CANADA ECONOMICS

NAFTA

The Globe and Mail. 27 Nov 2017. A vision of life after NAFTA: ‘It would not be a disaster’. Ontario most exposed if deal collapses

GREG KEENAN

Consumers would take a hit, the Canadian dollar would fall and economic growth in Canada would be curtailed if NAFTA were terminated, but policy makers and businesses would adjust quickly, the Bank of Montreal concludes in a new study.

The adjustments in interest rate policy, currency markets and business activity would ease the damage caused by the end of the threecountry trade deal and a reversion to tariffs established under the World Trade Organization regime, the bank’s study says.

“Reverting to WTO-level tariffs would leave Canada unequivocally worse off than under NAFTA, but it would not be a disaster, at least not for the aggregate economy,” the report released on Monday notes.

The study done by a team of BMO economists, titled The Day After NAFTA, is the latest in a series by analysts, banks and think tanks amid a deadlock in negotiations on a new Canada-U.S.-Mexico pact.

That deadlock after five rounds of talks comes amid key U.S. demands that Canada and Mexico have rejected outright as not being worthy of counterproposals. Among those are the elimination of a dispute settlement mechanism; onerous rules of origin for automobiles and other manufactured goods; an automatic review of the agreement every five years; and the end of supply management in Canada’s farm sector.

The study assumes Canada would reject those terms in any bilateral discussion with the United States that may happen if the North American free-trade agreement ends.

The risks to Canada from the deal being terminated are manageable, BMO chief economist Doug Porter said in an interview.

The Canadian economy has endured severe trauma in recent decades, including the massive appreciation of the Canadian dollar in the mid-2000s, the financial crisis of 2008-09 and the collapse of the technology bubble, Mr. Porter noted.

“I would actually view the termination of NAFTA as not being in quite the same league as some of those traumatic events,” he said.

Nonetheless, the Canadian dollar would likely sink about 5 per cent to the 74-cent (U.S.) range, real GDP would be about 1 per cent lower than it otherwise would have been and certain sectors of the economy and regions of the country would sustain more damage than others, the bank concludes.

But the Bank of Canada would likely respond by holding the line on interest rates in 2018, perhaps even cutting them once.

British Columbia has the least exposure based on exports to the United States as a percentage of GDP, but Alberta’s $50-billion (Canadian) in crude oil exports would likely escape any tariffs, leaving it less vulnerable than some other provinces.

Ontario would be the province most in danger, given that 83 per cent of that province’s exports went to markets in the United States last year.

The danger to Ontario comes in part from the impact termination would have on the transportation equipment industry, which includes the auto sector and is ranked by the study as one of the most vulnerable given the integrated nature of the industry in North America.

Prices would rise about 1 per cent in Canada over all and by more than that figure for some goods and services, Mr. Porter noted.

“Often forgotten is the biggest beneficiary of free trade is the average person, the consumer, and I suspect that were NAFTA to be terminated, ultimately the biggest loser from that would be the North American consumer,” he said.

Autos and textiles, clothing and leather are two sectors of the economy that have the highest WTO tariffs that Canada imposes so prices for those goods could be affected.

With the imposition of WTO tariffs, the levy on vehicles imported from the United States would be 6.1 per cent, while the average tariff on textiles, leather and clothing would be even higher at 8 per cent.

The study said the U.S. economy would endure a smaller impact than Canada, but Michigan, Texas and the belt of auto-producing states in the south – including Alabama, Tennessee and Kentucky – would face greater risks than many other states.

But the implications go beyond economics, David Jacobson, vicechairman of BMO and the U.S. ambassador to Canada from 2009 to 2013, said in the interview.

“If the United States backs out of a trade agreement for the first time in our history, I think it can’t help but cast a shadow over all those other things that are so important to people on both sides of the border,” Mr. Jacobson said.

The Globe and Mail. 27 Nov 2017. Why is Canada letting dairy farmers imperil NAFTA? Executive director of Affordable Milk Canada and former chief of staff to Canada’s Foreign minister, Defence minister and Agriculture minister

AARON GAIRDNER

Canada and the United States already trade hundreds of farm products tariff-free. The Americans have a deepening $3.1-billion (U.S.) agrifood trade deficit with us. So why should they see milk differently than other products such as bacon, tofu or orange juice? Fair is fair.

Canada is an agricultural powerhouse. We are the world’s fifthlargest agricultural exporter, with more than 90 per cent of Canadian farmers competing around the world and winning. We export half of our beef, 75 per cent of our pork and 90 per cent of our canola.

Much of this trade is with the United States. They are the largest market for our agricultural products, with annual trade at an impressive $56-billion.

Our government is now renegotiating the North American freetrade agreement, our free-trade pact with the United States and Mexico. It is in our national interest to preserve the open access to the U.S. market that Canada’s progressive, export-oriented farmers depend on.

But negotiations are never easy. The Trump administration is demanding Canada end its isolation of milk and dairy products in a renewed NAFTA. Isolation? That sounds very un-Canadian. But it’s true.

Many decades ago, Canada erected a near 300-per-cent border tax on dairy, poultry and egg products in order to insulate 8 per cent of Canadian farmers from competition. This system – called supply management – also regressively fixes the price of these products at double the market rate. That’s right – this isolationist policy means we all pay double for basics, such as milk and cheese.

Not surprisingly, the World Trade Organization has essentially banned Canada from exporting these products. But we should be exporting more food, not less. The world’s population is expected to reach 9.7 billion by 2050. Canadian farmers are an essential part of ensuring the world, especially the world’s poorest, are fed.

Meanwhile, back in Ottawa, an army of dairy lobbyists have been using heavy protectionist rhetoric, such as the need for “food sovereignty,” in an effort to maintain our massive dairy tariffs.

They are anti-free trade. These isolationist dairy farmers would rather kill NAFTA than join the rest of the Canadian farmers who successfully sell their products around the world. Dig down into their rhetoric and you will find an alarming hostility toward foreign foods. The impression is left that they don’t want Canadians eating imported food – be it butter from New Zealand or chicken from New York.

Will our government choose maintaining dairy tariffs over signing a new NAFTA deal? We’ll soon find out. The U.S. administration has been very explicit with its threat to withdraw from NAFTA if we do not completely open up our dairy, poultry and egg markets.

And why shouldn’t the Americans make such a demand? After all, free trade is a two-way street. Canada and the United States already trade hundreds of farm products tarifffree. The Americans have a deepening $3.1-billion (U.S.) agrifood trade deficit with us. So why should they see milk differently than other products such as bacon, tofu or orange juice? Fair is fair.

As the NAFTA talks drag on, there is a growing anxiety among Canada’s progressive farmers whose outlook goes beyond Canada’s borders. These farmers only see downside in the sky-high dairy, poultry and egg tariffs. They view them as harming their global market access and now threatening their most important market, the United States.

Fortunately, Prime Minister Justin Trudeau and his ministers take a global view and generally support free trade. They care about things such as ensuring the world’s poorest are fed.

Their political support base is in urban and suburban Canada. Where voters care about unnecessarily high grocery bills. Where they value diversity on the grocery-store shelf – not some isolationist cocktail of sovereigntist economics and opposition to foreign foods.

Let’s all hope Mr. Trudeau has the courage to take the progressive path by tearing down the sky-high border tax on milk. He’ll be helping Canada’s poorest at the grocery store and making a transformative change in Canada’s approach to global food security.

REUTERS. NOVEMBER 27, 2017. Ending NAFTA would hurt growth, competitiveness of United States, Canada: report

Nick Carey

DETROIT (Reuters) - Terminating the North American Free Trade Agreement would harm the U.S. and Canadian economies and reduce their competitiveness versus Asia and Europe, a report issued by the Bank of Montreal (BMO.TO) said on Monday.

According to the report, “The Day After NAFTA,” a failure to renegotiate the trade agreement between the United States, Canada and Mexico would lead to a 0.2 percent net reduction in real U.S. gross domestic product over the next five years, and a 1 percent decrease for Canada’s economy.

U.S. President Donald Trump has threatened to withdraw from NAFTA unless it can be reworked in favor of the United States, arguing that the pact has hollowed out U.S. manufacturing and caused a trade deficit of more than $60 billion with Mexico.

The United States, Mexico and Canada concluded a fifth round of talks to update NAFTA last week with major differences unresolved, casting doubt on whether a deal could be reached by the end of March 2018 as planned. [L3N1NR4K2]

Douglas Porter, chief economist of BMO Financial Group and one of the report’s authors, said that while the three North American economies would adjust to a new reality, a shift in low-wage work to Mexico enabled by NAFTA had made them collectively more competitive on the global stage.

“If we splinter up NAFTA into three separate economies, that makes all of us less competitive and ultimately the whole region will end up losing a bit versus other trading areas like Asia,” Porter told Reuters by telephone. “The point here is there would be a cost to the U.S. economy and it’s a totally unnecessary cost.”

“Our view is even if the U.S. administration were to achieve that goal, it might come at the cost of an even wider deficit with Asia in particular,” Porter said.

If NAFTA negotiations were to fail, trade among the three countries would be subject to tariffs set by the World Trade Organization (WTO).

According to the report, the U.S. industries that would be hardest hit by reverting to WTO tariffs would be automotive, where the supply chain straddles all three economies, and textiles, as Canada and Mexico account for 15 percent of U.S. manufacturers’ sales.

The report did not examine a “Zombie NAFTA” scenario, where opposition from the U.S. Congress would stall Trump administration efforts to terminate NAFTA, but Porter said that would create huge uncertainty for businesses in North America.

“Arguably uncertainty would be a bigger drag on all three economies,” he said.

(This story was refiled to add dropped word “percent” in second paragraph.)

Reporting By Nick Carey

INTERNATIONAL TRADE

PM. November 26, 2017. Prime Minister to strengthen bilateral and commercial ties on trip to China. The Prime Minister, Justin Trudeau, today announced that he will travel to China from December 3 to 7, 2017.

The Government of Canada remains committed to a stronger relationship between Canada and China – one that strengthens and grows the middle class, and is based on regular, frank, and comprehensive dialogue, including on issues like good governance, human rights, and the rule of law.

During the trip, the Prime Minister will meet with Chinese government and business leaders to build on the progress that the two countries have made since the Prime Minister’s first official visit to China in September 2016.

Prime Minister Trudeau will promote a progressive trade agenda and tourism initiatives that will create good, middle class jobs and more opportunities for people in both countries. He will also highlight the considerable potential for Canada and China to strengthen their cooperation on climate action, and lead the global effort to combat climate change.

Prime Minister Trudeau will begin his visit in Beijing where he will be officially welcomed at the Great Hall of the People and meet with His Excellency Li Keqiang, Premier of the State Council of the People’s Republic of China. He will also meet with His Excellency, Chairman Zhang Dejiang of the Standing Committee of the National People’s Congress, and His Excellency, President Xi Jinping of China.

The Prime Minister will then head to the city of Guangzhou where he will meet with Li Xi, Party Secretary of the Guangdong Provincial Committee of the Communist Party of China. He will then deliver the keynote address at a special session of the Fortune Global Forum, and hold several meetings with global business leaders to discuss ways to increase trade and attract international investments to Canada.

Quote

“A strong relationship with China is essential to creating jobs, strengthening the middle class, and growing the Canadian economy. A closer relationship also means more opportunity to hold regular, frank dialogue on human rights issues like good governance, freedom of speech, and the rule of law. As we approach the Canada-China Year of Tourism in 2018, I look forward to meeting again with China’s leaders to strengthen our relationship and set the stage for even greater trade and investment cooperation.”

— The Rt. Hon. Justin Trudeau, Prime Minister of Canada

Quick Facts

- Prime Minister Justin Trudeau undertook his first official visit to China from August 30 to September 6, 2016, when he also participated in the G20 Leaders’ Summit in Hangzhou.

- China is Canada’s second-largest trading partner, largest and fastest growing source market for international students, and third-largest source of tourists.

- Canada’s merchandise exports to China were almost $21 billion in 2016, an increase of four per cent over 2015, with top exports being forest and agricultural products, copper and iron ores, and motor vehicles.

- In 2016, Canada and China agreed to make 2018 the Canada-China Year of Tourism, which includes initiatives to increase the flow of tourists and promote cultural activities.

Canada-China Relations: http://www.canadainternational.gc.ca/china-chine/bilateral_relations_bilaterales/index.aspx?lang=eng&_ga=2.56003307.1168694504.1511191876-108037952.1511191871

THE GLOBE AND MAIL. NOVEMBER 27, 2017. TRADE. Canadians skeptical of China trade deal as Ottawa set to launch talks

NATHAN VANDERKLIPPE

BEIJING - To gauge Canadian public opinion on free trade with China, Ottawa dispatched federal officials across the country on a listening tour.

They landed in 10 provinces and one territory, consulting more than 600 people and businesses.

What they heard was less than a ringing endorsement of a deal the Liberal government appears set to pursue, amid wide expectations that Canada will formally launch free-trade talks when Prime Minister Justin Trudeau visits Beijing next week.

The official listening tour found that farmers, fishermen and foresters, on balance, like the idea of better access to the Chinese market – a move that would bring Canada in line with countries such as Australia and New Zealand, where existing trade deals with China have won broad support.

But the consultations in Canada also showed skepticism that a deal "would be able to meaningfully address the full spectrum of challenges faced by Canadian businesses trading with China," according to "What we heard," a recent report on the consultations.

People "expressed concerns that increased engagement with China could lead Canada to compromise on its values." They worried a deal with Beijing could hurt "Canadian jobs and competitiveness in certain sectors, especially mining and certain manufacturing sub-sectors."

Even companies already doing business with China said their biggest problems lay not with the tariffs a free-trade deal would hope to vanquish. They were more concerned with endemic issues in China related to unreliable courts and government subsidies.

Free trade with the world's second-largest economy, in other words, is hardly seen by many Canadians as an unalloyed good.

Indeed, coming to the table for trade talks will inevitably involve facing down a series of hefty demands from Beijing.

China "will want to have full access to our natural resources, including uranium mining. They will want an expansion of trade in services. They will want to be able to bring Chinese workers to Canada," said Guy Saint-Jacques, the previous Canadian ambassador to China.

"At the end of the day, it will be a question of sitting down and saying, 'okay – if we make concessions as the Chinese want, are we really sure that we are getting enough in exchange?' "

But Mr. Saint-Jacques believes Canada has little choice. Without a current trade deal, Canada must follow suit. "We have to proceed with these talks," he said. "I remain convinced that China wants this agreement more than we do, and that therefore we have a window of opportunity."

The experience of those other countries does bear out some of the Canadian qualms: both Australia and New Zealand have struggled against unexpected border barriers – inspections, esoteric demands on quality control and documentation – that have impeded the flow of goods.

But in both countries, free trade with China has come to be seen as an economic boon, one with benefits tilted not toward Beijing, but toward its smaller partners.

"There can be little doubt that it means more to Australia," said James Laurencon, deputy director of the Australia-China Relations Institute at the University of Technology Sydney.

"Australian producers get substantially improved access to the world's largest population and second largest economy, growing at 6 to 7 per cent," he said in an e-mail. "China gets slightly better access (tariffs were already low) to a country with a population of 24 million and an economy growing at 2 to 3 per cent."

Australia's free-trade agreement with China came into force at the end of 2015.

Since then, "Australian exports to China have grown about three times as fast as Australian exports to the rest of the world – and that's in a commodity market that's soft," said Peter Drysdale, head of the East Asian Bureau of Economic Research at Australian National University. As tariffs fell, exports of wine jumped 40 per cent in a single year.

In New Zealand, exports to China have nearly quadrupled since free trade began in 2008.

For that country's farmers, free trade came at almost exactly the right time, coinciding with a huge rise in China's appetite for imported dairy.

But business has grown beyond milk products. The 2008 deal served as a signal, directing local companies to pay attention to China.

"The number of companies opening up and establishing beachheads in China is large," said Andrew Ferrier, the former chief executive of Fonterra Co-operative Group, the country's biggest company. He is now chair of New Zealand Trade & Enterprise, a government agency that helps local companies go global.

"China has become a mainstream destination for Kiwi companies, that would never have existed without a free-trade agreement – companies of all different sizes."

Nonetheless, both countries have had issues. Chinese authorities have on a number of occasions created unexpected rules or imposed quality-inspection regimes that have blocked some trade.

Such non-tariff barriers can counteract provisions meant to liberalize trade.

"There are some challenges operating in the Chinese market," said Mike Petersen, New Zealand's special agricultural trade envoy.

But, he said, "we have had far greater success resolving those challenges being in a trade agreement with China, rather than being without."

Indeed, "bilateral agreements like this are as much a political document as an economic one. They are very important as a building block to get a robust relationship in place," said Mark Vaile, the former deputy prime minister of Australia who chairs Whitehaven Coal, the country's largest independent coal producer.

That said, negotiating a trade deal is unlikely to be easy. Though the Australian agreement could serve as a template, Canadian leaders have been clear in saying they want a more comprehensive deal. China may want the same.

In some areas, "they will expect to get equivalency with the United States in NAFTA," Mr. Vaile said.

Pursuing such a deal in the midst of NAFTA renegotiations, too, could be "negatively interpreted by the White House," said John Gruetzner, a Canadian with decades of experience in China who is founder of Intercedent, a business investment advisory. He also worries that an agreement on paper will leave unchanged corporate Canada's reticence toward China.

"Canada also needs to design and implement a detailed national business plan," he said.

Further complicating matters for Canada are changes taking place in China under President Xi Jinping. Mr. Xi has sought to reinvigorate state-owned enterprises and burnished the role of the Communist Party inside other firms, blurring the line between the private sector and state control. That poses a challenge to free-trade negotiators concerned about opening sectors of Canada to acquisition by arms of the Chinese government.

Mr. Xi, too, has presided over a strategy, called China 2025, that privileges Chinese companies, erecting new barriers to the outside world at the same time it has sought better access to other countries.

"Over time," said Loren Brandt, an economist at the University of Toronto who specializes in China, "the terms and conditions facing multinationals trying to sell into China have been deteriorating."

BLOOMBERG. 27 November 2017. Trade High on Trudeau's Agenda for Visit to China Next Week

- Prime minister seeks to boost business ties on Dec. 3-7 visit

- Canada has explored opening free-trade talks with China

Trade will be high on the agenda when Canadian Prime Minister Justin Trudeau visits China next week in a bid to boost business ties with the world’s second-largest economy.

The Dec. 3-7 trip comes as Trudeau wrestles with free-trade pacts in North America and with other partners in Asia. The visit is aimed at promoting a "progressive trade agenda and tourism initiatives that will create good, middle class jobs" and seeking greater cooperation on fighting climate change, according to a statement Sunday from Ottawa.

“A closer relationship also means more opportunity to hold regular, frank dialogue on human rights issues like good governance, freedom of speech, and the rule of law,” Trudeau said in the statement. “I look forward to meeting again with China’s leaders to strengthen our relationship and set the stage for even greater trade and investment cooperation.”

Canada has explored opening full-blown free trade talks with China, and the National Post newspaper earlier this month cited unidentified diplomatic sources as saying the next trip there would open those discussions. But Sunday’s statement didn’t mention this, and Trudeau in the past has suggested an agreement with China could be difficult because of differences over human rights and other issues.

"The feasibility study and exploratory talks are almost done," China’s Ministry of Commerce said in response to a request for comment about the National Post report. "To facilitate a free-trade agreement between China and Canada is not only significant to deepening bilateral economic ties, it would also be conducive to boosting economic integration in the Asia-Pacific region," according to the statement from the ministry.

"This definitely is significant," said Gai Xinzhe, an analyst at Bank of China’s Institute of International Finance in Beijing. "If it’s announced, it would be China’s first new free-trade talks with a major developed economy following the 19th Party Congress, which emphasized a greater opening up."

China earlier this month announced a major change to give foreign investors more access to its financial system following President Xi Jinping’s pledges for greater reform during a twice-a-decade Communist Party meeting in October. Next year will mark the 40th anniversary of China’s historic reform and opening up that spurred decades of rapid growth.

Trudeau’s office said he’ll meet with President Xi Jinping and Premier Li Keqiang in Beijing, then visit Guangzhou to meet with Li Xi, the recently appointed party chief of Guangdong province, the southern industrial powerhouse with an economy larger than Mexico’s.

Students, Tourism

China was Canada’s second-largest trade partner after the U.S. last year, with almost $70 billion in total trade. Merchandise shipments to China rose 4 percent to almost $21 billion in 2016, led by forest and agricultural products, copper and iron ore, and motor vehicles, according to the government’s statement Sunday. The Asian nation is Canada’s largest and fastest-growing source for foreign students and the third-largest source of tourists, it said.

Canadian trade negotiators are already in talks with the U.S. and Mexico on a modernized North American Free Trade Agreement. Canada is also part of the 11-nation Trans-Pacific Partnership, though it has held up a deal to salvage the pact as it pushes for some changes.

The TPP doesn’t include China and is seen as a potential check on the country’s expanding economic clout in the region. Talks on the China-backed Regional Comprehensive Economic Partnership, an alternative trade pact, are set to drag on into next year.

— With assistance by Greg Quinn, and Miao Han

ENERGY

REUTERS. NOVEMBER 27, 2017. Keystone's existing pipeline spills far more than predicted to regulators

Valerie Volcovici, Richard Valdmanis

(Reuters) - TransCanada Corp’s (TRP.TO) existing Keystone pipeline has leaked substantially more oil, and more often, in the United States than indicated in risk assessments the company provided to regulators before the project began operating in 2010, according to documents reviewed by Reuters.

The Canadian company is now seeking to expand the pipeline system linking Alberta’s oil fields to U.S. refineries with its proposed Keystone XL project, which has U.S. President Donald Trump’s backing.

The existing 2,147-mile (3,455 km) Keystone system from Hardisty, Alberta, to the Texas coast has had three significant leaks in the United States since it began operating in 2010, including a 5,000-barrel spill this month in rural South Dakota, and two others, each about 400 barrels, in South Dakota in 2016 and North Dakota in 2011.

Before constructing the pipeline, TransCanada provided a spill risk assessment to regulators that estimated the chance of a leak of more than 50 barrels to be “not more than once every seven to 11 years over the entire length of the pipeline in the United States,” according to its South Dakota operating permit.

For South Dakota alone, where the line has leaked twice, the estimate was for a “spill no more than once every 41 years.”

The spill risk analysis was conducted by global risk management company DNV GL. A spokesman for DNV did not respond to a request for comment.

Members of South Dakota’s Public Utilities Commission told Reuters last week they could revoke TransCanada’s operating permit if an initial probe of last week’s spill shows it violated the terms of the license.

Those terms include requirements for standards for construction, regular inspections of pipeline infrastructure, and other environmental safeguards.

“They testified that this is going to be a state-of-the-art pipeline,” said one of the commissioners, Gary Hanson. “We want to know the pipeline is going to operate in a fashion that is safe and reliable. So far it’s not going well.”

TransCanada shut a section of the line while it cleans up the leak, which occurred near the town of Aberdeen on Nov. 16. An official did not respond to a request for comment.

The spill took place days before regulators in neighboring Nebraska approved a route for TransCanada’s proposed Keystone XL pipeline through the state, lifting the last major regulatory hurdle for the expansion that has been delayed for years by environmental opposition.

Trump handed TransCanada a presidential permit for Keystone XL in March, reversing former President Barack Obama’s decision to reject the line on economic and environmental grounds, saying that it would create jobs and boost national security.

TransCanada’s spill analysis for Keystone XL, which would cross Montana, South Dakota and Nebraska, estimates 2.2 leaks per decade with half of those at volumes of 3 barrels or less. It estimated that spills exceeding 1,000 barrels would occur at a rate of once per century.

Reporting by Valerie Volcovici and Richard Valdmanis

FINANCE

BLOOMBERG. 27 November 2017. Canada's Debt Problem Gets Helping Hand From Economic Boom

By Chris Fournier and Erik Hertzberg

- Bank of Canada releases Financial System Review on Tuesday

- Worries about impact of higher rates could impede central bank

There are two things that could impede Bank of Canada Governor Stephen Poloz from raising interest rates further in the coming months: worries about the financial system’s ability to cope with higher borrowing costs and concern that plenty of slack remains in the economy.

By the end of this week, the picture should be at least a little clearer on both fronts.

On Tuesday, the central bank’s semi-annual report on financial stability will reveal its thinking about risks such as how vulnerable are highly indebted households to a major housing correction. That’s followed Friday by Statistics Canada’s gross domestic product numbers for the third quarter and October jobs data that will show the extent to which the economy continues to eat into its spare capacity.

The reports are widely seen reinforcing market expectations for continued interest rate increases, but only gradually as the Bank of Canada tiptoes its way to more normal levels.

Poloz’s main message at his last Financial System Review in June -- which came just before his first rate increase in seven years -- was that despite an unsustainable jump in Toronto home prices earlier this year and the consequent rise in debt levels, the financial system’s resilience was actually strengthening on the back of an improving economy.

And since then, Canada’s economy has done even better than Poloz had thought at the time.

Cool Housing

While economists expect Statistics Canada to report a slowdown to 1.8 percent annualized growth in the third quarter, growth in the second quarter turned out to be a much stronger 4.5 percent and the economy is on pace for 3 percent growth for all of 2017.

Toronto’s housing market, meanwhile, is cooling after Ontario imposed a foreign-buyer tax and the country’s main financial regulator tightened mortgage-qualification rules.

Stronger economic growth and cooler housing should mean -- in the eyes of policy makers -- the financial system has only become more resilient over the past six months.

Of course, what has changed since June is that Poloz raised the central bank’s key interest rate twice, and the Bank of Canada has said it’s monitoring closely how the higher borrowing costs will impact the economy. It’s one of the reasons the central bank claims it will remain cautious on future hikes.

Soft Landing

But the initial signs should be comforting.

A soft landing seems to be playing out in Toronto’s housing market and households are hardly slowing their credit growth.

Year-over-year benchmark home price gains in Toronto averaged 27 percent in the first six months of 2017, according to the city’s realtor board. Since June, that average has halved to 13.6 percent. Vancouver’s housing market underwent a similar slowdown after a foreign-buyer tax was imposed in August 2016, and is now recovering.

Stronger demand and tighter supply mean the Toronto and Vancouver markets are “still on an upward trajectory, but it’s on a more stable upward trajectory,” said Royce Mendes, an economist at CIBC World Markets. New regulations in places like Toronto and Vancouver “will be more like a bump in the road than a car driving into a sink hole.”

Household credit data -- the latest were released Friday -- show year-over-year growth still hovering at the 5.5 percent range it’s averaged over the past 18 months, with consumer credit gains offsetting slowing residential loan borrowing.

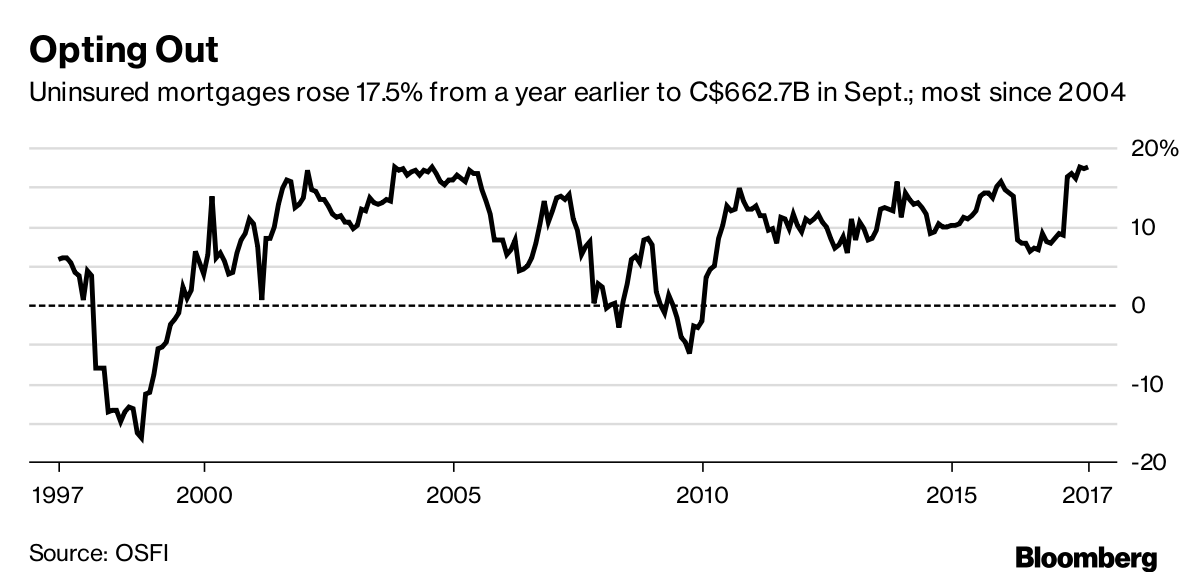

Uninsured Mortgages

One issue likely to remain an area of concern is the growing share of uninsured mortgages, which is being fueled by higher Toronto and Vancouver home prices and tighter qualification rules for insured mortgages.

Specifically, the central back said in its June FSR that it worries some home buyers are finding new ways to finance larger deposits -- so-called co-lending arrangements -- to skirt the tougher qualification rules. Essentially, they are borrowing to finance larger down payments.

The latest data suggest the uninsured market has only gotten larger since the June FSR. As of September the number of uninsured mortgages in Canada was C$662.7 billion ($437 billion), up 17.5 percent from a year earlier, the largest year-over-year increase since 2004. Uninsured mortgages now represent 48 percent of outstanding mortgages, from 36 percent just five years earlier.

Last month, the Office of the Superintendent of Financial Institutions also stepped in to make it harder for home buyers to qualify for an uninsured mortgage. The issue is likely to be top-of-mind at the central bank, if tighter regulations of the federally regulated sector are only pushing borrowers to private lenders outside of the regulated space.

“You’re kind of back to these non-banks and these provincially-regulated institutions apparently just skating along,” said Eric Lascelles, chief economist at RBC Global Asset Management. “There could be some talk about the composition of the financial sector and just where the risk is accruing. It’s still a fairly serious risk.”

Household Debt

The Bank of Canada sometimes comes under criticism for its role in fueling all this household debt, with some suggesting the central bank should stop worrying about the impact of raising interest rates and hike more aggressively in order to curb borrowing more quickly.

This month, the Organization for Economic Cooperation and Development flagged Canada as leading the advanced and developed world in household borrowing, and how that poses a risk to growth. Canada currently has the second-highest gross debt to income ratio in the Group of 20, the International Monetary Fund reported in October.

Canada’s debt addiction is frequently the subject of such warnings, yet CIBC’s Mendes says they’re misleading. He says the overall economic backdrop in Canada is much better than in other countries with less debt.

“Despite the fact that we have a high level of household debt or high ratio of household debt to income, the quality of that debt is probably pretty high compared to other nations, and that’s one reason to have some confidence in Canada,” he said.

For example, the risks are nowhere near where they were in the U.S. before the financial crisis, according to Mendes. He says the proportion of non-prime mortgage origination is about 10 percent of the total, compared with 33 percent in the U.S. before the crash.

“Some of these international organizations make too big a deal of this one metric,” Mendes said. “It’s not the be all and end all of economics. It also doesn’t tell you the distribution of the debt. If all the debt is held by people with really well-paying jobs and lots of money in the bank, then that doesn’t really matter.”

The Bank of Canada publishes its Financial Stability Report on Tuesday at 10:30 a.m. in Ottawa, and Statistics Canada’s releases data on GDP and the labor market Friday at 8:30 a.m.

HOUSING

Employment and Social Development Canada. 2017-11-24. Canada’s National Housing Strategy

Canada’s National Housing Strategy

The National Housing Strategy is a part of a long-term vision to strengthen the middle class, promote sustainable growth for Canadians, and lift more Canadians out of poverty.

The Strategy – funded through new and existing programs – follows a human rights-based approach, and includes a National Housing Co-Investment Fund, community housing initiatives, and the Canada Housing Benefit.

A human rights-based approach to housing

Canadians deserve safe and affordable housing.

The National Housing Strategy will help address a range of housing needs, from shelters and community housing, to affordable rental and homeownership. It will promote:

- Accountability

- New legislation that promotes a human rights-based approach to housing and prioritizes the housing needs of Canada’s most vulnerable

- A federal housing advocate to advise and identify actions to address systemic barriers faced by vulnerable groups

- Participation and inclusion

- A National Housing Council with a diverse membership that will provide advice to CMHC and the responsible Minister

- A Community-Based Tenant Initiative that will support grassroots organizations by providing information and resources to tenants facing barriers in accessing community and affordable housing

- A public engagement campaign to highlight the benefits of inclusive communities and housing to begin in 2020

National Housing Co-Investment Fund

The National Housing Co-Investment Fund will provide $15.9 billion – including $4.7 billion in contributions and $11.2 billion in low interest loans – to repair existing rental housing and develop new affordable housing. The Fund is expected to create up to 60,000 new homes and repair up to 240,000 existing community homes.

The Fund will involve partnerships with – and investments from – the provinces and territories, municipalities, non-profits, co-operatives, and the private-sector. It will provide:

· More shelter spaces for survivors of violence

· Transitional and supportive housing for those in need

· New and repaired affordable and community housing

· Help to make homeownership more affordable for modest income earners

The Fund will also support Canada’s climate change goals, promote technologies that decrease the impact of housing on the environment, and improve the accessibility of housing for people with disabilities.

To encourage the development of sustainable, accessible, mixed-income, and mixed-use developments and to maximize the impact of this Fund, the Government of Canada will transfer up to $200 million in federal lands to housing providers. Funding will also be provided for environmental remediation, renovations, or retrofits to ensure surplus federal buildings are suitable for use as housing.

Canada Housing Benefit

The federal government will invite provinces and territories to partner on a jointly funded $4-billion Canada Housing Benefit.

To be launched in 2020, the Canada Housing Benefit will provide affordability support directly to families and individuals in housing need, including those currently living in social housing, those on a social housing wait-list and those housed in the private market but struggling to make ends meet.

The Government estimates that the Canada Housing Benefit will deliver an average of $2,500 per year to each recipient household. Over time, the Canada Housing Benefit will grow to support at least 300,000 households across the country.

Employment and Social Development Canada. 2017-11-24. Canadians get affordable housing help. Plan calls for significant investments in affordable units and repairs to existing units

THUNDER BAY, Ontario - All Canadians need and deserve housing that is safe and affordable. A home makes Canadians feel more secure, making it easier to raise healthy children, pursue an education, and gain employment.

The Honourable Patty Hajdu, Minister of Employment, Workforce Development and Labour, on behalf of the Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development, in Thunder Bay, today shared details of the 10-year, $40 billion National Housing Strategy that will help reduce homelessness and improve the availability and quality of housing for Canadians in need.

Across Canada, 1.7 million Canadians are in need of core housing. To help address this, the Strategy has set bold goals including:

- reducing chronic homelessness by 50 per cent;

- removing more than 530,000 households from housing need;

- creating four times as many new housing units as built under federal programs from 2005 to 2015;

- repairing three times as many existing housing units as repaired under federal programs from 2005 to 2015; and

- protecting an additional 385,000 households from losing an affordable place to live.

The National Housing Strategy is meeting the needs of Canadians, including seniors, Indigenous Peoples, survivors of family violence, people with disabilities, refugees, veterans, and those grappling with homelessness. It will promote diverse communities and encourage the construction of homes that are sustainable, accessible, mixed-income, mixed-use, and located near transit, work, and public services. In response to calls from housing advocates, service providers and feminist leaders, the Strategy commits to ensuring that at least 25% of funds go to projects for women, girls and their families.

This Strategy – built by and for Canadians – sets a long-term vision for housing in Canada with unprecedented investments and new programs that will deliver real results for Canadians working hard to improve their quality of life.

This Strategy will focus on the needs of the most vulnerable through a human-rights-based approach to housing. Within the next year, legislation will be introduced and will obligate the federal government to maintain a National Housing Strategy and report to Parliament on housing targets and outcomes.

The federal government will work with provinces and territories to develop a $4 billion Canada Housing Benefit, which will be launched in 2020 to respond to local housing needs and priorities. This will be a significant new tool to address challenges of housing affordability in communities across the country. It will provide an estimated average of $2,500 per year to each household recipient, assisting at least 300,000 families when fully implemented. The benefit is delivered directly to individuals as a portable benefit they can use to help with the costs of housing.

Plan calls for significant investments in affordable units and repairs to existing units

THUNDER BAY, Ontario - All Canadians need and deserve housing that is safe and affordable. A home makes Canadians feel more secure, making it easier to raise healthy children, pursue an education, and gain employment.

The Honourable Patty Hajdu, Minister of Employment, Workforce Development and Labour, on behalf of the Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development, in Thunder Bay, today shared details of the 10-year, $40 billion National Housing Strategy that will help reduce homelessness and improve the availability and quality of housing for Canadians in need.

Across Canada, 1.7 million Canadians are in need of core housing. To help address this, the Strategy has set bold goals including:

- reducing chronic homelessness by 50 per cent;

- removing more than 530,000 households from housing need;

- creating four times as many new housing units as built under federal programs from 2005 to 2015;

- repairing three times as many existing housing units as repaired under federal programs from 2005 to 2015; and

- protecting an additional 385,000 households from losing an affordable place to live.

The National Housing Strategy is meeting the needs of Canadians, including seniors, Indigenous Peoples, survivors of family violence, people with disabilities, refugees, veterans, and those grappling with homelessness. It will promote diverse communities and encourage the construction of homes that are sustainable, accessible, mixed-income, mixed-use, and located near transit, work, and public services. In response to calls from housing advocates, service providers and feminist leaders, the Strategy commits to ensuring that at least 25% of funds go to projects for women, girls and their families.

This Strategy – built by and for Canadians – sets a long-term vision for housing in Canada with unprecedented investments and new programs that will deliver real results for Canadians working hard to improve their quality of life.

This Strategy will focus on the needs of the most vulnerable through a human-rights-based approach to housing. Within the next year, legislation will be introduced and will obligate the federal government to maintain a National Housing Strategy and report to Parliament on housing targets and outcomes.

The federal government will work with provinces and territories to develop a $4 billion Canada Housing Benefit, which will be launched in 2020 to respond to local housing needs and priorities. This will be a significant new tool to address challenges of housing affordability in communities across the country. It will provide an estimated average of $2,500 per year to each household recipient, assisting at least 300,000 families when fully implemented. The benefit is delivered directly to individuals as a portable benefit they can use to help with the costs of housing.

“Our Government is establishing a federal leadership role in housing. The National Housing Strategy will create a new generation of housing in Canada. It will promote diverse communities and will build housing that is sustainable, accessible, mixed-income and mixed-use that will be located near transit, work and public services.”

- Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development and Minister Responsible for Canada Mortgage and Housing Corporation

“This truly is an historic announcement that will help create new generation of housing for Canadians. Housing is a key social determinant of health and is critical in helping more people succeed. This strategy help ensure we improve a number of outcomes for Canadians, starting with the most vulnerable...”

– Honourable Patty Hajdu, Minister of Employment, Workforce Development, and Labour

Quick Facts

- The National Housing Strategy – Canada’s first ever – was developed through consultations with Canadians from all walks of life: people who have experienced barriers to good housing, experts, stakeholders, think tanks, as well as provinces and territories and municipalities.

- Over the next 10 years, the Strategy – which will be in part funded jointly by the federal, provincial, and territorial governments – will help reduce homelessness and the number of families living in housing need, and will help strengthen the middle class.

- Investment under the National Housing Strategy includes:

-

- $15.9-billion for a new National Housing Co-Investment Fund

- $8.6-billion for a new Canada Community Housing Initiative in partnership with provinces and territories, and $500 million through a new Federal Community Housing Initiative

- $4-billion for a new Canada Housing Benefit to be launched in 2020 in partnership with provinces and territories

- $2.2-billion to reduce homelessness

- $300-million in additional federal funding to address housing needs in Canada’s North.

- $241-million for research, data and demonstrations.

-

- In recognition of the significant amount of new housing units to be built and repaired through the federal Co-Investment Fund, the Strategy also includes ambitious targets to reduce greenhouse gas emissions, and ensure accessibility in building design.

- The Government of Canada is also working with Indigenous leaders to co-develop distinctions-based housing strategies with First Nations, Inuit, and Métis Nation that will be founded on the principles of self-determination, reconciliation, respect, and cooperation.

________________

LGCJ.: