CANADA ECONOMICS

ISRAEL - USA - CANADA

U.S. Department of State. December 6, 2017. President Trump's Decision to Recognize Jerusalem as Israel's Capital. Statement. Rex W. Tillerson, Secretary of State

Washington, DC - President Trump‘s decision to recognize Jerusalem as Israel’s capital aligns U.S. presence with the reality that Jerusalem is home to Israel’s legislature, Supreme Court, President’s office, and Prime Minister‘s office.

We have consulted with many friends, partners, and allies in advance of the President making his decision. We firmly believe there is an opportunity for a lasting peace.

As the President said in his remarks today, “Peace is never beyond the grasp of those willing to reach it.”

The President decided today, as Congress first urged in the Jerusalem Embassy Act in 1995, and has reaffirmed regularly since, to recognize Jerusalem as the capital of Israel.

The State Department will immediately begin the process to implement this decision by starting the preparations to move the U.S. Embassy from Tel Aviv to Jerusalem.

The safety of Americans is the State Department’s highest priority, and in concert with other federal agencies, we’ve implemented robust security plans to protect the safety of Americans in affected regions.

Global Affairs Canada. December 6, 2017. Statement by Minister of Foreign Affairs on the status of Jerusalem

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement:

‘‘Canada is a steadfast ally and friend of Israel and friend to the Palestinian people. Canada’s longstanding position is that the status of Jerusalem can be resolved only as part of a general settlement of the Palestinian-Israeli dispute.

‘‘We are strongly committed to the goal of a comprehensive, just and lasting peace in the Middle East, including the creation of a Palestinian state living side-by-side in peace and security with Israel. We call for calm and continue to support the building of conditions necessary for the parties to find a solution.’’

INTEREST RATE

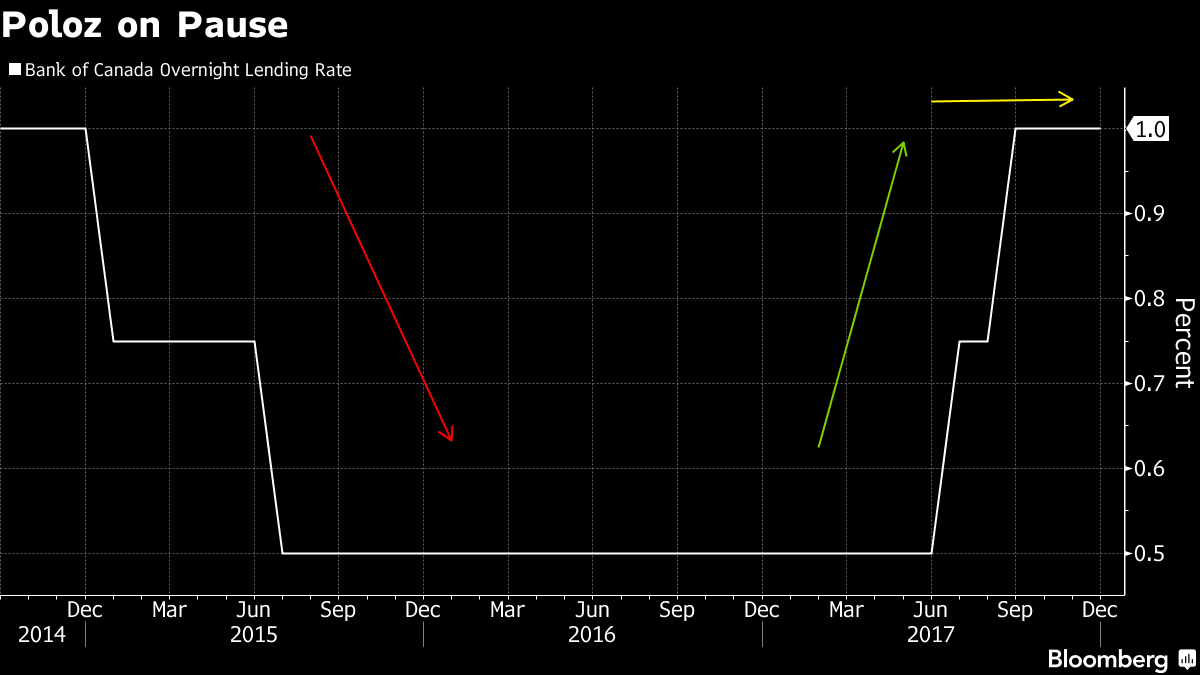

December 6, 2017. BANK OF CANADA. Bank of Canada maintains overnight rate target at 1 per cent

Ottawa, Ontario - The Bank of Canada today maintained its target for the overnight rate at 1 per cent. The Bank Rate is correspondingly 1 1/4 per cent and the deposit rate is 3/4 per cent.

The global economy is evolving largely as expected in the Bank’s October Monetary Policy Report (MPR). In the United States, growth in the third quarter was stronger than forecast but is still expected to moderate in the months ahead. Growth has firmed in other advanced economies. Meanwhile, oil prices have moved higher and financial conditions have eased. The global outlook remains subject to considerable uncertainty, notably about geopolitical developments and trade policies.

Recent Canadian data are in line with October’s outlook, which was for growth to moderate while remaining above potential in the second half of 2017. Employment growth has been very strong and wages have shown some improvement, supporting robust consumer spending in the third quarter. Business investment continued to contribute to growth after a strong first half, and public infrastructure spending is becoming more evident in the data. Following exceptionally strong growth earlier in 2017, exports declined by more than was expected in the third quarter. However, the latest trade data support the MPR projection that export growth will resume as foreign demand strengthens. Housing has continued to moderate, as expected.

Inflation has been slightly higher than anticipated and will continue to be boosted in the short term by temporary factors, particularly gasoline prices. Measures of core inflation have edged up in recent months, reflecting the continued absorption of economic slack. Revisions to past quarterly national accounts have resulted in a higher level of GDP. However, this is unlikely to have significant implications for the output gap because the revisions also imply a higher level of potential output. Meanwhile, despite rising employment and participation rates, other indicators point to ongoing – albeit diminishing – slack in the labour market.

Based on the outlook for inflation and the evolution of the risks and uncertainties identified in October’s MPR, Governing Council judges that the current stance of monetary policy remains appropriate. While higher interest rates will likely be required over time, Governing Council will continue to be cautious, guided by incoming data in assessing the economy’s sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/12/fad-press-release-2017-12-06.pdf

THE GLOBE AND MAIL. DECEMBER 6, 2017. ECONOMY. Bank of Canada keeps rate options open with cautious tone

BARRIE MCKENNA, Columnist

OTTAWA - The Bank of Canada remains in cautious mode about its next interest rate hike, even as the key pieces of a healthy recovery are falling into place.

Governor Stephen Poloz and his central bank colleagues kept the benchmark overnight rate unchanged at 1 per cent Wednesday in its final rate decision of 2017.

Canada's central bank has already hiked interest rates twice this year – in July and September – as it tries to gradually return rates to more normal levels.

"While higher interest rates will be required over time, [the bank] will continue to be cautious, guided by incoming data in assessing the economy's sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation," the bank said in a statement accompanying its rate decision. That sentence repeats nearly word-for-word the language of its statement in October, when the bank also left rates unchanged.

Mr. Poloz is choosing to keep his options open even though most of the economic conditions are now in place for a resumption of rate hikes, Toronto-Dominion Bank economist Brian DePratto said in a research note.

"Despite things seeming to line up for further near-term tightening, Governor Poloz has chosen to maintain his optionality," Mr. DePratto said. "Things continue to point to a hike sooner rather than later. However, as [Wednesday's] statement shows, nothing is a done deal until the day of the decision."

Royal Bank of Canada, however, expects the central bank to remain in a holding pattern on rates until next April.

"That will give them some time to evaluate the impact of this summer's two rate hikes," RBC economist Josh Nye said. "They'll also, hopefully, have a better idea of how one of the most significant risks facing the economy, the NAFTA renegotiation, is evolving."

The bank also repeated a warning that the global outlook is clouded by "considerable uncertainty, notably about geopolitical developments and trade policies." The possible failure of talks with the United States to renegotiate the North American free trade agreement has put a chill on business investment in Canada, particularly in the manufacturing sector.

The rest of the bank's latest statement is mainly about how the economy is pivoting towards more sustainable growth. The bank pointed out that GDP growth will remain "above potential" in the second half of this year, job gains are "very strong," wages are improving, consumer spending is "robust," government infrastructure spending is becoming "more apparent," and export growth is picking up again.

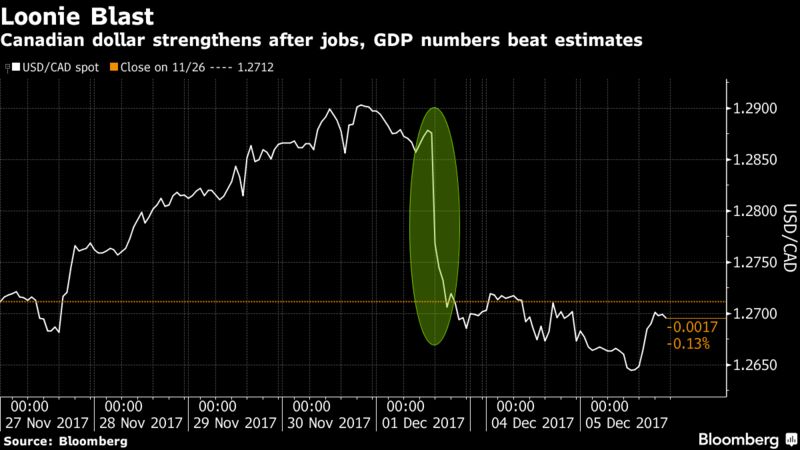

The Canadian dollar gave up early gains in the wake of the statement, falling more than half a cent from morning highs to trade around 78.35 cents (U.S.).

Even inflation, which has remained stubbornly below the bank's 2-per-cent target for years, is showing signs of life amid "diminishing" labour market slack, according to statement.

"Inflation has been slightly higher than anticipated and will continue to be boosted in the short term by temporary factors, particularly gasoline prices," the bank said.

One outlier in the otherwise bullish outlook is the slowing housing market. But a cool down of the hottest housing markets in Toronto and Vancouver is exactly what the central bank wants in the face of record household debt. Canadians owe $1.68 for every dollar of disposable income.

Many economists expect the Bank of Canada to resume hiking interest rates in 2018, possibly as early as its next slated rate announcement on Jan. 17. The bank is also slated to release its first quarterly set of forecasts at that time.

The Canadian economy grew at an annual pace of 1.7 per cent in the third quarter, dramatically slower than in the first half of the year. Most other economic indicators, including job gains and exports have improved.

The bank's take on the global economy is also relatively upbeat. The bank said growth is strengthening in other developed countries, oil prices have moved up and financial conditions are improving.

REUTERS. DECEMBER 6, 2017. Bank of Canada holds rates steady, points to strength

Andrea Hopkins, Leah Schnurr

OTTAWA (Reuters) - The Bank of Canada held interest rates steady on Wednesday, as expected, and reiterated its pledge to be cautious, but said more rate hikes will be required over time amid diminishing slack in the labor market and signs of inflation pressures.

Pointing to “very strong” employment growth, improving wages and robust consumer spending, the central bank left the official overnight rate at 1 percent but said it will likely add to its July and September rate hikes.

“While higher interest rates will likely be required over time, Governing Council will continue to be cautious, guided by incoming data in assessing the economy’s sensitivity to interest rates, the evolution of economic capacity, and the dynamics of both wage growth and inflation,” the bank said.

The central bank said recent Canadian data are in line with its October outlook, though it noted inflation has been slightly higher than anticipated and will continue to be boosted in the short term by temporary factors, particularly gas prices. Measures of core inflation have edged up in recent months, reflecting the continued absorption of economic slack, it said.

“Meanwhile, despite rising employment and participation rates, other indicators point to ongoing - albeit diminishing - slack in the labor market,” the bank said.

Analysts widely expect the bank to resume policy tightening in 2018, possibly as early as January, but uncertainty about the future of the North American Free Trade Agreement (NAFTA) has weighed on the outlook.

The bank said that while revisions to quarterly national accounts data have boosted GDP, this is unlikely to have significant implications for the output gap because the revisions also imply a higher level of potential output.

It noted that business investment continued to contribute to growth after a strong first half to 2017, and said public infrastructure spending is becoming more evident in the data.

While exports declined more than was expected in the third quarter, the bank said the latest trade data support its projection that export growth will resume as foreign demand strengthens. U.S. growth in the third quarter was stronger than forecast but is expected to moderate in the months ahead.

In its sole nod to Canada’s precarious housing market, the bank said “Housing has continued to moderate, as expected,” and made no mention of recent record levels of household debt and looming mortgage rule changes, a focus of the bank’s November Financial System Review.

Reporting by Andrea Hopkins; Editing by Frances Kerry

BLOOMBERG. 6 December 2017. Bank of Canada Reiterates Caution in Holding Rates Steady

By Theophilos Argitis

- Central bank leaves benchmark interest rate at 1 percent

- Sees ongoing slack in labor market, makes no mention of dollar

The Bank of Canada kept borrowing costs on hold at its last interest rate decision of 2017 and reiterated it will be “cautious” with future moves, indicating it’s in no rush to cool an economy that is very close to capacity.

Policy makers led by Governor Stephen Poloz left the benchmark overnight rate at 1 percent Wednesday for a second straight rate decision, as the market expected. The current pause comes after consecutive hikes in July and September.

Even as it acknowledges borrowing costs will eventually need to rise, the Bank of Canada is handling the normalization of rates very carefully, wary of inadvertently triggering another downturn. One argument, repeated Wednesday, is that geopolitical uncertainties remain around U.S. trade policies.

“While higher interest rates will likely be required over time, Governing Council will continue to be cautious,” the Ottawa-based central bank said in its statement. “The current stance of monetary policy remains appropriate.”

The Canadian dollar dropped after the statement, down 0.4 percent at 10:10 a.m. in Toronto trading.

“It was always going to be a wait and see decision, but today’s Bank of Canada statement also didn’t offer a clarion call on just how long they will be waiting and seeing before raising rates again,” Avery Shenfeld, chief economist at CIBC Capital Markets, said in a note to investors.

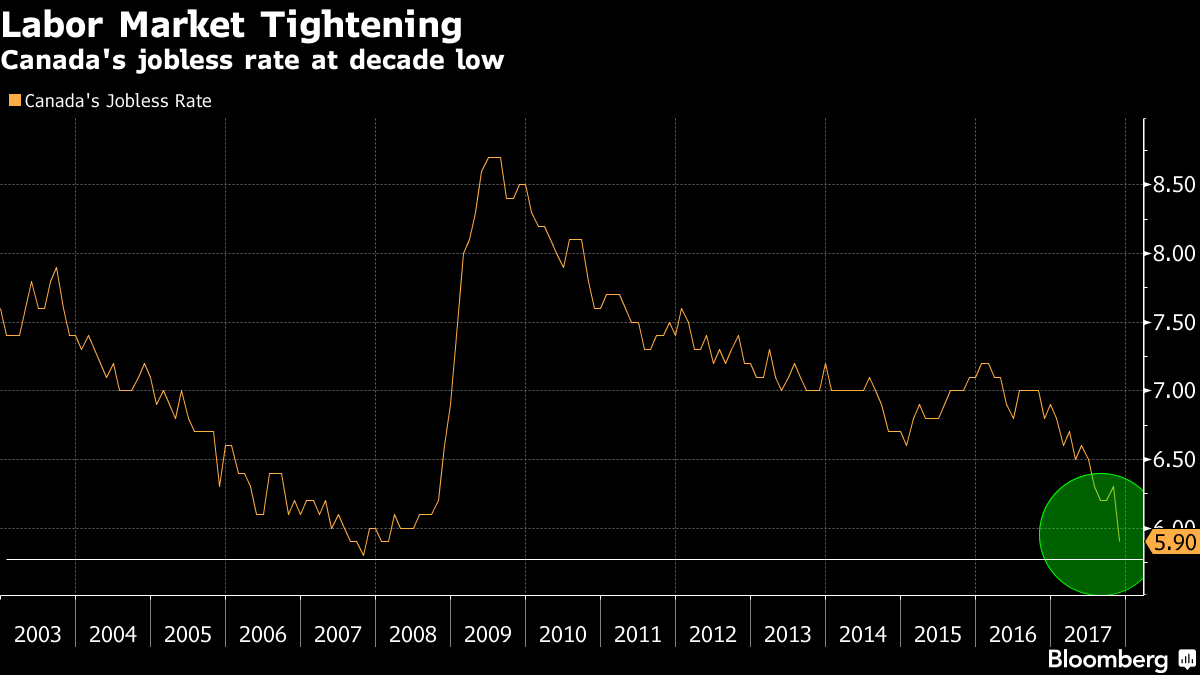

Higher rates will eventually be needed to account for an economy that’s been one of the strongest in the developed world with a jobs market on a tear. Even with an anticipated second-half slowdown, Canada is headed for 3 percent growth this year. Its unemployment rate, meanwhile, has fallen to the lowest in a decade.

By the central bank’s own measure, interest rates are still a full 2 percentage points below what it would consider “neutral.” Before Wednesday’s decision, investors were anticipating as many as three more hikes by the end of 2018, with the first likely in March.

Labor Slack

In its statement, the Bank of Canada gave a nod to the nation’s employment strength and recent wage gains. But it stuck to its assessment that excess labor capacity remains. “Despite rising employment and participation rates, other indicators point to ongoing -- albeit diminishing -- slack in the labor market,” policy makers said.

The central bank cited buoyant global growth, higher oil prices and eased financial conditions, but cautioned the “global outlook remains subject to considerable uncertainty, notably about geopolitical developments and trade policies.”

It also said recent Canadian economic data are in line with its October projections, which “was for growth to moderate while remaining above potential in the second half of 2017.”

GDP Revisions, Loonie

The central bank, meanwhile, downplayed recent revisions to gross domestic product that suggest historical output was higher than initially estimated, saying the new data may not necessarily imply tighter capacity conditions.

“Revisions to past quarterly national accounts have resulted in a higher level of GDP,” it said. “However, this is unlikely to have significant implications for the output gap because the revisions also imply a higher level of potential output.”

One change in the statement was the removal of any reference to the Canadian dollar. In October, the dollar’s appreciation earlier this year was cited as a factor for slower exports. The loonie has, however, slumped since September.

One argument against rate increases has been weak inflation, which has undershot the central bank’s 2 percent target for years. Policy makers acknowledged a pick-up in core inflation measures that reflects “the continued absorption of economic slack”, while higher-than-anticipated headline inflation has been boosted in the “short-term by temporary factors, particularly gasoline prices.”

— With assistance by Erik Hertzberg

BLOOMBERG. 6 December 2017. Canada’s Strong Economic Data Unlikely to Shake Poloz Pause

By Maciej Onoszko and Alexandria Arnold

- Short-term rates, loonie may retreat on Bank of Canada caution

- Central bank expected to keep rates on hold on Wednesday

Investors in Canadian assets may be wise to look through the stronger-than-expected economic data last week because they probably won’t alter the Bank of Canada’s wait-and-see approach to monetary policy.

The loonie jumped the most in three months and short-term rates spiked on Friday after Canada posted the biggest monthly increase in jobs since 2012 and the economy grew faster than expected in the third quarter.

The reports are unlikely to derail Bank of Canada Governor Stephen Poloz’s cautious stance, with growth expected to slow in 2018 and stretched households are vulnerable to a jump in borrowing costs. All but three of 26 economists surveyed by Bloomberg expect the central bank to keep rates unchanged at 1 percent on Wednesday, its last policy meeting this year. The bank releases its rate decision at 10 a.m. in Ottawa.

“Although the jobs numbers probably moved the dial for the bank in a slightly positive sense, I don’t think it really means that there’s going to be any significant change of views here,” said Shaun Osborne, chief foreign exchange strategist at Bank of Nova Scotia in Toronto. “What we’ve heard from the bank, and Poloz in particular, recently is a fairly strong indication that having got back to 1 percent, they’re probably going to remain on hold for a while here.”

Swaps traders place just a 16 percent chance of a rate increase Wednesday, following two hikes in 2017. Odds jump to 39 percent for a move in January and 69 percent in March.

Osborne sees the Canadian dollar weakening to C$1.28 per U.S. dollar by the end of the year from C$1.2695 at 4 p.m. in Toronto on Tuesday.

The stronger than expected data upset a trend of steady declines in short-term yields as traders were gradually scaling back expectations for further monetary tightening. The rate on Canada’s two-year government bond was at 1.54 percent on Tuesday, seven basis points below a six-year high reached in September, after shooting up nine basis points on Friday.

“The bond market got a little spooked by the jobs and GDP data,” said Kamyar Hazaveh, who oversees about C$11 billion ($8.7 billion) in fixed income at CI Investments Inc. “It would be wise for the bank to actually tone that down.”

ENERGY

National Energy Board. December 5, 2017. NEB Releases Pre-Construction Audit Report for Enbridge’s Line 3 Pipeline Replacement Project

Calgary – The National Energy Board (NEB) has released the results of a pre-construction audit of Enbridge Pipelines Inc. showing the company has a plan in place to manage safety and environmental protection during construction of its Line 3 Replacement Project. The pre-construction audit report, released today, assessed whether Enbridge’s documentation, processes and activities met NEB requirements.

NEB auditors looked at 35 audit protocol questions, including management system elements such as quality assurance, communications, hazard identification, risk assessment and controls. Enbridge was found to be non-compliant in one area – the company did not have a documented process for sharing corrective actions and learnings with employees and contractors. Enbridge has already taken action to correct the non-compliance.

The pre-construction audit involved more than two months of document review and on-site activities, including extensive interviews with company employees and review of internal documents that describe company procedures, training materials, and staff responsibilities. The audit was carried out from April to July 2017.

NEB staff have completed more than a dozen compliance verification activities for the Line 3 Replacement Project to date, including on-site inspections, a review of the construction safety manual and meetings with the company.

Enbridge began construction of the new Line 3 Pipeline in August, 2017. The project is expected to go into service in 2019.

The National Energy Board is an independent federal regulator of several parts of Canada’s energy industry. It regulates pipelines, energy development and trade in the public interest with safety as its primary concern. For more information on the NEB and its mandate, please visit www.neb-one.gc.ca

Quick Facts

- The NEB maintains a proactive approach to safety and incident prevention and we take all available actions to protect Canadians and the environment.

- The NEB reviews the state of all compliances activities on an ongoing basis and has the authority to stop work if compliance is not being maintained.

- On November 5, 2014, Enbridge applied to replace 1,067 kilometres of aging 36 inch Line 3 pipeline between Hardisty, Alberta to Gretna, Manitoba, with 1,096 kilometres of new pipeline built to current standards.

- The NEB takes a lifecycle approach to pipeline regulation, starting from the planning and application phase all the way through to abandonment and post-abandonment.

Pre-Construction Audit Report: http://www.neb-one.gc.ca/sftnvrnmnt/cmplnc/rprts/dt/index-eng.html#s3

Line 3 Replacement Project web site: http://www.neb-one.gc.ca//pplctnflng/mjrpp/ln3rplcmnt/index-eng.html

REUTERS. DECEMBER 5, 2017. Enbridge halts Great Lakes Line 5 pipeline due to bad weather

Nia Williams

CALGARY, Alberta (Reuters) - Enbridge Inc temporarily shut down its Line 5 oil pipeline across the Straits of Mackinac in North America’s Great Lakes on Tuesday, due to high winds and nine-foot (3 meter) high waves, according to the Michigan Agency for Energy (MAE).

The 540,000 barrel per day pipeline carries Canadian light crude and refined products from Wisconsin to Ontario and is a key link in Enbridge’s network, which transports the bulk of Canadian crude exports to the United States.

Light synthetic Canadian crude prices weakened by 35 cents on Tuesday, according to Shorcan Energy brokers. One market participant in Calgary said the dip was most likely in relation to the Line 5 outage.

In a statement on its website, the MAE said Enbridge told Michigan that Line 5 was shut down at 11.37 a.m. local time (1637 GMT) and would restart when conditions improve.

Enbridge did not immediately respond to a request for comment.

The Straits of Mackinac are a turbulent 5-mile (8 km) wide stretch of water connecting lakes Huron and Michigan. Some local businesses, politicians and environmental groups fear the 64-year-old underwater pipeline crossing the Straits is at risk of leaking and contaminating the Great Lakes.

In response to those concerns, Enbridge signed an agreement with the state of Michigan on Nov. 27 to suspend the pipeline’s operations during sustained bad weather in which wave heights reach more than eight feet.

“The purpose of the state’s agreement with Enbridge was to find practical solutions to concerns we had about the operation of Line 5 and the safety of the Great Lakes,” said Valerie Brader, executive director of the Michigan Agency for Energy.

“Enbridge’s action today shows the steps outlined in the plan will have immediate and long-term positive outcomes.”

Under the agreement Enbridge must also study the feasibility of placing a new pipeline or the existing Line 5 in a tunnel under the Straits, assess installing underwater technology to better monitor Line 5 and look at ways of mitigating the risk of boat anchors damaging the pipeline.

The Calgary-based company must also evaluate ways of minimizing the likelihood of an oil spill at the 245 bodies of water Line 5 crosses in Michigan.

Reporting by Nia Williams, Editing by Rosalba O'Brien

AVIATION

The Globe and Mail. 6 Dec 2017. Ottawa scraps plan to buy Boeing jets, turns to Australian military instead

DANIEL LEBLANC

The federal government will officially punish Boeing Co. for its trade dispute against Canada’s Bombardier Inc., replacing the planned order of 18 new Boeing jets with the purchase of up to 30 second-hand fighters from the Australian military, sources said.

Government and industry sources said the Australia deal will be announced as early as next week, with the Royal Canadian Air Force needing 28 to 30 used F/A-18 fighter jets to meet its international commitments.

Defence Minister Harjit Sajjan has said Canada cannot meet all of its obligations to the North American Aerospace Defence Command (NORAD) and the North Atlantic Treaty Organization (NATO) with its current fleet of CF-18s, arguing new fighter jets are needed before the entire fleet is replaced in the next decade.

“We are going to fill that interim capability gap,” he told reporters on Tuesday. “I look forward

to making the announcement at

the appropriate time.”

The government’s decision to buy Australian fighter jets stands

to increase tensions with Boeing, which has repeatedly warned

that billions of dollars in business activity in Canada are at stake in the ongoing dispute.

Speaking to The Globe and Mail in September, Boeing International president Marc Allen said the federal government should not forget that Boeing does $4-billion a year of business in Canada, with 560 suppliers and an overall impact of 17,000 jobs.

“If Canada kicks Boeing out, I

think that will be deeply unfortunate for us both. It would be a deeply unfortunate outcome,” he said. “It has to be a two-way street, there has to be this mutually beneficial relationship for it to be one that grows, one

that both sides are happy and excited about.”

In addition, industry sources said it remains an open question whether Ottawa will be saving money by buying second-hand Australian jets that are nearly as old as Canada’s CF-18s.

The U.S. Department of Defence said in September that

the contract for the Super Hornets could be worth up to $6.4billion.

Sources said that in order to offer the same capabilities as 18 new Boeing Super Hornets, which were the federal government’s first choice, the RCAF will need at least 10 additional second-hand fighter jets.

A Canadian delegation travelled to Australia in August to inspect the used aircraft. At the

time, Prime Minister Justin Trudeau and his top ministers said Ottawa would not do business with Boeing as long as it was engaged in a dispute with Bombardier.

Boeing filed a trade complaint against Bombardier last April, alleging the Canadian plane maker used unfair government subsidies to clinch an important contract for 75 CS 100 planes to Atlanta-based Delta Air Lines at “absurdly low” sale prices.

Commerce sided with Boeing in rulings in September and October and slapped preliminary import duties totalling 300 per cent on C Series planes. That legal process continues with final rulings expected by the U.S. International Trade Commission early next year.

Bombardier denies any wrongdoing and says Boeing cannot prove it was harmed by the Canadian company’s actions because it did not offer Delta any planes of its own.

Canada, Britain and Quebec, which all provided support to Bombardier to get the C Series to market, say their investments adhere to international rules.

“Boeing is underestimating what they are tackling. It’s not just the company but countries”

that they’re targeting, Bombardier chief executive officer Alain Bellemare said at an investors conference in Boston last month. “Unfortunately, I think they’re

taking advantage of a [political] context that’s favourable to

them.”

In October, Mr. Trudeau said he warned U.S. President Donald Trump that the trade dispute was blocking “any military procurements from Boeing.” It has been

the standard line in Ottawa for months that Boeing, having failed to act as a trusted or valued partner, has effectively been shut out of any new federal contracts.

REUTERS. DECEMBER 5, 2017. Canada scraps plan to buy Boeing fighters amid trade dispute: sources

David Ljunggren

OTTAWA (Reuters) - Canada is scrapping a plan to buy 18 Boeing Co (BA.N) Super Hornet fighter jets amid a deepening dispute with the U.S. aerospace company, three sources familiar with the matter said on Tuesday.

Instead, the Liberal government will announce next week it intends to acquire a used fleet of older Australia F-18 jets, the same kind of plane Canada currently operates, said the sources, who asked not to be identified because of the sensitivity of the situation.

The move underlines Ottawa’s anger at a decision by Boeing to launch a trade challenge against Canadian planemaker Bombardier Inc (BBDb.TO), which the U.S. giant accuses of dumping airliners on the American market.

It also casts into question the future of Boeing’s military sales in Canada. Boeing says its commercial and defense operations in Canada support more than 17,000 Canadian jobs.

Canada and Mexico are locked into increasingly acrimonious negotiations with the United States over the NAFTA trade pact, which President Donald Trump says has not done enough to protect U.S. jobs.

The Liberal Party of Prime Minister Justin Trudeau initially said in late 2016 it wanted the Boeing jets as a stopgap measure until it could launch a competition for a permanent fleet to replace Canada’s ageing CF-18 jets.

But as relations with Boeing deteriorated, Ottawa slammed the firm for not acting as a trusted partner and began looking at the Australian jets.

Australia’s Defence Department said Canada lodged a formal expression of interest for “a number” of Australia’s F/A-18 Classic Hornets on Sept. 29, in a statement emailed to Reuters.

“Defence is continuing to assist Canada in regards to their EOI,” the statement added, without disclosing a price or any other details.

Two sources also said Australian military officials had been in Ottawa late last month for talks.

One source said that by buying the Australian fleet, Canada would save money as well as avoid the need to train its pilots on a new aircraft or spend money on a new supply chain.

Officials had previously said that if the purchase went ahead, some of the Australian aircraft would be used for spare parts.

The offices of Public Works Minister Carla Qualtrough and Defence Minister Harjit Sajjan, who share responsibility for military procurement, both declined to comment.

Boeing declined to comment. The Australian mission in Ottawa was not immediately available for comment.

Canada is due to officially announce the requirements for its new fighter fleet in early 2019, kicking off an open competition.

One potential contender is Lockheed Martin Corp’s (LMT.N) F-35 fighter, which Trudeau initially said he would not buy because it was too expensive. The government has since softened its line, saying the plane would be allowed to compete.

Additional reporting by Leah Schnurr in OTTAWA, Allison Lampert in MONTREAL and Tom Westbrook in SYDNEY; Editing by Lisa Shumaker, Sandra Maler and Kim Coghill

REUTERS. DECEMBER 6, 2017. Canada's WestJet to partner with Delta, grow fleet by 2020

(Reuters) - Canada’s WestJet Airlines Ltd on Wednesday announced a joint venture with Delta Air Lines to boost trans-border flights and said it expects to nearly double its fleet by 2020 to meet growing passenger traffic.

Calgary-based WestJet is targeting an annual operating margin of between 10 percent and 12 percent in 2018 to 2020, consistent with last year, and an improving annual return on invested capital that is expected to exceed 13 percent in 2020.

Canada’s second-largest carrier said it intends to increase its number of aircraft to 96 by 2020 from 51 at the end of the third quarter, as the airline eyes both price-sensitive passengers and higher-paying customers.

WestJet, which competes against Air Canada , said it struck a preliminary agreement with Delta to coordinate schedules for new nonstop flights in the United States and Canada.

WestJet Chief Executive Gregg Saretsky said in a statement that the company will invest in initiatives that would support its transition from a “low-cost point-to-point model into a high value-based network airline with a global footprint.”

WestJet’s decision preceded the launch of its new ultra-low-cost carrier, Swoop, which is expected to begin service next summer.

Some analysts remained cautious about WestJet’s plans at a time when organized labor has unionized the company’s pilots and are eyeing other staff.

“We remain concerned about execution with so many simultaneous initiatives underway, all in a climate of unease on the labor front,” AltaCorp analyst Chris Murray wrote in a note.

Low and ultra low-cost flight are a hot market for airlines as passengers look for cheaper air travel. Swoop will charge lower fares but generate higher fees for services such as meals.

Ahead of its investor day, the company laid out plans to save C$140 million ($110.6 million) to C$200 million in costs through 2022.

It said its plans to attract and retain premium travelers, among other revenue-generating strategies, represent an annual opportunity of between C$300 million to C$500 million through to 2022. The company also said it expects C$780 million in expenses next year, compared with C$1 billion in 2017.

“We believe this guidance should be seen positively on the margin as it confirms that WestJet’s multiple expansion programs are not going to come at the expense of near-term profitability and balance sheet,” Canaccord Genuity analyst Doug Taylor wrote in a note to clients.

Reporting By Taenaz Shakir in Bengaluru and Allison Lampert in Montreal; Editing by Arun Koyyur, Shounak Dasgupta and Jonathan Oatis

CANADA - CHINA

The Globe and Mail. 6 Dec 2017. Trudeau presses China on human rights. Prime Minister lauds his achievements as free-trade talks with Beijing are delayed. Free-trade discussions between the two countries continue

STEVEN CHASE

Prime Minister Justin Trudeau lauded the achievements of his second official visit to China, and his efforts to raise human-rights concerns, after the widely anticipated launch of trade talks with Beijing was delayed by further haggling.

Mr. Trudeau had been expected to launch free-trade negotiations during this trip.

Discussions continued on Tuesday as Canada and China

tried to agree on the scope of

talks.

Canada’s International Trade Minister François-Philippe Champagne ended up changing his travel plans on Tuesday night in order to redouble the effort between Canada and China to agree on terms for the talks.

Mr. Champagne had intended

to head to the Beijing airport with Mr. Trudeau’s entourage, which was going to the southern business hub of Guangzhou where the Prime Minister is speaking at a gathering of business elites. But circumstances changed and Mr. Champagne stayed in Beijing.

Mr. Trudeau, for his part, defended the effort he has put into raising human-rights concerns with Chinese Premier Li Keqiang. At least five Canadians are currently being detained in China under controversial circumstances in cases that critics say constitute unreasonable imprisonment.

“I brought them up last night – human rights and consular cases – with Premier Li, and I will certainly be addressing those issues with [Chinese President Xi Jinping]” he said of a planned dinner with the head of state.

The Prime Minister said he stressed to Mr. Li how important it is for Canada to be granted consular access to imprisoned Canadians.

“We discussed the continued opposition Canada has, as a matter of principle, to the death penalty.”

Business leaders who had journeyed to China to join Mr. Trudeau in opening up trade talks voiced their concern that Canada sorely needs new markets in light of souring economic relations with the United States. After the Trump administration had tabled a series of demands for rewriting the North American free-trade agreement that Canada and Mexico have decried as unreasonable, businesses are planning for the possibility the United States will tear up the continental deal.

“Our biggest risk is that we ship 270,000 tonnes a year of beef to the United States and possibly facing losing that NAFTA agreement … which I think is a possibility that we have to take seriously,” John Masswohl, an executive with the Canadian Cattlemen’s Association, told reporters at business roundtable in Beijing.

As The Globe and Mail reported on Monday, sticking points preventing free-trade talks from launching include resistance to

the Liberal government’s effort

to ensure that talks will include setting standards for labour and

the environment.

Mr. Trudeau declined to reveal details of talks with the Chinese, but said his government wants

to see future trade agreements “account for things like labour protection, environmental standards and gender.”

Following a dinner with Mr. Jinping on Tuesday, Mr. Trudeau flies to the business hub of Guangzhou where he will promote Canadian business at a

global forum of chief executive officers.

China’s Ambassador to Canada Lu Shaye has been telling Canadians that Beijing is ready to agree to the same sort of trade deal struck with Australia in 2014.

There is widespread agreement among business groups and trade analysts that the Australia-China deal is not ambitious enough and that Canada has to achieve more – including strong rules to allow them to challenge Chinese efforts to frustrate Canadian imports.

Mr. Trudeau said he and Chinese leaders agreed to co-operate further to fight climate change and promote clean technology and collaborate further on tourism and agriculture.

He played down the lack of progress on launching free-trade

talks, saying Canada and China are being careful to ensure they

get it right. “This is not an overnight process.”

Mr. Trudeau was asked what he’s doing in China to demonstrate he is committed to more

than just business deals, but instead subjects such as human rights. He replied that answering questions from Canadian journalists is how he shows he cares about freedom of the press.

“I am happy to be here now

taking a broad range of questions from the media on a broad range of issues to demonstrate

that I truly believe a free and informed and independent process is something necessary to support for a society to thrive. This is something I demonstrate all around the world.”

The Globe and Mail. 6 Dec 2017. China is chasing PM less now that it thinks he needs free-trade deal

CAMPBELL CLARK, Columnist, OTTAWA

A free-trade deal with China was also going to be a difficult thing to sell to Canadians, and Mr. Trudeau has to steer it through skeptical public opinion.

Justin Trudeau now knows his trade agenda is stuck between a rock and a harder place. One is U.S. President Donald Trump, and the other is a Chinese regime that is no longer so anxious to do a free-trade deal with Canada.

Chinese leaders once chased the Prime Minister. Now,

they think he needs them.

That is clear after Mr. Trudeau’s high-level meetings in Beijing didn’t lead to a quick announcement that formal free-trade negotiations will be launched. There was a

grumpy reception from Premier Li Keqiang, who cancelled a joint news conference, signalling that even if the differences are hammered out and free-trade talks go ahead – and

that’s still likely – the Chinese will make it tough.

That makes it harder on Mr. Trudeau. Canadian business leaders are anxious about Mr. Trump’s protectionism and

the potential crack-up of the North American free-trade agreement. Many are pushing Mr. Trudeau to expand market access elsewhere. A deal with big, fast-growing China is an ambitious alternative.

But a free-trade deal with China was also going to be a difficult thing to sell to Canadians, and Mr. Trudeau has to steer it through skeptical public opinion. So he told Canadians he’d insist on high standards, including a “progressive

trade” agenda of labour and environmental standards and

gender equality.

Now, Beijing doesn’t have much time for all that.

The significance is not simply that Mr. Trudeau might have to tone down the “progressive trade” stuff to make a deal. That could be politically embarrassing, but not fatal to Canadian interests. The larger signal is that China is not chasing Canada any more. The Chinese don’t think they have to make so many concessions for a Canadian deal.

“We’re needier,” said Daniel Schwanen, vice-president of research at the C.D. Howe Institute. Beijing knows Mr. Trump has thrown NAFTA up in the air, and the Trans-Pacific Partnership is stalled, too. Guy-Saint Jacques, the former Canadian ambassador to China, said Beijing is the “demandeur,” believing a deal with Canada could be a template for other Group of Seven countries and advance its goal of recognition as a “market economy.” But if Canada won’t do it, Mr. Saint-Jacques said, others probably will.

When Mr. Trudeau first came to power, Chinese officials remembered his father and were quick to proclaim a “golden era” of Canada-China relations. Beijing, which doesn’t like other countries poking their noses into its domestic affairs, never liked Mr. Trudeau’s “progressive trade” agenda or the precedent of putting things such as labour rights in

trade deals. But they still chased Canada.

When Mr. Trudeau visited China in August, 2016, his meeting with Mr. Li was very different. China wanted to announce “exploratory” talks on free trade, Mr. Saint-Jacques said, but Mr. Trudeau insisted they must include environment, labour standards, state-owned enterprises and procurement. Mr. Li didn’t immediately commit – but told

the press the two countries had agreed to exploratory talks. Mr. Saint-Jacques had to deny it; China agreed a few weeks later to include those four topics.

This time, it was Mr. Li who backed out of announcing

talks – apparently unwilling to bend.

That’s not just a political embarrassment if Mr. Trudeau can’t get China to pay lip service to his progressive trade agenda. It’s a changed dynamic that suggests China will be less willing to put new elements into a trade agreement to

get a deal with Canada.

That’s critical because a good trade deal with China requires novel provisions. China has agreements with a few countries such as Australia and Switzerland, which lowered

tariffs on goods and allowed expanded access to Chinese markets for some services. But a more ambitious trade agreement means obtaining guarantees that Canadian companies really will have fair access to Chinese markets which

the centralized, authoritarian state cannot block with arbitrary regulations, fees, inspections, prosecutions and so on. That requires novel provisions on “how the market functions in a non-market economy,” as Mr. Schwanen puts it.

Without that, a Canada-China trade agreement won’t be a good deal. And if Beijing is less willing to make concessions for a deal with Canada, that kind of deal is less likely.

Only 18 months ago, it seemed Mr. Trudeau was fielding

trade-agreement opportunities. Now, he is a Prime Minister facing a cold, harsh trade squeeze, between less-friendly partners. Mr. Trump is threatening to break an old trade alliance, and China’s leaders are no longer so ardent in chasing him to make a new one.

BLOOMBERG. 6 December 2017. Trudeau Defends Progressive Trade as China Talks Sputter

By Chris Fournier

- Canada appears to be running out of time to salvage FTA launch

- Prime minister touts investment benefits in Guangzhou

Canadian Prime Minister Justin Trudeau continued to push his progressive trade message in China, even as his efforts to launch formal talks with Beijing appeared increasingly doomed.

Trudeau said in a speech in the southern Chinese manufacturing powerhouse of Guangdong on Wednesday that he and Chinese President Xi Jinping agreed on the need to work together on economic growth. He reaffirmed calls for China to accept elements it doesn’t usually seek in trade deals, such as provisions for labor, gender and environmental rights.

“We discussed the expanding relationship between Canada and China, as we continue exploratory discussions on comprehensive -– and progressive –- trade between our two countries,” Trudeau said, referring to his dinner with Xi the previous night in Beijing. He made his pitch at the Fortune Global Forum ahead of speeches by Apple Inc.’s Tim Cook and Alibaba Group Holding Ltd.’s Jack Ma.

“By keeping our borders open, and pursuing progressive trade deals that put people first and reflect our values, we give our businesses access to more customers, and we give our customers greater access to the goods they want,” Trudeau said.

Discussions Continue

Canada’s trade strategy is in flux after the two sides failed to agree as anticipated on a negotiating framework for a free-trade agreement. Trudeau unexpectedly left his trade minister behind in Beijing late Tuesday to continue discussions, and former Chinese trade officials said talks were still possible.

Time is running out before Trudeau’s scheduled Thursday night trip to Ottawa. His push for progressive elements has upended talks on the North American Free Trade Agreement and the revamped 11-member Trans-Pacific Partnership as he looks to diversify his options and expand markets for Canadian exports amid U.S. President Donald Trump’s protectionist threats.

“The trend is good. The general direction is good, but it will take a bit more time. I think eventually we should reach agreement,” said Wang Huiyao, director of the Beijing-based Center for China and Globalization and an adviser to China’s cabinet. “Canada is always kind of difficult. Even in TPP 11, Canada was the last one to agree. I think maybe Canada should be more positive.”

Enticing Prize

Trudeau’s diversification effort offers China an enticing prize: its first free-trade agreement with a Group of Seven country. Canada exported $18.2 billion worth of goods to China last year, compared with the $278 billion it sold to the U.S. About 95 percent of the countries’ two-way trade is in merchandise, primarily lumber and agricultural products such as canola and pork, as well as copper and iron ore and cars.

In his keynote speech, Trudeau touted Canada’s predictable business environment, low costs and stable banking system. The country has the best availability of skilled labor among Group of 20 countries and the most educated talent pool in the 35-member Organisation for Economic Co-operation, according to the government.

Canada was hoping that Australia’s two-year-old pact with China would provide a template, even if talks took years. While China is Canada’s second-largest trading partner, the North American country doesn’t make the top 15 for China, which exchanges more goods with Thailand.

No ‘Early Harvest’

“We should not expect an early harvest from such talks,” Wendy Dobson, a professor at the University of Toronto’s Rotman Institute for International Business, said before Trudeau’s delegation left Ottawa. “Remember that the negotiations with Australia took 10 years.”

It’s still unclear what led Trudeau and Premier Li Keqiang to cancel an announcement Monday and instead make brief statements on the countries’ economic compatibility. Both sides have reiterated a mutual desire to deepen the relationship, while hinting they were unable to come to terms on some issues such as human rights.

Speculation of a late breakthrough intensified after Trudeau’s dinner with Xi, when he directed Trade Minister Francois-Philippe Champagne to remain in Beijing to pursue talks. But as Wednesday wore on, the prime minister’s office offered no updates.

“I don’t think this declared the death of bilateral trade talks,” said Jiang Shan, a former general director for Americas and Oceanic affairs at the Chinese Commerce Ministry. “It could be postponed, but that’s not necessarily a bad thing, as both sides need to learn more about each other’s concerns and try to address them in a prudent way.”

BLOOMBERG. 5 December 2017. China Finds Gems in Canadian Tech as Free Trade Talks Stumble

By Natalie Wong

- Tencent, BYD, Huawei ramping up investments in AI, autos

- U.S. political tensions makes Canada more welcome alternative

Free trade talks between Canada and China may have yet to achieve lift off. Tell that to technology sector.

China tech giants including Tencent Holdings Ltd. and Huawei Technologies Co. are boosting investment in Canadian companies with exposure to everything from electric vehicles to artificial intelligence, attracted by the country’s swelling ranks of science and technology graduates, valuations that are cheaper than the U.S., and government enticements.

“Over the last six months, I’ve probably been contacted by at least half a dozen new funds that have Chinese money,” said Janet Bannister, partner at Toronto-based Real Ventures. The venture capital firm said last week it raised C$180 million ($142 million) in fresh funds for new Canadian startups, including an undisclosed amount from Shenzhen-based Tencent.

While China is Canada’s second-largest trading partner, Chinese investment in the country shrank to an annual average of C$1.21 billion in the 2013-2017 period, from C$8.16 billion in the previous five years, when the Asian country was pouring money into the energy patch. Justin Trudeau has vowed to reverse that trend but the two countries have yet to kick start talks on a possible free-trade agreement during the Canadian prime minister’s visit to China this week.

Robot Startup

Still, tech is becoming increasingly attractive for China, though the values may be tiny compared to the $15.1 billion takeover of oil company Nexen Inc. by Cnooc Ltd. in 2012.

In addition to the venture capital fund, Tencent took part in a $102 million funding round for Montreal-based Element AI and put $28 million into Kindred Systems, an AI robot-manufacturing startup based in Toronto. Telecommunications giant Huawei, which already employs 700 people in the country, is testing an Internet-of-Things project alongside Canada’s BCE Inc. in a Niagara winery. And BYD Co., the world’s largest electric vehicle manufacturer, said it plans to open an assembly plant in Ontario after partnering with Loblaws Cos., to electrify the grocery giant’s trucking fleet.

Kathleen Wynne, premier of Ontario, Canada’s most populous province, traveled to China last week to meet with a host of tech companies. Announcements included a C$351 million investment from Hong Kong-based John Electric Holdings Inc. to augment its auto-parts operations, with the provincial government kicked in C$24 million.

Robust Research

While Chinese companies have been hunting for tech investments around the world -- Tencent bought a stake in Snap Inc. and backed German flying jet taxi designer Lilium GmbH -- political tensions are increasingly prompting investors to look north to Canada from the U.S., Bannister said.

“With us being open to immigration and particularly with the U.S. closing their door, that has also created a window of opportunity for the Canadian ecosystem and Chinese investors,” she said, adding valuations for startups north of the border tend to be more reasonable than Silicon Valley.

China is part of a broader wave of foreign investors tapping Canadian tech talent, particularly in AI. Facebook Inc. opened its first AI lab in Montreal this fall and Uber Technologies Inc. is building a team in Toronto to improve its autonomous-vehicle software, hiring a University of Toronto professor to lead its operations.

Canada’s robust talent pool and Shenzhen’s expertise in bringing products to market makes a great match, said Jenny Qi, chairwoman of the Canada Confederation of Shenzhen Associations, which connects businesses and investors between the two regions.

“In Canada, R&D advantage is here, education, research is here, but in Shenzhen, the global supply chain, manufacturing systems, commercialization is really advanced,” Qi said. “They complement each other very well.”

— With assistance by Chris Fournier

The Globe and Mail. 6 Dec 2017. Sea to drone to air: Chinese firm pitches speedy export of seafood. Drones: Plan could take flight within a year, JD’s chief executive says

NATHAN VANDERKLIPPE, BEIJING

You might call it the Flying Lobster – or maybe Brisk Bisque. One of China’s biggest online companies wants to deploy a fleet of drones in Canada to airlift seafood from East Coast processing plants to the airport, cutting out land-haul costs in its bid to deliver more Atlantic lobsters, prawns and clams to Chinese consumers.

JD.com is also developing plans for a drone network for the Canadian West Coast that could be used to carry local blueberries to cargo aircraft headed for China. It wants to replicate plans for similar drone networks in China, where it believes unmanned aircraft can slash logistics costs by 50 per cent to 70 per cent, chief executive Richard Liu said in an interview Tuesday.

Mr. Liu met with Prime Minister Justin Trudeau in Beijing on Tuesday and discussed the concept of bringing the company’s delivery drones to Canada.

JD, an Amazon-like company

that is China’s largest direct online sales platform, needs

government approval for a licence to operate drones nationwide.

The company has yet to apply for a licence, and says it will need to conduct cold-weather testing before it can launch. Even in China, its drone project remains at an early stage, well short of full commercial usage.

XINHUA/SIPA/NEWSCOM

JD.com’s current drones can carry up to 50 kilograms, but it is developing a much larger pilot-less aircraft that can carry one tonne of cargo for 500 kilometres.

But Mr. Liu said the Canada plan, although ambitious, has moved beyond the conceptual stage and could take flight in as little as a year.

JD’s drones “can help reduce domestic logistics fees” in Canada, he added.

His plan involves JD drones carrying fresh product between a series of drone bases, each a small patch of land that can be built into an operations centre for as little as $125,000. The drone would land for a few minutes to swap its battery before continuing onward to an airport, where seafood and fruit could be loaded into a cargo aircraft bound for China.

The drones could cover hundreds of kilometres this way, hopping between bases. Squadrons of the airborne couriers could shrink the time between harvest and plate, Mr. Liu said.

With blueberries, for example, drones could take product from “farms to an airport, and then to China,” Mr. Liu said. “Within 24 hours, we can deliver to a family in China.”

In China’s Sichuan, which is half the size of British Columbia, JD has estimated it will take 185 bases to connect the entire province. The company’s current drones can carry up to 50 kilograms, but it is developing a much larger pilot-less aircraft that can carry one tonne for 500 kilometres, although it will require a runway.

The company’s interest in Canada, Mr. Liu said, has been sparked by the comparatively high cost of domestic shipping and small number of airports with connections to China. Canadian seafood today is typically flown from Halifax to Toronto before leaving for Shanghai, Beijing or Guangzhou.

Next year, JD wants to sell roughly $500-million in Canadian goods, about half of it fish and shellfish. It expects to grow sales of Canadian beef and pork, and has plans to begin selling Canadian fresh milk, too. The company’s Canadian beef sales rose 800 per cent this year on Singles’ Day, China’s annual Nov. 11 shopping spree.

JD’s Canadian ambitions come amid a new wave of Chinese overseas investment by firms possessed not just of deep pockets, but also world-leading technology they are now bringing to other countries.

Some of China’s best-known corporate names – Tencent, Ctrip, Mobike – are stepping abroad with cellphone payment systems, travel services and shared-bike concepts developed in China. Canada, with its large population of ethnic Chinese, is a valuable overseas proving

ground.

JD, too, expects to bring its main line of business, an Amazon-like platform for online sales, to Canada within the next

three years – although it doesn’t want to take on Amazon directly.

“If we can bring a lot of Chinese local brands, those of best quality but with lower prices, I’m sure local people will love it,” Mr. Liu said.

But for now, its primary focus is on seafood.

The drone plan is part of an attempt to slash the price of JD’s Canadian catch by 20 per cent. The company is also mulling investments in expanding or modernizing Canadian fishing fleets. Mr. Liu also suggested looking to Europe for advanced processing technology that can be brought to Canada.

“Though I am not clear what it is about seafood production in Canada that makes costs so high,

technically speaking, I think the cost of its marine products can be lowered if technical problems can be tackled,” he said.

If costs can be cut 20 per cent, he said, “Canadian seafood will be very competitive globally.”

And, he added, “we’ve got enough cash” to do what it

takes.

Not all of the company’s plans have won a receptive audience in Canada.

“I’m not sure how I would see drones playing a role,” said Ian Smith, chief executive of Clearwater Seafoods, a Bedford, N.S.based company that now sells roughly 20 per cent of its product to China.

But, he said, JD is one of the company’s key sales outlets and “has done a phenomenal job in

the seafood e-commerce area” in a country where the average person consumes nearly double the seafood of someone in North America.

“There’s definitely room for Chinese investment in Canadian seafood,” Mr. Smith said.

China, which this week lowered tariffs on imports of some seafood products, “is where the market is.”

NAFTA

The Globe and Mail. REUTERS. 6 Dec 2017.U.S. trade deficit worsens as gap widens with China, Mexico

LUCIA MUTIKANI, WASHINGTON

The U.S. trade deficit increased to a nine-month high in October because of rising oil prices and

the widening of the long-standing deficits the United States has with China and Mexico.

The worsening trade deficit came even as exports to China and Mexico were the strongest in more than three years, which some economists said challenges

the Trump administration’s argument that the United States was being disadvantaged in its dealings with trade partners.

“This leaves the Trump economics team empty-handed when it comes to its mission to improve the unfair terms of

trade which sent factories offshore starting a couple of decades ago,” said Chris Rupkey, chief economist at MUFG in New York.

The U.S. Commerce Department said the trade gap widened 8.6 per cent to $48.7-billion (U.S.), the highest since January. The U.S.-China trade deficit increased 1.7 per cent to $35.2-billion and the deficit with Mexico surged 15.9 per cent to $6.6-billion. Economists polled by Reuters had forecast the l deficit rising to $47.5-billion in October.

U.S. President Donald Trump has blamed the trade deficit for

the massive loss of U.S. manufacturing jobs as well as moderate economic growth. He has ordered the renegotiation of the North American free-trade agreement. NAFTA talks have stalled, with Mexico and Canada rejecting a U.S. proposal to raise the minimum threshold for autos to 85 per cent North American content from 62.5 per cent as well as

to require half of vehicle content

to be from the United States. The U.S. government reported last month that trade contributed 0.43 percentage points to the economy’s 3.3-per-cent annualized growth pace in the third quarter. The Trump administration believes a smaller trade deficit, together with deeper tax cuts could boost annual GDP

growth to 3 per cent on a sustained basis.

Republicans in Congress have approved a broad package of tax cuts, including slashing the corporate income tax rate to 20 per cent from 35 per cent. But the fiscal stimulus will come at a time when the economy is at full employment, which will boost imports and widen the trade gap.

“While U.S. domestic demand will strengthen, foreign producers will supply an increased share,” said Mickey Levy, chief economist for the Americas and Asia at Berenberg Capital Markets in New York. “We project the U.S. trade and current account deficits will widen.”

Imports of goods and services increased 1.6 per cent to a record $244.6-billion in October. Goods imports were the highest since May, 2014, amid a $1.5-billion increase in crude oil imports. Imported oil prices averaged $47.26 a barrel in October, the highest since August, 2015

Exports of goods and services were unchanged at $195.9-billion in October as a surge in shipments of industrial supplies and petroleum was offset by declines in civilian aircraft exports. Exports to China were at their highest since December, 2013.

The Institute for Supply Management said its non-manufacturing index fell to a reading of 57.4 last month from 60.1 in October. A reading above 50 in the ISM index indicates an expansion in the services sector, which accounts for more than twothirds of the U.S. economy.

INTERNATIONAL TRADE

MDIC-Brazil. StatCan. International trade balance of Brazil on November/2017; Canada on October/2017 and Brazil-Canada on October/2017.

DOCUMENT: https://drive.google.com/file/d/1r98Fs6a6daFSlKdvnXL5zPSv7XwTUwNR/view?usp=sharing

________________

LGCJ.: