CANADA ECONOMICS

Bank of Canada. 05/11/2017. Bank of Canada Review - Spring 2017

Some suggest the global economy is facing a fourth industrial revolution. Bank researchers discuss the possible implications of digitalization on the economy. This issue also shares insights on the effectiveness of some unconventional monetary policies in a small open economy, how Government of Canada bonds are used throughout their life cycle, as well as how the Big Six Canadian banks choose their funding strategies and why. The final article examines the slow growth in business investment.

CONTEMPT

Some suggest the global economy is facing a fourth industrial revolution. Bank researchers discuss the possible implications of digitalization on the economy. This issue also shares insights on the effectiveness of some unconventional monetary policies in a small open economy, how Government of Canada bonds are used throughout their life cycle, as well as how the Big Six Canadian banks choose their funding strategies and why. The final article examines the slow growth in business investment.

The Bank of Canada Review is published twice a year. Articles undergo a thorough review process. The views expressed in the articles are those of the authors and do not necessarily reflect the views of the Bank.

The contents of the Review may be reproduced or quoted, provided that the authors and the publication, with its date, are specifically cited as the source.

The Digital Economy

Chris D'Souza, David Williams

Digital technologies—cloud computing, the Internet of Things, advanced robotics, big data analytics, artificial intelligence and machine learning, social media, 3D printing, augmented reality, virtual reality, e-money and distributed ledgers—are transforming the way busi-nesses operate. How does this transformation compare with past industrial revolutions? How are digital technologies changing production systems across industries? Agile firms that use knowledge intensively and have high levels of both organizational and human capital appear set to realize the greatest benefits from digitalization. Finally, what are the implications for productivity, labour markets, inflation and monetary policy as we transition to the digital economy?

Unconventional Monetary Policy: The Perspective of a Small Open Economy

Jean-Sébastien Fontaine, Lena Suchanek, Jing Yang

How do unconventional monetary policies like quantitative easing and negative interest rates affect domestic financial conditions and the broader economy in small open econo-mies, such as Canada? These policies are effective in depreciating the exchange rate in small open economies, while lower interest rates are also passed through to the economy, albeit only partially. When conventional monetary policy is close to its limits, fiscal policy may be a more important complement to monetary policy in a small economy, particularly if global demand for safe assets compresses long-term interest rates.

The Life Cycle of Government of Canada Bonds in Core Funding Markets

Narayan Bulusu, Sermin Gungor

Data on the use of government securities in the repo, securities lending and cash markets suggest there are bond market clienteles in Canada. Shorter-term bonds are more prevalent in the repo market, while longer-maturity securities are more active in the securities lending market—consistent with the preferred habitat hypothesis. These results could help design better debt-management strategies and more-effective policies to maintain well-functioning financial markets.

Wholesale Funding of the Big Six Canadian Banks

Matthieu Truno, Andriy Stolyarov, Danny Auger, Michel Assaf

The Big Six Canadian banks are a dominant component of the Canadian financial system. How they finance their business activities is fundamental to how effective they are. Retail and commercial deposits along with wholesale funding represent the two major sources of funds for Canadian banks. What wholesale funding instruments do the Big Six banks use? How do they choose between different funding sources, funding strategies and why? How have banks changed their funding mix since the 2007–09 global financial crisis?

Why Is Global Business Investment So Weak? Some Insights from Advanced Economies

Robert Fay, Justin-Damien Guénette, Martin Leduc, Louis Morel

Various drivers of business investment can be used to explain the underwhelming performance of investment in advanced economies since the global financial crisis, particularly since 2014. The slow growth in aggregate demand cannot by itself explain the full extent of the recent weakness in investment, which appears to be linked primarily to the collapse of global commodity prices and a rise in economic uncertainty. Looking ahead, business investment growth is likely to remain slower than in the pre-crisis period, largely because of structural factors such as population aging.

FULL DOCUMENT: http://www.bankofcanada.ca/2017/05/boc-review-spring-2017/

Global Affairs Canada. May 12, 2017. Parliamentary Secretary to Minister of International Trade to attend Belt and Road Forum for International Cooperation in Beijing

Ottawa, Ontario - Expanding trade with large, fast-growing markets like China is important for Canadians and to help grow the middle class. As the world’s second-largest economy, China presents many new opportunities for increased trade in goods and services. This will create new opportunities for Canadian businesses and lead to more good-paying jobs for Canada’s middle class.

Pamela Goldsmith-Jones, Parliamentary Secretary to the Minister of International Trade, today announced that she will be in Beijing, China, May 14 and 15, to represent Canada at the Belt and Road Forum for International Cooperation. This forum provides Canada an opportunity to discuss cooperation in key areas such as infrastructure connectivity, trade, investment, financial support and people-to-people exchanges throughout the Asia-Pacific region. On the sidelines of the conference she will seek to identify opportunities for Canadian businesses to take part in infrastructure investments in the region.

Education is a key pillar of Canada-China bilateral relationship. While in Beijing, the Parliamentary Secretary will visit the Canadian International School of Beijing, to speak with students about international education experience and promote Canada as a destination of choice for Chinese students. She will also participate in a round table with education sector stakeholders in Beijing to highlight the value of long-term Canada-China education programs.

Quotes

“Canada is a strong and valuable trading partner We are well positioned to leverage global opportunities that will lead to jobs and growth for Canada’s middle class..”

- Pamela Goldsmith-Jones, Parliamentary Secretary to the Minister of International Trade

Quick facts

- Canada’s bilateral trade with China reached a value of $85 billion in 2016, and Canada and China’s two-way foreign direct investment reached $34.7 billion at the end of 2016.

- Canada’s merchandise exports to China in 2016 were worth $21 billion, up 4% since 2015, with the top exports being forest products, agricultural products, ores and motor vehicles.

- People of Chinese descent make up approximately 4.5% of Canada’s population.

- China is an important source of international students: approximately 120,000 Chinese students currently study in Canada, more than the number of international students from any other country.

________________

HOUSING BURBLE

The Globe and Mail. May 12, 2017. CIBC wins approval for $4.9-billion takeover of PrivateBancorp

Canadian Imperial Bank of Commerce’s U.S. expansion plans got a shot in the arm Friday after shareholders of PrivateBancorp Inc. voted to approve its $4.9-billion (U.S.) takeover.

The banks said they expect the transaction to close in June.

Shares of CIBC were up modestly in early trading to $107.41 (Canadian). PrivateBancorp’s stock rose 0.25 per cent to $59.63 (U.S.).

CIBC agreed to acquire PrivateBancorp for $3.8-billion in stock and cash last June, ending months of speculation around how the bank would diversify its earnings away from Canada.

The transaction was supposed to have been put to a vote in December, but the meeting was postponed after the surprise election of Donald Trump fuelled a rally in U.S. bank stocks. The problem for CIBC was that the rally wiped out the premium it had offered to pay for PrivateBancorp, which spurred a trio of proxy advisory firms to urge that investors reject the deal.

By delaying the shareholder vote, CIBC tried to buy itself time for the rally to lose steam. But it didn’t, and on March 30, CIBC bit the bullet and raised its bid by 20 per cent to $4.9-billion.

But it wouldn’t be the last time CIBC amended its offer. On May 4, the Canadian lender sweetened the offer once more by raising the cash component of the deal by $3 per share.

The Globe and Mail. May 12, 2017. Home Capital board says no rush to sell business

JACQUELINE NELSON AND NIALL MCGEE

Board members at mortgage lender Home Capital Group Inc. said the troubled company is combing through a range of restructuring options, but will not pursue a rapid sale of its business.

Home Capital’s directors and interim management said Friday on a call with analysts that they would consider a wide-range of potential funding sources and reassess how the business is run. But the company said it will not make any significant transactions in the coming weeks, they said, even as the business is suffering from extensive reputation damage and a run on deposits used to back the company’s mortgage portfolio.

“Asset sales here is not our first priority. You don’t shrink your way to greatness. We’ve got to have enough time to stabilize the right-hand side of the balance sheet here,” said former banker and Home Capital board director Alan Hibben on the call, which often took on a lighthearted tone.

One of Home Capital’s top priorities is a replacement of the onerous $2-billion credit line it took out late last month, which came with a punishing interest rate of 10 per cent and an upfront fee of $100-million. The credit line came from a consortium led by Healthcare of Ontario Pension Plan (HOOPP) and is secured against a portfolio of mortgages. Home Capital has used $1.4-billion so far.

Home Capital has said it is planning to sell some loan portfolios to pay down this emergency credit line, but Mr. Hibben also said that the company would favour securing some term financing similar to the deal that competing alternative mortgage lender Equitable Group Inc. secured in early May. Equitable’s own $2-billion financing was backed by the six largest Canadian banks in a bid to shore up funding.

