CANADA ECONOMICS

US TARIFF ON STEEL AND ALUMINIUM

THE WHITE HOUSE. April 30, 2018. STATEMENTS & RELEASES. ECONOMY & JOBS. President Donald J. Trump Approves Section 232 Tariff Modifications

Today, President Donald J. Trump issued two proclamations authorizing modifications of the Section 232 tariffs on steel and aluminum. The Administration has reached a final agreement with South Korea on steel imports, the outlines of which were previously announced by U.S. Trade Representative Robert Lighthizer and Republic of Korea Minister for Trade Hyun-chong Kim. The Administration has also reached agreements in principle with Argentina, Australia, and Brazil with respect to steel and aluminum, the details of which will be finalized shortly. The Administration is also extending negotiations with Canada, Mexico, and the European Union for a final 30 days. In all of these negotiations, the Administration is focused on quotas that will restrain imports, prevent transshipment, and protect the national security.

These agreements underscore the Trump Administration’s successful strategy to reach fair outcomes with allies to protect our national security and address global challenges to the steel and aluminum industries.

THE WHITE HOUSE. April 30, 2018. PROCLAMATIONS. ECONOMY & JOBS. Presidential Proclamation Adjusting Imports of Steel into the United States

BY THE PRESIDENT OF THE UNITED STATES OF AMERICA

A PROCLAMATION

1. On January 11, 2018, the Secretary of Commerce (Secretary) transmitted to me a report on his investigation into the effect of imports of steel mill articles on the national security of the United States under section 232 of the Trade Expansion Act of 1962, as amended (19 U.S.C. 1862).

2. In Proclamation 9705 of March 8, 2018 (Adjusting Imports of Steel Into the United States), I concurred in the Secretary’s finding that steel mill articles are being imported into the United States in such quantities and under such circumstances as to threaten to impair the national security of the United States, and decided to adjust the imports of steel mill articles, as defined in clause 1 of Proclamation 9705, as amended by clause 8 of Proclamation 9711 of March 22, 2018 (Adjusting Imports of Steel Into the United States) (steel articles), by imposing a 25 percent ad valorem tariff on such articles imported from all countries except Canada and Mexico. I further stated that any country with which we have a security relationship is welcome to discuss with the United States alternative ways to address the threatened impairment of the national security caused by imports from that country, and noted that, should the United States and any such country arrive at a satisfactory alternative means to address the threat to the national security such that I determine that imports from that country no longer threaten to impair the national security, I may remove or modify the restriction on steel articles imports from that country and, if necessary, adjust the tariff as it applies to other countries, as the national security interests of the United States require.

3. In Proclamation 9711, I noted the continuing discussions with the Argentine Republic (Argentina), the Commonwealth of Australia (Australia), the Federative Republic of Brazil (Brazil), Canada, Mexico, the Republic of Korea (South Korea), and the European Union (EU) on behalf of its member countries, on satisfactory alternative means to address the threatened impairment to the national security by imports of steel articles from those countries. Recognizing that each of these countries and the EU has an important security relationship with the United States, I determined that the necessary and appropriate means to address the threat to national security posed by imports of steel articles from these countries was to continue the ongoing discussions and to exempt steel articles imports from these countries from the tariff proclaimed in Proclamation 9705 until May 1, 2018.

4. The United States has successfully concluded discussions with South Korea on satisfactory alternative means to address the threatened impairment to our national security posed by steel articles imports from South Korea. The United States and South Korea have agreed on a range of measures, including measures to reduce excess steel production and excess steel capacity, and measures that will contribute to increased capacity utilization in the United States, including a quota that restricts the quantity of steel articles imported into the United States from South Korea. In my judgment, these measures will provide an effective, long-term alternative means to address South Korea’s contribution to the threatened impairment to our national security by restraining steel articles exports to the United States from South Korea, limiting transshipment, and discouraging excess capacity and excess steel production. In light of this agreement, I have determined that steel articles imports from South Korea will no longer threaten to impair the national security and have decided to exclude South Korea from the tariff proclaimed in Proclamation 9705. The United States will monitor the implementation and effectiveness of the quota and other measures agreed upon with South Korea in addressing our national security needs, and I may revisit this determination, as appropriate.

5. The United States has agreed in principle with Argentina, Australia, and Brazil on satisfactory alternative means to address the threatened impairment to our national security posed by steel articles imported from these countries. I have determined that the necessary and appropriate means to address the threat to national security posed by imports of steel articles from Argentina, Australia, and Brazil is to extend the temporary exemption of these countries from the tariff proclaimed in Proclamation 9705, in order to finalize the details of these satisfactory alternative means to address the threatened impairment to our national security posed by steel articles imported from these countries. In my judgment, and for the reasons I stated in paragraph 10 of Proclamation 9711, these discussions will be most productive if steel articles from Argentina, Australia, and Brazil remain exempt from the tariff proclaimed in Proclamation 9705, until the details can be finalized and implemented by proclamation. Because the United States has agreed in principle with these countries, in my judgment, it is unnecessary to set an expiration date for the exemptions. Nevertheless, if the satisfactory alternative means are not finalized shortly, I will consider re-imposing the tariff.

6. The United States is continuing discussions with Canada, Mexico, and the EU. I have determined that the necessary and appropriate means to address the threat to the national security posed by imports of steel articles from these countries is to continue these discussions and to extend the temporary exemption of these countries from the tariff proclaimed in Proclamation 9705, at least at this time. In my judgment, and for the reasons I stated in paragraph 10 of Proclamation 9711, these discussions will be most productive if steel articles from these countries remain exempt from the tariff proclaimed in Proclamation 9705.

7. For the reasons I stated in paragraph 11 of Proclamation 9711, however, the tariff imposed by Proclamation 9705 remains an important first step in ensuring the economic stability of our domestic steel industry and removing the threatened impairment of the national security. As a result, unless I determine by further proclamation that the United States has reached a satisfactory alternative means to remove the threatened impairment to the national security by imports of steel articles from Canada, Mexico, and the member countries of the EU, the tariff set forth in clause 2 of Proclamation 9705 shall be effective June 1, 2018, for these countries.

8. In light of my determination to exclude, on a long‑term basis, South Korea from the tariff proclaimed in Proclamation 9705, I have considered whether it is necessary and appropriate in light of our national security interests to make any corresponding adjustments to the tariff set forth in clause 2 of Proclamation 9705 as it applies to other countries. I have determined that, in light of the agreed-upon quota and other measures with South Korea, the measures being finalized with Argentina, Australia, and Brazil, and the ongoing discussions that may result in further long-term exclusions from the tariff proclaimed in Proclamation 9705, it is necessary and appropriate, at this time, to maintain the current tariff level as it applies to other countries.

9. Section 232 of the Trade Expansion Act of 1962, as amended, authorizes the President to adjust the imports of an article and its derivatives that are being imported into the United States in such quantities or under such circumstances as to threaten to impair the national security.

10. Section 604 of the Trade Act of 1974, as amended (19 U.S.C. 2483), authorizes the President to embody in the Harmonized Tariff Schedule of the United States (HTSUS) the substance of statutes affecting import treatment, and actions thereunder, including the removal, modification, continuance, or imposition of any rate of duty or other import restriction.

Now, Therefore, I, Donald J. Trump, President of the United States of America, by the authority vested in me by the Constitution and the laws of the United States of America, including section 232 of the Trade Expansion Act of 1962, as amended, section 301 of title 3, United States Code, and section 604 of the Trade Act of 1974, as amended, do hereby proclaim as follows:

(1) Imports of all steel articles from Argentina, Australia, Brazil, and South Korea shall be exempt from the duty established in clause 2 of Proclamation 9705, as amended by clause 1 of Proclamation 9711. Imports of all steel articles from Canada, Mexico, and the member countries of the EU shall be exempt from the duty established in clause 2 of Proclamation 9705 until 12:01 a.m. eastern daylight time on June 1, 2018. Further, clause 2 of Proclamation 9705, as amended by clause 1 of Proclamation 9711, is also amended by striking the last two sentences and inserting in lieu thereof the following two sentences: “Except as otherwise provided in this proclamation, or in notices published pursuant to clause 3 of this proclamation, all steel articles imports specified in the Annex shall be subject to an additional 25 percent ad valorem rate of duty with respect to goods entered for consumption, or withdrawn from warehouse for consumption, as follows: (a) on or after 12:01 a.m. eastern daylight time on March 23, 2018, from all countries except Argentina, Australia, Brazil, Canada, Mexico, South Korea, and the member countries of the European Union, and (b) on or after 12:01 a.m. eastern daylight time on June 1, 2018, from all countries except Argentina, Australia, Brazil, and South Korea. This rate of duty, which is in addition to any other duties, fees, exactions, and charges applicable to such imported steel articles, shall apply to imports of steel articles from each country as specified in the preceding sentence.”.

(2) In order to provide the quota treatment referred to in paragraph 4 of this proclamation to steel articles imports from South Korea, U.S. Note 16 of subchapter III of chapter 99 of the HTSUS is amended as provided for in Part A of the Annex to this proclamation. U.S. Customs and Border Protection (CBP) of the Department of Homeland Security shall implement this quota as soon as practicable, taking into account all steel articles imports from South Korea since January 1, 2018.

(3) The exemption afforded to steel articles from Canada, Mexico, and the member countries of the EU shall apply only to steel articles of such countries entered for consumption, or withdrawn from warehouse for consumption, through the close of May 31, 2018, at which time such countries shall be deleted from the article description of heading 9903.80.01 of the HTSUS.

(4) Clause 5 of Proclamation 9711 is amended by inserting the phrase “, except those eligible for admission under “domestic status” as defined in 19 CFR 146.43, which is subject to the duty imposed pursuant to Proclamation 9705, as amended by Proclamation 9711,” after the words “Any steel article” in the first and second sentences.

(5) Steel articles shall not be subject upon entry for consumption to the duty established in clause 2 of Proclamation 9705, as amended by clause 1 of this proclamation, merely by reason of manufacture in a U.S. foreign trade zone. However, steel articles admitted to a U.S. foreign trade zone in “privileged foreign status” pursuant to clause 5 of Proclamation 9711, as amended by clause 4 of this proclamation, shall retain that status consistent with 19 CFR 146.41(e).

(6) No drawback shall be available with respect to the duties imposed on any steel article pursuant to Proclamation 9705, as amended by clause 1 of this proclamation.

(7) The Secretary, in consultation with CBP and other relevant executive departments and agencies, shall revise the HTSUS so that it conforms to the amendments and effective dates directed in this proclamation. The Secretary shall publish any such modification to the HTSUS in the Federal Register.

(8) Any provision of previous proclamations and Executive Orders that is inconsistent with the actions taken in this proclamation is superseded to the extent of such inconsistency.

IN WITNESS WHEREOF, I have hereunto set my hand this

thirtieth day of April, in the year of our Lord two thousand eighteen, and of the Independence of the United States of America the two hundred and forty-second.

DONALD J. TRUMP

THE WHITE HOUSE. April 30, 2018. ECONOMY & JOBS. PROCLAMATIONS. Presidential Proclamation Adjusting Imports of Aluminum into the United States

BY THE PRESIDENT OF THE UNITED STATES OF AMERICA

A PROCLAMATION

1. On January 19, 2018, the Secretary of Commerce (Secretary) transmitted to me a report on his investigation into the effect of imports of aluminum articles on the national security of the United States under section 232 of the Trade Expansion Act of 1962, as amended (19 U.S.C. 1862).

2. In Proclamation 9704 of March 8, 2018 (Adjusting Imports of Aluminum Into the United States), I concurred in the Secretary’s finding that aluminum articles are being imported into the United States in such quantities and under such circumstances as to threaten to impair the national security of the United States, and decided to adjust the imports of aluminum articles, as defined in clause 1 of Proclamation 9704, by imposing a 10 percent ad valorem tariff on such articles imported from all countries except Canada and Mexico. I further stated that any country with which we have a security relationship is welcome to discuss with the United States alternative ways to address the threatened impairment of the national security caused by imports from that country, and noted that, should the United States and any such country arrive at a satisfactory alternative means to address the threat to the national security such that I determine that imports from that country no longer threaten to impair the national security, I may remove or modify the restriction on aluminum articles imports from that country and, if necessary, adjust the tariff as it applies to other countries, as the national security interests of the United States require.

3. In Proclamation 9710 of March 22, 2018 (Adjusting Imports of Aluminum Into the United States), I noted the continuing discussions with the Argentine Republic (Argentina), the Commonwealth of Australia (Australia), the Federative Republic of Brazil (Brazil), Canada, Mexico, the Republic of Korea (South Korea), and the European Union (EU) on behalf of its member countries, on satisfactory alternative means to address the threatened impairment to the national security by imports of aluminum articles from those countries. Recognizing that each of these countries and the EU has an important security relationship with the United States, I determined that the necessary and appropriate means to address the threat to national security posed by imports of aluminum articles from these countries was to continue the ongoing discussions and to exempt aluminum articles imports from these countries from the tariff proclaimed in Proclamation 9704 until May 1, 2018.

4. The United States has agreed in principle with Argentina, Australia, and Brazil on satisfactory alternative means to address the threatened impairment to our national security posed by aluminum articles imported from these countries. I have determined that the necessary and appropriate means to address the threat to national security posed by imports of aluminum articles from Argentina, Australia, and Brazil is to extend the temporary exemption of these countries from the tariff proclaimed in Proclamation 9704, in order to finalize the details of these satisfactory alternative means to address the threatened impairment to our national security posed by aluminum articles imported from these countries. In my judgment, and for the reasons I stated in paragraph 10 of Proclamation 9710, these discussions will be most productive if aluminum articles from Argentina, Australia, and Brazil remain exempt from the tariff proclaimed in Proclamation 9704, until the details can be finalized and implemented by proclamation. Because the United States has agreed in principle with these countries, in my judgment, it is unnecessary to set an expiration date for the exemptions. Nevertheless, if the satisfactory alternative means are not finalized shortly, I will consider re-imposing the tariff.

5. The United States is continuing discussions with Canada, Mexico, and the EU. I have determined that the necessary and appropriate means to address the threat to the national security posed by imports of aluminum articles from these countries is to continue these discussions and to extend the temporary exemption of these countries from the tariff proclaimed in Proclamation 9704, at least at this time. In my judgment, and for the reasons I stated in paragraph 10 of Proclamation 9710, these discussions will be most productive if aluminum articles from these countries remain exempt from the tariff proclaimed in Proclamation 9704.

6. For the reasons I stated in paragraph 11 of Proclamation 9710, however, the tariff imposed by Proclamation 9704 remains an important first step in ensuring the economic stability of our domestic aluminum industry and removing the threatened impairment of the national security. As a result, unless I determine by further proclamation that the United States has reached a satisfactory alternative means to remove the threatened impairment to the national security by imports of aluminum articles from Canada, Mexico, and the member countries of the EU, the tariff set forth in clause 2 of Proclamation 9704 shall be effective June 1, 2018, for these countries.

7. I have determined that, in light of the ongoing discussions that may result in long-term exclusions from the tariff proclaimed in Proclamation 9704, it is necessary and appropriate, at this time, to maintain the current tariff level as it applies to other countries.

8. Section 232 of the Trade Expansion Act of 1962, as amended, authorizes the President to adjust the imports of an article and its derivatives that are being imported into the United States in such quantities or under such circumstances as to threaten to impair the national security.

9. Section 604 of the Trade Act of 1974, as amended (19 U.S.C. 2483), authorizes the President to embody in the Harmonized Tariff Schedule of the United States (HTSUS) the substance of statutes affecting import treatment, and actions thereunder, including the removal, modification, continuance, or imposition of any rate of duty or other import restriction.

Now, Therefore, I, Donald J. Trump, President of the United States of America, by the authority vested in me by the Constitution and the laws of the United States of America, including section 232 of the Trade Expansion Act of 1962, as amended, section 301 of title 3, United States Code, and section 604 of the Trade Act of 1974, as amended, do hereby proclaim as follows:

(1) Imports of all aluminum articles from Argentina, Australia, and Brazil shall be exempt from the duty established in clause 2 of Proclamation 9704, as amended by clause 1 of Proclamation 9710. Imports of all aluminum articles from Canada, Mexico, and the member countries of the EU shall be exempt from the duty established in clause 2 of Proclamation 9704 until 12:01 a.m. eastern daylight time on June 1, 2018. Further, clause 2 of Proclamation 9704, as amended by clause 1 of Proclamation 9710, is also amended by striking the last two sentences and inserting in lieu thereof the following two sentences: “Except as otherwise provided in this proclamation, or in notices published pursuant to clause 3 of this proclamation, all aluminum articles imports specified in the Annex shall be subject to an additional 10 percent ad valorem rate of duty with respect to goods entered for consumption, or withdrawn from warehouse for consumption, as follows: (a) on or after 12:01 a.m. eastern daylight time on March 23, 2018, from all countries except Argentina, Australia, Brazil, Canada, Mexico, South Korea, and the member countries of the European Union, (b) on or after 12:01 a.m. eastern daylight time on May 1, 2018, from all countries except Argentina, Australia, Brazil, Canada, Mexico, and the member countries of the European Union, and (c) on or after 12:01 a.m. eastern daylight time on June 1, 2018, from all countries except Argentina, Australia, and Brazil. This rate of duty, which is in addition to any other duties, fees, exactions, and charges applicable to such imported aluminum articles, shall apply to imports of aluminum articles from each country as specified in the preceding sentence.”.

(2) The exemption afforded to aluminum articles from Canada, Mexico, and the member countries of the EU shall apply only to aluminum articles of such countries entered for consumption, or withdrawn from warehouse for consumption, through the close of May 31, 2018, at which time such countries shall be deleted from the article description of heading 9903.85.01 of the HTSUS.

(3) Clause 5 of Proclamation 9710 is amended by inserting the phrase “, except those eligible for admission under “domestic status” as defined in 19 CFR 146.43, which is subject to the duty imposed pursuant to Proclamation 9704, as amended by Proclamation 9710,” after the words “Any aluminum article” in the first and second sentences.

(4) Aluminum articles shall not be subject upon entry for consumption to the duty established in clause 2 of Proclamation 9704, as amended by clause 1 of this proclamation, merely by reason of manufacture in a U.S. foreign trade zone. However, aluminum articles admitted to a U.S. foreign trade zone in “privileged foreign status” pursuant to clause 5 of Proclamation 9710, as amended by clause 3 of this proclamation, shall retain that status consistent with 19 CFR 146.41(e).

(5) No drawback shall be available with respect to the duties imposed on any aluminum article pursuant to Proclamation 9704, as amended by clause 1 of this proclamation.

(6) The Secretary, in consultation with U.S. Customs and Border Protection of the Department of Homeland Security and other relevant executive departments and agencies, shall revise the HTSUS so that it conforms to the amendments and effective dates directed in this proclamation. The Secretary shall publish any such modification to the HTSUS in the Federal Register.

(7) Any provision of previous proclamations and Executive Orders that is inconsistent with the actions taken in this proclamation is superseded to the extent of such inconsistency.

IN WITNESS WHEREOF, I have hereunto set my hand this thirtieth day of April, in the year of our Lord two thousand eighteen, and of the Independence of the . of America the two hundred and forty-second.

DONALD J. TRUMP

THE GLOBE AND MAIL. 1 May 2018. White House extends tariff exemptions for Canada, EU, Mexico

ADRIAN MORROW, WASHINGTON

Canada and Mexico will receive another one-month break from U.S. President Donald Trump’s steel and aluminium tariffs as the countries try to renegotiate NAFTA.

Mr. Trump issued proclamations shortly after 9 p.m. Monday extending the tariff exemptions to June 1.

The President announced levies of 25 per cent on all imports of steel and 10 per cent on aluminum in early March, but granted temporary exemptions to several U.S. allies. The exemptions were due to expire May 1.

The tariffs are mostly aimed at keeping cheap Chinese steel from flooding the U.S. market, but would disproportionately hurt Canada, which is the United States’ largest supplier.

The levies, Mr. Trump wrote in his proclamation Monday, are an “important first step in ensuring the economic stability of our domestic steel industry and removing the threatened impairment of the national security.”

Mr. Trump has threatened to hit Canada and Mexico with the tariffs if they do not reach a deal with him on overhauling the North American free-trade agreement.

Top officials from the three countries are scheduled to reconvene in Washington next week for further negotiations.

The United States has granted a permanent exemption to one country, South Korea, after it agreed to limit the amount of steel it sends to the United States. The European Union also received a one-month extension to its exemption Monday, while Brazil, Argentina and Australia received indefinite exemptions.

THE GLOBE AND MAIL. APRIL 30, 2018. Trump extends exemption for Canada, Mexico on steel and aluminum tariffs

ADRIAN MORROW, AUTO AND STEEL

GREG KEENAN, AIRLINE INDUSTRY REPORTER

WASHINGTON AND TORONTO - U.S. President Donald Trump is granting Canada and Mexico a “final” one-month break from his tariffs on steel and aluminum – and demanding that both countries agree to quotas that would limit Canadian and Mexican exports of the metals to the U.S.

Mr. Trump issued proclamations around 9 p.m. Monday extending the tariff exemptions to June 1.

The President announced levies of 25 per cent on all imports of steel and 10 per cent on aluminum in early March, but granted temporary exemptions to several U.S. allies. The exemptions were due to expire Tuesday.

In the case of Canada and Mexico, Mr. Trump threatened to impose the tariffs if the two countries did not agree to a renegotiated North American free-trade agreement. Top officials from the three countries are scheduled to reconvene in Washington next week for further negotiations.

The U.S. has granted a permanent exemption to one country, South Korea, after it agreed to limit the amount of steel it sends to the United States. The European Union also received a one-month extension to its exemption Monday, while Brazil, Argentina and Australia received indefinite exemptions, pending negotiations with the U.S.

In a press release Monday, the White House said the newly extended exemption for Canada, Mexico and the EU would be the last.

“In all of these negotiations, the Administration is focused on quotas that will restrain imports, prevent transshipment, and protect the national security,” the release said.

Adding steel and aluminum quotas to the NAFTA bargaining table would insert another tough subject into an already fraught negotiation.

In NAFTA talks, the U.S. is currently demanding more stringent rules on the continental auto industry with the goal of stopping companies from sourcing parts from countries outside the NAFTA zone and driving auto jobs away from Mexico and back to the United States.

The Trump administration has also proposed tough new measures to limit the amount of U.S. government contracting Canadian and Mexican firms can bid on, a gutting of NAFTA’s dispute resolution system and dismantling Canada’s protectionist supply-management system for milk, eggs and dairy.

Still, Canada’s steel industry welcomed the news Monday evening.

“We are happy with the extension and looking forward to discussions with the U.S. on what a full, permanent exemption - which would benefit businesses and employees on both sides of the boarder - would look like,” said Joseph Galimberti, president of the Canadian Steel Producers Association.

The steel and aluminum tariffs are mostly aimed at keeping cheap Chinese steel from flooding the U.S. market, but would disproportionately hurt Canada, which is the U.S.’s largest supplier. Prime Minister Justin Trudeau promised last week to spend more money on more rigorous border inspections to stop foreign steel and aluminum from circumventing U.S. tariffs by passing through Canada – a bid to win over Washington by showing Ottawa is serious about helping Mr. Trump fight overseas imports.

The President is using national security as the grounds for the tariffs, arguing that the U.S. needs to beef up its domestic industry so it does not have to rely on foreign countries for the metal to build its tanks and ships. But Ottawa has argued that, as a long-time U.S. ally, it poses no threat at all.

At an event at the Canadian embassy in Washington last week, ambassador David MacNaughton said that Mr. Trump’s officials in the office of the U.S. trade representative have even privately admitted to him that Canada is not the target of the tariffs – even if it risks getting hit hard.

“USTR people keep saying to me ‘Well, you know, we’re not really trying to get at you. We’re trying to get at some of the, you know, in the far east,’” he said. “And I say, ‘Well, why are you punching me in the nose, then, if you’re trying to get at them?’”

REUTERS. MAY 1, 2018. Canada says U.S. tariffs hurt jobs; aluminum industry worried

OTTAWA (Reuters) - Canada has repeated its position that imposing punitive trade measures would hurt jobs in both countries, in reaction to U.S. President Donald Trump’s decision to postpone steel and aluminum tariffs that were set to go into effect on Tuesday.

The Trump administration said on Monday that the 25 percent tariff on steel imports and 10 percent tariff on aluminum imports from Canada and Mexico would be suspended until June 1.

Speaking a few hours before the announcement, Canadian Prime Minister Justin Trudeau said the tariffs were a “very bad idea” guaranteed to disrupt trade between the two nations.

“As the Prime Minister said today, we remain confident that the U.S. administration understands that tariffs would hurt American jobs as much as they would Canadian jobs,” said Adam Austen, a spokesman for Canadian Foreign Minister Chrystia Freeland.

In a statement emailed late on Monday, Austen also said Canada would work to secure good jobs for steel and aluminum workers on both sides of the U.S.-Canadian border.

The tariffs as well as Trump’s insistence that Canada and other nations accept the idea of import quotas look set to further complicate slow-moving talks to update the North American Free Trade Agreement.

The influential auto lobbies in Canada and Mexico are upset by new U.S. proposals for increasing NAFTA’s regional content for vehicles produced in the three member nations of the 1994 trade pact.

Trudeau and Freeland, who is due to testify to a Canadian Senate committee later on Tuesday, have already made clear they expect Canada to be granted a permanent exemption from the tariffs.

The Aluminium Association of Canada on Tuesday said the U.S. move to put off a decision would only increase uncertainty affecting the industry worldwide.

“Nothing less than a permanent and total exemption is required as soon as possible,” Jean Simard, the association’s president, said in a statement.

Reporting by David Ljunggren; Editing by Jeffrey Benkoe

REUTERS. MAY 1, 2018. Wilbur Ross says U.S. economy strong despite trade issues

Lawrence Delevingne

BEVERLY HILLS, Calif (Reuters) - U.S. Commerce Secretary Wilbur Ross said the American economy is strong despite a range of uncertainties over global trade.

There are “lots of clear signs” that the U.S. economy is doing “very, very well,” Ross said on stage Tuesday at the Milken Institute Global Conference in Los Angeles.

Ross cited such factors as the “reshoring” of jobs to America, deregulation, and tax cuts benefiting companies and individuals.

Ross also noted that steel tariffs negotiations with Canada, Mexico and the European Union were making enough progress to delay imposition another 30 days.

He added that separate negotiations with the E.U. over potential tariffs on U.S. goods were “a work in progress,” with no solution yet.

Reporting by Lawrence Delevingne; Editing by Chizu Nomiyama

BLOOMBERG. 1 May 2018. EU Warns of More U.S. Uncertainty After Tariff Delay

By Andrew Mayeda

- Trump gives another 30 days for EU, Canada permanent relief

- Allies want unconditional reprieve from American steel duties

- Trump Delays Steel and Aluminum Tariffs Against Some Allies

- Trump Extends Tariff Relief as Delegation Heads to China

The European Union and businesses are warning of more market uncertainty following the Trump administration’s decision to delay U.S. steel and aluminum tariffs for the next month.

President Donald Trump left the world in limbo on Monday until just hours before temporary tariff exemptions for the metals were due to expire for key allies. In a presidential proclamation, Trump allowed another 30 days for the EU, Canada and Mexico to continue negotiations for permanent exemptions. The U.S. made a tentative agreement to remove the tariffs for Australia, Argentina and Brazil, which should be finalized soon, it said.

The EU’s frustration continued over tariffs the U.S. has justified on national security grounds. Last week, French President Emmanuel Macron and German Chancellor Angela Merkel both made their case to Trump for why the EU bloc should get permanent and unconditional relief from the tariffs, partly arguing that they are America’s security partners.

“The U.S. decision prolongs market uncertainty, which is already affecting business decisions,” the European Commission said in a statement on Tuesday. “The EU should be fully and permanently exempted from these measures, as they cannot be justified on the grounds of national security.”

Wider Talks

Commerce Secretary Wilbur Ross said the talks over steel and aluminum tariffs with the EU are forcing a productive conversation about the wider trading relationship. He said he didn’t expect the U.S. will keep adding extensions.

“We are having some potentially fruitful discussions about an overall reduction in trade tensions between the EU and ourselves,” Ross said in an interview with CNBC on Tuesday. “We are getting into a whole lot of topics. We are hopeful that something good will come out of it.”

With the extension leaving the door open to more permanent arrangements, shares in U.S. steelmakers dropped Tuesday. AK Steel Holding Corp. declined the most almost six weeks, falling 7.7 percent, while U.S. Steel Corp. slipped 4.8 percent as of 10:47 a.m. in New York.

The president’s decision to delay the tariffs gives the White House breathing room as it weighs leaving the Iran nuclear accord this month and prepares for disarmament talks with North Korea’s Kim Jong Un.

The postponement also gives more time for another major priority for the administration: Treasury Secretary Steven Mnuchin will lead a contingent of cabinet members to China this week to try to head off a brewing trade dispute between the world’s two biggest economies.

Great Potential

Trump tweeted Tuesday that there was “great potential” for the U.S. in addressing the trade disparities with other countries.

“Delegation heading to China to begin talks on the Massive Trade Deficit that has been created with our Country,” Trump said. “Very much like North Korea, this should have been fixed years ago, not now. Same with other countries and NAFTA...but it will all get done.”

Trump has dangled a permanent exemption as incentive to reach a tentative Nafta deal with Mexico and Canada, though talks continue with no immediate agreement in sight. Canadian Prime Minister Justin Trudeau has said the U.S. understands that the tariffs could cause job losses on both sides of the border. Canada is the biggest foreign supplier of steel to the U.S., and also America’s biggest customer of the metal.

Canadian Industry

The Aluminum Association of Canada said the industry needs assurances from the U.S. over tariffs as quickly as possible to protect supply chains that have grown increasingly connected over past half century.

“As a strategic ally to the United States, nothing less than a permanent and total exemption is required as soon as possible,” the association said in a statement on Tuesday. “We need certainty in order for the integrated manufacturing supply chain -- that both countries helped build over the last 50 years -- to work well and keep North America competitive.”

The Washington-based Beer Institute, which represents the American brewing industry, repeated its criticism of the tariffs, which it say will drive up their production costs.

“The tariffs are already having an immediate and disproportionate impact on American brewers and American jobs,” the institute said in statement on Tuesday.

European officials have said the U.S. tariffs violate international trading rules, and they have threatened to retaliate with levies on iconic American brands such as Harley-Davidson motorcycles and Kentucky bourbon.

To read more about how the EU will react to U.S. tariffs, click here

The White House in March spared South Korea from the duties after Seoul accepted a quota of 70 percent of the average of its steel exported to the U.S. between 2015 and 2017. The U.S. on Monday confirmed that South Korea was granted a permanent exemption.

Trump’s embrace of trade barriers this year has sparked fears of tit-for-tat retaliation that could undermine consumer confidence and stymie the strongest global economic expansion in years.

The dispute comes as Washington seeks to stave off a separate trade conflict with China. The president has threatened to slap tariffs on as much as $150 billion in Chinese imports in retaliation for alleged violations of intellectual property, while Beijing has vowed to retaliate.

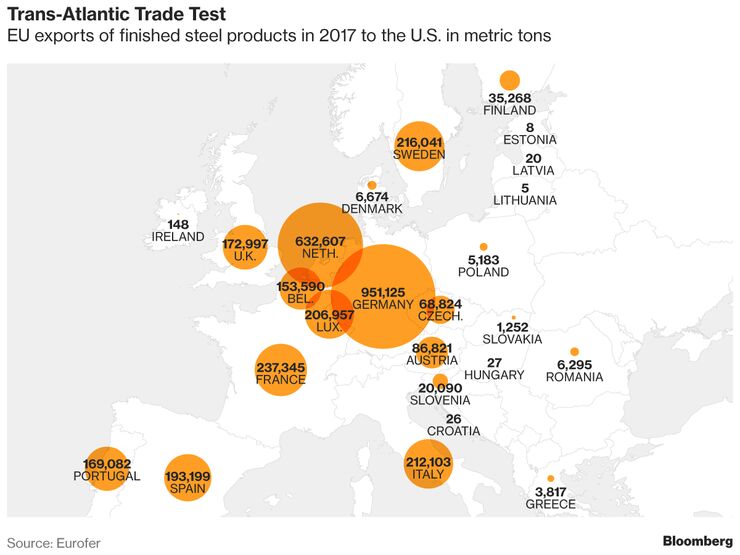

Steel and aluminum exporters from China, along with other metal-exporting nations such as Japan and India, have been paying the U.S. tariffs since late March. The U.S. and EU have complained for years that Chinese steel producers unfairly benefit from state subsidies and dump their products on the world market.

— With assistance by Justin Sink, Richard Bravo, Lyubov Pronina, Josh Wingrove, and Joe Deaux

BLOOMBERG. 1 May 2018. U.S. Factory Managers Fuming as Trump Tariffs Add to Headaches

By Sho Chandra

Very concerning. Two products eliminated. Commodity prices rising. Business planning “is at a standstill.”

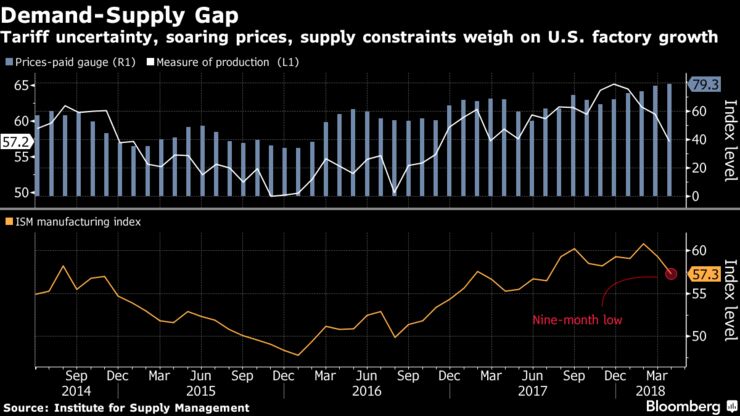

That’s what a few American manufacturers said they’re facing as the Trump administration weighs tariffs on imported metals and Chinese products, creating uncertainty for companies that by most other accounts are going gangbusters. The threats of a trade war are worsening the headaches for factories already struggling to find the workers, supplies and delivery trucks to keep up with robust demand, according to a report Tuesday by the Institute for Supply Management.

Overall, the ISM survey several showed the industry remains in a healthy, if constrained, expansion. “Business is off the charts,” according to a transportation equipment maker, while a producer in the computer and electronics sector said the “new-order rate exceeds shipment rate.”

Still, the ISM’s factory index slumped in April to a nine-month low, signaling a moderating though solid pace of expansion. A measure of order backlogs was the highest in almost 14 years, and delivery times lengthened to match the second-longest since 2010. The gauges for new orders and production weakened for a fourth straight month.

Tariff-related uncertainties may last another one or two months and will probably “work itself out,” said Timothy Fiore, chairman of the factory survey for the Tempe, Arizona-based ISM. “Overall demand remains very strong,” and manufacturers are “having trouble catching up,” he said. The shortage of qualified labor is a long-term constraint, Fiore added.

— With assistance by Katia Dmitrieva, and Jeanna Smialek

BLOOMBERG. 30 April 2018. Here's How the EU Will Punch Back Against Trump Trade Tariffs

By Bryce Baschuk

- U.S. tariffs on steel, aluminum may be imposed at midnight

- EU prepared to retaliate against core American products

President Donald Trump will decide by midnight Monday if the U.S. will slap permanent aluminum and steel tariffs on the European Union, inflaming trans-Atlantic tensions and raising the chances of a global trade conflict.

Washington imposed a 25 percent tariff on steel and 10 percent on aluminum products on March 23, saying the imports threatened national security. The EU, Australia, Argentina, Brazil, Canada, Mexico and South Korea were given temporary waivers, which are slated to expire on May 1.

The EU and U.S. are the world’s biggest economic partners, with two-way trade valued at 632 billion euros ($765 billion) for goods in 2017 and at 437 billion euros for services in 2016, according to the European Commission.

The commission, the EU’s executive arm that coordinates trade policy for the 28-nation bloc, has already prepared a three-fold retaliatory strategy if the exemption isn’t made permanent. This is how any dispute will likely play out with the EU, in this order:

Defensive Action

The EU on April 16 submitted a request to the World Trade Organization for consultations with Washington to determine whether and how the U.S. can compensate the bloc if trade flows into the EU are affected by the new tariffs. The talks are taking place under the WTO’s Safeguards Agreement, which governs the use of temporary trade restrictions that members use to protect their domestic producers from a sudden surge of imported products.

The EU has argued that the U.S. tariffs are “essentially” safeguard measures, despite the fact that Washington said its actions were to protect national security. The U.S. refused to offer the EU compensation and said the request for consultations had no basis under WTO rules.

WTO Complaint

The EU also plans to join a separate WTO dispute against the U.S., arguing that the American tariffs violate the WTO’s most-favored nation principle, which prevents countries from discriminating between their trading partners. This move could risk the stability of the multilateral trade system.

The White House, which instituted the metals levies on national-security grounds, has argued that the WTO has no authority to adjudicate such matters because WTO rules permit countries to take “any action” to protect their “essential security interests.” If the WTO supports Washington’s action then it could tempt more countries to bypass trade norms, citing security risks.

Tit-For-Tat Tariffs

The EU has said it would then introduce levies on 2.8 billion euros ($3.5 billion) of imports on iconic American goods in response to the proposed action by the White House. The bloc would be able to impose the retaliatory measures on June 21, 90 days after the U.S. levies took effect, according to an EU official with knowledge of the plans, who asked not to be identified because the discussions are private.

The EU tariffs would hit U.S. consumer, agricultural and steel products in many key Republican constituencies, putting pressure on Trump ahead of crucial midterm elections in November. Harley-Davidson Inc. and bourbon are both on the list of goods that could be hit, pressuring Republican speaker of the House of Representatives Paul Ryan, who hails from the Wisconsin home of the motorcycle maker, and Senate Majority Leader Mitch McConnell, from Kentucky, where the whiskey is made.

TTIP Lite?

U.S. Commerce Secretary Wilbur Ross has expressed interest in reviving talks on a free-trade agreement, a suggestion that has split the EU and may not be possible in the current environment. Before the tariffs were introduced, French President Emmanuel Macron said that the bloc “won’t talk about anything while there’s a gun pointed at our head.”

German Economy Minister Peter Altmaier took a more conciliatory approach over the weekend, saying steps should be taken to avoid a trade war and that the EU should put a free-trade offer on the table as a way to begin negotiations.

Ross also said last week that nations have been asked to accept import quotas in return for tariff-free access of the metals into the U.S. But that suggestion puts the EU in the difficult position of either succumbing to U.S. demands that could breach trade rules or face punitive tariffs. Forcing governments to limit shipments of goods violates WTO rules, which prohibit so-called voluntary export restraints. The demand is also contrary to the entire trade philosophy of the bloc, which is founded on the principle of the free movement of goods.

The European Commission has also tamped down hopes of revived trade discussions, saying that a dialog with the U.S. “does not represent the revival of the process for a comprehensive Trans-Atlantic Trade and Investment Partnership.” Negotiations on TTIP have been stalled ever since Trump entered the White House, decrying such multilateral trade deals.

— With assistance by Jonathan Stearns

BLOOMBERG. 30 April 2018. U.S. Extends Steel Tariffs Relief for EU and Other Allies

By Justin Sink and Andrew Mayeda

- Argentina, Australia, Brazil have reached deals in principle

- Negotiations to continue with EU, Canada, Mexico for 30 days

President Donald Trump will delay imposing steel and aluminum tariffs on the European Union, Mexico and Canada until June 1 as he finalizes deals with them, the White House said in a statement.

The administration has reached agreements-in-principle with Argentina, Australia and Brazil, according to the statement, which the White House released late Monday night. The details "will be finalized shortly," the statement added. The U.S. will also extend exemptions for the EU, Canada and Mexico for 30 days to allow for further talks.

”In all of these negotiations, the administration is focused on quotas that will restrain imports, prevent transshipment, and protect the national security,” the White House said. “These agreements underscore the Trump administration’s successful strategy to reach fair outcomes with allies to protect our national security and address global challenges to the steel and aluminum industries.”

Trump in March imposed a 25 percent tariff on steel imports and a 10 percent duty on aluminum after a government report found that foreign shipments of the metals imperil national-security interests. He directed U.S. Trade Representative Robert Lighthizer to negotiate with countries seeking to turn their temporary tariff exemptions into permanent ones. Exemptions for the EU and the five other nations were due to expire May 1.

The president’s decision to delay the tariffs gives breathing room -- but also a new deadline -- for allies who have been scrambling to secure permanent refuge from the metals duties. It could be seen as a gesture of goodwill for Canadian and Mexican negotiators who are in talks with the U.S. to revise the North American Free Trade Agreement.

Trump dangled a permanent exemption as incentive to reach a tentative Nafta deal, though talks continue with no immediate agreement in sight. Canada is the biggest steel exporter to the U.S.

European Retaliation

At the same time the extension on Monday prolongs the standoff with the EU, the world’s largest trading bloc. European officials have said the U.S. tariffs violate international trading rules, and they have threatened to retaliate with levies on iconic American brands such as Harley Davidson motorcycles and Kentucky bourbon.

“The EU should be fully and permanently exempted from these measures, as they cannot be justified on the grounds of national security,” the European Commission, the 28-nation bloc’s trade authority in Brussels, said in an emailed statement on Tuesday. “The EU has also consistently indicated its willingness to discuss current market access issues of interest to both sides, but has also made clear that, as a longstanding partner and friend of the US, we will not negotiate under threat.”

The Trump administration has been pushing countries to accept quotas on the amount of steel and aluminum they export to the U.S. The White House in March spared South Korea from the duties after Seoul accepted a quota of 70 percent of the average of its steel exports to the U.S. between 2015 and 2017. The U.S. confirmed that South Korea was granted a permanent exemption on Monday in a presidential proclamation.

Trump’s embrace of trade barriers this year has sparked fears of tit-for-tat retaliation that could undermine consumer confidence and stymie the strongest global economic expansion in years.

The U.K. government on Tuesday called the exemption extension “positive,” but added: “We remain concerned about the impact of these tariffs on global trade and will continue to work with the EU on a multilateral solution to the global problem of overcapacity, as well as to manage the impact on domestic markets.”

The German government “has taken note” of Trump’s plan to delay tariffs on aluminum and steel imports, adding that “the expectation remains for a permanent exemption,” Steffen Seibert, German Chancellor Angela Merkel’s chief spokesman, said on Twitter.

China Trip

The decision comes days before Treasury Secretary Steven Mnuchin and other senior members of Trump’s cabinet travel to China in search of a deal that would head off a brewing trade dispute between the world’s two-biggest economies.

The president has threatened to slap tariffs on as much as $150 billion in Chinese imports in retaliation for alleged violations of intellectual property, while Beijing has vowed to retaliate.

Steel and aluminum exporters from China, along with other steel-exporting nations such as Japan and India, have been paying the U.S. tariffs since late March. The U.S. and EU have complained for years that Chinese steel producers unfairly benefit from state subsidies, and dump their products on the world market.

— With assistance by Mark Niquette, Josh Wingrove, Greg Quinn, and Joe Deaux

AMAZON - INVESTMENT

PM. April 30, 2018. Amazon creates thousands of new jobs in Vancouver

Ottawa, Ontario - From shopping and banking, to planning events and getting directions, Canadians rely on online services and applications every day. They improve our quality of life, drive innovation and technological advancement, and create new opportunities for the middle class and people working hard to join it.

The Prime Minister, Justin Trudeau, today welcomed Amazon’s announcement that it will create 3,000 new jobs in Vancouver. Combined with the 1,000 new jobs announced by Amazon in November 2017, this will bring the company’s workforce in Canada to over 9,000 employees.

Canada is known for its excellent post-secondary institutions and robust high-tech sector, which produce top-tier talent in science, technology, engineering, and mathematics. Amazon’s expansion will help Canada develop and retain talented students and professionals, create good, well-paying middle class jobs, and grow our economy.

Quote

“Today’s announcement is a testament to Canada’s highly-skilled, diverse workforce and tremendous potential as an innovation and tech hub. Tech talent and investment are coming to our country in record numbers, and companies like Amazon are bringing even more energy, vision – and thousands of good jobs – to Canada. We are proud to champion these companies, who invest in our talent and the future of our economy, and create new opportunities for Canadians to succeed.

— The Rt. Hon. Justin Trudeau, Prime Minister of Canada

Quick Facts

- Amazon is an e-commerce and cloud computing company offering a range of products and services through its online properties. The company currently employs over 4,100 people in Canada, with offices in Vancouver, Toronto, and Ottawa. It also operates six automated centres in other locations across the country.

- The 3,000 new jobs will be in fields including e-commerce technology, cloud computing, and machine learning.

- Amazon will expand into a brand new location in QuadReal’s The Post redevelopment when the project opens in 2022. Amazon’s future 416,000 square foot Development Centre will sit above the former central Canada Post building, a city landmark.

- Amazon is considering Toronto as a location for its second headquarters.

- Prime Minister Trudeau met with Amazon Chief Executive Officer Jeff Bezos on several occasions, including during his visit to San Francisco in February 2018, where he promoted Canada’s diverse and skilled workforce.

- The Government of Canada’s Innovation and Skills Plan, launched in Budget 2017, has introduced policies and programs to create high-quality jobs for Canadians and make Canada a global centre for innovation.

- Last year, Canada launched a $125 million Pan-Canadian Artificial Intelligence Strategy to retain and attract top academic talent, and to increase the number of post-graduate trainees and researchers studying artificial intelligence and deep learning.

- The Government of Canada recently launched Invest in Canada, a new federal organization dedicated to attracting job-creating investment and simplifying the process for global businesses looking to make Canada their new home.

Amazon announces plans to open new office in Vancouver and create 1,000 jobs

Amazon.ca. Nov 03, 2017. New office will open in 2020 and will enable Amazon to double its workforce in Vancouver. Across Canada, Amazon now has over 5,000 full-time, full-benefit employees

SEATTLE, Nov. 3, 2017 /CNW/ - Amazon (NASDAQ: AMZN) today announced that the company has signed a lease for a new office in downtown Vancouver. The office will allow Amazon to double its workforce in the city from 1,000 to 2,000. The office, with Oxford Properties, is scheduled to open in 2020 and will be Amazon's second in Vancouver.

Amazon also announced that its current Canadian workforce has grown to over 5,000 full-time, full-benefit employees across Canada, spanning sites in British Columbia, Ontario and Quebec.

"Amazon is excited to continue growing our workforce throughout Canada," said Alexandre Gagnon, Vice President of Amazon Canada and Mexico. "We are among the largest employers of software engineers in Canada and look forward to continuing to create new job opportunities for Canadians."

In addition to its office in Vancouver, Amazon employs over 500 British Columbians at its fulfillment centres in Delta and New Westminster, BC, and also operates subsidiary Abebooks.com, based in Victoria, BC. Interested candidates can find available openings by field or location at Amazon.jobs.

Navdeep Bains, Canadian Minister of Innovation, Science and Economic Development said, "One of our government's top priorities is job creation for a strong and robust middle class in Canada. This exciting growth announcement by Amazon is proof that our plan is working. Global companies like Amazon see Canada as a strong place to invest because of our talented workforce and focus on innovation – that's translating into more jobs for people in Vancouver. Congratulations to Amazon on your continued success – you have a committed partner in Canada."

"I'm pleased Amazon is increasing their presence in Vancouver, creating good jobs and helping us build a strong, sustainable economy that works for everyone," said Premier John Horgan. "We will build on Amazon's plans to bring new jobs to B.C. by continuing to open up access to education and skills training, so British Columbians are ready to fill these high-paying jobs."

"Vancouver's innovation economy is booming and it's exciting to have Amazon expand here, adding valuable job space for 1,000 more employees," says Mayor Gregor Robertson. "Vancouver's leading the way with the fastest growing, most resilient and greenest economy in Canada, and companies from all over the world, like Amazon, are moving to Vancouver with well-paying jobs to be a part of our success."

There are also tens of thousands of Canadian small businesses and entrepreneurs selling on Amazon.ca, and they achieved a record-setting one billion in sales in 2016. "The growth we've seen from selling on Amazon has helped us add 12 full and part-time jobs in Vancouver with plans for another 12 in the next 18 months," said Kevin Pasco, Co-Founder, CMO of Nested Naturals. "Our best-selling natural sleep aids and greens powders were proudly launched on Amazon.com and continue to serve thousands of happy customers daily."

Amazon provides employees with highly-competitive pay, benefits, a group RRSP plan, and company stock. With more than 500,000 employees worldwide, Amazon ranks #1 on Fast Company's Most Innovative Companies, #2 on Fortune's World's Most Admired Companies, and #1 on The Harris Poll's Corporate Reputation survey. Amazon was also recently included in the Military Times' Best for Vets list of companies committed to providing opportunities for military veterans.

Government of Canada launches Invest in Canada to attract global investment and create jobs

Global Affairs Canada. March 12, 2018. Government of Canada launches Invest in Canada to attract global investment and create jobs

Ottawa, Ontario - Foreign investment offers far-reaching economic benefits for the middle class and everyone working hard to join it. It creates jobs in Canada for Canadians, expands trade, boosts productivity, provides access to new technologies, encourages innovation, and links Canadian firms to global supply chains.

Canada is stepping up its efforts to attract and increase foreign direct investments (FDI) to Canada.

Today, the Honourable François-Philippe Champagne, Minister of International Trade, launched Invest in Canada, a new federal organization dedicated to attracting global investment and simplifying the process for global businesses to make Canada their new home, creating jobs that come with their investments.

As part of its launch, Minister Champagne introduced Mitch Garber as its inaugural chairperson of the board and Ian McKay as its inaugural chief executive officer (CEO).

Under the leadership of a CEO and an independent board of directors, Invest in Canada will promote FDI into Canada and bring together all levels of government and private sector partners to provide seamless, single-window service to global investors.

Invest in Canada will promote Canada to global investors and entrepreneurs as a diverse and open place to do business that inspires creativity and offers stability, predictability and clarity. Invest in Canada will position Canada for success today and in the long term.

The appointments were made following open, transparent and merit-based selection processes developed to attract high-quality candidates, while reflecting gender parity and Canada’s diversity in Governor-in-Council appointments.

Quotes

“Canada is a great place to do business, and a strong FDI attraction strategy can strengthen economic growth, create middle-class jobs and lead to a higher standard of living for Canadians. I am confident that Mr. Garber and Mr. McKay have the experience and leadership to guide Invest in Canada’s development and success and to position Canada as the top investment destination.”

- François-Philippe Champagne, Minister of International Trade

“As a long-time entrepreneur, I understand the challenges that companies can face when trying to set up or expand their businesses in a new country. I am excited to be part of developing this organization and making sure that Canada is at the forefront of the innovation and prosperity that comes with global investment in our country.”

- Mitch Garber, Chairperson of Invest in Canada

“Canada has a lot to offer international businesses, which can, in turn, create jobs that are important to Canadians. As the CEO of this new organization, I look forward to building the partnerships and team that will make it easier for international companies to choose Canada as the place to invest and grow their businesses.”

- Ian McKay, CEO of Invest in Canada

Quick facts

- The Government of Canada announced funding of $218 million to create Invest in Canada and enhance the Canadian Trade Commissioner Service in the 2016 Fall Economic Statement.

- Approximately 1.9 million Canadians are employed by foreign-controlled multinational enterprises in Canada; that’s almost 12% of Canadian workers, or 1 in 8 Canadian jobs.

- The organization will work with global companies to attract FDI in sectors aligned with the government’s economic growth strategy, in particular in advanced manufacturing, agri-food, clean technology, digital technology, health sciences and bio-sciences, and clean resources.

- Most, if not all, G20 countries currently have similar organizations, which have become vital instruments in attracting foreign investment in a very competitive landscape.

- Foreign investment in Canada currently stands at approximately $800 billion.

BLOOMBERG. 1 May 2018. ‘Amazon Effect’ May Push Vancouver Housing Prices Even Higher

By Natalie Obiko Pearson

- Company plans to increase local workforce five-fold by 2022

- Seattle rental prices, home values soared amid Amazon boom

A spate of government policies have tried to temper Vancouver’s housing prices, to little avail. Now Amazon.com Inc. may give Canada’s costliest market another boost.

The Seattle-based company plans to increase its Vancouver workforce five-fold to 5,000 by 2022 - mostly high-tech positions, said Jesse Dougherty, Amazon’s general manager of web services. Dougherty spoke Monday in the bunker-like former Canada Post mailing center that’s set to be re-developed to host Amazon’s new 416,000-square-foot office.

“It’s no joke for any metro when Amazon comes in, especially in a mid-market city," says Aaron Terrazas, senior economist at real estate portal Zillow Group Inc., which calculates Seattle rental prices increased by 50 percent and home values nearly doubled since Amazon’s start as a bookseller in the mid-1990s.

Seattle was a city of about 3 million people -- roughly on par with the population of Greater Vancouver -- before Amazon’s workforce exploded from about 5,000 workers in 2010 to about 40,000 today, helping turn it into one of the fastest-growing U.S. cities, said Terrazas.

“It’s the Amazon effect," he said. “Amazon attracts other companies that also want that talent so they build, have offices next door or adjacent to it - supply becomes a challenge."

Today, so-called Amazonians occupy more office space in Seattle than the next 40 largest employers in the city combined, according to a study by real-estate data firm CoStar for the Seattle Times last year. Rent increases in neighborhoods that experienced the biggest influx of those workers have risen 65 percent faster over the past five years than areas with the smallest influx, according to Zillow.

Anything similar in Vancouver could create additional pressure in an already strained market. Vancouver’s supply of available rentals has remained below 1 percent for three years in a row. The price of a benchmark home has risen 91 percent in a decade. Government attempts to ease prices -- including a 20 percent provincial tax on foreign buyers, a city tax on empty homes, as well as stricter federal mortgage rules -- have made little difference: prices are up 16 percent in the past year.

GDP

StatCan. 2018-05-01. Gross domestic product by industry, February 2018

- Real GDP by industry, February 2018, 0.4% increase (monthly change)

- Source(s): CANSIM table 379-0031: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3790031&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

After a slight decline in January, real gross domestic product rose 0.4% in February, as 15 of 20 industrial sectors increased. The growth was led by a rebound in the mining and oil and gas extraction sector.

Chart 1: Real gross domestic product grows in February

The output of goods-producing industries grew 1.2% as manufacturing and construction rose in addition to the rebound in mining and oil and gas extraction.

Services-producing industries edged up 0.1% as increases in most sectors more than offset declines in wholesale trade and in the real estate and rental and leasing sector.

Mining, quarrying and oil and gas extraction leads the growth

The mining, quarrying and oil and gas extraction sector expanded 2.4% in February.

Chart 2: Mining, quarrying, and oil and gas extraction grows in February

Conventional oil and gas extraction rose 2.9% from increased crude petroleum and natural gas extraction. Non-conventional oil extraction was up 3.0%, offsetting some of January's decline, as production began returning to normal levels as some facilities experienced a number of issues affecting their capacity in January.

Mining excluding oil and gas grew 1.9% following four months of decline. Non-metallic mineral mining rose 6.3%, mainly as a result of increased potash production to supply export markets outside North America. Metal ore mining declined (-0.9%) for the fourth month in a row, as growth in iron ore (+8.2%) and gold and silver ore (+1.4%) mining was more than offset by a sixth consecutive decline in copper, nickel, lead and zinc mining (-6.2%) and lower other metal ore mining (-3.9%).

Support activities for mining and oil and gas extraction declined 0.9% as a result of lower rigging services in February.

Mining, quarrying, and oil and gas extraction grows in February

Chart 2: Mining, quarrying, and oil and gas extraction grows in February

Manufacturing up from durables

The manufacturing sector rose 1.0% in February as durable manufacturing was up 1.8%, while non-durable manufacturing was essentially unchanged.

Durable manufacturing (+1.8%) was up for the third time in four months on broad-based growth as 8 of 10 subsectors grew. Transportation equipment led the growth, expanding 2.7%, as motor vehicle (+4.2%) and motor vehicle parts (+3.4%) manufacturing began returning to normal production following atypical plant shutdowns in January. Aerospace product and parts manufacturing rose 1.2% as exports of aircrafts contributed to growth. Fabricated metal products manufacturing grew 4.4% as the majority of industry groups expanded.

Non-durable manufacturing was essentially unchanged in February. Chemical manufacturing was down 1.6% as there were unscheduled plant shutdowns stretching from late January until mid-February. This decline was offset by increases in other subsectors, led by paper manufacturing (+1.9%) and petroleum and coal products (+0.8%), which rose for the first time following three consecutive monthly declines.

Construction grows

The construction sector was up 0.7% as activity in the majority of subsectors increased. Residential construction grew 1.3% from increases in row, apartment-type dwellings, and home alterations and improvements. Non-residential construction expanded 0.6% as industrial, public and commercial construction increased. Repair construction rose 1.6%, while engineering and other construction activities declined 0.2%.

Finance and insurance up

The finance and insurance sector rose 0.4% in February. Financial investment services, funds and other financial vehicles were up 2.0% from increased activity in bond and foreign securities markets. Depository credit intermediation and monetary authorities grew 0.2%, while insurance carriers and related activities edged up 0.1%.

Most subsectors in transportation and warehousing show gains

Transportation and warehousing rose 0.5% in February as five of nine subsectors increased. Support activities for transportation (+1.5%), truck transportation (+1.0%) and air transportation (+0.9%) led the growth.

Pipeline transportation decreased 1.0%. Crude oil and other pipeline transportation increased 0.2%, as exports to the United States increased while domestic deliveries declined. Pipeline transportation of natural gas decreased 2.2% as exports and imports of natural gas declined.

Rail transportation edged down 0.1% after a 3.4% decline in January, as lower carloadings of grains and fertilizers were mainly offset by increased rail movement of other goods such as minerals and manufactured goods.

First back-to-back declines in the real estate and rental and leasing sector since the summer of 2010

Following a 0.5% decline in January, real estate and rental and leasing was down 0.2% in February, the first back-to-back declines since the summer of 2010. The output of offices of real estate agents and brokers fell 7.9% in February after a 12.9% drop in January. Home resale activity declined in the majority of Canadian markets in the aftermath of the implementation of new mortgage lending rules in January 2018, including stress-testing for uninsured mortgages.

Wholesale trade declines while retail trade grows

Wholesale trade declined 0.5% in February, continuing its sequence of offsetting increases and decreases since November 2017. Seven of nine subsectors declined. Contributing most to the decline were miscellaneous wholesaling (-2.2%) on account of lower agricultural supplies wholesaling, and wholesalers of farm products (-4.9%) as a result of lower exports of wheat, canola, and other farming and intermediate food products. Motor vehicle and parts wholesaling (-2.3%) declined for the third consecutive month.

The retail trade sector grew 0.3% in February after three consecutive monthly declines. Increases in building material and garden equipment and supplies (+3.1%), general merchandise stores (+2.6%), motor vehicle and parts dealers (+0.7%) and health and personal care stores (+0.2%) more than offset declines in other subsectors.

Other industries

Professional, scientific and technical services were up 0.6% in February, the third increase in four months, with gains in most industry groups.

The public sector edged up 0.1%, with all three components (education, health care and public administration) showing increases.

Information and cultural industries rose 0.4%, partly as a result of increased advertising revenue earned by the radio and television broadcasting industry largely related to the airing of the 2018 Winter Olympics.

Agriculture, forestry, fishing and hunting increased 0.5%.

Accommodation and food services was unchanged as growth of 0.2% in food services and drinking places was offset by a 0.6% decline in accommodation services.

Utilities declined 0.9%. Electric power generation, transmission and distribution decreased 1.2%, as an unseasonably warm February in Central and Eastern Canada lowered demand for heating. Natural gas distribution rose 0.9% on higher demand across all classes of customers.

Chart 3: Main industrial sectors' contribution to the percent change in gross domestic product in February

Table 379-0031 1, 3

Gross domestic product (GDP) at basic prices, by North American Industry Classification System (NAICS)

monthly (dollars x 1,000,000)

Data table

The data below is a part of CANSIM table 379-0031. Use the Add/Remove data tab to customize your table.

Selected items [Add/Remove data]

Geography = Canada

Seasonal adjustment = Seasonally adjusted at annual rates

Prices = Chained (2007) dollars

Seasonal adjustment = Seasonally adjusted at annual rates

Prices = Chained (2007) dollars

| North American Industry Classification System (NAICS) | 2017 | 2018 | |||

|---|---|---|---|---|---|

| October | November | December | January | February | |

| footnotes | |||||

| All industries [T001] 2 | 1,752,621 | 1,759,451 | 1,762,937 | 1,760,330 | 1,767,926 |

| Goods-producing industries [T002] 2 | 522,276 | 527,000 | 527,849 | 525,269 | 531,381 |

| Service-producing industries [T003] 2 | 1,231,277 | 1,233,453 | 1,236,059 | 1,235,971 | 1,237,615 |

| Business sector industries [T004] | 1,460,300 | 1,466,681 | 1,469,366 | 1,466,367 | 1,473,741 |

| Non-business sector industries [T007] | 293,792 | 294,300 | 295,053 | 295,379 | 295,759 |

| Industrial production [T010] 2 | 374,595 | 378,673 | 379,949 | 376,528 | 381,661 |

| Non-durable manufacturing industries [T011] 2 | 77,090 | 77,948 | 77,319 | 78,045 | 78,027 |

| Durable manufacturing industries [T012] 2 | 102,971 | 105,487 | 105,175 | 105,352 | 107,279 |

| Information and communication technology sector [T013] 2 | 77,380 | 78,342 | 78,785 | 79,342 | 79,839 |

| Energy sector [T016] 2 | 172,218 | 172,127 | 174,494 | 170,775 | 173,509 |

| Industrial production (1950 definition) [T017] 2 | 368,868 | 372,977 | 374,234 | 370,783 | 375,854 |

| Public Sector [T018] 2 | 315,123 | 315,791 | 316,710 | 317,204 | 317,674 |

| Content and media sector [T019] 2 | 12,514 | 12,528 | 12,475 | 12,306 | 12,437 |

| Agriculture, forestry, fishing and hunting [11] | 27,797 | 27,721 | 27,797 | 27,632 | 27,771 |

| Mining, quarrying, and oil and gas extraction [21] | 149,440 | 150,070 | 152,010 | 147,638 | 151,249 |

| Utilities [22] | 39,531 | 39,737 | 40,002 | 40,013 | 39,670 |

| Construction [23] | 124,993 | 125,708 | 125,261 | 126,195 | 127,127 |

| Manufacturing [31-33] | 179,996 | 183,289 | 182,319 | 183,267 | 185,063 |

| Wholesale trade [41] | 104,462 | 104,563 | 104,392 | 104,945 | 104,415 |

| Retail trade [44-45] | 98,271 | 97,694 | 96,581 | 96,368 | 96,679 |

| Transportation and warehousing [48-49] | 78,983 | 79,173 | 79,553 | 79,580 | 80,011 |

| Information and cultural industries [51] | 52,694 | 52,756 | 52,743 | 52,558 | 52,744 |

| Finance and insurance [52] | 122,617 | 122,958 | 123,687 | 124,070 | 124,592 |

| Real estate and rental and leasing [53] | 226,991 | 227,621 | 228,768 | 227,576 | 227,122 |

| Professional, scientific and technical services [54] | 96,690 | 97,220 | 97,781 | 97,617 | 98,188 |

| Management of companies and enterprises [55] | 10,844 | 10,821 | 10,868 | 10,821 | 10,848 |

| Administrative and support, waste management and remediation services [56] | 42,934 | 42,857 | 42,791 | 43,026 | 43,049 |

| Educational services [61] | 90,187 | 90,407 | 90,933 | 91,145 | 91,247 |

| Health care and social assistance [62] | 115,484 | 115,736 | 116,140 | 116,507 | 116,696 |

| Arts, entertainment and recreation [71] | 13,308 | 13,457 | 13,598 | 13,517 | 13,706 |

| Accommodation and food services [72] | 37,979 | 38,010 | 37,970 | 38,043 | 38,025 |

| Other services (except public administration) [81] | 33,024 | 33,111 | 33,087 | 33,090 | 32,952 |

| Public administration [91] | 109,504 | 109,702 | 109,712 | 109,635 | 109,811 |

Footnotes:

Aggregates are not always equal to the sum of their components.

The alphanumeric code appearing in square brackets beside the industry title represents the identification code of an aggregation of NAICS industries, whose definition is included in the full classification provided in the definitions, data sources and methods for the statistical program 1301 - Gross domestic product by Industry - National (Monthly).

At the lowest level of detail, it may not be possible to produce a homogeneous series from 1997 to the present. Only industries and certain aggregates that provide good continuity back to 1997 have data from 1997 to 2006.

Source: Statistics Canada. Table 379-0031 - Gross domestic product (GDP) at basic prices, by North American Industry Classification System (NAICS), monthly (dollars), CANSIM (database). (accessed: )

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180501/dq180501a-eng.pdf

THE GLOBE AND MAIL. MAY 1, 2018. Canada’s economy rebounds on broad gains; economists eye July rate hike

DAVID PARKINSON, ECONOMICS REPORTER

Canada’s economy surged in February, making up for a lacklustre start of the year, in a widespread upturn led by rebounds in the energy and auto sectors.

Statistics Canada reported that real gross domestic product rose 0.4 per cent month over month, the strongest one-month growth since last spring, reversing course after a decline of 0.1 per cent in January.

Economists had expected the economy to rebound from January’s weakness, as both oil sands and auto plants came back up to speed from maintenance shutdowns. But the February growth was a bit stronger than economists’ 0.3-per-cent estimate. And growth was broadly based, with 15 of 20 industry sectors posting gains.

“The Canadian economy bounced back nicely after a difficult January,” said National Bank of Canada senior economist Krishen Rangasamy in a research report. “The breadth of increases is encouraging.”

The goods-producing side of the economy was responsible for much of February’s growth, up 1.2 per cent month over month. Services-producing industries posted 0.1-per-cent growth.

The goods growth was led by oil and gas extraction, which jumped 3 per cent, as oil sands producers recovered from a series of January production interruptions. Motor vehicle manufacturing jumped 4.2 per cent and parts output was up 3.4 per cent, as auto plants also returned from usual January downtime.

Overall, manufacturing was up 1 per cent month over month. The construction sector also had a solid month, up 0.7 per cent.