CANADA ECONOMICS

BRAZIL

BLOOMBERG. 2017 M05 19. Chaos Takes Hold in Brazil as Markets Sink, Temer Vows to Fight

by Bruce Douglas and Raymond Colitt

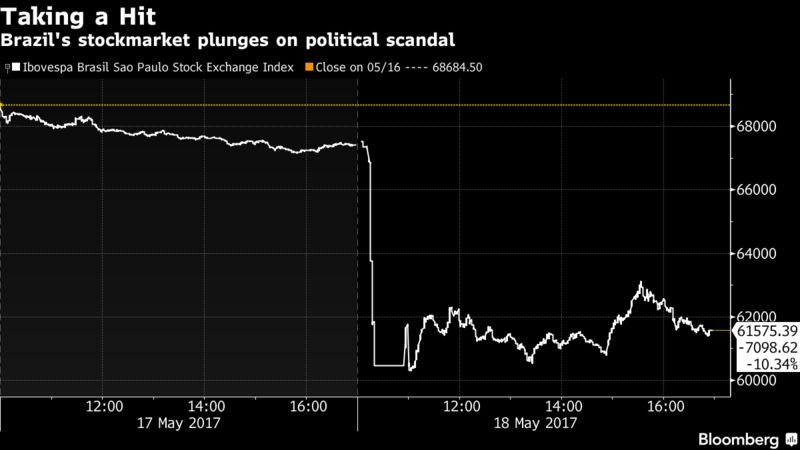

- $150 billion wiped off the value of the local stock market

- Allegations against president exploded ‘like an atomic bomb’

- What a New Political Crisis Means for Brazil

The impeachment of one president was traumatic. The prospect of two back-to-back spread dread and disbelief across Brazil Thursday as federal police raided politicians’ homes, helicopters droned over the capital city, markets collapsed and a defiant President Michel Temer declared he wouldn’t step down.

It has been just 12 months since the removal of his predecessor, Dilma Rousseff, on charges she broke budget laws. Allegations against Temer could end his tenure too, if what the O Globo newspaper reported is true -- that he endorsed the payment of hush-money to the imprisoned former speaker of the lower house of Congress.

The news exploded “like an atomic bomb,” in the words of Alessandro Molon, an opposition lawmaker. Calls for the president’s ouster mounted. Temer was holed up with advisers for much of the day before saying in a televised speech that he intends to hold on to power and prove his innocence. “I know what I did,” he said. “I know my actions were correct.”

For investors who bought into his pledge to push austerity measures on a nation enduring the worst recession on record, the day delivered a crushing blow, including a 15 percent drop in the shares of state-owned oil company Petroleo Brasileiro SA, which is at the center of the sweeping Operation Carwash corruption investigation. The stock-market losses totaled $150 billion.

Late on Thursday Temer told G1 news site that the matter had been blown out of proportion and that the crisis would be over sooner than people expect. In early trading on Friday the real bounced back 1.5 percent, after plunging over seven percent the day before. Petrobras shares were up 4 percent.

Brazilians, long familiar with scandal and upheaval, aren’t looking forward to more legal proceedings and political wrangling, maddeningly reminiscent of the tumultuous months preceding Rousseff’s impeachment. In a gritty open-air shopping arcade in downtown Brasilia, some people said they’d be better off with a return to a military dictatorship.

‘All Clowns’

Francisco Rodrigues Araujo, 41, a vendor selling clothes displayed on a blue blanket, had another idea. He suggested that Tiririca, a famous circus clown and a federal deputy who ran in 2010 on the slogan, “It can’t get any worse!,” be installed in the presidency.

“They’re all clowns anyway,” he said. “Why not put one in charge?”

The country’s tumble into its latest crisis began with the O Globo report Wednesday night that the Supreme Court had received testimony that Temer approved payment of a bribe to buy the silence of Eduardo Cunha, the former speaker and mastermind of last year’s impeachment process. On Thursday afternoon, the paper’s website posted an audiotape that purports to be of Temer discussing the alleged payoff.

The paper said the testimony was submitted by Joesley and Wesley Batista, the brothers who run the meat-packing giant JBS SA, as part of a plea-bargain deal in an Operation Carwash case. The court is looking into the allegations against Temer and others implicated by the Batistas as part of Carwash, which started three years ago as an investigation into a money-laundering scheme run out of a gas station in Brasilia and blew up into a scandal that has tarnished most of Brazil’s political establishment.

Opposition parties, which began filing for Temer’s impeachment within hours of the O Globo report, called for street protests in favor of new elections. As night fell, crowds gathered in several cities to demand the president’s ouster. In Rio, police fired stun guns and tear gas at rock-throwing demonstrators.

Outside the presidential palace in Brasilia, about 1,000 people waved flags and chanted a slogan, which rhymes in Portuguese, that calls Temer a thief who belongs in prison. Joao Bendito, 18, saw the rally as just the beginning. “It will need a lot more people to really make Temer resign,” he said, “the common people who are indignant at these spoiled children in power today.”

Resentment has been building for months against Temer, an unelected president -- he stepped into the job as Rousseff’s vice president -- with single-digit approval ratings who many Brazilians associate with shady wheeling and dealing. Eight of his cabinet ministers have been forced to resign over allegations of misconduct; three are currently under investigation. His political enemies frequently compare him to a butler in a horror movie.

As Thursday wore on, the Temer government suffered several blows, with allies jumping ship or threatening to quit if the allegations proved true. The culture minister, Roberto Freire, handed in his resignation.

In his speech, Temer said the renewed political uncertainty comes just as prospects for Brazil are improving, with inflation under control, signs of economic recovery sprouting and reform bills advancing in Congress. “All this immense effort to haul the country out of its worst recession could be in vain,” he said. “We cannot throw so much work for the good of our country into the dustbin of history.”

Janete Silva, a writer protesting outside the presidential palace, wasn’t buying it. “Temer’s speech was hypocritical, insecure, authoritarian and arrogant,” she said. “It shows that he doesn’t care what people think."

The president is facing another threat: Brazil’s top electoral court is assessing whether to annul the results of the 2014 elections on grounds the joint Rousseff-Temer campaign was financed illegally.

As it is, “Temer’s refusal to step down means that political uncertainty will remain heightened in the near term, fueling street protests and bringing Congress to a halt,” Thomaz Favaro, the chief Brazil analyst at consulting firm Control Risks, wrote in a note. “An unscheduled government change remains a credible development.”

BLOOMBERG. 2017 M05 19. For These Die-Hard Investors, Now Is the Time to Buy Brazil

by Paula Sambo

- Deutsche Bank and Morgan Stanley say Ambev looks attractive

- Some see value in bonds from JBS, company at center of crisis

- What a New Political Crisis Means for Brazil

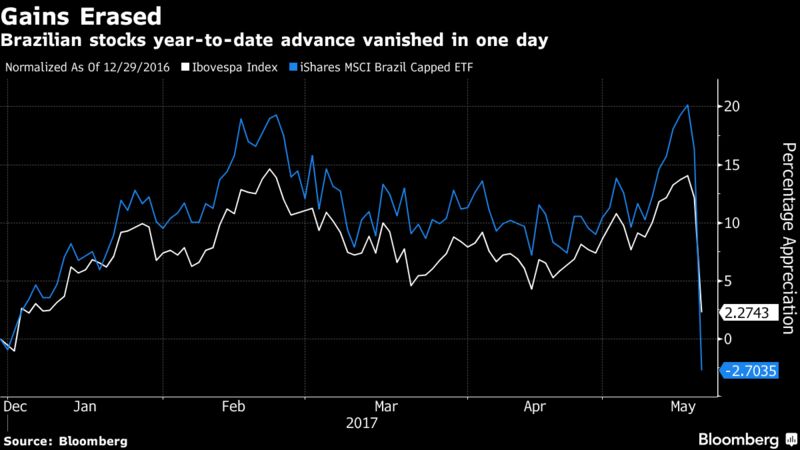

For months, investing in Brazil has been a breeze. Buying into any asset class delivered some of the world’s biggest gains as traders cheered on President Michel Temer’s pursuit of austerity measures designed to rein in a ballooning budget deficit.

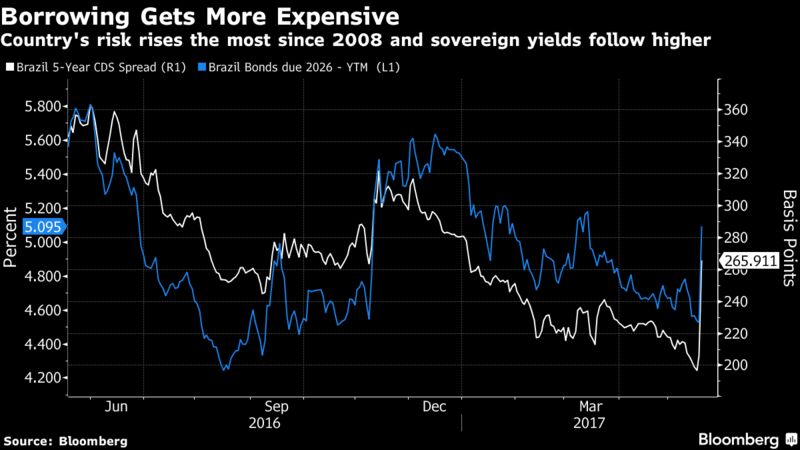

That changed abruptly Wednesday evening, following reports that Temer approved illegal payments to a disgraced lawmaker who had orchestrated the impeachment of his predecessor. Investors smelled a disaster in the making, and markets staged a a massive selloff Thursday with everything from the real to the Ibovespa to Brazilian bonds tanking.

Yet some brave fund managers are bringing out their calculators and looking for buying opportunities amid the chaos. Sure, they acknowledge, Temer might well be on his way out and his ambitious plans to rein in the pension system and change Brazil’s labor laws seems imperiled, but Latin America’s biggest economy still holds a lot of value for investors willing to put in the work.

“In the short term, this is negative for social security reform and for sentiment, but we’re the kind of fund that when prices fall, we’re more inclined to buy,” said Adrian Landgrebe, an emerging-markets portfolio manager at Sagil Capital in London. “We see some really extreme moves and those are the kind of things that we look to buy.”

Brazilian assets staged somewhat of a recovery Friday, with the real rallying 2.8 percent to 3.2831 per dollar as of 10:21 a.m. in New York and the Ibovespa adding 3.1 percent. Sovereign bonds also advanced.

It followed a rout on Thursday. The real fell the most since 1999, the Ibovespa tumbled to the lowest since January and government bonds posted the biggest loss in emerging markets.

No one is saying it’s all smooth sailing from here. Temer stuck a defiant tone in a speech Thursday evening, saying he wouldn’t resign and denying any wrongdoing, dashing some investors’ hopes for a quick resolution. But the optimists say Brazil is a massive economy with a large middle class and abundant natural resources, and at some point it’ll regain its footing.

Brazilian assets had rallied over the past 18 months as investors gained confidence that the government would be able to tackle the excessive spending and low tax revenue that had resulted in the loss of its coveted investment-grade rating. The Ibovespa surged 69 percent in dollar terms last year, while the real strengthened 22 percent, the best performance in the world for both stocks and currencies.

Marcelo Assalin, who manages $8.5 billion as head of emerging-market debt at NN Investment Partners, said Thursday’s selloff was exacerbated by the fact that so many big investors were overweight Brazil and were quickly trying to unwind their positions. He said the outlook for markets is dependent on how fast an institutional solution takes shape.

“The time will come to search for good investing opportunities,” he said. “This is the time to be calm and wait for more clarity. Brazilian assets offer good value to investors who have a longer-term approach.”

Several analysts say that Ambev SA, the Brazilian unit of the world’s largest brewer, Anheuser-Busch InBev, could be a good stock pick. Deutsche Bank AG wrote in a note that the beermaker’s currency hedges would help protect it from a weaker real, and Morgan Stanley strategist Guilherme Paiva also cited it as a good value.

Investors should favor high-quality companies able to withstand prolonged political uncertainty and economic weakness, Paiva wrote. In addition to Ambev, he recommended shares of pulp- and paper-maker Fibria Celulose SA, dental insurer Odontoprev SA and Ultrapar Participacoes SA, a fuel distributor.

Fibria and its rivals Suzano Papel & Celulose SA and Klabin SA were some of the few bright spots among Brazilian stocks Thursday, rallying on speculation that a weaker currency will boost their competitiveness by making their exports cheaper in dollar terms.

Iron-ore miner Vale SA is also a good bet, according to Tony Robson, chairman of Global Mining Research in Sydney, who said the company’s fundamentals remain sound.

Vinicius Pasquarelli, an emerging-market debt trader at Fynsa International in Santiago, said the selloff in bonds from state-controlled oil producer Petroleo Brasileiro SA makes them look like a good buy.

“When a country like Brazil faces a scenario of political risk as strong as this, a good strategy is to take advantage of low prices to get active in the best credit stories,” he said.

Perhaps the unlikeliest recommendation to emerge from Thursday’s carnage was to buy bonds from the company that helped cause all the chaos, JBS SA. The allegations that Temer approved payoffs to buy the silence of lawmaker Eduardo Cunha stemmed from leaked testimony by the meatpacking giant’s executives.

The executives’ plea deals signal JBS is closer to putting the scandal behind it, according to Ian McCall, who manages $185 million in emerging-market assets at Quesnell Capital in Geneva. He recommends notes from the meatpacker and its Eldorado Brasil Celulose SA offshoot.

Jim Barrineau, the co-head of emerging markets debt for Schroder Investment Management, said he was sticking with bets on bonds from Petrobras and JBS on the view that as more of the corruption details leak out, the less risk there are for new damaging revelations.

“The cloud on top of JBS and Eldorado can begin to lift,” said McCall, who added that he was fully aware of the irony of his recommendation. “For those two names, the events of the past 24 hours can turn out to be quite constructive in the longer run.”

________________

STATISTICS

StatCan. 2017-05-19. Consumer Price Index, April 2017

Consumer Price Index

April 2017

1.6% increase (12-month change)

Source(s): CANSIM table 326-0020.

The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in April, matching the gain in March.

Overall, energy prices rose more year over year in April than they did in March, while declines in food prices moderated.

Excluding food and energy, the CPI was up 1.5% on a year-over-year basis in April, following a 1.7% increase in March.

Chart 1 Chart 1: The 12-month change in the Consumer Price Index (CPI) and the CPI excluding food and energy

The 12-month change in the Consumer Price Index (CPI) and the CPI excluding food and energy

12-month change in the major components

Prices were up in six of the eight major components in the 12 months to April, with the transportation and shelter indexes contributing the most to the year-over-year rise in the CPI. The food index declined on a year-over-year basis for the seventh consecutive month.

Chart 2 Chart 2: Consumer prices increase in six of the eight major components

Consumer prices increase in six of the eight major components

Transportation costs rose 4.2% over the 12-month period ending in April, after increasing 4.6% in March. This deceleration was led by the purchase of passenger vehicles index, which rose less on a year-over-year basis in April than in March. Gasoline prices posted a 15.9% year-over-year increase in April, slightly larger than the 15.2% rise registered in March. On a monthly basis, gasoline prices rose 9.5% in April, partly due to supply disruptions at oil refineries, as they changed over to summer fuel blends.

Shelter costs rose 2.2% in April on a year-over-year basis, matching the increases in February and March. The homeowners' replacement cost index (+3.9%) was the main upward contributor to the 12-month change in the shelter index, despite slowing growth since November 2016. Prices for natural gas (+15.2%) rose on a year-over-year basis for the fourth consecutive month. Conversely, electricity prices posted their fourth consecutive decline, down 1.3% year over year in April.

The recreation, education and reading index grew 3.3% in the 12 months to April, following a 3.6% increase in March. The travel tours index rose 9.4% year over year in April, contributing the most to the rise in the recreation, education and reading index. Traveller accommodation costs were up 5.7% year over year in April, after rising 1.4% in March. At the same time, the video equipment index fell 8.8% on a year-over-year basis in April. Prices for video and audio subscription services rose less in the year to April than in the 12-months to March.

The household operations, furnishings and equipment index rose 0.5% year over year in April, following no change in March. This acceleration was mainly attributable to a 3.8% month-over-month rise in the prices of telephone services, as new product introductions affected the price of service plans.

12-month change in the provinces

In five provinces, consumer prices rose less on a year-over-year basis in April than in March. The 12-month increase in the CPI was unchanged in two provinces in April from a month earlier, while it accelerated in Saskatchewan, Alberta and British Columbia.

Chart 3 Chart 3: Consumer prices rise at a slower rate in five provinces

Consumer prices rise at a slower rate in five provinces

In the Atlantic provinces, the gasoline index was the main contributor to the deceleration in the year-over-year change in consumer prices, due in part to smaller monthly increases this April compared with a year ago. At the national level, gasoline prices rose more on a year-over-year basis in April than in March.

Consumer prices in Ontario rose 1.9% in the 12 months to April, matching the gain in March. The homeowners' replacement cost index registered a 6.8% year-over-year increase in April, which was the largest gain among the provinces for the 10th consecutive month. Passenger vehicle insurance premiums were up 4.4% in the 12-month period ending in April, following a 3.5% increase in March. Among the provinces, Ontario registered the largest decline in men's clothing prices in the 12 months to April.

In Saskatchewan, an increase in the provincial sales tax, effective March 23, 2017, and an increase in its scope, effective April 1, 2017, both contributed to an acceleration in consumer price growth in the province. On a year-over-year basis, the CPI in Saskatchewan posted a 1.4% gain in April, after increasing 0.6% in March. Prices for food purchased from restaurants were up 7.3% year over year in April. Despite registering a 4.6% month-over-month increase, the telephone services index still declined 10.4% on a year-over-year basis in April.

In Nova Scotia, consumer prices rose 0.8% year over year in April, following a 1.3% gain in March. Among the provinces, Nova Scotia posted one of the largest declines in fresh vegetable prices in the 12 months to April. Passenger vehicle insurance premiums posted a 1.8% year-over-year decline in April; Nova Scotia was the sole province to record a decline in this index. Additionally, fuel oil prices were up 11.5% year over year in April, after posting a 15.0% gain in March.

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI rose 0.5% in April after falling 0.2% in March.

Chart 4 Chart 4: Seasonally adjusted monthly Consumer Price Index

Seasonally adjusted monthly Consumer Price Index

Six major components increased on a seasonally adjusted monthly basis in April, with the transportation index (+1.3%) recording the largest increase. The clothing and footwear index declined 0.6%, while the recreation, education and reading index was unchanged.