“But as you can imagine, the market is thin for these sorts of things,” Mr. Hibben said. “And so we will be looking at a wider range of alternatives than just a liquidity backstop... Some of those alternatives are going to be contingent upon continuing changes in governance and management, and that’s why I’m very happy that we have enough time to actually be able to execute on those.”

Home Capital also addressed its recent agreement where an “independent third party” intends to buy up to $1.5-billion of its commitments to new mortgages, as well as some existing mortgages and home loans that are up for renewal. That deal will be facilitated by mortgage finance firm MCAP Corp. It’s an agreement that the company said is not ideal and will have an impact on its business, but was a necessary step to keep Home Capital’s ties to the mortgage broker channel.

“Nobody likes the fact that we’re going to have to give our customers away to a third party,” Mr. Hibben said. “But it gives us more than enough time to be able to execute on alternative transactions here.”

Shares of Home Capital slipped by 10 per cent in early trading on Friday to $9.71, but shares have climbed nearly 70 per cent so far this week.

In a release early Friday, Home Capital said high interest savings account (HISA) balances at Home Trust are now at approximately $125-million, versus $128-million on Thursday. About 6 weeks ago, the company had roughly $2-billion in those accounts. The company had liquid assets of roughly $962-million as of Thursday night, versus $1.02-billion one day earlier – a drawdown of 2.8 per cent.

The Globe and Mail. May 11, 2017. What you need to know about alternative lender GIC and savings accounts as Home Capital struggles

ROB CARRICK

The problem with people waking up to risks in the financial system is that they can swing in a heartbeat from obliviousness to unfounded suspicion.

There are signs this is happening with customers of Home Trust, Home Bank and Oaken Financial, all part of alternative mortgage lender Home Capital Group Inc.’s corporate family. Some of these clients are wondering if it makes sense to pay a penalty to redeem GICs issued through the Home Capital family before maturity.

These people are aware of Canada Deposit Insurance Corp., which includes Home Bank and Home Trust as members (Oaken has CDIC coverage through both of these entities). Still, they’re anxious about guaranteed investment certificates they bought mainly because of the rate. Perhaps they’re worrying needlessly.

Home Capital faces allegations from securities regulators that it did not properly disclose flaws in its mortgage underwriting process to investors. The company’s share price has fallen, and customers of Home Bank, Home Trust and Oaken have pulled hundreds of millions of dollars out of high rate savings accounts used to fund mortgage lending. It’s no exaggeration to say Home Capital is fighting for corporate survival.

The company’s troubles offer a lesson to everyone who has put money in alternative online banks, trust companies and credit unions to take advantage of interest rates that exceed what the big banks offer: Better rates mean higher risk. Now for a follow-up lesson in understanding this risk.

If the worst happens, and you can bet regulators would work hard to prevent it, then people with deposits in a failed bank, trust or credit union would have to rely on deposit insurance. Let’s look at CIDC first (more info here: tgam.ca/gics).

The coverage limit for member banks and trusts is $100,000 in combined principal and interest per eligible deposit. For a typical person, an account in a single name, a joint account and registered accounts would each be separately insured for $100,000.

One of the big worries about CDIC stepping in seems to be that money held in savings accounts and GICs will be tied up until an insolvent bank is wound down. In fact, CDIC pays depositors before it knows how much money can be salvaged from a dying bank. Also, because it shares some client data with its members, the agency is able to pay depositors automatically. You don’t need to file a claim.

CDIC says it aims to reimburse people holding non-registered deposits within three business days through cheques that would be mailed out. Expect registered accounts to take a little longer.

People also worry that CDIC doesn’t have enough money on hand to cover potential losses. Home Capital, for example has about $12.6-billion in GICs outstanding. The latest numbers show CDIC has $3.8-billion in liquid securities held at the Bank of Canada, and a $22-billion line of credit it can use to borrow from either the central bank or private lenders. In any case, it’s almost inconceivable that the agency would have to cover every dollar in deposits at a failed bank or trust.

Decades back, CDIC had to fight it out with other creditors when a bank collapsed and typically recovered roughly 50 cents of every $1 paid to depositors. Since the late 1980s, the agency has had the latitude to get involved with weakening banks to preserve their assets. This has allowed CDIC to recover an average 83 cents on the dollar, and thus dip only minimally into their reserves.

Credit unions have their own provincial deposit insurance plans, often with higher or unlimited coverage. The Canadian Credit Union Association says that in all provinces except Saskatchewan and Manitoba, these deposit insurance plans are government organizations. Both the Saskatchewan and Manitoba plans are government regulated and have authority to access financing from their respective provincial governments.

Manitoba’s unlimited deposit insurance is noteworthy because several provincial credit unions operate online banking divisions that offer premium rates on savings and GICs. Regardless of what province you live in, you’re protected by this coverage.

CDIC has handled 43 bank failures since it was created in 1967, the most recent in 1996, and says none of the two million people affected lost a dollar of insured deposits. Your biggest risk if a CDIC-member bank or trust company fails and you’ve kept to the $100,000 coverage limits? Brief uncertainty about when your money will be repaid.

The Globe and Mail. Bloomberg News. May 11, 2017. Home Capital foe says his short's bigger than much of board owns

BY LUKE KAWA

The most vocal opponent of Home Capital Group Inc. has revealed the extent of his bet against the alternative Canadian mortgage lender.

Marc Cohodes, the fund manager-turned-chicken farmer who has been betting Home Capital will fall since November 2014 -- when the stock was near its peak -- said his short position is now bigger than the total number of shares owned by almost all of Home Capital’s insiders. These exclude founder Gerald Soloway and board members John Marsh and Dinah Henderson, but include the rest of Home Capital’s directors and former CEO Martin Reid.

Shares of Home Capital have plunged since April 19 following the Ontario Securities Commission’s allegation that the company misled investors. A run on deposits ensued, prompting the company to take an expensive line of credit to ensure its ability to service near-term obligations.

“All these heavy hitters,” Mr. Cohodes said in a phone interview. “They have such little faith in the company that a private individual in California is short more than all of them hold.”

A position of this size would amount to over 121,000 shares or 4.5 per cent of the total short interest in the firm as of the end of April. Based on Wednesday’s closing price, Cohodes stands to gain $1-million if the stock fell to zero. He did not provide documentation to support his claim.

Home Capital declined to comment on Mr. Cohodes’s claims. Interim CEO Bonita Then however said the company is taking steps to regain confidence of its stakeholders, and pointed to recent board changes and a new funding plan. “So it’s working. We are making progress,” she said in an emailed reply.

Mr. Cohodes has slammed Home Capital’s business model, transparency and management, both through his Twitter feed and in public interviews. The latest disclosure on the size of his position was motivated by Canadian newspaper commentators critical of his public battle against Home Capital, he said. It comes on the day Home Capital is scheduled to announce first-quarter earnings.

Home Capital has taken a costly rescue loan and is exploring options including a potential sale. Much of its board has only been added in recent weeks as part of a “governance renewal” in the wake of the allegations.

The most recent filings from Home Capital insiders are from the end of February. The group -- which includes Then, former Chairman Kevin Smith, interim Chief Financial Officer Robert Blowes, and Mr. Reid -- own some 0.25 per cent of Home Capital’s outstanding shares.

The stock has rebounded 69 per cent over the past five sessions amid news that CIBC Asset Management more than tripled its holdings during the month of April to own 15 per cent of the company. Top shareholder Turtle Creek Investment Management Inc. boosted its stake to 19 per cent. Shares are however still down some 60 per cent over the past month.

REUTERS. May 12, 2017. Home Capital shares fall after flagging going concern issues

TORONTO (Reuters) - Shares in Home Capital Group Inc HCG.TO fell as much as 20 percent in early trading on Friday after the lender said uncertainty around future funding had cast doubt about whether it could continue as a going concern.

Shares in Canada's biggest non-bank lender hit a low of C$8.70 in early deals before recovering to trade down 11 percent at C$9.60.

Home Capital issued first-quarter results after the market closed on Thursday, alongside which it stated that: "Management believes that material uncertainty exists regarding the company's future funding capabilities as a result of reputational concerns that may cast significant doubt upon the company's ability to continue as a going concern."

Depositors have withdrawn nearly 94 percent of funds from Home Capital's high-interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

The withdrawals accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business.

Home Capital relies on deposits from savers to fund its lending to borrowers, such as self-employed workers or newcomers to Canada, who may not meet the strict criteria of the country's biggest banks.

Reuters reported on Thursday that Home Capital was in talks to divest about C$2 billion in assets to help pay down a high-interest loan, according to people familiar with the situation.

The lender needs to raise funds to help repay a C$2 billion loan from Healthcare of Ontario Pension Plan (HOOPP), which provided the high-interest line of credit last month, charging interest of 10 percent on outstanding balances. Home Capital has so far drawn down C$1.4 billion from the facility but is hoping to secure alternative funding on more favorable terms.

In a conference call with investors on Friday, Chief Financial Officer Robert Morton confirmed the company is considering selling assets to enable it to refinance quicker and pay off the emergency loan provided by HOOPP.

"Given the cost of the C$2 billion credit line repayment of amounts, repayment of the amounts drawn under this facility in a timely fashion is an essential part of management's plans. This may necessitate asset dispositions," he said.

Home Capital disclosed data on Friday that showed the rate of withdrawals by depositors was slowing, a day after the company raised doubts about its ability to continue as a going concern.

(Reporting by Matt Scuffham; Editing by Nick Zieminski)

REUTERS. May 12, 2017. Home Capital's deposit balances remain stable

(Reuters) - Canada's biggest non-bank lender Home Capital Group Inc HCG.TO disclosed data on Friday that showed the rate of withdrawals by depositors was slowing, a day after the company raised doubts about its ability to continue as a going concern.

Home Capital said its high-interest savings deposits were expected to have fallen to about C$125 million following the completion of Thursday's settlements, down from a balance of C$128 million the day before.

Depositors have withdrawn nearly 94 percent of funds from Home Capital's high-interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

The withdrawals accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business.

Home Capital relies on deposits from savers to fund its lending to borrowers, such as self-employed workers or newcomers to Canada, who may not meet the strict criteria of the country's biggest banks.

The company agreed last month to receive C$2 billion in emergency funding from the Healthcare of Ontario Pension Plan (HOOPP). It has so far drawn down C$1.4 billion from that facility.

Home Capital said on Friday its liquid assets stood at C$962 million at the end of Thursday, which, combined with the funds not drawn down on the HOOPP credit facility, gives it access to C$1.56 billion in available liquidity and credit capacity.

(Reporting by Swetha Gopinath in Bengaluru; Editing by Saumyadeb Chakrabarty)

REUTERS. May 12, 2017. Canada home prices up in April as Toronto market keeps rising: Teranet

OTTAWA (Reuters) - Canadian home prices rose in April, data showed on Friday, lifted once again by hefty price gains in the hot Toronto market, which some fear is becoming overheated.

The Teranet-National Bank Composite House Price Index, which measures changes for repeat sales of single-family homes, showed prices rose 1.2 percent last month, making for the fifteenth consecutive month national prices have increased.

In the Toronto market, which some economists have called a bubble, prices climbed 2.6 percent, while nearby Hamilton was up 2.1 percent. Indexes for both cities were at record highs.

Compared to a year ago, prices were up 26.3 percent in Toronto and 22.9 percent in Hamilton, a record pace for both, the report said.

The rapid growth in Toronto home prices has spread to surrounding regions, including Hamilton, as potential buyers are priced out of Canada's largest city. The provincial government announced measures at the end of last month to try to cool the Toronto market, including a tax on foreign buyers.

The report pointed to tight market conditions as demand exceeds the supply of homes for sale, a factor that has been partly blamed for rising prices.

In Vancouver, where the British Columbia government imposed its own foreign buyers tax last August, prices dipped 0.1 percent on the month. Nonetheless, prices remained just 0.3 percent away from the peak seen last year.

Elsewhere in the province, prices climbed 1.5 percent in Victoria.

Canada's housing market has been generally robust in the years since the global financial crisis, partly fueled by low interest rates, but concern over consumer indebtedness and housing affordability has become more prominent recently.

Moody's on Thursday downgraded the ratings of Canada's major banks, citing rising household debt and the hot housing market.

(Reporting by Leah Schnurr; Editing by James Dalgleish)

BLOOMBERG. 2017 M05 11. Home Capital Warns of ‘Knock-On Effects’ If It Fails to Recover

by Katia Dmitrieva and Kim Chipman

- Troubled lender says has ‘breathing room’ to mull options

- Company seeks additional funding options amid deposit run

- Home Capital Foe Reveals Extent of Bet Against Lender

Home Capital Group Inc. said it’s seeking new sources of funding to counter a run on deposits and warned that the failure of the Canadian lender would have significant “knock-on effects” in the broader mortgage market.

The struggling mortgage lender has some “breathing room” to pursue strategic options and new funding sources following an C$1.8 billion ($1.4 billion) plunge in deposits and a 60 percent share decline, director Alan Hibben, a former RBC Capital Markets managing director, said on a conference call.

“I don’t expect there to be any new significant transactions within the next days and weeks, however that shouldn’t be misconstrued, we will be extremely active in bringing a range of options forward,” Hibben said without elaborating. The former investment banker said he’s taking a more active role alongside management.

Home Capital’s troubles are being closely watched by investors concerned about possible contagion to other lenders and to the red-hot real estate markets in Toronto and Vancouver. The Canadian dollar has slumped, and is the worst performing currency among Group of 10 nations this year. Moody’s Investors Service late Wednesday cut the credit ratings on six Canadian banks, citing rising household debt and soaring real estate prices that make the banks more vulnerable to losses.

Home Capital executives sought to reassure investors that’s it’s working to find new sources of funding to stem the deposit outflows and to replace a costly C$2 billion credit line arranged last month by the Healthcare of Ontario Pension Fund.

Ripple Effect

A company failure would have knock-on effects for the market and for the so-called alternative mortgage customers who can’t get loans from the major commercial banks, the company said.

“There is much at stake,” Chairwoman Brenda Eprile said on the call in her first public comments since taking the position this month. “We are working diligently” to rebuild strength of the company, said Eprile, former chief accountant for the Ontario Securities Commission.

Home Capital, accused by regulators last month of misleading investors over fraudulent mortgage loan applications, has lost almost C$1.8 billion in high-interest deposits in five weeks, draining the Toronto-based company of funds used to finance mortgages. The company said it’s facing liquidity issues because of reputational concerns raised by the Ontario Securities Commission allegations, as well as a class action lawsuit announced earlier this year. The lack of a chief executive officer and chief financial officer is also hurting, the company said.

Home Capital fell 10 percent to C$9.71 at 10 a.m. in Toronto, paring its gain this week to 65 percent. The stock has fallen by two-thirds this year.

Going Concern

Home Capital executives addressed investors and analysts after warning Thursday that the reputational hit threatens the company’s viability.

“We are facing a crisis of confidence,” Hibben said.

“Material uncertainty exists regarding the company’s future funding capabilities as a result of reputational concerns that may cast significant doubt" about continued operations, the company said in its earnings statement. “Management’s focus is on finding more sources of funding in the near term so we can be more active serving our customers, and on seeking longer-term solutions that put the business back on track.”

High-interest savings deposits dropped to about C$125 million as of Friday from $1.9 billion at March 31, the company said. Home Capital also lost C$344 million in cashable GICs, or guaranteed investment certificates. Tightening lending criteria and broker incentive programs will lead to a decline in originations and renewals going forward, the company said.

Pension Loan

The lender’s liquid assets are about C$962 million as of May 11, it said in a separate statement. It had drawn C$1.4 billion of a C$2 billion rescue loan from an Ontario pension fund that carries an effective interest rate of 22.5 percent, the firm disclosed. The company also sold a C$154 million portfolio of preferred shares to raise cash.

Total on-balance sheet loans grew 3.2 percent to C$18.6 billion in the first quarter from the end of 2016 as traditional single-family residential mortgages, which comprise half of total loans, grew 3.4 percent to C$11.4 billion.

Home Capital used its first quarter results to underscore its battle plan. It’s planning to sell assets to help pay down the C$2 billion loan. The lender’s priority is to fill the CEO and CFO roles, and is in talks with an external adviser on strategic options. The company is also talking to industry partners about funding mortgage commitments and renewals in the near-term, according to its statement.

The company reached an agreement MCAP Corp. to service C$1.5 billion of Home Capital’s mortgages and renewals.

Maxime Chagnon, a spokesman for the Caisse de depot et placement du Quebec, which has a partnership with MCAP in a unit of its business, said in an email Friday MCAP is not the buyer of the mortgages but rather a facilitator for the sale of them. He said MCAP will manage and service the loans for the buyer and won’t own them. Home Capital hasn’t identified the partner on this deal. A representative for MCAP declined to comment.

“If successfully implemented, a combination of some of these actions will enable the company to continue as a going concern,” the firm said, adding that the ability to attract new deposits may be outside its control. “Therefore management believes that material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern.”

New Directors

In the last week, lenders, investors and brokerages including Dominion Lending Centres have come out in support of the company and its new management, sparking a rally in the share price. Home Capital replaced the company’s founder Gerald Soloway on the board with Hibben, and added three more industry heavy-hitters to the board.

The company reported profit for the period ending March 31 that matched the preliminary disclosure it gave April 21, with earnings of 90 cents a share, or C$1.02 on an adjusted basis.

BLOOMBERG. 2017 M05 12. Home Capital Is a Minor Meltdown That’s Left a Major Mark on Canada

by Theophilos Argitis and Kristine Owram

- Moody’s sees growing risks as house prices, debt hit records

- Mortgage lender’s crisis may bring squeeze in credit market

- Home Capital Foe Reveals Extent of Bet Against Lender

The story Canada has been telling itself about its economy is starting to sound like wishful thinking.

It’s too early for the meltdown at Home Capital Group Inc. to show up in the data -- and, with just 1 percent of the national market, the mortgage lender may be too small to do so anyway. But it’s already had a big impact on how investors and analysts are weighing the country’s weaknesses against its strengths.

Boom-times in Vancouver and Toronto look increasingly like the spillovers from debt-fueled housing bubbles, the kind that wrought havoc in so many Western countries last decade. A banking system long considered among the world’s soundest got hit by a Moody’s downgrade this week. The government has touted a transition away from commodity-dependence and toward hi-tech smarts; Canadians are waking up to the possibility that their economy got hooked on real-estate instead.

None of that is to say that Canada has become a basket case overnight, of course. Still, expectations that it’ll grow faster than developed-world peers this year -- as forecast by the Bank of Canada -- may be unsustainable, according to Craig Fehr, Canadian investment strategist at money-manager Edward Jones & Co.

“Every time I see estimates for 2 plus percent GDP growth this year I just think they’re far too rosy,” he said. “It’s a function of the imbalances that exist in the economy.”

Housing is exhibit no. 1. Estimates of its direct contribution to the economy exceed 20 percent.

The figure is much higher when secondary effects are included, from lawyer fees to higher government revenue to increased retail spending driven by homeowners’ inflated sense of their own wealth, as house prices in some regions shot up more than 20 percent a year. Consumer spending as a share of gross domestic product is hovering around the highest since possibly as far back as the 1960s.

“The question is just how will the economy look as that ceases to contribute quite so forcefully,” said Eric Lascelles, chief economist at RBC Global Asset Management Inc. “All bubbles come to an end. I think it could be an interesting year or two ahead.”

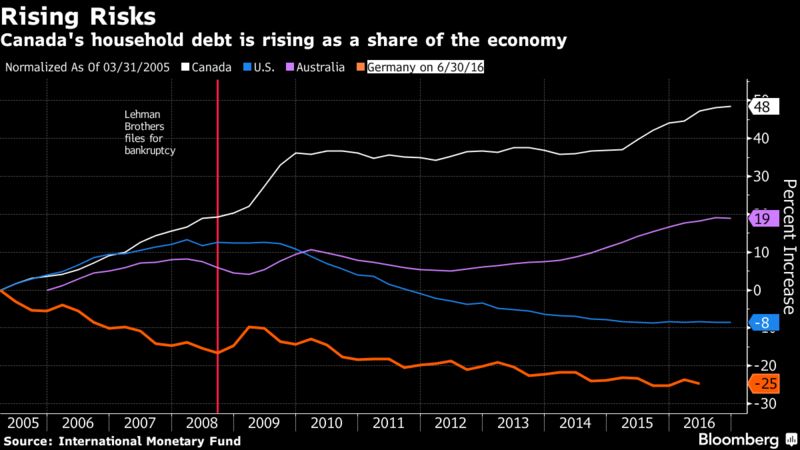

Both home-ownership and consumption are being financed by record levels of household debt. Canada’s traditional remedy for commodity busts involved scraping together enough foreign financing to cushion the initial blow, then depreciating the currency to stoke manufacturing and exports.

This time, after the oil crash of 2014, there’s little sign of an industrial revival. There has been plenty of overseas borrowing: External debt was about 60 percent of GDP a decade ago; now, at C$2.3 trillion, it’s larger than the economy. But much of it has been channeled to households.

As a result, they’re “indebted to a level that is unprecedented,” said Michael Emory, chief executive officer of Allied Properties Real Estate Investment Trust, who describes that as the economy’s biggest concern. “Canadian consumers historically have been very prudent with the levels of debt they bear,” he said.

Not anymore.

Moody’s Investors Service cited the private-debt burden when it cut ratings on the country’s six biggest banks, expressing concern about asset quality.

That backdrop makes the Home Capital crisis more threatening than it otherwise might have been. A run on deposits, even at a small lender, sparks concern about contagion. Default levels across the system remain low, but could rise if the economy slows and financial conditions tighten.

Which they likely will, according to David Rosenberg, chief economist at Gluskin Sheff & Associates Inc. in Toronto, who expects credit growth to tail off. “That alone will probably cause the Bank of Canada to keep interest rates that much lower for longer,” he said.

Investors looking for the drama of a full-blown financial crash may be disappointed.

Even while downgrading Canadian banks, Moody’s acknowledged that they “maintain strong buffers in terms of capital and liquidity.” Regulators keep a relatively tight grip on the system.

And history shows that, when forced to confront problems, the industry tends to circle the wagons. Home Capital’s troubles, for example, have prompted other lenders to step up to limit the fallout. MCAP Corp. agreed to pick up C$1.5 billion in mortgages and renewals from its rival, according to the Globe and Mail. Investment funds at Canadian Imperial Bank of Commerce are buying Home Capital’s equity.

All has that contributed to a rally in the shares this week. They’re still trading at less than half the level of a month ago, and plunged again at the market’s opening on Friday after company management said on a conference call that there’s no immediate prospect of additional asset sales.

Canada’s wider financial markets have been lackluster rather than dismal. The loonie is down 1.9 percent this year, the most among 16 major currencies tracked by Bloomberg. The main stock gauge has underperformed other developed countries, but it’s still up 1.7 percent.

So investors aren’t exactly flashing warning signals. Still, they’re finding more things to worry about than was the case a month ago.

When the U.S. housing bubble collapsed, it triggered first a financial crisis and then a recession. In the event of a replay north of the border, Canada might avoid the first pitfall, if its banks are as sound as everyone says. That doesn’t mean its economy won’t get hurt in the fallout.

BLOOMBERG. 2017 M05 11. There's No Canadian Crisis In Sight Despite Downgrade Hitting Assets

by Maciej Onoszko

- Loonie, bank stocks and bonds initially fell after Moody’s cut

- Canada’s banking system is strong: Finance Minister Morneau

- Why Moody's Downgraded Canada's Biggest Banks

Moody’s downgrade of Canada’s biggest banks beat down assets in a market already rattled by woes of mortgage lender Home Capital Group Inc. Yet analysts say this isn’t evidence of an impending crisis.

“The weatherman just warned us about a storm that already came and went,” said Derek Holt, head of capital markets economics at Scotiabank. “You can get cooling markets without it being terribly negative for the financial system, given how profoundly different our financial system and mortgage market are in Canada compared to other countries that had those troubles.”

Investors are concerned that Home Capital’s troubles can lead to broader financial contagion, tipping Canada’s economy into the kind of crisis it averted in 2008. Take a closer look, though, and underlying indicators are reassuring.

Currency

Canada’s dollar has fallen about 1.6 percent since the regulator on April 19 accused Home Capital of misleading investors, taking the drop for the year to 1.9 percent, the biggest among Group-of-10 countries. Then there’s also worry about a protectionist U.S. under President Donald Trump and a drop in crude oil prices. Yet the premium that you pay for purchasing three-month options to buy the U.S. dollar, otherwise known as risk-reversals, has been gradually falling this month, suggesting there’s less scope for further weakness in the loonie.

Bank Bonds

Canadian banks’ local-currency bonds fell on Thursday, after Moody’s Investors Service lowered their credit ratings by one level citing soaring household debt and runaway house prices. Yet five-year credit-default swaps on the U.S. dollar bonds of Toronto-Dominion Bank -- Canada’s largest lender by assets -- were at a record-low on Thursday, signalling little concern about the bank’s ability to pay off its debt.

Stocks

Bank stocks suffered on Thursday too, with the main bank index falling 0.9 percent compared with a 0.5 percent decline in the broader S&P/TSX gauge. Yet the gauge is nowhere near its lows. “As Shakespeare said, it’s much ado about nothing -- or very little,” said Ian Lee, an associate professor at the Sprott School of Business at Ottawa’s Carleton University. “We ended up with a few very, very large and very safe banks.”

________________

LGCJ.: