesn’t present a broader risk to the nation’s economy. Still, both stressed that high real estate prices, which have climbed sharply in past years, are among their primary concerns.

The potential for fallout if an economic downturn suddenly leaves Canadians unable to repay their mortgages is “a topic quite high on our list,’’ Poloz told the Globe and Mail on the sidelines of a Group of Seven meeting of finance chiefs in Bari, Italy. “In fact it’s at the top of our list.”

The central banker has called accelerating home values in Toronto and Vancouver unsustainable. Most of the growth in housing prices is based on market fundamentals, but there is still a “speculative element’’ in the market, he told the paper.

Politicians have tried to cool the market, with Ontario and British Columbia instituting a 15 percent tax on non-resident home buyers and the federal government tightening mortgage rules.

BLOOMBERG. 2017 M05 12. Home Capital Warns of ‘Knock-On Effects’ If It Fails to Recover

by Katia Dmitrieva and Kim Chipman

- Troubled lender says has ‘breathing room’ to mull options

- Company seeks additional funding options amid deposit run

Home Capital Group Inc. said it’s seeking new sources of funding to counter a run on deposits and warned a failure of the Canadian lender would have “significant knock-on effects” in the mortgage market.

The struggling lender has “breathing room” to stabilize finances and pursue options following an C$1.8 billion ($1.3 billion) plunge in deposits and a 60 percent stock decline, director Alan Hibben, a former RBC Capital Markets managing director, said on a conference call Friday.

Selling off assets “is not our first priority,” said Hibben, who joined the company last week and is taking an active role at the company. “You don’t shrink your way to greatness.”

Home Capital’s troubles are being closely watched by investors concerned about possible contagion to other lenders and to the red-hot housing markets in Toronto and Vancouver. The Canadian dollar has slumped, and is the worst performing currency among Group of 10 nations this year. Moody’s Investors Service late Wednesday cut the credit ratings on six Canadian banks, citing rising household debt and soaring real estate prices that make the banks more vulnerable to losses.

If Home Capital collapses it would “have significant knock-on effects, particularly to new Canadians and others who this company services,” Hibben said, referring to the “alternative” market of borrowers, such as immigrants or small-business owners, who have trouble getting loans from big banks due to lack of credit or income history. Hibben estimates Home Capital has about 5 percent of this market.

The former investment banker said he doesn’t expect any “new significant transactions within the next days and weeks,” though stressed the company will aggressively seek a “range of options.”

Home Capital executives on the call said there are potential investors “in the data room.”

They also emphasized their focus on finding new funding sources to stem deposit outflows and replace a costly C$2 billion credit line arranged last month by the Healthcare of Ontario Pension Fund.

Ripple Effect

“There is much at stake,” Chair Brenda Eprile said on the call, in her first public comments since taking the position this month. “We are working diligently” to rebuild strength of the company. Eprile is the former chief accountant for the Ontario Securities Commission, which on April 19 accused Home Capital of misleading investors over fraudulent mortgage loan applications.

Hibben said he would welcome the type of backstop reached by rival Equitable Group Inc., which got a two-year, C$2 billion credit line this month from Canada’s six largest banks.

“The top priority if I would be able to point one is somebody who would write a liquidity piece” with medium-term notes, Hibben said. “Somewhat similar to the Equitable deal, but as you can imagine the market is thin for these sorts of things.”

The lender has lost almost C$1.8 billion in high-interest deposits in five weeks, draining the Toronto-based company of funds used to finance mortgages. The company said it’s facing liquidity issues because of reputational concerns raised by the Ontario Securities Commission allegations, as well as a class action lawsuit announced earlier this year. The lack of a chief executive officer and chief financial officer is also hurting, the company said.

Home Capital fell 12 percent to C$9.54 at 1 p.m. in Toronto. The stock has fallen by about two-thirds this year.

Going Concern

Home Capital executives addressed investors and analysts after warning Thursday that the reputational hit threatens the company’s viability.

“Material uncertainty exists regarding the company’s future funding capabilities as a result of reputational concerns that may cast significant doubt" about continued operations, the company said in its earnings statement. “Management’s focus is on finding more sources of funding in the near term so we can be more active serving our customers, and on seeking longer-term solutions that put the business back on track.”

High-interest savings deposits dropped to about C$125 million as of Friday from $1.9 billion at March 31, the company said. Home Capital also lost C$344 million in cashable GICs, or guaranteed investment certificates. Tightening lending criteria and broker incentive programs will lead to a decline in originations and renewals going forward, the company said.

Home Capital continues to see a net outflow of GICs, “as we would expect in a liquidity situation and a confidence crisis that we’ve just gone through,” interim CFO Robert Blowes said. He declined to provide specific figures.

“We are continuing to take in new deposits, which is encouraging,” he said. “It’s lower than we have experienced in the past, and we’ve built our models taking that into account.”

Pension Loan

The lender’s liquid assets are about C$962 million as of May 11, it said in a separate statement. It had drawn C$1.4 billion of a C$2 billion rescue loan from an Ontario pension fund that carries an effective interest rate of 22.5 percent, the firm disclosed. The company also sold a C$154 million portfolio of preferred shares to raise cash.

Total on-balance sheet loans grew 3.2 percent to C$18.6 billion in the first quarter from the end of 2016 as traditional single-family residential mortgages, which comprise half of total loans, grew 3.4 percent to C$11.4 billion.

Home Capital used its first quarter results to underscore its battle plan. It’s planning to sell assets to help pay down the C$2 billion loan. The lender’s priority is to fill the CEO and CFO roles, and is in talks with an external adviser on strategic options. The company is also talking to industry partners about funding mortgage commitments and renewals in the near-term, according to its statement.

Home Capital reached an agreement for MCAP Corp. to manage and service C$1.5 billion of its mortgages and renewals, MCAP Senior Vice President Don Ross said Friday. MCAP has a group of investors who hold the loans, he said, without identifying them. MCAP and the investors have capacity to take on more mortgages, he said.

The MCAP partnership is a “critical piece of good news for Home,” Cormark Securities Inc. Analyst Jeff Fenwick wrote in a note to clients after the call. He is maintaining his “buy” rating on the stock, though warned that estimates for the company “are likely to change significantly” depending on how the saga unfolds.

Hibben said he’s confident that a wind down of assets is “unlikely.”

“A run-off scenario is only going to occur if every other option that we’re exploring doesn’t work,” he said.

BLOOMBERG. 2017 M05 12. What Analysts Are Saying About Home Capital's Warning Shot

by Luke Kawa and Aoyon Ashraf

- Embattled lender includes ‘going concern’ reference in report

- Management warned of ripple effects if company doesn’t recover

Beleaguered Canadian mortgage lender Home Capital Group Inc. posted its first-quarter results after the close of markets Thursday -- and the “slight dip” in profit and revenue was the last thing on anyone’s mind.

The company’s shares are down as much as 20 percent after management said during a conference call Friday that asset sales aren’t likely to happen any time soon and more collateral needs to be pledged than expected. In the quarterly report, the company also confirmed what was widely speculated, they share concerns about Home Capital’s ability to continue as a going concern.

A run on the company’s deposits in the wake of allegations from the Ontario Securities Commission on April 19 led to a severe selloff in the shares, forced the company to take an expensive line of credit to meet its near-term obligations, and hire advisers to evaluate its strategic options, including a potential sale. There have been a few recent bright signs, however: CIBC Asset Management more than tripled its stake in April, while top shareholder Turtle Creek Asset Management boosted its holdings to more than 15 percent of the company.

Late Thursday night, the alternative mortgage provider also released a filing detailing the terms of its $2 billion credit facility with a syndicate led by the Healthcare of Ontario Pension Plan, which turn out to be more onerous than previously thought.

During the conference call on Friday morning, management warned that significant "knock-on effects" would ensue if the company failed to recover.

Here’s what analysts are saying about the quarterly results:

Laurentian Bank, Marc Charbin (Hold, price target cut to C$11 from $C28): “Deposits continue to decrease for HCG without any evidence of a turnaround. HCG has highlighted that $2.7B of deposits are due in the next three months and a further $4.3B in the next nine months. It appears as though asset sales are the priority to satisfy deposit outflows so that HCG can maintain a level of renewals and originations that meet more narrow underwriting criteria. Cash flow is being managed daily and surely will be disclosed in the coming weeks along with new funding sources.”

National Bank Financial, Jaeme Gloyn (Underperform, price target C$6): “We continue to see material risks related to each new development, in particular HCG’s ability to attract new deposits, raising significant concern with viability of the existing business model. With that in mind, we revisit the next steps for Home Capital, in chronological order as we see it: 1) Continue operating the company as is, 2) Explore an originate to sell business model, 3) Solicit asset sales, and 4) Regulatory resolution.”

Scotiabank, Phil Hardie (Rating under review): “Given significantly reduced earnings visibility and diminished ability to confidently quantify the numerous stacked risks involved, our rating remains Under Review. The stacked risks include: (1) execution risk in an operational turn, (2) executive management transition, (3) regulatory, (4) a late cycle and transitioning housing market, and finally (5) the higher funding costs and ability to attract sufficient cost-efficient retail deposits to fund loans. Due to regulatory involvement we do not expect to gain much clarity on issues related to the OSC allegations.”

TD Securities, Graham Ryding (Speculative buy, price target C$15): “Results shed little insight towards near-term outlook…The company acknowledges there is material uncertainty regarding its future funding capabilities and ability to continue as a going concern.”

RBC Dominion Securities Inc., Geoffrey Kwan (Underperform, price target C$8): “We believe investors may be concerned that the over-collateralization is higher than what they may have initially believed. Given there is no penalty to cancel the facility, we think it makes it that much more important for HCG to secure funds (e.g., alternative funding facility with better terms, asset sales) to cancel the facility. While the credit agreement answers some of our questions (e.g., there is no penalty/premium if HCG wants to permanently cancel the credit line), it is unclear what mortgages qualify for the security backing the loan and whether it’s a broadly diversified pool of mortgages or whether the mortgages used for security backing the credit line might be the highest credit quality mortgages in HCG’s mortgage book. More broadly speaking, with one of HCG’s competitors getting a $2B credit line from a syndicate of the Big Six Canadian banks at more attractive terms than HCG’s credit line, is this a potential funding source for Home Capital?”

Industrial Alliance Securities, Dylan Steuart (Hold, price target C$.9.50): “Ironically, the view as of March 31 looked promising: Loan originations of $2.3B were up 32% from a year ago, and loans on the balance sheet were up 3.5% YoY. Of course, given the events subsequent to quarter-end, little of that is consequential to the prospects going forward… While the going concern disclosures and the increased collateral identified against the credit line could raise some eyebrows, very little in the quarterly disclosure changes the challenges going forward.”

BLOOMBERG. 2017 M05 15. Toronto Home Price Rally Triggers Rush of Listings in April

by Greg Quinn

- Benchmark home price in Canada’s biggest city up 5% on month

- New listings increase 36% in Toronto to new record levels

Toronto home prices continued surging in April, prompting a rush of new listings that hints the rally could soon be poised to slow.

Toronto’s benchmark home price index rose 5 percent last month, the second highest gain in data going back to 2005, a report Monday from the Canadian Real Estate Association showed. The record gain was a 6.2 percent advance in March, bringing year over year price increases to 32 percent.

What has changed over the past month is that soaring prices are finally beginning to bring sellers into the market, possibly anticipating a slowdown after Ontario Finance Minister Charles Sousa brought in a suite of measures including a foreign buyer tax on April 20.

“Home buyers and sellers both reacted to the recent Ontario government policy announcement aimed at cooling housing markets in and around Toronto,” Gregory Klump, the agency’s chief economist, said in the statement.

Another strain on the market is coming from troubles at Home Capital Group Inc., a mortgage lender that has suffered a share price plunge after a regulator opened hearings into its business practices.

New Listings

New listings climbed by 36 percent in the Greater Toronto Area to record levels, leading a 10 percent nationwide increase.

Nationally, prices rose by 3.2 percent on the month and by 20 percent from April 2016.

Vancouver, Canada’s priciest real estate market, is seeing a similar trend of rising prices and surging listings. Prices in that city were up 2.4 percent in April, and have gained 11.4 percent over the past 12 months, triggering a 12 percent increase in listings last month.

While prices rose, transactions declined nationally.

Existing home sales fell by 1.7 percent in April from the previous month and by 7.5 percent from a year earlier, the Ottawa-based group said in the statement. In Toronto, transactions were down 6.7 percent while gaining 16 percent in Vancouver.

BLOOMBERG. 2017 M05 15. Toronto's Rent Control Risks Stoking the Red-Hot Housing Market

by Kim Chipman

- Rent caps risk choking supply and boosting prices in Toronto

- Developers relooking at rental-unit plans, struggling to price

Toronto’s trying to make it more affordable to rent in one of the world’s hottest housing markets. New measures may have the opposite effect.

Ontario’s government is set to impose the most sweeping rent controls in a quarter century, linking annual increases to inflation, with a cap of 2.5 percent, on all buildings as it tries to keep costs under control. The measure, meant to protect tenants from price gouging, could end up making it more -- not less -- expensive to rent in North America’s fourth biggest city.

The rules threaten to bring apartment construction to a halt, critics warn. At least one developer said he’s scrapping all rental projects in the pipeline. Others are considering doing the same. This risks worsening the rental-housing shortage and hurting those already priced out of the for-sale housing market, where prices are at a record high even as the troubles at mortgage lender Home Capital Group Inc. threaten to spill into the market.

Lamb Development Corp. had seven apartment buildings in the works in Ontario -- five in downtown Toronto -- before Premier Kathleen Wynne announced the expanded rent control on April 20, part of the province’s 16-point plan to cool scorching home price gains. The proposal calls for a rent cap on all units, not just those built before 1991 as mandated by current law.

Projects Abandoned

“We won’t build these buildings as apartments. We will build condominiums,” said Brad Lamb, Lamb Development’s founder. “If you were to now ask 20 or 30 prominent developers about purpose-built apartments, they will tell you they are no longer viable in Toronto.”

The government’s decision puts C$6.5 billion ($4.8 billion) in potential rental investment at risk, according to Jim Murphy, head of the Federation of Rental-Housing Providers of Ontario, citing a survey of 40 of the its biggest members.

“This year was on track to be the best for new rental construction in decades, but this sudden decision to change the rules has thrown that all into doubt," Murphy said.

Lending laws put in place after Toronto’s 1989 housing crash made it more difficult to finance rental dwellings, prompting many developers to turn to condos instead. About 9,000 rental units have been built in Toronto and its suburbs since 2005, compared with about 180,250 condos, according to Joel Conquer, a consultant at real estate research firm Urbanation Inc. Rental apartments are also often more cumbersome to maintain for developers compared with condos that are sold off.

However, in a tight market where home prices are expected to keep rising even though Home Capital’s woes have pushed up borrowing costs, rental demand is increasing. Toronto-area rents shot up 11 percent in the last three months of 2016, making it more lucrative for developers to consider entering the space.

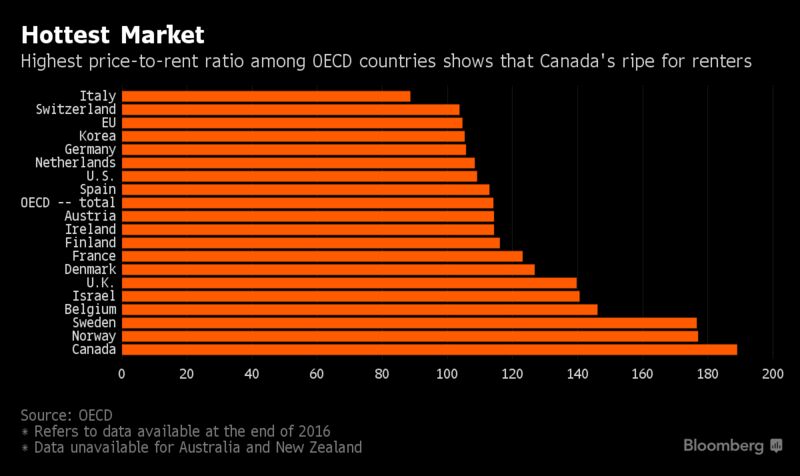

Canada’s price-to-rent ratio is among the highest in the world, indicating that it’s cheaper to rent a house rather than buy -- if you can find a home to rent.

The rent control also risks deterring solid investors like pension funds, which are lured by the stable, long-term income flows as rents rise. However, they’d need the returns that would come with annual rent increases of 3 percent to 3.5 percent, higher than the 2.5 percent cap imposed by the government, according to Benjamin Tal, Toronto-based deputy chief economist at Canadian Imperial Bank of Commerce.

Kenneth Hale, legal director at non-partisan Advocacy Centre for Tenants Ontario, said Tal’s thesis ignores the fact that the measure allows landlords to request permission to charge higher rents under certain circumstances, such as replacing a roof or appliances. It also allows an unlimited rent increase when a new tenant moves in.

“We see rent regulation as a consumer-protection measure enacted to make it more difficult for landlords to take advantage of the shortage of rental housing,” said Hale, who is concerned government officials will buckle to industry pressure and water down the rent-control proposal before it becomes law. “All these big-time developers are coming out saying this is the worst thing that’s ever happened in history. We are worried this may have some influence on them.”

Ontario’s majority Liberal party, which proposed the measures, didn’t make any changes to the bill before last week’s deadline to do so, spokeswoman Theresa Lubowitz said in an emailed statement. The government’s housing plan will “support the development of new purpose-built rental housing and increase supply," she said.

‘Price It Aggressively’

Tell that to Steve Diamond, founder and chief executive officer at Diamond Corp., who’s re-evaluating his decision to build rental units in the Toronto region. Meanwhile, Medallion Corp., a closely held Toronto-based company, is struggling to price rents at the first phase of its six-building, C$300 million rental complex in the Toronto suburb of Ajax.

“No one has built a rental building there in 40 years and we have to speculate what the rents should be because there’s no hard data out there,” said George Espinola, Medallion’s director of residential property management. Price it too high, and demand suffers; too low, and you’d probably suffer losses because the rent control doesn’t let you revise.

“We are going to have to price it aggressively,” Espinola said. “We’ve got to be safe.”

________________

SPECIAL - HOME CAPITAL "CASE"

THE GLOBE AND MAIL. MAY 14, 2017. REPORT ON BUSINESS. Mayday at Home Capital

JANET MCFARLAND, ANDREW WILLIS, NIALL MCGEE, DAVID PARKINSON, RITA TRICHUR, JACQUELINE NELSON, CHRISTINA PELLEGRINI, JAMES BRADSHAW

In the early hours of Monday, May 1, exhausted representatives for Home Capital and a group of lenders hung up the phone in frustration. A deal to give the company an emergency $2-billion loan appeared to be falling apart. Directors at the mortgage firm felt that without the money, they wouldn’t be able to open for business a few hours later. The dramatic story of a financial institution’s near-collapse.

It was late in the evening on Sunday, April 30, when lawyers working for Home Capital Group Inc. dialled into a call with lawyers representing the company’s new lending syndicate.

The troubled mortgage lender had negotiated a $2-billion credit line just days earlier, emergency money the board felt was needed to survive after a high-profile run on deposits at subsidiary Home Trust. The company planned to draw down the first $1-billion from it the next morning, May 1.

But the deal was getting bogged down in a last-minute dispute over details of the funding, according to two sources familiar with the talks. As the conversation proceeded late on Sunday, it became increasingly evident that the fate of the financing was hanging in the balance. Another call at 2 a.m. on Monday ended badly with no agreement, a source said.

There was no room for error. Home Capital was hours from the start of its business day, and it was critically low on capital. The board had determined the company could not open its doors for business Monday morning without the financing in place, the sources said.

As the dispute continued, officials from Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), were on standby to launch a process to take control of the company Monday, a move that would have almost certainly forced some form of wind-up of Home Capital’s business, the sources said.

In the end, some time prior to 7 a.m., the lawyers hammered out a deal on final terms of the loan, allowing the first $1-billion to be transferred Monday. When business started a couple of hours later, only a small circle of exhausted insiders knew how close the company had come to collapse.

‘It happened very fast’

Over the past three weeks, events at Home Capital have captivated Bay Street and policy makers in Ottawa and Toronto. The attention may seem outsized for a company that is such a relatively small player in Canada’s lending market, but Home Capital dominates an important niche of the market, providing mortgages to people who are turned down by banks, including many new immigrants and self-employed workers.

But much of the unrelenting focus on the company is also due to the rarity of a financial institution failing in this country. Canada Deposit Insurance Corp. (CDIC), which insures deposits in the event of a bank failure, hasn’t paid a claim since 1996.

The Globe and Mail has pieced together the story of Home Capital’s scramble in recent weeks to cope with an escalating crisis of confidence, and the array of factors that led the company to the brink of collapse early in the morning on May 1.

Many commentators have pinpointed April 19 as a pivotal date when the Ontario Securities Commission unveiled an explosive enforcement case against the company and three of its executives, accusing them of making misleading disclosure to investors about mortgage underwriting problems in 2014 and 2015.

But if the OSC announcement sparked a conflagration at Home Capital, it was only because there was so much dry tinder already in place to ignite. The case landed amid a broader backdrop of concern about the company’s financial condition, a loss of faith in senior management and the board, and extreme nervousness about the vulnerability of a non-prime mortgage lender deeply exposed to Toronto’s overheated housing market.

Asked whether she blames the OSC for touching off the crisis Home Capital has faced over the past three weeks, Home Capital’s new chair, Brenda Eprile – a former OSC executive director – said she does not. Indeed, Ms. Eprile said she still doesn’t have a clear understanding about what caused a stable financial institution to unravel within days.

“I’ve heard various people say different things – I don’t really know,” she said in an interview on Friday. “All I know is that it happened very fast.”

The runup to the run

For two months prior to the OSC announcement, concerns about Home Capital had mounted among investors over an unfolding series of events. Many of these matters played out quietly but were watched closely by analysts, major shareholders and a rabid group of short-sellers.

The first alert about the OSC case, for example, emerged late on a Friday afternoon on Feb. 10, when many had already left for the weekend.

Home Capital Group issued a two-paragraph release revealing it had received an enforcement notice from the OSC, relating to disclosures in 2014 and 2015 about an internal investigation that found information on some loan applications had been falsified, leading to suspensions of 45 mortgage brokers. The enforcement notice said OSC staff had reached a preliminary conclusion about problems at the company, but Home Capital still had an opportunity to respond before the commission decided whether to launch disciplinary proceedings.

The company’s share price slid 6 per cent the following Monday as investors digested the news, but many hoped the company would quickly resolve the matter, with one analyst predicting there could be a negotiated settlement deal.

The February release also landed two days after the company had posted its less-than-stellar 2016 financial results, reporting a 14-per-cent drop in profit after expenses climbed 20 per cent last year.

In response to concerns about expense growth, CEO Martin Reid announced the company launched “Project Expo,” a campaign to slash $15-million from its expense base during 2017 by targeting operating costs. Analysts, however, were particularly focused on the company’s continuing inability to retain clients.

Home Capital had no trouble writing a growing number of new mortgages for non-prime borrowers in a hot housing market last year, but it also saw many of those customers leave at the first opportunity when their mortgages came up for renewal.

Borrowers at Home Capital typically sign on for one-year or two-year mortgages in the hopes of moving to a mainline bank with a cheaper lending rate once their credit history is established. That leaves Home Capital facing constant churn, analyst Jeff Fenwick of Cormark Securities said, making its retention data one of its most closely watched metrics.

Of the $13.3-billion in residential mortgages on Home Capital’s books at the start of 2016, Mr. Fenwick estimates $6-billion or 45 per cent “rolled off” during the year – a rate of attrition far higher than faced by bank lenders, whose customers tend to opt for five-year mortgages.

“This is one disadvantage for a lender like Home – there is a consistent treadmill of origination activity that needs to happen in order to prevent the mortgage book from shrinking,” he said.

In a statement in February, Mr. Reid said the attrition rate was disappointing, telling analysts that performance in 2016 was “muted” by lower-than-expected renewals. He said improving retention would be a priority in 2017.

The financial results on their own would not have been a major concern, but they also came as worries were mounting about Toronto’s housing market.

Through February and March, investors were growing increasingly jumpy about the prospect of a housing bubble in the Toronto market as home prices climbed over 30 per cent compared with a year earlier. Major bank economists began warning about a housing bubble and even normally reserved bank CEOs began to voice their concerns about excessive speculation in the market.

For investors watching for signs of a possible trouble in the housing market, Home Capital was a particular focus because it is an alternative or “near-prime” lender, whose customers don’t qualify for mortgages at major banks.

A CEO departs

Of the many moves that laid the groundwork for the run on the bank at Home Trust in late April, the company’s decision to terminate Mr. Reid on March 27 has emerged as a particularly critical moment.

Mr. Reid had only stepped into the CEO job in May, 2016, after the retirement of company founder Gerry Soloway. (Independent director Bonita Then was appointed interim CEO, but she was unknown to most analysts.) In a news release issued in the early evening on March 27, the company vaguely announced it wanted new leadership that could “bring to bear a renewed operational discipline.”

The information vacuum frustrated investors and allowed speculation to mount about what was happening behind the scenes, and whether Mr. Reid’s departure was linked to the OSC investigation or other major problems. During the decade Mr. Reid spent at Home Capital, he had earned a reputation as a thoughtful leader, and Mr. Soloway supported his appointment as CEO, according to a source familiar with company management.

But once Mr. Reid took over, the board – which was used to having a strong, entrepreneurial founder CEO at the helm – came to think Mr. Reid was taking too long to consider and make decisions. With Home Capital under review by the OSC in late March, the board felt it was time to bring in a new CEO who could take bolder action.

Whatever the reasons for his departure, the news spooked investors more than any announcement in the prior month. The company’s share price fell 10 per cent on the day following the evening announcement, and continued to slide even lower in the two subsequent days.

The short-sellers pounce

That same day investors were reacting to news of Mr. Reid’s departure, Canadian Imperial Bank of Commerce made a decision that would prove important, at least in hindsight.

The bank issued an internal directive to financial advisers on March 28, telling them to limit their clients’ exposure in Home Trust’s GICs to the $100,000 limit insured by Canada Deposit Insurance Corp. The decision meant financial advisers had to shift assets above that cap to other institutions.

Around the same time, Royal Bank of Canada made a similar move for clients of its full-service brokerage division. Bank of Montreal also imposed caps, but will not say when it introduced the limits.

Home Capital would later disclose that savings account withdrawals began to mount at the end of March, around the same time that these policies were implemented.

During the same period, short-sellers moved into overdrive to fan fears about Home Capital, while filling social-media sites with speculative claims and half-truths. Short-sellers, who bet that a company’s share price will fall, have targeted Home Capital aggressively since the summer of 2015, making it consistently one of the most-shorted companies in Canada.

An example of their influence was evident on April 13, when shares of Home Capital fell by up to 8 per cent in a single day, despite no apparent news about either company. Home Capital believed the decline was sparked by inaccurate social-media comments claiming Bank of Montreal and Bank of Nova Scotia had issued directives to its advisers to stop buying Home Capital’s GICs. Such a move would have been major news because the lender relies on deposits to provide the capital to run its mortgage-loan business.

The company told analysts the claims were untrue, and analysts at National Bank of Canada said they double-checked with other financial institutions and found they were still offering the GICs, at least for full-service clients.

But the fact that unproven claims published by dubious sources could so significantly move Home Capital’s share price was evidence of the nervousness surrounding the company.

“The short-sellers to their credit were enormously successful in raising fear,” said a Toronto-based fund manager who held Home Capital shares. “If the short-seller’s job is to sow fear and confusion, they were very successful in doing it.”

The company also saw the stream of inaccurate rumours swirling, but could do little to stop the shorts.

“They have their own vested interests, and so they’ve got their agenda, which they’re trying to promote,” Ms. Eprile said. “It is a frustration.”

The crackdown

It was amid this worry, less than a week after the April 13 share price drop, that the OSC unveiled its allegations in the evening of April 19.

While many of the main issues laid out in the statement of allegations had been previously disclosed by Home Capital, there were new details about the volume of material the company had collected in an internal investigation into its mortgage loan problems from mid-2014 to early 2015, but had not reported publicly until July, 2015, when pushed by the OSC to provide disclosure to investors.

When markets opened the following morning, April 20, Home Capital’s share price began to crater.

A key concern was that the release came just hours before the Ontario government unveiled a series of measures to cool off Toronto’s housing market on the morning of April 20, including imposing a new 15-per-cent tax on foreign buyers. The combination of both was seen as a double-whammy, hitting Home Capital at a vulnerable time in the housing cycle.

For its part, the OSC said it does not co-ordinate with the province on the timing of enforcement cases, and the province does not consult with the OSC on other initiatives.

“We are not privy to the province’s plans regarding budgetary policy and legislation,” spokeswoman Kristen Rose said. “We also do not discuss ongoing enforcement matters with the province.”

The news of the OSC allegations, combined with the new housing measures, drove Home Capital’s shares down by over 20 per cent on Thursday, April 20, and spurred more institutions to start limiting deposits with Home Trust, most notably Bank of Nova Scotia.

Losing faith

On the morning of Friday, April 21, as investors scrambled out of Home Capital shares, a message popped up on financial advisers’ computer screens at Scotiabank. It was an internal notification from ScotiaMcLeod head Rob Djurfeldt, announcing that as part of an “ongoing review of 3rd-party products,” the bank would no longer allow the sale of Home Trust GICs.

While some other banks had already limited sales of Home Trust products to the $100,000 CDIC cap, the memo suggested Scotiabank was going even further to cut off sales entirely. It was taken by many – including Home Capital itself – as a signal of a loss of faith in the company.

Over the subsequent weekend, however, Scotia abruptly changed course and put Home Trust back on its platform with a $100,000 limit per client.

Some players in the market jumped to their own conclusions that a regulator was involved in the reversal.

“When Scotia dropped Home Trust on a Friday, only to put them back on the following Monday, everyone connected the dots,” that regulators were involved somehow, said Lee Matheson, managing director with Toronto-based hedge fund Broadview Capital Management Inc., which has had a short position in Home Capital for the past 18 months.

However, Scotiabank spokeswoman Debra Chan said the company made its own decision internally to reverse course. “The decisions related to selling GICs were business decisions made independently by us,” Ms. Chan said. “We cannot speak on behalf of OSFI and any question related to them is better directed to them.”

Alex Besharat, senior vice-president at Scotia Wealth Management Canada, was part of the discussions held internally at Scotia that weekend about whether to put Home Trust’s GICs back on its platform. “There was a lot to that decision – it wasn’t just sort of a one-dimensional decision,” he said in an interview.

OSFI turned down multiple requests for comment, saying it is prohibited from commenting on institutions it supervises or its supervisory work.

The scramble

By Monday morning, April 24, Home Capital was facing a raft of withdrawals from depositors.

The public nature of Scotiabank’s move was part of the reason for the rush, with Home Capital itself announcing Monday morning that the bank had put its products back onto its platform.

The announcement served to ensure any financial advisers still unaware that other banks had quietly limited client exposure weeks earlier were now fully aware of at least one major bank’s moves to cap deposits at Home Trust.

Many brokers and financial advisers quickly moved client funds to other institutions, unwilling to jeopardize their deposits for a slightly higher interest rate offered by Home Trust’s high-interest accounts.

Home Capital officials watched the pace of client withdrawals climb quickly on Monday, and decided they needed to do more to reassure the markets. That same day, the company announced that Mr. Soloway – Home Capital’s founder, who had remained on the board after stepping down as CEO in 2016 – would depart entirely as a director “when a replacement with recognized expertise in financial services is named.” However, the company said Mr. Soloway would still stand for re-election at the annual meeting, which was then scheduled for May 11, but has since been delayed until June 29.

It also announced Mr. Morton would step down as CFO, but only after the first-quarter financial results were filed. He would take on a new role as head of special projects, and would be replaced by Robert Blowes as interim CFO.

Board chair Kevin Smith said the changes were aimed at rebuilding market confidence in the company. But the moves were again too little, and too late.

On Wednesday, April 26, the company made its first disclosure to alert the markets about the run on Home Trust’s savings accounts, saying deposits in high-interest savings accounts were down by almost $600-million to $1.4-billion from $2-billion at the end of March.

The announcement sparked a far broader panic, and was the first indication that many in the public had of the size of the company’s problems. Savings account withdrawals would accelerate rapidly through the subsequent days, leading to a classic unstoppable run on the bank caused by depositor panic.

The company most recently revealed Home Trust has just $125-million left in its high-interest savings accounts, a decline of over 90 per cent since late March.

The regulators

Canada hasn’t seen a run on a bank such as this in decades, and many in the current crop of regulators have no personal experience dealing with the sort of crisis that unfolded in late April at Canada’s largest alternative mortgage lender.

A source said regulators began co-ordinating discussions “early on” in the crisis, before Home Capital was front page news, but no one anticipated the company was so vulnerable. Last summer, OSFI had no concerns with the company’s capital levels, liquidity or stress test results, according to another person familiar with the matter.

But as the week of April 24 progressed, regulators grew worried they may not be able to halt the company’s slide.

At one meeting involving officials from OSFI, CDIC and the federal finance department, there was discussion that Home Capital could collapse by early May, based on the pace of withdrawals and its remaining capital, the source said.

Participants even discussed a scenario where Home Trust could fail, which would require Finance Minister Bill Morneau to sign an order giving OSFI control of the bank, the source said.

No regulator has agreed to comment publicly about Home Capital, but behind the scenes sources say procedures quickly kicked into place, if not always in perfect harmony.

In the first two weeks of the crisis, top leaders and their staff – including OSFI, the Bank of Canada and Canada Deposit Insurance Corp. – were on the phone “every hour” to discuss their response, the first source said.

At one point, a meeting at one regulator’s headquarters was interrupted repeatedly as officials left the room in a steady stream to answer urgent calls about Home Capital, the source said.

A focus of regulators has been on ensuring Home Capital remains “orderly,” the two sources said, and especially that there is no contagion to other institutions, including other specialty lenders such as Equitable Bank.

Key regulators who monitor system risks in the financial system – including the federal finance department – have also held Sunday morning conference calls to discuss plans for the week ahead, with the heads of the organizations typically on the calls.

A lifeline from HOOPP

As worries grew that the company could be facing imminent collapse, Home Capital needed a lifeline, and turned to what would prove to be a controversial solution.

The company negotiated a new line of credit led by the Healthcare of Ontario Pension Plan, a pension fund whose CEO, Jim Keohane, also sat on the Home Capital board.

Critics were shocked by the crippling terms of the loan. Home Capital agreed to pay 10-per-cent interest on the drawn portion of the credit line and 2.5-per-cent interest on unused balances, as well as an up-front, non-refundable fee of $100-million to secure the loan. On the first $1-billion that would be drawn on May 1, the effective interest rate was 22.5 per cent, factoring in the commitment fee.

The loan was also backed by up to $5.4-billion of Home Capital’s mortgages, the company would later reveal.

The HOOPP loan sent all the wrong signals. For many in the financial community, the onerous terms were seen not only as an anchor around the company’s neck, but even as a signal from HOOPP that Home Capital’s finances must be worse than anyone knew if this was the best possible deal.

Many believe the loan was negotiated too hastily by a board that lacked the connections or clout to find a better deal on better terms. One source close to the company said the board appeared to have “panicked” while another said the board “malfunctioned” due to a lack of sophistication and expertise.

Ms. Eprile said she knows the board has been criticized for the terms of the deal, but directors took the best possible offer at that time.

“Every option was explored in the circumstances and it was the best option for us to go with,” she said. “It wasn’t the only option – it was the best option. And the board, I think, acted very responsible.”

A funding option foregone

As the board was taking steps to negotiate the HOOPP loan, a senior Canadian banker came forward with another offer, according to a source involved in the financing.

The offer included a $2-billion line of credit backed by Canada’s largest banks, at a much lower interest rate, along with a proposed candidate for a new CEO and proposed new board candidates. But the source said the offer came when Home Capital was late in negotiations with HOOPP, and it was not guaranteed.

Ms. Eprile said she could not discuss other funding options, “but this [HOOPP loan] was the best option at the end of the day, so we went with it,” she said.

Faced with a rapid run on deposits, and with strong ties with HOOPP’s CEO, the board decided to lock in the deal on the table.

The company moved quickly to use the HOOPP financing. Early on Monday, May 1, Home Capital needed to make the first drawdown on its HOOPP line of credit, initially seeking $1-billion of the credit line.

Late Sunday evening, however, lawyers began to fight over details of the agreement and the money was not immediately transferred. During the delay, company officials feared they may not have been able to open for business that morning with no financing to conduct any operations.

Ms. Eprile would not discuss the events of that Sunday in detail, but said everyone was working “around the clock” throughout that period, and she was sleeping with her cellphone during those days as she awaited news of developments.

“Crises have lots of twists and turns, and this one did too, but we got through it,” she said. “We got the short-term [HOOPP] funding, which was fantastic, and we live to fight another day.”

A clean sweep

While Home Capital spent the first week of its crisis scrambling to respond to the run on its deposits, it spent the second week on two priorities: putting a new board of directors in place and securing a better source of additional financing.

Home Capital quickly announced four senior business executives would join its board as part of a “governance renewal.” They included Claude Lamoureux, former CEO of the Ontario Teachers’ Pension Plan, and Alan Hibben, a former Royal Bank of Canada executive with long experience restructuring troubled companies.

Mr. Hibben said he previously knew two of the other new directors – Paul Haggis and Sharon Sallows – because they had worked together at Bank of Montreal earlier in their careers. Ms. Sallows knew Mr. Lamoureux because she had previously sat on the Teachers board.

To complete the clean sweep, the company also announced Mr. Smith would step down as chair of the board, and independent director Brenda Eprile would become chair. Mr. Smith will remain an independent director.

The company also announced a deal this week to sell up to $1.5-billion of new mortgages as it originates them. The deal will be facilitated by mortgage finance firm MCAP Corp.

The company’s next move will be to replace the HOOPP loan with more affordable funding. The terms of that loan allow the company to repay the credit line whenever possible, and the company has hired investment bankers to explore different funding options.

Ms. Eprile said a committee of the board is also actively talking to new CEO and CFO candidates as one of the next top priorities.

She said she feels “a real sense of optimism” that Home Capital is now stabilizing, especially after strong new directors like Mr. Hibben joined the board last week and immediately rolled up their sleeves to tackle a host of issues.

“There’s a real sense that we can make it,” she said. “We just have to be very hunkered down and do our plan, and the company can be restored to a very positive future.”

A timeline of the Home Capital saga

2015:

May 6: Home Capital Goup Inc. issues solid first-quarter earnings, but reports a drop in mortgage originations (new mortgages). The company cites “a traditionally slow real estate market exacerbated by very harsh winter conditions,” and refers to “ongoing reviews of its business partners ensuring that quality is within the company’s risk appetite.”

July 10: Home Capital reports a continued slowdown in mortgage originations for the second quarter of 2015. The company says the causes included the suspension during September, 2014, to the following March of the company’s relationship with 18 independent mortgage brokers and two brokerages, for a total of 45 mortgage brokers. The price of HCG shares drops 19 per cent the next day.

2016:

July 29: Disclosing more information about the terminated brokerage relationships, Home Capital says that in late 2014, an external source alerted Home Capital’s board to possible discrepancies in income verification information submitted by certain mortgage brokers. An investigation determined that falsification of income information had occurred.

Feb. 29: Home Capital says Gerald Soloway will retire as CEO, and names president Martin Reid as his successor.

Nov. 10: Canaccord Genuity Group Inc. tells financial advisers in a memo they should no longer steer investors to high-interest savings accounts at Home Capital or rival alternative mortgage lender Equitable Bank. Canaccord says it was concerned about the alternative lending sector, saying the rate of interest on the savings accounts was no longer high enough to offset the risks of being exposed to Canada’s overheated housing sector.

2017:

Feb. 10: Home Capital discloses it received an enforcement notice from the Ontario Securities Commission on Feb. 9 relating to the company’s disclosure in 2014 and 2015 regarding the company’s internal findings that some income information had been falsified and the suspension of brokers. The notice indicates the OSC found Home Capital failed to meet its disclosure obligations.

March 14: Home Capital says the OSC subsequently issued enforcement notices to several current and former officers and directors of the company relating to the disclosure and in some instances trades in the company’s shares. The company says its disclosure satisfied applicable requirements.