Chart 5 Chart 5: The clothing index and its subcomponents, annual average, Canada, 1983 to 2016

The clothing index and its subcomponents, annual average, Canada, 1983 to 2016

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170519/dq170519a-eng.pdf

StatCan. 2017-05-19. Retail trade, March 2017

Retail sales — Canada

$48.3 billion, March 2017

0.7% increase (monthly change)

Source(s): CANSIM table 080-0020.

Following a 0.4% decline in February, retail sales rose 0.7% in March to $48.3 billion on the strength of higher sales at motor vehicle and parts dealers. Sales were up in 6 of 11 subsectors, representing 53% of total retail trade.

After removing the effects of price changes, retail sales in volume terms rose 1.2%.

Chart 1 Chart 1: Retail sales increase in March

Retail sales increase in March

New car dealers lead gain

Motor vehicle and parts dealers (+3.2%) recorded the largest gain in dollar terms across all subsectors. The increase was largely attributable to higher sales at new car dealers (+3.8%). Used car dealers (+2.7%) and automotive parts, accessories and tire stores (+1.2%) also posted higher sales. Sales at other motor vehicle dealers (-1.4%) were down for the third month in a row.

Sales at general merchandise stores (+1.4%) were up for the third consecutive month.

Electronics and appliance stores (+3.1%) continued their upward trend in March.

Store types traditionally associated with housing purchases and home renovation showed growth in March. Sales at building material and garden equipment and supplies dealers (+1.0%) and furniture and home furnishings stores (+0.8%) both increased for the sixth time in seven months.

Amid lower consumer prices for food purchased from stores, lower receipts were reported at food and beverage stores (-0.7%). This decrease was due in large part to weaker sales at supermarkets and other grocery stores (-0.6%) and, to a lesser extent, convenience stores (-2.9%).

Sales up in seven provinces

Retail sales were up in seven provinces in March. Higher sales in Ontario and British Columbia accounted for the majority of the increase.

In Ontario, retail sales increased 0.9%, primarily on the strength of higher sales at motor vehicle and parts dealers.

Sales in British Columbia rose 2.3%. Gains were widespread across most store types.

Following severe winter weather events in February, retail sales in Nova Scotia (+4.8%) rebounded on higher sales at new and used car dealers.

Sales in Saskatchewan (+2.7%) continued their upward trend in March, rising for the eighth consecutive month. Over this period, higher sales have been reported at general merchandise stores, gasoline stations, and health and personal care stores.

In Quebec, retail sales decreased 0.8%.

After increasing for seven consecutive months, sales in Alberta fell for the first time since mid-2016.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales were $1.2 billion in March, accounting for 2.4% of total retail trade. On a year-over-year basis, retail e-commerce sales increased 43.2% while total unadjusted retail sales rose 9.5%.

Summary tables of unadjusted data by industry and by province and territory are now available.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170519/dq170519b-eng.pdf

StatCan. 2017-05-19. Investment in new housing construction, March 2017

Investment in new housing construction — Canada

$4,191.3 million, March 2017

9.0% increase (12-month change)

Source(s): CANSIM table 026-0017.

New housing construction investment totalled $4.2 billion in March, up 9.0% compared with March 2016. This gain was mainly the result of a $252.6 million increase in investments in Ontario.

Nationally, higher investments were observed for the four main types of dwellings. The biggest gain was observed in spending on single-family dwellings, rising $265.8 million to $2.2 billion. This accounted for just over half (51.8%) of total spending on residential construction in March.

Investments in apartment building construction totalled $1.4 billion in March, accounting for one-third (33.4%) of total spending. At the national level, investments in this type of dwelling edged up 0.2% from March 2016. Five provinces posted increases for this type of dwelling, led by British Columbia ($70.3 million), while the other provinces reported declines, with Alberta falling by $52.7 million and Ontario down $17.2 million compared with March 2016.

Investments of $438.7 million in new row housing construction represent an increase of 14.4% compared with March 2016 levels. For this type of dwelling, eight provinces posted increases, led by Ontario with a $52.5 million gain year over year.

Compared with March 2016, construction spending on double dwellings rose 12.4% to $183.9 million in March, with every province except British Columbia and Manitoba showing increases.

Chart 1 Chart 1: Investment in new housing construction, by type of dwelling

Investment in new housing construction, by type of dwelling

Ontario continues to account for much of the national increase in spending

In March, eight provinces saw higher spending in new housing construction compared with the same month a year earlier. Ontario posted the greatest increase for a total of $1.8 billion in spending. However, Alberta (-$52.7 million) and Newfoundland and Labrador (-$6.7 million) posted declines.

Ontario saw increases for all types of dwellings except apartments, which fell 3.6% compared with March 2016.

Investment in new housing construction in Manitoba rose 39.2% year over year to $116.1 million. This gain was mainly attributable to higher investments in single-family dwellings (51.6%), although increases were posted for all dwelling types other than double dwellings.

Quebec was the lone province to have posted increases for all types of dwellings. Investments in apartment building construction accounted for 56.1% of total investments, the highest proportion among the provinces.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170519/dq170519c-eng.pdf

StatCan. 2017-05-19. Pipeline transportation of oil and other liquid petroleum products, March 2017

Closing Inventories of crude oil and equivalent products

12.4 million cubic metres

March 2017

Crude oil receipts

Oil pipelines received 21.2 million cubic metres of crude oil and equivalent products from Canadian fields and plants in March, up 10.3% compared to the same month in 2016. Of this total, 20.6 million cubic metres (97%) were received from Alberta and Saskatchewan.

Chart 1 Chart 1: Pipeline receipts of crude oil from fields and plants

Pipeline receipts of crude oil from fields and plants

Crude oil deliveries

In March, pipelines delivered 7.2 million cubic metres of oil to Canadian refineries, a 3.5% decrease compared with the same month in 2016. Just under two-thirds (61%) of crude oil was sent to refineries in the western provinces, while the remainder (39%) was delivered to Ontario and Quebec refineries.

Exports and imports

Oil pipelines exported 14.8 million cubic metres of crude oil and equivalent products to the United States. March exports were 4.8% higher than the same month in 2016, and crude oil imports rose 9.4% to 2.3 million cubic metres.

Chart 2 Chart 2: Exports and imports of crude oil by pipeline

Exports and imports of crude oil by pipeline

Closing inventories

Closing inventories of crude oil and equivalent products totaled 12.4 million cubic metres, up 1.7% compared with the same month in 2016.

Chart 3 Chart 3: Pipeline closing inventories of crude oil & equivalent products

Pipeline closing inventories of crude oil & equivalent products

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170519/dq170519e-eng.pdf

________________

BOMBARDIER

Global Affairs Canada. May 18, 2017. Statement by Minister of Foreign Affairs on the U.S. Department of Commerce initiation of investigations into large civil aircraft from Canada

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement:

“The aerospace industries of Canada and the United States are highly integrated and support good, middle class jobs on both sides of the border.

“We strongly disagree with the U.S. Department of Commerce’s decision to initiate anti-dumping and countervailing duty investigations into imports of Canadian large civil aircraft.

“Boeing’s petition is clearly aimed at blocking Bombardier’s new aircraft, the CSeries, from entering the U.S. market. Boeing admits it does not compete with exports of the CS100 aircraft, so it is all the more difficult to see these allegations as legitimate, particularly with the dominance of the Boeing 737 family in the U.S. market.

“Furthermore, many of the CSeries suppliers are based in the United States. Components for the CSeries are supplied by American companies, directly supporting high-paying jobs in many U.S. states, including Connecticut, Florida, New Jersey, Washington, New York, Ohio, Iowa, Kansas, Pennsylvania and Colorado.

“Canada is reviewing current military procurement that relates to Boeing.

“Our government will defend the interests of Bombardier, the Canadian aerospace industry, and our aerospace workers.”

The Globe and Mail. May 19, 2017. Quebec open to more investors for Bombardier’s C Series, Couillard says

NICOLAS VAN PRAET

MONTREAL — Quebec says it is open to other investors in Bombardier Inc.’s C Series under certain conditions as speculation mounts about a possible Chinese investment in the airliner program.

“Any partnership attractive to Quebec that maintains the C Series head office and engineering jobs at home will be welcome,” Quebec Premier Philippe Couillard told reporters in Jerusalem, where he was taking part in a trade mission to Israel.

New questions are being raised about Bombardier plans for the C Series following a report the Canadian company held talks with Chinese state-owned aerospace manufacturer Comac about an investment in the fledgling aircraft program.

Comac is working with at least one bank on a tie-up that could see it make an investment in Bombardier’s commercial aerospace arm or take a stake in the C Series program, the Financial Times said Thursday, citing unnamed sources.

“Everything is on the table,” the newspaper quoted a source as saying. The companies have been in talks for some time although no decision is imminent, the paper reported.

Bombardier has declined to comment on the report, calling it market rumour.

Quebec made a $1-billion (U.S.) investment in the C Series last year that saved program and the plane maker from possible collapse. At the time, Montreal-based Bombardier was grappling with a cash crunch as it tried to get the 100 to 150-seat airliner to market following a two year delay and rising costs.

The C Series has since started commercial service, earning rave early reviews for its performance. The key challenge for Bombardier now is to hold the line on the aircraft’s pricing. Like other manufacturers introducing new planes, it has offered steep discounts to early buyers but will have to win better terms on new orders to boost profitability.

Quebec now owns a 49.5-per-cent stake in a limited partnership that controls the C Series program. That investment is now the subject of a trade complaint by Boeing Co. Bombardier owns 50.5 per cent and holds operational control of the program.

In exchange for the cash infusion, Bombardier agreed to maintain the strategic, financial and operational headquarters of the limited partnership in Quebec for at least 20 years. Under the deal, “assembly, manufacturing, engineering services and research and development activities” of the partnership will also remain in Quebec for the same length of time, according to a Bombardier statement explaining the terms.

Mr. Couillard said Quebec has a say in any new C Series investor Bombardier brings into the fold. “There cannot be agreement without our involvement,” the premier said. His comments were reported by Montreal’s La Presse newspaper, which had a journalist on site.

Bombardier and COMAC signed a strategic co-operation agreement in 2012 that saw the two manufacturers collaborate on common systems for the C919 and C Series planes. The partnership included working together on cockpit and electrical systems as well as the supply chain.

REUTERS. May 18, 2017. Canada links fighter jet deal to Boeing's dumping claims

By Alwyn Scott and Alana Wise

SEATTLE (Reuters) - Canada suggested on Thursday it could scrap plans to buy Boeing Co fighter jets if the United States backed Boeing's claims that Canadian plane maker Bombardier Inc dumped jetliners in the U.S. market.

"Canada is reviewing current military procurement that relates to Boeing," Canadian Foreign Minister Chrystia Freeland said in a statement released late on Thursday.

Canada "strongly disagrees" with the U.S. Commerce Department decision to investigate Boeing's claims that Bombardier sold planes below cost in the United States and benefited unfairly from Canadian government subsidies, the statement added.

The remarks came after the U.S. Commerce Department launched an investigation into Boeing's claims, and pointed to the potential for rising trade tension between the two countries. Boeing and Canada are in talks over the purchase of 18 Boeing Super Hornet fighters this year or in early 2018.

President Donald Trump has called for a strong stronger stance on trade with his "America First" policy that got a boost on Thursday when Commerce formally announced its intent to renegotiate the North American Free Trade Agreement.

The Commerce probe in Boeing's case, which was expected, parallels a probe by the U.S. International Trade Commission (USITC) into Boeing's allegations that Bombardier sold 75 CSeries planes to Delta Air Lines Inc last year at a price well below cost. Bombardier has rejected the allegations and the two sides clashed at an ITC hearing on Thursday on whether the companies' competing plane models are even comparable.

"While assuring the case is decided strictly on a full and fair assessment of the facts, we will do everything in our power to stand up for American companies and their workers," Commerce Secretary Wilbur Ross said in a statement.

"ISN'T MUCH COMPETITION"

The Commerce investigation was announced as USITC staff heard arguments on Thursday from representatives for Boeing, Bombardier and Delta Air Lines Inc, which has sided with Bombardier against Boeing.

The former head of Boeing's commercial aircraft unit told the panel that government subsidies for Bombardier allowed the Canadian company to sell small, 100- to 150-seat jet liners at prices Boeing could not match.

"It is untenable for us to continue competing with government subsidized competitors" Boeing Vice Chairman Raymond L. Conner said. "Bombardier is very close to forcing us out of (the 100- to 150-seat market) altogether."

Bombardier representative Peter Lichtenbaum countered that Boeing's claims were overblown.

"Boeing has not suffered any lost sales or lost revenues due to competition with Bombardier," he told the panel. "There just isn't much competition between Bombardier's CSeries and Boeing's products."

Delta agreed last year to buy up to 75 Bombardier CSeries planes, a deal worth an estimated $5.6 billion based on the list price of about $71.8 million.

How U.S. regulators decide the dispute will have a significant impact on the market for small, regional jetliners in North America and globally, and on U.S.-Canadian relations.

The CSeries is critical to Bombardier's future. If the United States finds that Canadian subsidies for Bombardier have harmed Boeing and imposes duties, demand for the CSeries in the United States could suffer and airlines could pay more.

The disagreement between the two planemakers also adds frost to an increasingly chilly U.S.-Canadian trade relationship, along with disputes over Canadian softwood lumber and U.S. milk protein products.

Commerce said that if the investigations determine that CSeries planes were dumped in the U.S. market or unfairly subsidized, it would collect duties equal to the value of the benefits. Those duties would increase the cost of the Bombardier planes ordered by Delta.

(Reporting by Alwyn Scott, Alana Wise and David Lawder and Allison Lampert; Editing by Andrew Hay and Bill Trott)

REUTERS. May 19, 2017. Boeing military arm frets over Canada jets threat, seeks government talks: source

OTTAWA (Reuters) - Boeing Co's BA.N military sales division is worried about Canada's threat to scrap the proposed purchase of 18 Super Hornet jets and is seeking talks with government officials, a source familiar with the situation said on Friday.

Canada suggested on Thursday it could ditch its plans to buy the jets if the United States backed Boeing's claims that Canadian plane maker Bombardier Inc (BBDb.TO: Quote) dumped jetliners in the U.S. market.

(Reporting by David Ljunggren; Editing by Bernard Orr)

________________

NAFTA

The Globe and Mail. May 18, 2017. Canada threatens U.S. over aerospace as NAFTA talks loom

STEVEN CHASE, ADRIAN MORROW AND GREG KEENAN

OTTAWA/WASHINGTON/TORONTO — The Trudeau government is threatening to jettison a multibillion-dollar purchase of Boeing Super Hornet fighters if the United States proceeds with damaging trade action against Montreal-based Bombardier Inc. – a warning shot fired the same day the Trump administration officially started the countdown to the renegotiation of the North American free-trade agreement.

Freeland says reworked NAFTA could have labour, environmental benefits (The Canadian Press)

The looming trade battle ratchets up the tension between Ottawa and Washington as the two sides gear up for NAFTA talks set to kick off in mid-August, and signals Canada’s willingness to stand up to President Donald Trump.

The U.S. Department of Commerce announced Thursday it will investigate accusations from Chicago-based Boeing Co. that sales of Bombardier’s new C-series jetliner constitute dumping into the U.S. market, because the plane is subsidized by the Canadian and Quebec governments. The investigation could lead to punitive U.S. duties being slapped on sales of the jet as soon as July.

Foreign Affairs Minister Chrystia Freeland promptly fired back.

In a blunt statement, she said that Boeing’s complaint is aimed at blocking the jet from the U.S. market. And she warned that Boeing’s attempts to sell fighter jets to the Canadian government could be at risk as a result.

“Canada is reviewing current military procurement that relates to Boeing,” Ms. Freeland said. “Our government will defend the interests of Bombardier, the Canadian aerospace industry and our aerospace workers.”

The federal government has started negotiations this year to buy 18 Boeing Super Hornet fighter planes as an interim measure to bolster the capacity of the Royal Canadian Air Force as it seeks a longer-term solution to replace its fleet of aging CF-18 warplanes.

The dogfight comes a month after Mr. Trump blasted Canada’s softwood lumber and dairy industries for “taking advantage” of the United States under NAFTA and considered – but ultimately decided against – triggering an American withdrawal from the deal.

Earlier Thursday, United States Trade Representative Robert Lighthizer formally gave Congress 90 days’ notice of the administration’s intent to reopen NAFTA. His one-and-a-half page letter was short on specific negotiating objectives, sticking instead to broad themes. It steered clear of the protectionist language that permeated an earlier draft circulated in March.

The letter listed the digital economy, intellectual property protections, labour and environmental standards as possible areas of discussion. It said the United States will look for better enforcement of the provisions of the deal. “We note that NAFTA was negotiated 25 years ago, and while our economy and businesses have changed considerably over that period, NAFTA has not,” the letter read. “Many chapters are outdated and do not reflect modern standards.”

The earlier draft, by comparison, suggested that Buy-American policies and tax provisions meant to favour U.S. goods could be among the things demanded by negotiators. It also floated abolishing NAFTA trade panels – which have previously ruled in Canada’s favour in the softwood dispute.

The Canadian and Mexican governments, as well as business groups, publicly embraced the renegotiations Thursday – even though officials have privately conceded they would rather NAFTA be left the way it is.

The aim is to divert the talks into a discussion over how to improve the deal, such as by adding new provisions for e-commerce and strengthening environmental and labour regulations, while leaving the integrated market intact and pushing back against Mr. Trump’s protectionist inclinations.

“Two areas that I think could very usefully benefit from modernization in NAFTA are the labour and environment chapters,” Ms. Freeland told reporters.

Mexican Foreign Secretary Luis Videgaray, speaking after a meeting with his American counterpart Rex Tillerson in Washington on Thursday, took a similar tack: “This is a 25-year-old agreement … The world has changed.”

Perrin Beatty, CEO of the Canadian Chamber of Commerce, said Canada will have to hold firm against Mr. Trump – but must also bring its own demands to the table with the goal of improving the deal. Ottawa should push for new NAFTA provisions that would make cross-border business even easier, such as more digital trade, labour mobility and regulatory co-operation, Mr. Beatty said.

“Nobody is under the illusion that these negotiations won’t be difficult. The government has to be prepared to defend Canada’s interests,” he said in an interview. “But it should go in with its own agenda, it should go in with optimism and confidence – it is possible to get a trade agreement that is better.”

The chief executive officers of two Canadian companies that have a big stake in the integrated North American economy staying that way said this week that they believe renegotiation of the trade agreement will not lead to wholesale changes.

“Mr. Trump is a businessman,” Linda Hasenfratz, president of auto parts maker Linamar Corp. said. “He will make fact-based decisions and it’s a matter of putting those facts in front of him.”

Those facts relate to the negative impact that drastic changes in NAFTA would have on the auto industry, which relies strongly on duty-free trade of parts and vehicles among the three countries.

Keith Creel, chief executive officer of Canadian Pacific Railway Ltd., said he thinks Mr. Trump’s call to revamp NAFTA is aimed at Mexico.

“I think he’s a negotiator,” Mr. Creel told The Globe and Mail earlier this week. “I think he’s trying to create leverage and at the end of the day if he does what is right for the country he understands how critical Canada is as a trading partner to the U.S.”

Still, the battle over the fighter jets signals that neither side is afraid to put its elbows out as the negotiations draw near.

Ms. Freeland noted any pain served on Bombardier by Washington would hurt Americans because many companies supplying the C-series jet program are based in the United States. “Components for the C-series are supplied by American companies, directly supporting high-paying jobs in many U.S. states, including Connecticut, Florida, New Jersey, Washington, New York, Ohio, Iowa, Kansas, Pennsylvania and Colorado.”

The initial purchase of these Super Hornets could cost $2-billion, but their maintenance, support and upgrades could cost as much as $10-billion over the full period of their use. That could mean billions of dollars more in parts and support for Boeing beyond the initial capital investment.

Analysts had been warning that Boeing’s actions against Bombardier could come back to bite the company, especially as it relates to the business it does with the Canadian government.

“Boeing is now part of Trump’s anti-Canada jihad,” Richard Aboulafia of the Teal Group said in a recent note.

Boeing has also supported a Republican plan to impose a border tax on imports – a proposal that would hurt Canadian firms shipping products to the United States.

Renegotiating or pulling out of NAFTA was one of Mr. Trump’s central campaign pledges. He blames the deal for hollowing out the U.S. manufacturing sector in the Rust Belt.

Congressional notification, a legal requirement before talks can start, was delayed as the Senate dragged its feet on confirming Mr. Lighthizer as Trade Representative. Mr. Lighthizer was finally confirmed last week, sworn in Monday and has spent the last three days in meetings with members of Congress.

With a report from Nicolas Van Praet in Montreal

SCOTIA BANK. ECONOMICS. ANALYSIS. May 18, 2017. NAFTA: US to Pursue ‘Tweaks’ to Modernize North American Trade Pact

FULL DOCUMENT: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/2017-05-18_I&V.pdf

_________________

TOURISM

The Globe and Mail. May 19, 2017. Canadian winery owners face closed trial in China

ROBERT FIFE AND STEVEN CHASE

OTTAWA — Charges of smuggling against a Canadian winery owner who has been locked up in a Chinese jail for more than a year are trumped up, his lawyers say, accusing China of criminalizing a customs dispute, one that could have far-reaching consequences for an eventual bilateral free-trade deal.

John Chang, who owns wineries in British Columbia and Ontario, will face a closed-door trial at the Shanghai High People’s Court next Friday, as will his wife, Allison Lu. Ms. Lu was released from jail in January, but is barred from leaving China and must report regularly to Chinese authorities. The couple’s Canadian passports have been seized.

China’s legal system has a 99.6-per-cent conviction rate, and the couples’ family fears Mr. Chang and Ms. Lu could receive lengthy prison sentences over what is a commercial dispute.

The legal battle casts doubt on China’s willingness to treat Canadian investors fairly – a standard foundation of any free-trade deal.

The Globe and Mail has obtained a copy of a brief prepared for the Trudeau government by the law firm Fasken Martineau – which represents the family – that takes the Canadian government to task for doing little to get Mr. Chang and his wife released.

“The arrest and continued detention of two Canadian business people and citizens, Mr. Chang and Ms. Lu, is on its face outrageous and unconscionable,” the brief says. It added the situation is urgent because Mr. Chang’s physical and mental health are deteriorating.

China has charged Mr. Chang and Ms. Lu with “smuggling of common goods” for allegedly underreporting the value of the wines they exported to China.

The trial of Ms. Lu and Mr. Chang, who has been imprisoned for more than 13 months, takes place as the federal government pursues exploratory talks on a free-trade deal with Beijing. Prime Minster Justin Trudeau has made a bilateral trade pact with China a cornerstone of Liberal foreign policy.

But Fasken Martineau argued in its presentation to the government that expanding trade with China can work only if Canadian businesses can trust Chinese authorities will treat them fairly.

“It is imperative that Canadians seeking to do business with China can do so in reliance on agreed upon rules and basic principles of justice, both substantive and procedural,” the brief stated, and noted the charges against the Canadian couple are “particularly troubling now, at a time when the government of Canada is consulting Canadians on a bilateral free trade deal with China.”

The law firm has asked International Trade Minister François-Philippe Champagne and Justice Minister Jody Wilson-Raybould to engage their Chinese counterparts to secure the immediate release of Mr. Chang from prison and to allow the couple to return to Canada “pending a resolution of the customs valuation dispute.”

David Mulroney, a former Canadian ambassador to China, said what happened to Mr. Chang reminds him of issues he encountered during his posting in Beijing.

“When I was in China, we were concerned about the disturbing tendency of local officials to transform any commercial dispute between Canadian and Chinese business partners into a criminal prosecution of the Canadian,” Mr. Mulroney said.

“We saw this as an attempt to intimidate the Canadian into making some kind of confession.”

The former diplomat says this tendency is an example of “how the playing field in China is tilted against foreign passport holders and how tenuous and conditional Chinese legal protections actually are.”

Liberal MP Omar Alghabra, the parliamentary secretary for consular issues at Global Affairs, told The Globe that Ottawa is seeking to get Mr. Chang and his wife out of China and have reached out to high-ranking Chinese officials.

“Economic cases have a different flavour than criminal cases, but they are done within our consular division in consultation with the Chinese government,” he said. “We are certainly having consultations with the Chinese government and with the family about this case.”

Mr. Alghabra said he was unable to “give any prediction of what might happen” at the couple’s trial next Friday “but we are taking this case very seriously and doing what we can to assist the family and help resolve this case.”

Fasken Martineau says this is a customs dispute, and China’s conduct is a violation of its international trade obligations under the World Trade Organization Valuation Agreement.

Under international trade law, disagreement over the valuation of imported goods is supposed to be resolved under the agreement.

Instead, China is using the state’s police power – arrest, detention and eventual prosecution – to address what is fundamentally a trade and customs dispute.

“The excessive power of China Customs to unilaterally jail the owners of a reputable Canadian business on a mere allegation of non-compliance with custom valuation rules, and to detain them in jail for more than one year without hearing or any meaningful recourse to justice, is a gross violation of personal liberty and security,” the brief said.

“In Canada, the actions of China Customs would be a clear violation of Section 9 of the Canadian Charter of Rights and Freedoms, which guarantees the right against arbitrary detainment and imprisonment.”

Dan Brock, a lawyer for Fasken Martineau, confirmed the law firm had prepared the brief for Ottawa but would provide no further comment.

Lulu Island Winery, one of three in Canada owned by Mr. Chang and Ms. Lu, said on Tuesday it hopes Ottawa can find a way to bring them home.

“We have been without our founders … for more than one year, and remain anxious for their safe return to Canada. Lulu Island denies the allegations made by the Chinese Customs Authority, and respectfully requests that China uphold its international trade obligations,” the winery said in a statement.

“As a Canadian company we have let our federal government take the lead in resolving this matter, and we patiently await progress.”

Conservative MP Gerry Ritz called Mr. Chang “a fantastic guy and a great entrepreneur” and criticized the Canadian government for not pressing hard enough to win the couple’s freedom.

“Nobody is taking it seriously. It is disconcerting,” he said. “Global Affairs is saying it is all consular and they are not going to do anything and that is unfortunate. It is a business side. It is trade. It is not criminal.”

NDP MP Nathan Cullen said the case of Mr. Chang and his wife should give the Liberal government serious pause about concluding a free-trade deal with a country that uses its judiciary to resolve commercial disputes.

“The more times China acts in aggressive ways toward people from other countries in ways that would seem to be unfair in our country, the less and less likely they will have the Canadian public onside for a trade deal,” he said. “What Trudeau is offering is that closer ties to China means greater influence with China on cases like this.”

Mr. Chang, who was born in Taiwan, was named an RBC Top 25 Canadian Immigrant award winner in 2015. He came to Canada in 2000 and built up a wine business with principal exports to the Asian market.

Since his arrest on March 25, 2016, Mr. Chang has received one visit every three months from Canadian consular officials, but the law firm said in the brief it was advised “the Government of Canada, including the Trade Commissioner Service, cannot interfere in the judicial affairs of another country.”

The wine business – with wineries in Richmond and Kelowna, B.C., and Niagara-on-the-Lake, Ont., has been run by the couple’s 23-year-old daughter Amy, in the meantime.

China’s embassy in Ottawa said it had no “specific information” about Mr. Chang’s case and that Canadians should be assured “China is a nation with rule of law and China’s law-enforcement departments handle cases strictly according to law.”

________________

HOUSING BURBLE

BLOOMBERG. 2017 M05 19. HSBC Canada Not Interested in Home Capital Assets, CEO Says

by Doug Alexander

- London bank has history in Canada of rescuing troubled lenders

- Stuart says bank doesn’t want to return to subprime loans

- Home Capital Turnaround Seen as Perilous, Getting Harder

One of the last times a Canadian bank ran into trouble, HSBC Holdings Plc came to the rescue. Don’t expect history to repeat itself in the case of Home Capital Group Inc.

HSBC Canada, which leapfrogged small Canadian competitors by acquiring failing Bank of British Columbia in 1986, wouldn’t be interested in Home Capital if the embattled mortgage lender put itself up for sale or sold off assets such as its mortgage portfolio.

“This isn’t something for us right now," Sandra Stuart, chief executive officer of HSBC’s Canadian unit said Thursday in an interview in her Vancouver office. “We were in the subprime business and we had a subprime portfolio that performed very well, and we took a decision to exit it. We understand deeply what it takes to run a subprime book, and at this stage I would say we’re not interested."

Home Capital has been seeking to stabilize itself after losing almost C$1.9 billion ($1.4 billion) in high-interest deposits since the end of March, forcing it to secure a costly C$2 billion rescue loan from a pension fund. The company also hired investment banks to advise on financing and “strategic options" that may include a sale of the company or assets.

Other Canadian financial firms earlier this month ruled out an outright purchase of Home Capital, including Canadian Western Bank and alternative lender Equitable Group Inc. HSBC’s case is noteworthy because of the bank’s history in Canada.

Bank Fails

Stuart has first-hand experience with a bank failure. She was a teller of Bank of British Columbia in Vancouver’s suburb of Burnaby when the lender ran into trouble. She became a part of HSBC when the Bank of British Columbia was acquired by the London-based lender in November 1986.

“Reflecting on it, it happened so quickly," Stuart said. “I remember when HSBC made the purchase and how exhilarating that was to have a foreign bank take over a little British Columbia bank and absolutely overnight the prospect for the whole business changed. It was really exiting."

Bank of British Columbia’s woes followed the failures of Canadian Commercial Bank and Northland Bank of Canada in 1985, when rising interest rates and a slumping dollar caused their real estate and energy-heavy loan books to deteriorate, according to a Bank of Canada report. The failure of two small Western Canadian lenders eroded the confidence of other banks that relied on wholesale deposit funding, leaving Bank of British Columbia unable to weather the storm.

The B.C. bank was run at the time by Edgar Kaiser Jr., an industrialist whose holdings included Canada’s biggest coal company, and the Denver Broncos of the National Football League, according to a New York Times obituary published when he died in 2012.

Expansion Plan

The B.C. purchase bolstered HSBC’s Canadian presence five years after entering the country, and the deal became the first of a string of purchases over 22 years in the bank’s strategy to expand across the nation.

HSBC Canada hasn’t seen much impact from Home Capital’s woes, Stuart said.

“If anything, we’ve seen our deposits increase over the last little while," Stuart said, adding that she doesn’t expect Home Capital’s troubles will spread to other financial firms. “It’s a C$20 billion book, it’s going to play out as it’s going to play out. We don’t feel any contagion to us, so I’m suspecting it’s probably going to be isolated."

Home Capital rose a second straight day, adding 5.9 percent to C$9.39 in Toronto. The stock is still down 70 percent on the year.

CIBC. ECONOMICS. ANALYSIS. May 19, 2017. A Very Different Housing Issue

by Andrew Grantham

FULL DOCUMENT: https://economics.cibccm.com/economicsweb/cds?ID=3097&TYPE=EC_PDF

________________

LGCJ.: