CANADA ECONOMICS

EDC. ANALYSIS. The Currency Churn

By Peter G Hall, Vice President and Chief Economist

Currency concerns seem to be rising again. I’m just one week into my month-long cross-Canada Let’s Talk Exports tour sharing insights from our new Global Export Forecast, and based on conference questions and individual conversations, the loonie is once again blipping on the radar screen. Small wonder – with political uncertainty swirling and a nascent stumble in commodity prices, our dollar’s near-term direction just became a little less clear. Will recent weakness persist? Are we flatlining? Or is a sharp upswing in the works?

Most of the concern seems focused on recent weakness. From the mid- to high-70-cent level in US dollar terms over the past year, the loonie has slid toward the 73 cent range, gradually losing steam. True, it seems a far cry from the air pocket the loonie hit in 2014. From its perch at 93 cents US in the middle of that year, the bird plummeted to the high-60-cent level by early 2016, following the earth-bound swoon in commodity prices. Our dollar staged a partial recovery – a relief to most – but it’s the general down-trend since then that has captured the attention.

Commodity prices are at least part of the problem. To many, economic growth was supposed to send commodity prices the other way. Surely if the global economy was strengthening, prices of raw materials should rise, they reasoned. As such, the plunge in oil and base metals prices was interpreted as just another sign that the world economy was weak, and would remain so for some time. Yet since then, it appears that the world’s big economic engines have actually been gaining momentum. What many analysts seem to have missed is that quantitative easing inflated commodity prices, and as growth prompted the Fed to wind the program down, prices lost their lift.

Here’s the current dilemma: if commodity prices were artificially high for multiple years, and that spurred a lot of over-investment in the mining and energy sectors, then nobody really knows what true equilibrium pricing looks like; the market is still trying to find its feet. And as long as these key drivers of the currency meander, we can expect our dollar to do the same.

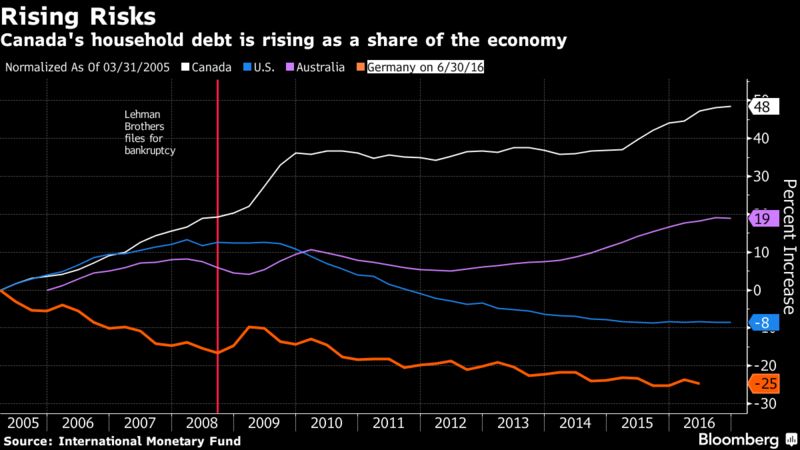

Interest rates are another factor. The Fed is in tightening mode, given looming capacity pressures in the US economy. Not so in Canada; high consumer debt levels and a top-heavy housing market suggest little need for an imminent rate run-up. Markets have long since priced this in to the currency, but any new signs of weakness weigh on the loonie.

Then there’s the greenback. It rose sharply against all currencies as commodity prices sunk, and more recently with all the political bravado of the election and inauguration of the new President. At the same time, worries about the future of the UK and more existential questions about the EU weakened currencies across the pond. The Yen was able to capitalize somewhat, but the most recent movement has been a strengthening of all the major currencies against the USD. All the major non-commodity currencies, that is. Chalk that up to a moment of pre-summer stock-taking, assessments of relative economic progress and uncertainty about a few key commodity balances.

Where to from here? General uncertainty is bound to persist, but it still seems that current evidence is on the side of growth. The US job market remains robust, and the employment picture in the EU is not far behind. Business seems to agree that things are looking up. With the US economy taking the lead, the greenback is expected to maintain its strong level, but to gently lose a bit of its lift over the near term to economies that are playing catch-up. Emerging market demand for basic goods is expected to follow the lead, a positive signal for near-term commodity prices. However, commodity price gains will be tempered by ample product supplies, made available by the considerable investments that persistently high prices attracted to the oil and gas sector, and also to the mining industry.

These signals generally point to a Canadian dollar that will rise over the medium term period, but only very gently. Our forecast calls for the loonie to average 76 cents US this year, rising to 78 cents in 2018. Against the Euro, the Canadian dollar is expected to see 1.39 for 2017 as a whole, and to average 1.33 next year.

The bottom line? Despite current policy turmoil, the loonie seems in for a season of unusual – but welcome – stability.

REUTERS. May 11, 2017. Loonie seen further clipped as speculators sell Canada

By Fergal Smith

TORONTO (Reuters) - The Canadian dollar could have further to fall over the coming weeks now that speculators have turned bearish on the country and as the currency nears the C$1.40 level targeted by some investors.

The loonie CAD=D4 has performed worst among G10 currencies this year. Late last week it touched its weakest in 14 months, near C$1.38 to the greenback, or 72.50 U.S. cents, pressured by a five-month low for the U.S. crude oil price.

Monetary policy divergence between the U.S. Federal Reserve and the Bank of Canada has added pressure on the Canadian dollar. Speculators have increased net short positions in the currency to the most since February 2016.

"We are seeing over the last week or two a large short Canada trade come into effect," said Scott Smith, chief market strategist at Viewpoint Investment Partners.

Depressed oil prices have prompted decisions by international energy companies to dump about $22.5 billion of Canadian oil sands assets this year, while a proposed U.S. border adjustment tax could threaten Canada's exporters.

Recent headwinds for Canada have also included U.S. duties on Canadian softwood lumber, a more uncertain outlook for the North American Free Trade Agreement and investor wariness about how the troubles of alternative lender Home Capital Group Inc HCG.TO could affect the country's real estate market.

In a trade that has been called "The Great White Short," investors are selling Canadian assets on expectations that the country's economy will suffer if a housing bubble pops.

"Technically, the Canadian dollar is in a tough spot," said Adam Button, a currency analyst at ForexLive. "I don't even think you need oil to fall further to see dollar-CAD hit C$1.40 in the month ahead."

A Reuters survey earlier this month showed strategists expect the loonie will recover over the coming months to trade around C$1.35. But currencies often overshoot, while round numbers, such as C$1.40, tend to act as pivots, where price swings can occur.

On Wednesday, the loonie was around C$1.365.

Economists say Canada's gross domestic product may have grown as much as 4 percent at an annualized rate in the first quarter. But solid data is not going to "translate" into support for the currency until the Bank of Canada turns more hawkish, Button said.

The central bank has played down the sustainability of recent better growth, while Canada's 2-year yield has fallen more than 60 basis points below its U.S. equivalent, to its largest gap in 10 years.

Still, cheapening of the market's pricing of Canadian dollar volatility has offered a lifeline for investors who must hedge currency exposure.

"As we move toward C$1.40, "vols" will move higher," said Patric Booth, head of trading at Velocity Trade. He recommends the purchase of a Canadian dollar put option, which gains in value as the loonie weakens.

(Reporting by Fergal Smith; Editing by Dan Burns and David Gregorio)

________________

HOUSING BURBLE

StatCan. 2017-05-11. New Housing Price Index, March 2017

New Housing Price Index — Canada

March 2017, 0.2% increase (monthly change)

Source(s): CANSIM table 327-0056.

The New Housing Price Index (NHPI) rose 0.2% in March compared with the previous month. Higher new house prices in Vancouver and Toronto led the gain.

Chart 1 Chart 1: New Housing Price Index

New Housing Price Index

New Housing Price Index, monthly change

New house prices were up in 10 of the 27 metropolitan areas surveyed, with the largest increases in Oshawa (+1.1%) and Guelph (+0.9%). In Oshawa, builders cited higher construction costs and improving market conditions as reasons for the gain. Builders in Guelph linked higher new house prices to improving market conditions and a shortage of developed land.

Vancouver was the top contributor to the national gain, with prices up 0.7%. Builders reported market conditions as the main source of the rise. This was the first price increase in five months and the largest since May 2016.

Ottawa (+0.6%) and Windsor (+0.4%) also posted significant price gains. Builders in Ottawa reported market conditions, a shortage of developed land and higher construction costs as the key reasons for the increase, the largest since April 2011. In Windsor, builders tied the price rise to higher land development costs and improving market conditions.

In Toronto, prices edged up 0.2%, the result of favourable market conditions.

New house prices were down in three metropolitan areas and unchanged in 14.

New Housing Price Index, 12-month change

The NHPI rose 3.3% over the 12-month period ending in March, largely reflecting higher prices for new homes in Toronto (+8.4%). Other notable year-over-year increases were reported in Victoria (+6.3%), Windsor (+6.2%) and St. Catharines-Niagara (+6.0%).

Chart 2 Chart 2: The metropolitan region of Toronto posts the highest year-over-year price increase

The metropolitan region of Toronto posts the highest year-over-year price increase

In March, six metropolitan areas recorded 12-month price declines with St. John's (-0.7%) posting the largest decrease.

Chart 3 Chart 3: New Housing Price Index for Alberta, January 2003 to April 2011

New Housing Price Index for Alberta, January 2003 to April 2011

Chart 4 Chart 4: New Housing Price Index for Calgary and Edmonton, January 2005 to December 2008

New Housing Price Index for Calgary and Edmonton, January 2005 to December 2008

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170511/dq170511a-eng.pdf

The Globe and Mail. ANALYSIS. May 11, 2017. Moody's cuts Canada's banks, warns of fat consumer debt, frothy home prices

Columnist MICHAEL BABAD

Briefing highlights

- Moody's downgrades Canadian banks

- Rating agency cites debt, home prices

- Beaudoin steps down from executive role

- More deposit draws at Home Capital

- Air Canada to launch loyalty program

- Canadian Tire results beat estimates

- Moody's downgrades banks

Moody’s Investors Service is downgrading Canada’s major banks, warning of frothy house prices and swelling levels of business and consumer debt.

The big credit rating agency’s action late Wednesday affects Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada and National Bank of Canada, as well as some affiliates.

Baseline credit assessment, deposit and long-term debt ratings were trimmed by one notch. Those on counterparty risk assessments were also affected, with the exception of TD.

Baseline credit assessments look at the strength of a company absent a government support measure such as a bailout.

The move initially hit the Canadian dollar, though stronger crude prices brought the currency back.

Canada’s banks are deemed among the soundest in the world, though for years now observers have warned about record household debt and inflated housing markets that have prompted the federal, B.C. and Ontario governments to act. Analysts do not expect any U.S.-style crash, but rather a slowing of the market.

This latest warning from Moody’s also comes amid the turmoil at Home Capital Inc., an alternative lender whose troubles have raised further concerns over mortgage financing and housing in Canada, despite its tiny portion of the market.

“Today’s downgrade of the Canadian banks reflects our ongoing concerns that expanding levels of private-sector debt could weaken asset quality in the future,” Moody’s senior vice-president David Beattie said in announcing the decision.

“Continued growth in Canadian consumer debt and elevated housing prices leaves consumers, and Canadian banks, more vulnerable to downside risks facing the Canadian economy than in the past.”

It’s not only household debt that’s troubling Moody’s, though that’s the primary issue.

The ratio of private-sector debt to gross domestic product swelled to 185 per cent at the end of last year, compared to 179.3 per cent a year earlier, the agency said, also citing the rapid rise in business credit.

As for households, the latest reading put consumer debt at a record 167.3 per cent of disposable income.

This all accounts for “increasing risk” to bank profitability and asset quality,” Moody’s said.

“Despite macro-prudential measures put into place by Canadian policy makers in recent years - which have had some success in moderating the rate of housing price growth - house prices and consumer debt levels remain historically high,” the agency said.

“We do note that the Canadian banks maintain strong buffers in terms of capital and liquidity,” it added.

“However, the resilience of household balance sheets, and consequently bank portfolios, to a serious economic economic downturn has not been tested at these levels of private sector indebtedness.”

TD, CIBC, Scotiabank and National Bank would not comment on the downgrade, while officials at other banks were not immediately available.

The shot across the bow by Moody’s is the latest in a series of warnings from economists, agencies, the central bank and the Bank for International Settlements, which has warned of the mounting threat of a financial crisis in Canada.

The Bank of Canada, for its part, has cited the rise in certain regions of high-ratio mortgages, or those with a marked loan-to-income measure.

The Moody’s downgrade rippled through currency markets, knocking the Canadian, Australian and New Zealand dollars.

The loonie traded as low as 72.63 cents (U.S.) and as high as 73.23 cents.

The latter were affected because “markets extrapolated the implications to structurally similar bank sectors in Australia and N.Z.,” said Adam Cole, RBC’s chief currency strategist in London.

“As usual, we we would caution against overreacting to the rating agency’s actions, which largely reflect factors already widely known and discounted,” he said, adding that rising oil prices buoyed the currencies after the initial reaction.

Derek Holt, Scotiabank’s head of capital markets economics, said he found the timing of the downgrade curious, given the steps being taken to “stabilize” Home Capital, and given how small the company is.

“Second, we’ve heard ratings agencies warning about Canadian housing and debt in Canada for years and years after having reacted after the fact to the U.S. crisis,” Mr. Holt said.

“Moody’s downgraded the Canadian banks in January, 2013, with very similar logic, and yet more than four years later the sky has not fallen on housing, the consumer or banks,” he added.

The move on Wednesday lowerered TD’s rating to Aa2, while the other big banks’ fell to A1.

“I’m not sure how much new information is contained within this latest salvo but it certainly plays to market sentiment.”

BLOOMBERG. 2017 M05 10. Six Canadian Banks Cut by Moody's on Consumers' Debt Burden

by Doug Alexander, Allison McNeely, and Maciej Onoszko

- Firm’s move follows concerns over mortgage lender Home Capital

- Banks still have strong capital and liquidity buffers, it says

Canada’s dollar and bank bonds declined after Moody’s Investors Service downgraded the nation’s banks for the first time in more than four years, signalling that soaring household debt combined with runaway housing prices leave the lenders more vulnerable to losses.

Spreads on Canadian bank debt were modestly wider after the ratings firm lowered the long-term debt and deposit ratings one level on Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, National Bank of Canada and Royal Bank of Canada Wednesday.

Deposit notes were expected to open 3 basis points to 5 basis points wider and non-viability contingent capital bonds were expected to begin trading 5 basis points to 8 basis points wider, Mark Wisniewski, a credit hedge-fund manager for Sprott Asset Management LP, said by phone from Toronto.

The Canadian dollar weakened 0.8 percent to 1.3757 per U.S. dollar at 8:36 a.m. in Toronto, extending its loss this year to 2.3 percent, the worst performance among Group-of-10 peers. An index of Canadian bank shares fell 0.5 percent.

“It’s never a good thing when there’s a wide-scale downgrade within a country,” said Andrew Torres, founding partner and chief investment officer at Toronto-based Lawrence Park Asset Management. “Even though you can’t ignore the move Moody’s made overnight, I don’t think it’s the sign of an impending banking crisis in Canada.”

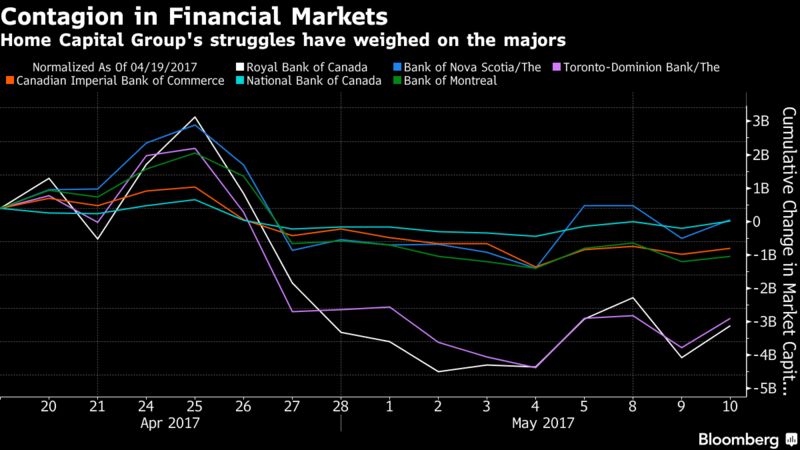

The downgrade of the Canadian banks follows a recent run on deposits at alternative mortgage lender Home Capital Group Inc. that has sparked concern over a broader slowdown in the nation’s real estate market as Canadians are taking on higher levels of household debt. The firm’s struggles have taken a toll on Canada’s biggest financial institutions, which have seen stocks slide on concern about contagion.

Untested Strength

In its statement, Moody’s pointed to ballooning private-sector debt that amounted to 185 percent of Canada’s gross domestic product at the end of last year. House prices have climbed despite efforts by policy makers to cool the market, it said Wednesday. Prices in Toronto and Vancouver have soared on the backs of strong economies, limited supply and foreign demand that’s sparking some speculative buying in the two markets. Toronto prices jumped 25 percent in April from the year earlier.

“Expanding levels of private-sector debt could weaken asset quality in the future,” David Beattie, a Moody’s senior vice president, said in the statement. “Continued growth in Canadian consumer debt and elevated housing prices leaves consumers, and Canadian banks, more vulnerable to downside risks facing the Canadian economy than in the past.”

Home prices in Toronto and the surrounding cities are gaining at a 30 percent annual pace, prompting provincial leaders to impose a foreign buyers tax and other measures last month to cool what they called dangerous speculation.

Canadian household debt climbed to a record relative to disposable income in the fourth quarter, another sign of strain from a long housing boom. Credit-market debt such as mortgages increased to 167.3 percent of after-tax income in the October-to-December period from 166.8 percent in the prior three months. Still, Canada’s consumer confidence is at the highest since at least 2009.

The news is “modestly negative” for spreads of bank bonds, according to Kris Somers, a credit analyst at BMO Capital Markets.

“We have not seen any evidence of credit deterioration with any of the banks,” Somers wrote in a report Thursday. “While we acknowledge that consumer leverage levels are increasing, we note that under a low-rate environment with stable employment, we see no catalysts for adverse shocks.”

Spokesmen for the six banks declined to comment or didn’t immediately respond to messages seeking comment outside of normal business hours.

Bank Buffer

“We do note that the Canadian banks maintain strong buffers in terms of capital and liquidity,” Moody’s said in its statement Wednesday. “However, the resilience of household balance sheets, and consequently bank portfolios, to a serious economic downturn has not been tested at these levels of private sector indebtedness.”

Moody’s also cited high housing prices and consumer debt when it cut five of the banks in January of 2013. That decision cost Toronto-Dominion its Aaa grade.

The downgrades aren’t likely to have a big impact on bond prices, according to RBC Capital Markets. Toronto-Dominion Bank’s widely traded March 2022 deposit note has a yield spread of about 75.9 basis points over government debt.

“The banks are 50 percent of the bond market. Do you think guys are going to wake up and sell them today?” Wisniewski said. “What are they going to buy?”

The ratings company said that it still has a negative outlook on all six lenders. The move left Toronto-Dominion with a long-term debt rating of Aa2, the third-highest level. Moody’s lowered the other five to A1, the fifth-highest.

BLOOMBERG. 2017 M05 11. Home Capital to Address Analysts as CIBC Funds Boost Stake

by Luke Kawa and Doug Alexander

- CIBC Asset, Turtle Creek now top Home Capital shareholders

- CIBC buys shares after Mawer, QV sell stock following plunge

Home Capital Group Inc. received a vote of confidence from two money managers as the embattled mortgage lender prepares to report earnings and address analysts for the first time since a regulatory probe sent the stock reeling.

CIBC Asset Management and Turtle Creek Investment Management Inc. both lifted their stakes as of the end of April to become the top two shareholders of the Toronto-based mortgage company. Turtle Creek holds a 19 percent stake, while the money management unit of Canadian Imperial Bank of Commerce owns 15 percent, according to filings.

Investors and analysts will be looking for more clues Thursday on whether the company can survive a run on deposits that sent the stock down more than 60 percent in three weeks and forced the lender to draw down C$1.4 billion ($1 billion) on a costly C$2 billion credit line. Home Capital is scheduled to report first-quarter earnings after the close of trading and speak to investors on a conference call Friday.

Home Capital rose 16 percent to C$10.20 in Toronto at 10:24 a.m. Through Wednesday, the stock had plunged 61 percent since April 19, dragging down other financial stocks.

Concerns of contagion may intensify after Moody’s Investors Service late on Wednesday downgraded six of Canada’s biggest banks.

The loss of about C$1.9 billion in high-interest deposits since late March has forced Home Capital to consider the sale of mortgages as funding dries up. Home Capital agreed this week to sell up to C$1.5 billion in mortgage renewals to a third party, which the Globe and Mail identified as rival MCAP Corp. Messages left with the Toronto-based mortgage financing firm weren’t returned, and Home Capital external spokesman Boyd Erman declined to comment.

Lower Balances

Details on how the lender plans to execute a shift in funding strategy away from deposits toward originating mortgages for sale will be closely parsed by analysts. The company said Tuesday the shift will result in lower mortgage balances, higher costs and reduced profitability in the “near term.”

“We will be looking for more details in the coming days on the structure of the agreement including origination and administration fees,” GMP Securities analyst Stephen Boland said in a May 9 note.

Boland, who has a buy rating and C$16 price target on the stock, said the shift in strategy is likely to squeeze profit margins but is “another positive step towards HCG continuing as a going concern.”

Home Capital’s high interest savings deposits slid to about C$128 million on May 11 from C$134 million the previous day and guaranteed investment certificate deposits were C$12.54 billion as of May 9, the Toronto-based lender said in a statement Thursday. Available liquidity and credit capacity totaled about C$1.62 billion. The run on deposits triggered concern that contagion may spread across Canada’s financial sector, threatening the fastest-growing economy in the developed world.

Big Six

Moody’s downgraded Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, National Bank of Canada and Royal Bank of Canada after regular trading hours on Wednesday. The company cut the lenders’ long-term debt and deposit ratings by one level, citing increasing consumer debt and house prices that could weaken asset quality.

The outlook is still negative on all six, Moody’s said in its statement. Spokesmen for the six banks declined to comment or didn’t immediately respond outside of normal business hours.

Some investors, meanwhile, see value in Home Capital after the stock plunge. CIBC Asset Management portfolio manager Colum McKinley called Home Capital’s decline an overreaction -- one that helped him, as a value investor, bolster his firm’s position in the lender.

“We think that there is an asset here where the quoted value in the market doesn’t represent the underlying value of the company, and ultimately that will be recognized for shareholders,” said McKinley, who runs funds including CIBC Canadian Equity Value Fund.

Increased Stakes

CIBC Asset Management and its funds, which oversee C$124 billion, now own 9.69 million shares as of April 30 from 2.46 million at the end of the first quarter, according to data compiled by Bloomberg. Their position swelled as other major shareholders were exiting.

Toronto-based Turtle Creek increased its position in late April and remains the largest shareholder, owning 12.2 million shares as of April 28. QV Investors and Mawer Investment Management Ltd. had also been major shareholders in the Toronto-based firm, but have exited their positions. Ian Cooke, a portfolio manager at QV Investors, said the money manager had “made an investing mistake in Home Capital.”

CIBC Asset Management and its funds snapped up shares of Home Capital through April, including buying on April 26 when the company’s stock plunged 65 percent after the high-interest terms of the credit line from Healthcare of Ontario Pension Plan was released. The Ontario Securities Commission on April 19 accused Home Capital of misleading investors about fraudulent mortgage applications.

‘Exceptionally Low’

“We had some we bought before, we bought some after the OSC investigation was announced and we bought more when the stock traded down to what we thought was exceptionally low levels,” said the portfolio manager, who added that he is “disappointed” in how this position has performed thus far.

McKinley is responsible for the CIBC Monthly Income Fund and the CIBC Canadian Equity Value Fund at Canada’s fifth-biggest bank. The investment decisions made by CIBC’s asset management unit are independent of the commercial bank.

Home Capital also suspended its dividend in a bid to preserve capital. Half of the firm’s GICs are scheduled to mature this year, according to the lender’s fourth-quarter earnings report.

“The assets of the business remain strong and really what this is, in the near term, is a cost of funding issue,” McKinley said. “We don’t see a solvency issue here, we see a cost of funding issue, and as confidence is restored in the business as they buy time, we think that will ultimately get recognized.”

He added the quality of Home Capital’s loan book and its provisioning remain “quite healthy,” and there doesn’t appear to be a systemic problem with its loan book.

The Globe and Mail. May 11, 2017. Home Capital sees more deposit drawdowns

NIALL MCGEE - CAPITAL MARKETS REPORTER

Embattled mortgage lender Home Capital Group Inc. has seen another drawdown in its deposit base over the past twenty four hours, as investors wait for an in-depth look into the company’s financial situation.

In a release on Thursday, the company said high interest savings account (HISA) balances at its subsidiary Home Trust now stand at roughly $128-million, versus $134-million on Wednesday – a decline of 4.5 per cent. About 6 weeks ago, the company had roughly $2-billion in those accounts.

Home Capital’s retail savings bank Oaken saw deposits fall slightly to $155-million as of Tuesday, compared to $159-million on Monday.

Canada’s biggest alternative mortgage lender has seen a wild run on the firm’s deposits that intensified after the Ontario Securities Commission brought allegations of faulty disclosure against the company in April. None of the charges have been proven and Home Capital says they are “without merit”.

After the markets close, Home Capital is scheduled to release its first quarter results and management will host a conference call with analysts and institutional investors on Friday morning. Investors will look for details on how the recent drama at the firm has impacted mortgage originations, and watch for any fresh information on funding plans.

On Tuesday, the company announced a tentative plan to sell up to $1.5-billion in mortgages to a third party. Yesterday, the Globe and Mail identified that third party as mortgage finance firm MCAP. Under the deal, MCAP would initially acquire $500-million worth of home-loan commitments, and potentially acquire an additional $1-billion of renewals, new mortgages and existing loans.

Since Home Capital’s entire mortgage book is the region of $18-billion, investors are waiting to see if the company can secure a substantial and long-term funding solution. On Tuesday, the company said it was working “very hard’ to develop additional sources of funding.

Late last month, a syndicate led by Healthcare of Ontario Pension Plan (HOOPP) arranged an emergency $2-billion credit line for Home Capital at an initial interest rate of 10 per cent. Home Capital has drawn down $1.4-billion so far. The Globe and Mail reported on Tuesday that Toronto-Dominion Bank also participated in the syndicate.

The company’s liquid assets stood at $1.01-billion as of Wednesday night – virtually unchanged from the day before.

REUTERS. May 11, 2017. Exclusive: Home Capital plans sale of C$2 billion in commercial, consumer finance assets

TORONTO (Reuters) - Home Capital Group, Canada's biggest non-bank lender, is looking to divest about C$2 billion in assets to help pay down a high-interest loan and delay a potential sale of the entire company, according to people familiar with the situation.

The company, which has seen a rapid decline in deposits amid a regulatory probe, wants to sell all or part of its commercial mortgage portfolio, its consumer finance business and a small portion of its traditional residential mortgage portfolio to raise the C$2 billion, the people said.

(Reporting by John Tilak and Matt Scuffham; Editing by Amran Abocar and Nick Zieminski)

REUTERS. May 11, 2017. Home Capital's high-interest accounts balance expected to fall to C$128 million

(Reuters) - Canada's biggest non-bank lender Home Capital Group Inc HCG.TO said on Thursday its high-interest savings deposits were expected to have fallen to about C$128 million ($93 million)following the completion of Wednesday's settlements.

Deposits were expected to have fallen to about C$134 million following completion of Tuesday's settlements.

Depositors have withdrawn more than 90 percent of funds from Home Capital's high-interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

The withdrawals accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business.

The company, which is set to report its results after markets close on Thursday, has said the accusations are without merit.

Home Capital relies on deposits from savers to fund its lending to borrowers, such as self-employed workers or newcomers to Canada, who may not meet the strict criteria of the country's biggest banks.

Last month, the company agreed to receive C$2 billion in emergency funding from the Healthcare of Ontario Pension Plan (HOOPP). It has so far drawn down C$1.4 billion from that facility.

The company said on Thursday its liquid assets stood at C$1.02 billion at the end of Wednesday, which, combined with the funds not drawn down on the HOOPP credit facility, gives it access to available liquidity and credit capacity of C$1.62 billion.

(Reporting by Arathy S Nair in Bengaluru; Editing by Saumyadeb Chakrabarty)

REUTERS. May 11, 2017. Canada new housing prices rise on Vancouver, Toronto strength

OTTAWA (Reuters) - Prices for new housing in Canada rose by 0.2 percent in March from February on gains in Toronto and Vancouver, two of the country's hottest markets in recent years, Statistics Canada data indicated on Thursday.

The increase matched estimates from analysts in a Reuters poll. Compared with March 2016, prices climbed by 3.3 percent, largely reflecting continued strength in Toronto.

Prices in Toronto, which accounts for 25.49 percent of the entire Canadian market, edged up by 0.2 percent in March.

Bank of Canada Governor Stephen Poloz last week said hefty Toronto home prices increases were not sustainable and had been driven in part by speculation.

Vancouver prices posted their first price increase in five months, jumping by 0.7 percent on better market conditions. Vancouver is the largest city in the Pacific province of British Columbia, where the government imposed a 15 percent property transfer tax on foreign real estate buyers last August.

The price index excludes apartments and condominiums, which the government says are a particular cause for concern and which account for one-third of new housing.

(Reporting by David Ljunggren; Editing by Lisa Von Ahn)

________________

THE GLOBE AND MAIL. REUTERS. May 11, 2017. In Trump’s shadow, Fed official calls trade barriers a ‘dead end’

SUVASHREE CHOUDHURY AND JONATHAN SPICER

MUMBAI and NEW YORK — Reuters

Trade protectionism is a “dead end” that may score political points but will ultimately hurt the U.S. economy, one of the most influential Federal Reserve officials said on Thursday in the central bank’s strongest defense yet of open borders in the face of a skeptical Trump administration.

William Dudley, head of the New York Fed, did not mention U.S. President Donald Trump by name in a speech at the Bombay Stock Exchange. But he gave a full-throated economic and even political argument for resisting trade barriers that he said would hurt growth and living standards in both the United States and around the world.

“Protectionism can have a siren-like appeal,” said Dudley, a close ally of Fed Chair Janet Yellen and a key decision-maker on U.S. interest-rate policy.

“Viewed narrowly, it may be potentially rewarding to particular segments of the economy in the short term,” he said in prepared remarks. “Viewed more broadly, it would almost certainly be destructive to the economy overall in the long term.”

The Fed is independent but answerable to Congress, and its governors are appointed by the White House and confirmed by the Senate. While Fed officials usually avoid recommending fiscal policies, several have highlighted the benefits of open borders since Trump was elected on an “America First” platform of revamping or ripping up trade deals.

The White House has said trade deals often do more harm than good for U.S. workers and companies, especially those in the manufacturing sector hard-hit by globalization. Over the last 25 years trade has grown to represent roughly 57 per cent of global output, from less than 40 per cent.

Dudley said he was speaking out because “we are at a particularly important juncture” in which trade issues could imperil the long-term health and productivity of the economy and “the economic opportunities available to our people.”

Barriers to trade are very costly, he said, because they blunt export opportunities, make everyday goods more expensive, and they can often “backfire” by harming workers who can no longer compete in a global economy.

“There are many approaches to dealing with the costs of globalization, but protectionism is a dead end,” said Dudley, a former Goldman Sachs partner who joined the New York Fed in 2007 and became its president in the depths of the financial crisis in early 2009.

“Trying to achieve a high standard of living by following a policy of economic isolationism will fail,” he said in Mumbai.

The unusually pointed speech comes after the New York Fed published research in recent months that warned against a Republican proposal for a border-adjustment tax and a Trump threat to ditch the North American Free Trade Agreement. Both the Republicans and Trump have since largely backed down from those positions.

The U.S. central bank has hiked interest rates twice since December and expects to tighten policy about two more times this year as the economy carries on a roughly 2-per cent growth track, and as unemployment at 4.4 per cent remains low.

Dudley has said the Fed would adapt its approach as tax, spending and trade policies emerge from Washington. He does not expect a “dramatic change” in policy, he said on Thursday, repeating his preference to start trimming the Fed’s $4.5-trillion balance sheet as early as this year in such a way that it is “a modest and minor” event.

THE GLOBE AND MAIL. Special to The Globe and Mail. May 10, 2017. U.S.-CANADA TRADE. Canadian exporters: Keep calm and carry on while NAFTA up in the air

DAVID ISRAELSON

As Canada prepares to renegotiate, or possibly see the death of the North American free-trade agreement with the United States and Mexico, the best advice to Canadian exporters seems to be: Keep calm and carry on … and strap in for what might be a bumpy ride.

“I don’t think we can anticipate anything. I think we have to plan for multiple scenarios, various different options,” says Danielle Goldfarb, director of the Conference Board of Canada’s Global Commerce Centre.

Like most leading think tanks, the Conference Board is deep into analyzing the often-conflicting signals on NAFTA emanating from U.S. President Donald Trump and his administration. In early June, the group is holding a webinar to discuss what Canada should call for in negotiations, and what to expect.

President Trump has alternated between calling NAFTA the “worst deal in history” during last year’s election campaign, to telling Prime Minister Justin Trudeau he was simply looking for a few “tweaks” to the 1994 deal, which has boosted cross-border trade and the integration of manufacturing in the area substantially.

Although the Trump administration has gone back and forth on the issue, just as recently as yesterday, U.S. Commerce Secretary Wilbur Ross warned that the United States may still pull out of the deal.

The most contentious issues include agriculture and lumber. Mr. Trump has tweeted that, “we will not stand for” Canadian marketing board supports for dairy farmers.

And on April 24, Mr. Ross slapped a 20-per-cent tariff on Canadian softwood exports into the United States. Mr. Ross called it “a bad week for U.S.-Canada trade relations,” and, referring to NAFTA, said pointedly that “this is not our idea of a properly functioning trade agreement.”

While most analysts are willing to chalk up some of the U.S. commentary as rhetoric and posturing, there is nevertheless unmistakable concern about where this aggressive talk might lead.

On May 2, John Manley, president and chief executive officer of the Business Council of Canada wrote Prime Minister Trudeau saying that his organization’s members are “deeply concerned about the future of Canada’s trade partnership with the United States and Mexico.”

The letter continued, “The prospect of a new round of NAFTA negotiations represents both a risk and an opportunity for Canada. …

“At a minimum … Canada’s objective must be to protect the framework of rights, benefits and privileges that our companies and citizens currently enjoy under NAFTA,” wrote Mr. Manley, a former Canadian deputy prime minister.

“Canada also should seek to modernize and improve the agreement in ways that will create new opportunities and enhanced prosperity for citizens across the continent.”

There is a consensus that these are sensible objectives; the challenge now is to try to achieve them with a bombastic, unpredictable negotiating partner.

Canada needs to play both offence and defence in the negotiations, says Andrea van Vugt, the Business Council’s vice-president of policy for North America.

“It’s important that in our negotiations, Canada ensures that existing access [to the North American market] isn’t eroded.”

There is a lot at stake. About three-quarters of our exports go south of the border, according to Export Development Canada; by comparison, about 10 per cent of our exports go to our second-largest trading partner, the European Union, according to the Canadian Trade Commissioner Service.

Perhaps even more important are the continental supply chains that have grown since NAFTA was ratified in 1994. For instance, goods such as auto parts go back and forth across both the Canadian and Mexican borders many times as cars and trucks are built.

The auto industry was worth $79.8-billion last year, according to Canadian customs data. Vehicle and auto-parts manufacturing provided nearly 127,000 Canadian jobs in 2016, and this does not take into account the thousands of indirect jobs that the sector contributes for services such as transport, retail and administration.

In addition to imposing the softwood tariff and seeking to dismember Canada’s agricultural supports, President Trump has also mused about imposing a border tax on Canadian exports to America. This is already being met with second thoughts in Congress and state governments, because it invites retaliation, and for 35 states, Canada is the top export market.

As Canada and Mexico wait for NAFTA negotiations to get under way, businesses cannot do much in anticipation of the possible negative U.S. demands, other than to keep doing business as usual, make their views clear through their umbrella organizations and count on Canadian negotiators to take strong positions to avoid any attempts by the United States to erect new trade barriers, experts say.

The softwood and agricultural issues are seen by most as perennial irritants that Canada will have to continue to negotiate regardless of the NAFTA negotiations. As for the President’s outrage over various aspects of NAFTA, “My advice would be, don’t extrapolate what’s in a tweet to the larger relationship between Canada and the U.S.,” said Lloyd Blankfein, chief executive officer of Goldman Sachs Group Inc. during a recent visit to Toronto.

Former prime minister Brian Mulroney, who successfully negotiated the Canada-U.S. free trade deal that preceded and formed the backbone of NAFTA, said last month that Canadian negotiators should be prepared for “more than a tweak” in the U.S. demands.

The United States might zero in on “rules of origin” that determine how much of a product is American-made, and the dispute-resolving mechanism in the agreement, he said.

Negotiations are not a bad thing for Canada, because the 1994 agreement is ready for an update, Ms. Goldfarb says. From Canada’s point of view, it could do with a refreshment of the rules for how Canadians, Americans and Mexicans move across borders to work.

Mr. Manley agrees. “Canada’s negotiators should take this opportunity to modernize our country’s trade and investment relationships with Mexico and the United States,” he said in his letter to the prime minister.

“Labour mobility and customs procedures are two areas in which NAFTA’s provisions are clearly outdated,” he said.

“Opportunities exist in areas such as intellectual property, e-commerce, the treatment of state-owned enterprises, competition rules, sanitary and phytosanitary measures [certifying that agricultural products are pest-free], labour, environment, procurement and regulatory co-operation.”

That is a tall list. Meanwhile, Canadian businesses can do little but wait until the procedural machinery cranks to let the negotiations begin.

REUTERS. May 11, 2017. Canada taps veteran negotiator to drive talks on NAFTA: sources

By David Ljunggren

OTTAWA (Reuters) - Canada's senior negotiator at talks to renew NAFTA will be the official who worked for years to push through a major free trade deal with Europe, two sources familiar with the matter said on Thursday.

Steve Verheul faces another challenge as he deals with the United States, which is threatening to walk away from the three-nation North American Free Trade Agreement unless major changes are made. The talks, which will also include Mexico, are due to start later this year.

"He will play a significant and instrumental role in handling and managing any future negotiations," said one of the sources, who requested anonymity because the news had not been announced yet.

The development was previously reported by the iPolitics website.

Verheul is a career bureaucrat. At certain points during the talks, Canada will most likely be represented by Prime Minister Justin Trudeau or Foreign Minister Chrystia Freeland, said the sources.

Verheul enjoyed a close working relationship last year with Freeland - who was then trade minister - as they strained to seal the pact with the European Union, which at one stage looked close to collapse.

Freeland is now in overall charge of ties with the United States. She has praised Verheul several times in public.

The talks on the EU trade deal were started by Canada's Conservative government in 2009. Former trade minister Ed Fast, who worked with Verheul for years, described him as a brilliant tactician.

"He has the ability to remain calm under trying circumstances ... he is incredibly patient," Fast said in a phone interview.

The negotiations are crucial for Canada, which sends

75 percent of its goods exports to the United States.

The Canadian government also intends to send a top trade bureaucrat to Washington to serve as the deputy head of the embassy, starting in September, the sources said.

Kirsten Hillman, currently in charge of trade policy at the foreign ministry, was Canada's chief negotiator at talks on the proposed 12-nation Trans Pacific Partnership pact.

The administration of U.S. President Donald Trump pulled out of the treaty in late January. The remaining 11 nations met last week to discuss ways of reviving the agreement.

(Reporting by David Ljunggren; Editing by Alistair Bell)

________________

ANALYSIS

The Globe and Mail. OPINION. ANALYSIS. May 10, 2017. COLUMNIST DOUG SAUNDERS. After Comey, Trudeau needs to change his tune on Trump

DOUG SAUNDERS, International-Affairs Columnist

Is it time to stop acting as if Donald Trump were an acceptable and legitimate national leader? That is a key question this week for Prime Minister Justin Trudeau.

On Tuesday, the U.S. President crossed a line that is one of the key safety barriers of democracy. By abruptly firing the head of an agency, the Federal Bureau of Investigation, that was responsible for investigating Mr. Trump’s election campaign for alleged collusion with Russian officials, the President jeopardized the rule of law. By doing so just as that investigation was getting uncomfortably close to the White House – and apparently with the goal of shutting it down – he ensured that the rule of law, and the sovereignty of the people, will be perpetually insecure.

Many referred to this week’s events as a tilt into arbitrary rule. General Michael Hayden, the former head of the Central Intelligence Agency and the National Security Agency, put it bluntly on Wednesday: “I’m trying to avoid the conclusion that we’ve become Nicaragua.”

Against that backdrop, Mr. Trudeau’s collegial meetings with the President and cheery roundtables with the President’s increasingly powerful daughter appear off-putting. They were never very comfortable, and a lot of veteran Liberals, including some in government, have told me they disapprove of the Prime Minister’s “enabler-in-chief” approach.

But there were good reasons why a Canadian leader might have wanted to play ball with Mr. Trump – at least at first. The question is whether those reasons still apply.

First, Mr. Trudeau and his staff believed that Canada could act as a force of moderation. Through quiet persuasion and example, Canadians could prevent the very worst from happening as the United States endured its worst moment.

That theory was given new credence with reports that Mr. Trudeau was responsible for talking Mr. Trump out of his plan to cancel the North American free-trade agreement on his 100th day in office. According to one report this week, more moderate members of the White House staff were so horrified at the prospect that they persuaded Mr. Trudeau to get on the phone and disabuse Mr. Trump of the idea.

If that’s the case, then the months of cringe-inducing diplomacy may have borne some fruit. Yet they didn’t prevent Mr. Trump for launching new trade wars over softwood lumber and dairy – and they haven’t quelled rumours that Mr. Trump is still prepared to pull the plug on NAFTA.

Second, Mr. Trudeau probably wanted to make sure that when the Canada-U.S. relationship falls apart – as it likely will – it will be Mr. Trump’s doing, not something to be blamed on Canadian intransigence or awkwardness, such as prime minister Stephen Harper’s falling out with Barack Obama over the Keystone XL pipeline. A Trump rage could hurt Canadian security and well-being badly.

Third, he likely wanted to reverse the old perception, dating back to the 1970s, that Liberals are anti-American and that only Tories can manage Washington. Mr. Harper did much to erase that image with his turn against Washington. Mr. Trudeau has made that point well enough by now.

On the other hand, Mr. Trudeau is taking a number of risks. He risks becoming a key figure in Mr. Trump’s campaign to appear to be a legitimate world leader and to popularize a form of politics to which the Western world has spent seven decades saying, “Never again.”

He risks making Mr. Trump’s politics appear to be something other than a disaster to voters in other countries. Did France’s Marine Le Pen double her party’s electoral outcome last weekend because Mr. Trump made it seem like the politics of intolerance produce results?

At worst, if Mr. Trump tilts further into demagoguery, Mr. Trudeau risks appearing to have sided against the American people by empowering a leader that the vast majority of them are opposed to and offended by. It could put Mr. Trudeau in a bloc of world leaders who are contributing to the problem, not the solution.

At some point, Mr. Trudeau will need to show the world that he knows not just how to stroke and cajole, but also how to denounce and condemn. Whether this week’s abuses should push him over that line is not the question – it is whether he has drawn such a line at all.

_________________

LGCJ.: