CANADA ECONOMICS

ECONOMY

StatCan. 2017-11-02. Canadian Economic News, October 2017. October 2017 edition

The October issue of Canadian Economic News is now available.

Canadian Economic News provides a concise monthly summary of selected Canadian economic events, and international and financial market developments, by calendar month.

Note

Canadian Economic News is intended to provide contextual information to support users of economic data published by Statistics Canada. In identifying major events or developments, Statistics Canada is not suggesting that these have a material impact on the economic data published for a particular reference month.

All information presented is obtained from publicly available news and information sources and does not reflect any protected information provided to Statistics Canada by survey respondents.

This module provides a concise summary of selected Canadian economic events, as well as international and financial market developments by calendar month. It is intended to provide contextual information only to support users of the economic data published by Statistics Canada. In identifying major events or developments, Statistics Canada is not suggesting that these have a material impact on the published economic data in a particular reference month.

Canadian Economic News, October 2017 edition

All information presented here is obtained from publicly available news and information sources, and does not reflect any protected information provided to Statistics Canada by survey respondents.

Resources

- Calgary-based Cenovus Energy Inc. announced it had entered into an agreement to sell its Palliser crude oil and natural gas assets in southeastern Alberta to Calgary-based Torxen Energy and Schlumberger Limited of Texas for cash proceeds of $1.3 billion. Cenovus said the sale is expected to close in the fourth quarter of this year, subject to customary closing conditions.

- The U.S. State Department issued a Presidential Permit that granted Enbridge Energy, Limited Partnership, permission to operate and maintain pipeline facilities at the border of the United States and Canada at Neche, North Dakota, for the transport of crude oil and other hydrocarbons between the United States and Canada. Enbridge said the Line 67 Pipeline currently operates under an existing Presidential Permit that was issued by the U.S. State Department in 2009, and that the 2017 permit authorizes Enbridge to fully utilize its capacity across the border.

- Calgary-based TransCanada Corporation announced it will no longer be proceeding with its proposed Energy East Pipeline and Eastern Mainline projects.

Manufacturing

- Unifor announced on October 13th that a tentative agreement had been reached between Unifor Local 88 representing workers at CAMI Automotive in Ingersoll, Ontario, and General Motors of Canada, ending a strike at CAMI that began on September 17th. Unifor Local 88 members working at CAMI ratified the agreement on October 16th.

- On October 6th, the U.S. Department of Commerce (DOC) announced its affirmative preliminary determination in the antidumping duty (AD) investigation of imports of 100- to 150-seat large civil aircraft from Canada. The DOC has applied a 79.82% antidumping duty, and will instruct U.S. Customs and Border Protection to collect deposits from importers based on this preliminary rate. Combined with the countervailing duties of 219.63% announced on September 26th, total duties on imports of 100- to 150-seat large civil aircraft from Canada are approximately 300%. The DOC said it is scheduled to announce its final determination on or about December 19, 2017.

- Bombardier Inc. announced on October 16th that it had signed an agreement with France-based Airbus SE to become partners on the C Series aircraft programme. Bombardier said Airbus will provide procurement, sales and marketing, and customer support expertise to the C Series Aircraft Limited Partnership (CSALP) and, at closing, Airbus will acquire a 50.01% interest in CSALP. Bombardier also said that CSALP headquarters and primary assembly are to remain in Québec, and that a second Final Assembly Line for the C Series will be located at Airbus' manufacturing site in Alabama. The company said completion of the transaction is expected for the second half of 2018, subject to regulatory approvals.

- Montreal-based Saputo Inc. announced it had entered into an agreement to acquire the business of Murray Goulburn Co-Operative Co. Limited (MG) of Australia, a producer of dairy foods, for $1.29 billion. The company said the transaction is expected to close in the first half of calendar year 2018 subject to the approval of MG shareholders and customary conditions.

Retail

- Toronto-based Sears Canada Inc. announced it had received approval from the Ontario Superior Court of Justice to proceed with a liquidation of all its inventory and furniture, fixtures and equipment located at its remaining stores. Liquidation sales commenced on October 19th and the Court has extended the Stay Period to January 22, 2018. As of June, 2017, Sears Canada employed approximately 17,000 individuals across Canada, including 2,900 positions that the company announced it was planning to reduce at that time.

- METRO INC. and The Jean Coutu Group (PJC) Inc., both of Montreal, announced they had entered into a definitive combination agreement pursuant to which METRO will acquire all of the outstanding Jean Coutu Group Class A subordinate voting shares and outstanding Class B shares, representing a total consideration of approximately $4.5 billion. The companies said the transaction is expected to close in the first half of 2018, subject to regulatory and Jean Coutu Group shareholder approvals.

- Washington-based Amazon.com Inc. announced plans to open its seventh Canadian fulfillment centre to be located in the greater Calgary region's Rocky View community. The company said the facility will create more than 750 new full-time associate roles.

Finance and Insurance

- The Office of the Superintendent of Financial Institutions Canada (OSFI) announced it had published the final version of Guideline B-20 – Residential Mortgage Underwriting Practices and Procedures – that now requires the minimum qualifying rate for uninsured mortgages to be the greater of the five-year benchmark rate published by the Bank of Canada or the contractual mortgage rate +2%. OSFI said the revised Guideline comes into effect on January 1, 2018, and applies to all federally regulated financial institutions.

- Toronto-based TMX Group Limited announced it had entered into an agreement to acquire Trayport Holdings Limited of the United Kingdom, and its U.S.-based affiliate, Trayport Inc., from Intercontinental Exchange, Inc. for $931 million in total consideration. TMX Group said that in conjunction with the proposed acquisition of Trayport it has agreed to sell Natural Gas Exchange Inc. and Shorcan Energy Brokers Inc., valued at a combined $339 million.

Other news

- The Government of Canada tabled its Fall Economic Statement on October 25th which included proposals to make annual cost of living increases to the Canada Child Benefit starting in July 2018, to enhance the Working Income Tax Benefit by $500 million annually, and to lower the small business tax rate from 11% in 2015 to 10% effective January 1, 2018, and to 9% effective January 1, 2019. The Government forecasts a $19.9 billion deficit in 2017-2018 and economic growth of 3.1% in 2017 and 2.1% in 2018.

- The Bank of Canada maintained the target for the overnight rate at 1.00%. The last change in the target for the overnight rate was a 25 basis-point increase announced in September 2017.

- The following provinces increased the minimum wage effective October 1st: Manitoba, from $11.00 to $11.15 per hour; Ontario, from $11.40 to $11.60 per hour; Saskatchewan, from $10.72 to $10.96 per hour; and Alberta, from $12.20 to $13.60 per hour.

- The fourth round of negotiations between Canada, the United States and Mexico pursuant to the renegotiation of the North American Free Trade Agreement took place in Washington, DC from October 11-17.

- On October 16th, the Ontario Public Service Employees Union (OPSEU) announced that more than 12,000 Ontario public college faculty had taken strike action.

- Toronto-based Aecon Group Inc. and CCCC International Holding Limited (CCCI) of China announced they had entered into a definitive agreement under which CCCI will acquire all of the issued and outstanding common shares of Aecon for an enterprise value of $1.51 billion. The companies said they expect to close the transaction by the end of the first quarter of 2018, subject to Aecon shareholder approval and applicable government and regulatory approvals.

United States and other international news

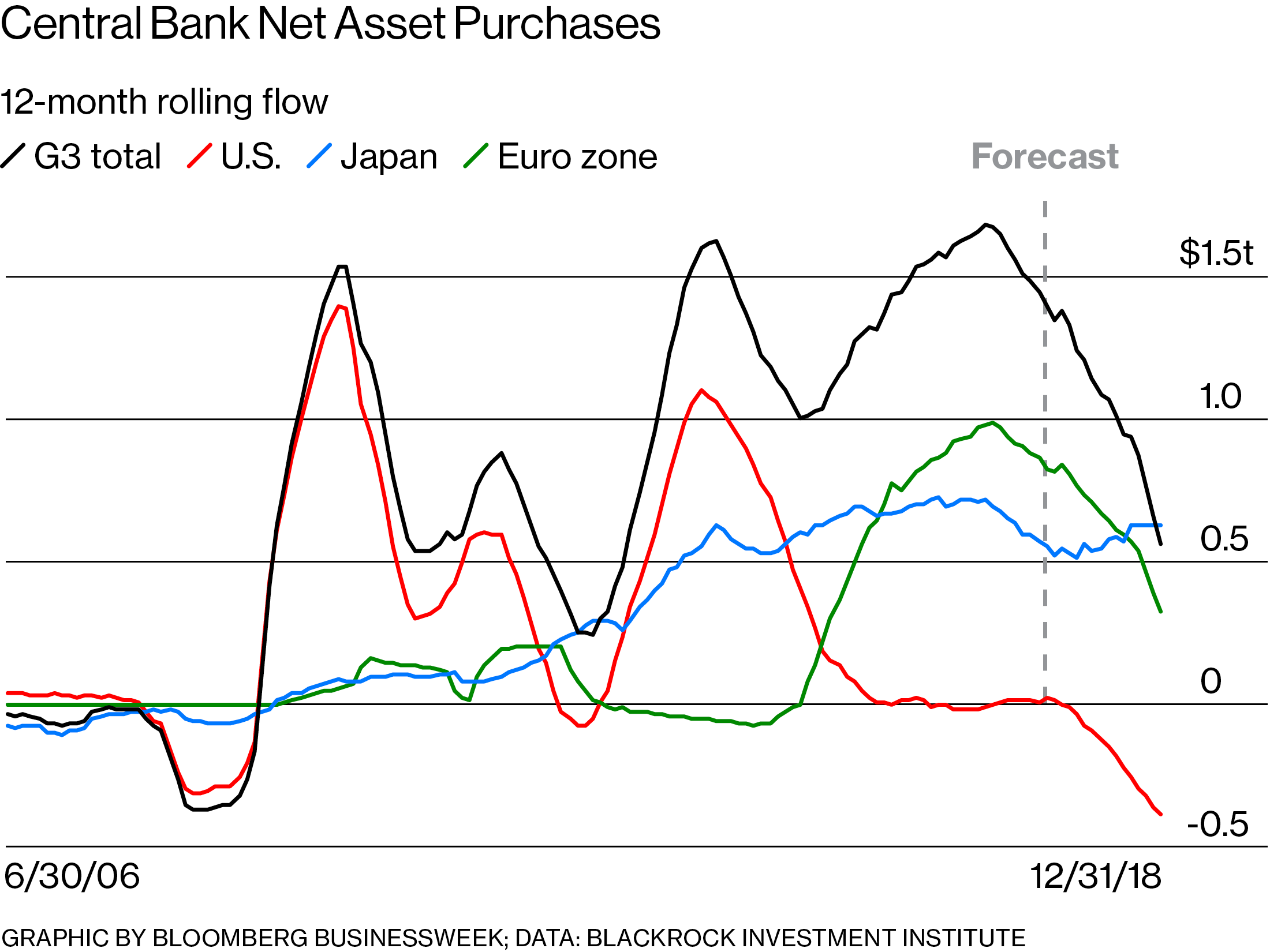

- The European Central Bank (ECB) left the interest rate on the main refinancing operations of the Eurosystem unchanged at 0.00%, and the interest rates on the marginal lending facility and the deposit facility unchanged at 0.25% and -0.40%, respectively. The ECB also said that net asset purchases will continue at a monthly pace of €60 billion until the end of December 2017, and €30 billion from January 2018 until the end of September 2018.

- The Reserve Bank of Australia maintained the cash rate at 1.50%. The last change in the cash rate was a 25 basis point reduction in August 2016.

- Sweden's Riksbank left its main interest rate, the repo rate, unchanged at -0.5%. The last change in the repo rate was a 15 basis point cut in February 2016. The Riksbank also said the purchases of government bonds will continue during the second half of 2017, as decided in April.

- The Bank of Japan (BoJ) announced it will continue to apply a -0.1% interest rate to the Policy-Rate Balances in current accounts held by financial institutions at the BoJ. The BoJ also said it would continue to purchase Japanese government bonds (JGB) so that 10-year JGB yields will remain at around zero percent.

- Michigan-based General Motors Co. announced it will introduce two new all-electric vehicles in the next 18 months, and that these will be the first in at least 20 new all-electric vehicles that will launch by 2023.

- Michigan-based Ford Motor Company announced that as part of its plan to reduce automotive cost growth through 2022, the company is targeting USD $10 billion in incremental material cost reductions and will reduce engineering costs by USD $4 billion from planned levels over the next five years. Ford also said it is reducing internal combustion engine capital expenditures by one-third and redeploying that capital into electrification – on top of the previously announced USD $4.5 billion investment. The company said this builds on Ford's earlier commitment to deliver 13 new electric vehicles in the next five years.

- California-based Cisco Systems, Inc. and BroadSoft, Inc. of Maryland, a communications software and service provider, announced a definitive agreement for Cisco to acquire BroadSoft for an aggregate purchase price of approximately USD $1.9 billion net of cash. The companies said the acquisition is expected to close during the first quarter of calendar year 2018, subject to customary closing conditions and regulatory review.

Financial market news

- Crude oil (West Texas Intermediate) closed at USD $54.15 on October 30th, up from USD $51.67 at the end of September. The Canadian dollar closed at 77.90 cents U.S. on October 30th, down from 80.13 cents U.S. on September 29th. The S&P/TSX closed at 16,002.78 on October 30th, up from a closing value of 15,634.94 at the end of September.

FULL DOCUMENT: http://www.statcan.gc.ca/eng/dai/btd/cen/oct2017

Department of Finance Canada. November 1, 2017. Minister of Finance Highlights Plan to Double Down on Progress for Middle Class

Ottawa, Ontario – When you have an economy that works for the middle class and those working hard to join it, you have a country that works for everyone. The investments the Government of Canada has made in Canadians and their families, in our communities and in our economy are working. Canada now has the fastest growing economy in the G7 and among the best job growth in a decade, giving our Government the ability to reinvest the benefits of that growth back into the people who contributed most to that success.

The Government knows that middle class families and small businesses are the cornerstone of the Canadian economy, and that tax fairness is essential to build sustainable growth. Since coming into office, the Government has focused on transforming Canada's economy by investing in our people and putting more money in the pockets of those who need it most, giving them confidence in our economy and in their future, while creating more opportunities and good, well-paying jobs.

Finance Minister Bill Morneau appeared today at the Standing Senate Committee on National Finance where he highlighted the next steps to help the middle class by lowering taxes on small business, while ensuring the system is not used to reduce personal income tax obligations for high-income earners.

Minister Morneau spoke about the proposed measures to address tax planning by owners of Canadian-controlled private corporations (CCPCs), as well as the Government's plan to reduce the federal small business tax rate to 9 per cent by 2019, all of which were included in the Fall Economic Statement.

The Fall Economic Statement proposes to:

- Strengthen the Canada Child Benefit (CCB) by making annual cost of living increases to the CCB starting in July 2018—two years ahead of schedule. For a single mother of two children making $35,000, a strengthened CCB will contribute $560 in the 2019–20 benefit year towards the cost of raising them. That means more money, tax-free, for books, skating lessons or warm clothes for winter. The added confidence the CCB brings to families has proven to have an immediate positive impact on economic growth.

- Put more money in the pockets of low-income workers—including young single workers just getting a foothold in the workforce—by further enhancing the Working Income Tax Benefit by an additional $500 million per year, starting in 2019.

- Help small businesses invest, grow and create jobs by lowering the small business tax rate to 10 per cent, effective January 1, 2018, and to 9 per cent, effective January 1, 2019. This will provide a small business with up to $7,500 in federal corporate tax savings per year to reinvest in and grow their business, and $1,600 per year for the average small business.

- Make important changes to the tax system that will ensure Canada's low corporate tax rates go towards supporting businesses, not to providing unfair tax advantages to high-income and wealthy Canadians.

Quote

"Our plan is working. Canada's economy is outpacing all G7 countries, growing faster than it has in a decade. So we are doing more to help those who create growth and drive our economy, with lower taxes on small business, more support for parents, and more money in the pockets of low-income workers. Canadians sent us here to grow the economy in a way that benefits the middle class and that is exactly what we are doing."

- Bill Morneau, Minister of Finance

Quick Facts

- All corporations, including CCPCs, benefit from a combined general corporate tax rate that is 12 percentage points lower than Canada's largest trading partner, the United States.

- The Government intends to provide support to small businesses in Canada through a further reduction of the federal small business tax rate to 9 per cent.

- As a result, the combined federal-provincial-territorial average tax rate for small business would be lowered to 12.9 per cent from 14.4 per cent, by far the lowest in the G7 and fourth lowest among Organisation for Economic Co-operation and Development countries. Small businesses can retain more of their earnings to reinvest, supporting the growth of their business and job creation.

- CCPCs with taxable passive income above the $50,000 threshold in 2015 represented 3 per cent of the CCPC population, but earned more than 88 per cent of total taxable passive income. The threshold is equivalent to $1 million in savings, based on a nominal 5-per-cent rate of return. The vast majority of businesses will not be affected by the Government's tax changes.

- In Canada, 80 per cent of passive investment income is earned by 2 per cent of all CCPCs.

- More than 80 per cent of passive investment income is earned by CCPC owners making more than $250,000 per year.

- An increasing number of Canadians—often high-income individuals—are using private corporations in ways that allow them to reduce their personal taxes. In some cases, someone earning $300,000 with a spouse and two adult children can use a private corporation to get tax savings that amount to roughly what the average Canadian earns in a year.

- Only an estimated 50,000 family-owned private businesses are sprinkling income. This represents only a small fraction—around 3 per cent—of CCPCs.

Obs.: What are CCPCs?

Canadian Controlled Private Corporation (CCPC).

Income Tax Act s. 125, s. 110.6(2.1), s. 121, s. 82(1)(b)(ii)

A CCPC is a private corporation which is controlled by Canadian residents. A corporation will not qualify as a CCPC if it is controlled directly or indirectly by a public corporation or non-residents, or a combination of the two.

A CCPC is eligible for the small business deduction, which provides a reduction in corporate income tax on active business income.

Dividends received from a CCPC are eligible for the small business dividend tax credit.

When the shares of a qualifying CCPC are sold, the shareholder(s) may avoid capital gains tax by utilizing all or part of the $800,000+ lifetime capital gains exemption (LCGE).

On July 18, 2017, the federal government tabled legislative proposals that restricted income sprinkling by CCPCs, limited the use of the LCGE, and increasing the tax paid on passive income earned by a CCPC. A consultation period ensued, and on October 16, 2017 the government started announcements about revisions to these measures, including the abandonment of proposed changes to the LCGE.

FULL DOCUMENT: http://www.fin.gc.ca/n17/17-107-eng.asp

BOMBARDIER

THE GLOBE AND MAIL. NOVEMBER 2, 2017. TRANSPORTATION. Bombardier clinches big C Series sale; cuts delivery goal. Bombardier says it has a firm European order for 31 C Series jets and options for another 30.

NICOLAS VAN PRAET

MONTREAL - Bombardier Inc. has clinched its first major C Series sale in 18 months in what the company says is a prelude for more orders under a new partnership with Airbus Group SE. But it won't deliver as many of its marquée jets this year as previously expected as it works through engine delays from supplier Pratt & Whitney.

The Montreal-based plane and train maker said in a statement Thursday it struck a letter of intent to sell 31 C Series planes to an unnamed customer in Europe. The buyer will also take purchase options on another 30 C Series aircraft. The firm portion of the order is valued at $2.4-billion (U.S.) before the discounts typically given on large-sized orders.

Investors have been waiting for Bombardier to make a sale for its flagship airliner, pushing the stock up nearly 5 per cent in Toronto trading Thursday to $2.91.There had been no significant sale since Delta Air Lines placed an order for 75 C Series jets in April of 2016.

Although the new deal did not come because of the Airbus partnership announced last month, Bombardier chief executive Alain Bellemare said bringing Airbus into the fold is giving customers more confidence to buy.

"It is clearly helping us to accelerate the sales momentum," Mr. Bellemare said on a conference call to discuss third quarter earnings. "We have and still have a number of active campaign ongoing." He declined to give further details.

Mr. Bellemare is now wrapping up the second year of a five-year effort to turn around the Montreal-based transportation company. Since he took the helm, he has cut more than 14,500 jobs, restructured Bombardier's train business, and struck an industry-changing agreement to cede control of the C Series program to Airbus in exchange for its sales and logistics power. Bombardier has no intention of exiting the commercial aerospace business, Mr. Bellemare said Thursday.

Earnings for the three months ended Sept. 30 were mixed.

The company posted a net loss of $117-million or 5 cents a share for the quarter, wider than the same period a year ago. Revenue climbed 3 per cent to $3.8-billion. Stripping out special items, earnings before interest and taxes grew to $165-million, nearly double the tally of last year's third quarter. Profit margins improved in each of Bombardier's four business units. The company burned through $495-million of cash in the quarter.

Bombardier said EBIT for the full year will be at least $630-million, at the upper end of what it previously forecasted. It expects to end fiscal 2017 with $16.3-billion in revenue and using $1-billion in cash. The company had $2.8-billion in short-term capital resources at the end of September and said it was monitoring cash usage closely.

"We are doing what we said we would do," said Bombardier chief financial officer John Di Bert.

Bombardier confirmed suspicions Thursday that it would not meet its previous target to deliver 30 C Series planes this year. Shipment of roughly 10 planes will get pushed into 2018 as the company deals with a shortage of geared turbofan engines supplied by United Technologies Corp.'s Pratt & Whitney unit. That in turn will bite Bombardier's revenue for the year.

Pratt has been wrestling with durability issues on the engines and had warned Oct. 24 that it couldn't meet its commitments to Bombardier this year because it was first fixing engines on planes already in service. Pratt will pay Bombardier a cash advance to help remedy the situation, Bombardier said.

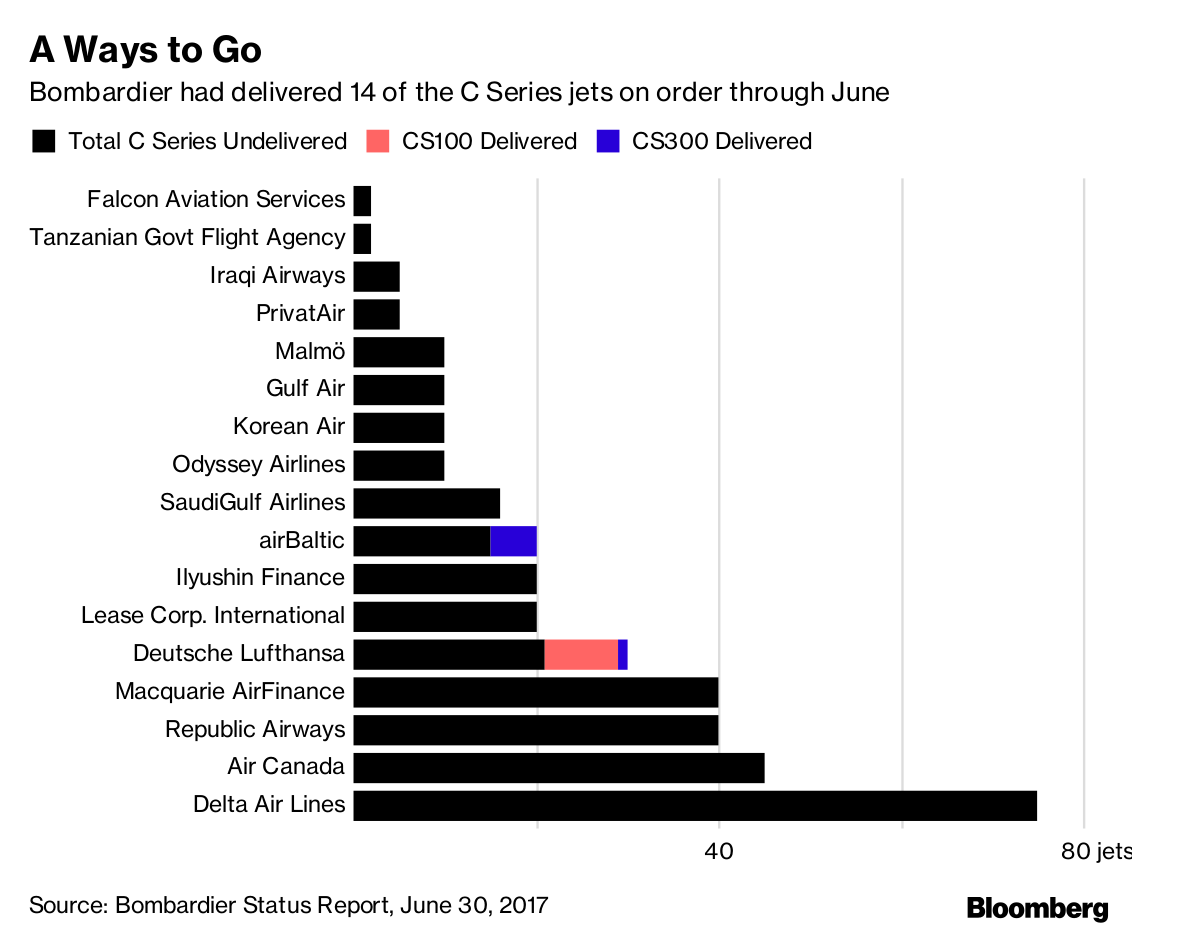

Through June this year, Bombardier has won orders for 360 C Series planes. The company is hoping existing customers will also convert purchase options they hold for the aircraft into firm orders. German carrier Lufthansa AG alone has options on 30 C Series airliners.

Mr. Bellemare plans to boost the company's revenue by roughly 50 per cent from 2016 levels, to $25-billion by 2020, in part by selling more C Series and Global 7000 private jets. The first customers for the Toronto-made Global, the company's biggest ever luxury jet, are scheduled to take delivery of their planes starting in the second half of 2018.

The CEO is also aiming to boost Bombardier's margin on earnings before interest and taxes to between 7 and 8 per cent over that same time, a result that will hinge on getting the C Series to break even between now and then. Plane makers typically experience losses on new aircraft programs as they sort out production inefficiencies and build up the airliner's market pricing after early discounts.

Plenty of skeptics remain about the company's prospects, particularly in the face of much better-capitalized global rivals like U.S. airframe manufacturer Boeing Co.

"This is a business that would not exist if the government wasn't giving them large financial handouts." Kash Pashootan, CEO and chief investment officer at First Avenue Investment Counsel, told BNN this week. "There isn't any sort of clear path to how Bombardier is going to grow."

Bombardier was left odd man out when France's Alstom SA and Germany's Siemens AG said in September they would merger their rail businesses to form a pan-European answer to China's CRRC Corp. Bombardier's train boss, Laurent Troger, subsequently downplayed the importance of the merger on the company's ability to compete. But pension fund Caisse de dépôt et placement du Québec, which holds 30 per cent of Bombardier's train business, is urging the company to find its own partner.

"I think we have to look at everything," Caisse CEO Michael Sabia told reporters in Toronto Wednesday. "Every opportunity that comes up ought to be looked at."

REUTERS. NOVEMBER 2, 2017. Bombardier gets new CSeries jet order, but deliveries cut

Allison Lampert, Nivedita Bhattacharjee

(Reuters) - Bombardier Inc (BBDb.TO) scaled back CSeries jet deliveries by around a third because of engine delays, but said on Thursday it received its first order for the narrowbodies in 18 months, helping send shares up 4 percent.

Engine delays, which reduced CSeries deliveries from 30 to an expected 20 to 22 this year, are a “short-term issue” that supplier Pratt & Whitney is “actively addressing,” Bombardier Chief Executive Alain Bellemare told analysts.

Pratt & Whitney, a division of United Technologies Corp (UTX.N), said in October it was resolving issues with the geared turbofan (GTF) engines that power the CSeries and Airbus A320neo to make them more durable.

Bombardier said the delays would raise its free cash flow usage for 2017 to about $1 billion, at the higher end of its forecast range.

Shares were up 4.7 percent in morning trading to C$2.92.

The Canadian plane-and-train-maker also said it received a letter of intent from an unnamed European customer for 31 firm CSeries orders.

European planemaker Airbus SE (AIR.PA) recently agreed to take a majority stake in the CSeries program for $1, in a deal expected to improve CSeries sales and reduce costs.

Bellemare told analysts the Airbus venture, while boosting “sales momentum” for the CSeries, isn’t directly “linked” to the order which the company was already working on and would be valued at about $2.4 billion based on list prices, with an additional 30 options.

Some analysts were anticipating orders because of increased confidence in the CSeries from the Airbus deal, which closes in 2018. A European customer won’t face potential duties stemming from a trade dispute with Boeing Co. (BA.N)

“We’ll have to see who the new airline is, but it certainly sounds promising, particularly since it isn’t subject to the US duty,” said Teal Group analyst Richard Aboulafia.

Bellemare said the company was weighing strategies like forming partnerships to boost volumes of its smaller aerostructures division, which makes components for planes like the CSeries.

Bombardier reported third-quarter earnings before interest, taxes and special items (EBIT) that surged 90 percent to $165 million and a loss in line with analysts’ expectations.

It expects full-year EBIT of at least $630 million, which is at the high end of its forecast of $580 million to $630 million.

Bombardier, which is in the middle of a five-year turnaround plan after facing a cash crunch in 2015, delivered 31 business jets in the third quarter ended Sept. 30, compared with 36 in the same period last year.

Reporting by Nivedita Bhattacharjee and Allison Lampert; Editing by Bernadette Baum

REUTERS. NOVEMBER 1, 2017. Bombardier should consider rail deal with China's CRRC: Caisse CEO

Matt Scuffham

TORONTO (Reuters) - Bombardier Inc (BBDb.TO) should look at all options for its transportation business including partnering with China’s state-owned CRRC (601766.SS), one of Bombardier’s biggest shareholders said on Wednesday.

“I think we have to look at everything. Every opportunity that comes up ought to be looked at,” Caisse de depot et placement du Quebec [CDPDA.UL] Chief Executive Officer Michael Sabia told reporters when asked about a deal with CRRC.

Germany’s Siemens (SIEGn.DE) and France’s Alstom (ALSO.PA) said they are merging their train manufacturing operations in September. The move will leave Bombardier competing in a market dominated by CRRC, the world’s largest train maker, and a combined Siemens and Alstom group as the second biggest.

Sabia said Bombardier should consider a partnership with CRRC rather than selling the business to the Chinese.

“I think the transportation business is a long-run asset of Bombardier. I don’t see an opportunity or reason to go down the sale path,” he said.

French Finance Minister Bruno Le Maire has said that the combination of Siemens and Alstom could be expanded to include Bombardier and create a business capable of competing with CRRC but Sabia said such a combination would be difficult.

“A three-party dance is a complicated dance. It’s hard not to step on people’s toes,” he said.

“If a door opened and there were an interesting transaction to be done, would we have any objections in principle? No. But those are very difficult to get done.”

The Caisse, which invests on behalf of workers and retirees in the Canadian province of Quebec, took a 30 percent stake in Bombardier’s money-generating rail division in November 2015.

Sabia welcomed an agreement last month for Airbus (AIR.PA) to take a majority stake in Bombardier’s CSeries jetliner program, securing the plane’s future and giving the Canadian firm a possible way out of a damaging trade dispute with Boeing (BA.N) in the U.S. market.

“I think the Airbus transaction was a very positive step. I think it does stabilize the company and I think it gives it a much more powerful platform to continue the development of the CSeries,” he said.

The deal , however, will see Bombardier lose control of a project it developed at a cost of $6 billion.

“The sales machine that is Airbus is something that’s very important in giving that aircraft access to the markets that it needs to have in order for it to be a big commercial success,” Sabia said.

Reporting by Matt Scuffham; Editing by Steve Orlofsky and Sandra Maler

BLOOMBERG. 2 November 2017. Bombardier Wins New C Series Deal to End 18-Month Sales Drought

By Frederic Tomesco

- Company unveils potential deal for at least 31 of marquee jets

- Delivery forecast for plane is cut to 20 to 22 for this year

Bombardier Inc. won the first major sales agreement in 18 months for its beleaguered C Series jet, as it prepares to hand control of the aircraft program to Airbus SE.

An unidentified European customer intends to buy 31 of the all-new planes with options for 30 more, Bombardier said Thursday as it reported earnings. That softened the blow from a cut to the company’s forecast for C Series deliveries this year.

The preliminary deal underscores the brighter outlook for the C Series after production delays and cost overruns marred Bombardier’s $6 billion investment and forced the company to rely on government assistance. Airbus agreed to take a majority stake in the partnership that builds the plane, vowing to cut production costs, win thousands of new orders and move some manufacturing to Alabama to sidestep recently imposed U.S. tariffs on the aircraft.

“This order is definitely getting the market’s attention,’’ said Nick Heymann, an analyst at William Blair & Co. “Their ability to bring home the big orders has been enhanced by the Airbus partnership. People are starting to understand this deal with Airbus has completely changed the market.’’

Bombardier’s widely traded B shares advanced 4 percent to C$2.89 at 10:05 a.m. in Toronto after gaining as much as 6.1 percent for the biggest increase since the Airbus deal was announced two weeks ago. The stock climbed 28 percent this year through Wednesday, compared with the 4.9 percent increase of Canada’s benchmark S&P/TSX Composite Index.

If the European customer finalizes its intent to purchase C Series planes, the deal would mark the first major sale of the aircraft since Delta Air Lines Inc. agreed to buy 75 of the single-aisle jets in April 2016. The only deal since then was a two-plane transaction with Air Tanzania at the end of last year.

Lower Deliveries

The Delta purchase prompted a complaint to the U.S. government by Boeing Co., which said the planes were sold at “absurdly low prices.” In response, the Commerce Department slapped import duties of 300 percent on the C Series, saying Montreal-based Bombardier sold it at less than fair value after receiving illegal government subsidies in Canada.

Bombardier said it would miss this year’s delivery target for the C Series as it grapples with engine delays. Customers will receive only 20 to 22 of the aircraft, down from an earlier plan for about 30, the company said in a statement.

Engine supplier Pratt & Whitney, a division of United Technologies Corp., has been working to overcome durability issues affecting the geared turbofan engines that power the C Series as well as Airbus’s A320neo family of jets. The turbine maker, which reaffirmed its target for 350 to 400 deliveries of the engine this year, is rolling out fixes for the problems.

Because of the delays, Pratt will provide Bombardier with an undisclosed supplier advance starting in the fourth quarter, the Canadian jetmaker said. On a conference call with investors and analysts, Bombardier Chief Executive Officer Alain Bellemare called the delays “a short-term issue that Pratt is actively addressing.”

Sales Hit

Shipping fewer-than-expected C Series jets will dent annual sales by $300 million to $500 million, Chief Financial Officer John Di Bert said. Airplane manufacturers typically collect the bulk of their payments when clients receive their aircraft.

The engine delays will probably crimp 2018 deliveries as well. While Bombardier has said before it would ship 45 to 55 C Series jets in 2018, the actual number is apt to be lower, Di Bert said.

“We need a little bit more work with Pratt to figure out the sequence and the scheduling of engines into the next year,’’ Di Bert said. “My expectation is, we will give you guys a number and it will be something like 40-45 when all is said and done.’’

This year, earnings before interest, taxes and special items will be at least $630 million, at the upper end of the previous forecast range, Bombardier said. Full-year sales will be about $16.3 billion while the company spends about $1 billion of free cash flow. The company burned through $495 million in cash in the third quarter, compared with $320 million a year earlier.

Meeting Estimates

In the third quarter, Bombardier reported an adjusted loss of 1 cent a share, matching the average of analysts’ estimates compiled by Bloomberg. Revenue climbed 2.6 percent to $3.84 billion, while analysts had projected $4.13 billion.

Bombardier had $2.81 billion of available short-term capital resources at the end of September, down from $4.48 billion at the end of last year. The most-recent figure includes $1.84 billion in cash and cash equivalents. Adjusted debt was $9.4 billion.

The company invested over the last decade to develop the C Series, a two-airplane family spanning 108 to 160 seats. The larger of the models overlaps with the smallest commercial jets sold by Airbus and Boeing Co.

The C Series entered commercial service last year at Deutsche Lufthansa AG’s Swiss International unit. The CS100 model has a catalog price of $79.5 million, before the discounts that are customary for aircraft purchases. The CS300 lists at $89.5 million.

Bombardier’s agreement with the European customer covers 31 firm aircraft and options for 30 more. The planemaker expects to cinch the deal by year-end. The firm order would have a list value of about $2.4 billion.

“As Airbus joins the program, and with the C Series continuing to prove itself in service, we expect sales momentum to accelerate quickly,’’ Bellemare said in the statement.

NAFTA

REUTERS. NOVEMBER 1, 2017. NAFTA talks causing business uncertainty: Rio Tinto executive

David Ljunggren

OTTAWA (Reuters) - The current state of talks to update the NAFTA trade pact is creating uncertainty among businesses and could hurt investments and growth, Rio Tinto Aluminium (RIO.L) chief executive Alf Barrios said on Wednesday.

Canada and Mexico say several U.S. proposals for modernizing the North American Free Trade Agreement are unacceptable, prompting increasing concern that Washington could walk away from the trilateral deal.

Rio Tinto exports 75 percent of the aluminum produced at its Canadian plants to the United States and supplies 30 percent of that market’s needs, Barrios told an evening conference organized by the Canadian-American Business Council.

“The negotiation process has created some uncertainty among business on both sides of the border and I think this puts at risk to a certain degree investments and growth,” he said when asked about the NAFTA talks.

U.S. President Donald Trump frequently describes the 1994 pact as a disaster and has threatened to walk away from the deal unless major changes are made.

Company data show Rio Tinto’s Canadian plants accounted for 53 percent of the 3.65 million tonnes of aluminum that the company produced last year.

Barrios said NAFTA had created a predictable business environment that made investment decisions easier and had also solidified ties between Canada and the United States.

“So we’re watching very, very carefully how things evolve ... We encourage the negotiating teams at the table to continue looking at ways to strengthen that relationship,” he said.

Speaking earlier in the day, Bank of Canada Governor Stephen Poloz said the lack of clarity over the NAFTA talks meant companies would put off investment decisions.

Reporting by David Ljunggren; Editing by Michael Perry

REUTERS. NOVEMBER 1, 2017. Bank of Canada's Poloz: NAFTA to delay investment decisions

OTTAWA (Reuters) - The uncertainty around renegotiations of the North American Free Trade Agreement means companies will hold off to make investment decisions down the road, rather than today, Bank of Canada Governor Stephen Poloz said on Wednesday.

Poloz, speaking to lawmakers for a second day in a row, reiterated that the central bank was more focused on the downside risks to inflation and highlighted the unknown factors that will keep the bank cautious on rates for now after two hikes earlier this year.

Reporting by Leah Schnurr and Andrea Hopkins; editing by Diane Craft

INTERNATIONAL TRADE

EDC. NOVEMBER 2, 2017. Feeding China’s Growing Appetite

By Peter G. Hall, Vice President and Chief Economist

This is big. In fact, of all the issues I have covered in the past 10 years – and I have covered a lot of issues – this could be the biggest. And it should come as no surprise that it’s about China. Just when you might have thought that we exhausted the last known superlative to describe a China issue, here’s another. It concerns the 1.3 billion mouths the economy has to feed. Here’s the news: their collective appetite is growing. And keeping that hunger satisfied is going to be one of the greatest challenges, not just for China, but for the world economy, in the coming decades. So, does Canada have a role to play?

First, a few details of the story. The current driver of additional food demand in China is rising wealth. McKinsey estimates that by 2022, just over three-quarters of China’s urban population will have ascended into the middle class, with a comfortable majority being in the upper end of that group. Other estimates put annual growth of the middle class at close to Canadian population. That is staggering. Studies also show that one of the top categories that these neo-wealthy consumers throw more money at is food. What’s even more interesting is that they are very keen on imported food. Trust is a problem in China’s food supply chain. But if product is coming from someplace abroad where food governance is better – like Canada – the interest goes way up.

If so, does Canada have a piece of the action? To say ‘yes’ is a gross understatement. Back in 2000, Canadian food shipments to China were just 3 per cent of our total food exports, a distant third behind Japan. Since then, China’s share has lurched to 11 per cent, vaulting past Japan to take a commanding lead of second place. For the last 16 years, growth in our food exports to China has averaged over 15 per cent annually, triple the rate of growth to the US. Better still, the number is accelerating. Since 2008, yearly growth has averaged 18 per cent, while the US number hasn’t changed. One more fact: since 2000, China has accounted for 17 per cent of the total growth of our food exports abroad. But in the past 8 years, it has risen to over one-quarter of total growth. No country other than the US even comes close. Keep this up and China knocks the US out of top spot in 2033.

What are we shipping to China? The categories are lopsided. The vast bulk of our China-bound agri-food exports (74 per cent) are raw and processed grains and oilseeds, with growth numbers much like the overall stats. If that’s not exactly inspiring, then consider this: rising wealth should mean that higher value-added products are the new up-and-comers. Any hints of that in the data? Check out meat products, number two on the list. They are above average, up 17 per cent annually. But this is changing: in the last 8 years, that number has zoomed up to 27 per cent, lifting its export share to 13 per cent of the total.

Just behind this are fish and fish products. Raw product is where the growth is, with salt water fish up by 24 per cent annually, and aquaculture, still in export infancy, up explosively. Prepared products are rising by double-digits, but below the overall average. That’s not likely to be the case for too long. Well, there are other, much smaller, categories that are also racking up very impressive growth. If that continues, they will also become part of a sector that is only likely to be more dynamic as time rolls on.

How do we know that? The Food and Agriculture Organization estimates that China’s food needs will outstrip its production in certain key food categories, notably pork. The implied growth rates for imports are arresting: double-digits annually through 2030 and beyond. That’s what you get just for showing up; the sky’s the limit if you increase market share!

What’s inspiring about this story is that in many ways, Canada has only just begun. Our foray into China’s food chain is still fairly concentrated, and there’s lots of capacity to up our game. Getting the business requires products appropriate to the market, and high quality standards. Keeping the business requires reliability – which likely means considerable investment.

The bottom line? When it comes to future agri-food sales to China, Canada has a lot going for it. We have the resource. We have the know-how. We have the supporting infrastructure. And this is one of those rare industries in which we actually have the scale to meet China-sized needs. All of these attributes stay parked on the shelf without bold vision. Are we up to it?

SOFTWOOD LUMBER

DoC. USITC. 11/02/2017. U.S. Department of Commerce Finds Dumping and Subsidization of Imports of Softwood Lumber from Canada

Today, the U.S. Department of Commerce announced the affirmative final determinations of the antidumping duty (AD) and countervailing duty (CVD) investigations of imports of softwood lumber from Canada.

While significant efforts were made by the United States and Canada, and the respective softwood lumber industries, to reach a long-term settlement to this on-going trade dispute, the parties were unable to agree upon terms that were mutually acceptable. As a result, the investigations were continued and Commerce reached its final determinations.

“While I am disappointed that a negotiated agreement could not be made between domestic and Canadian softwood producers, the United States is committed to free, fair and reciprocal trade with Canada,” said Secretary Ross. “This decision is based on a full and unbiased review of the facts in an open and transparent process that defends American workers and businesses from unfair trade practices.”

The Commerce Department determined that exporters from Canada have sold softwood lumber the United States at 3.20 percent to 8.89 percent less than fair value. Commerce also determined that Canada is providing unfair subsidies to its producers of softwood lumber at rates from 3.34 percent to 18.19 percent.

As a result of today’s decision, Commerce will instruct U.S. Customs and Border Protection (CBP) to collect cash deposits from importers of softwood lumber from Canada based on the final rates.

In 2016, imports of softwood lumber from Canada were valued at an estimated $5.66 billion.

The petition was filed on behalf of the Committee Overseeing Action for Lumber International Trade Investigations or Negotiations (COALITION), which is an ad hoc association whose members are Plywood filed the case on behalf of its individual members: U.S. Lumber Coalition, Inc. (DC), Collum’s Lumber Products, L.L.C. (SC), Hankins, Inc. (MS), Potlatch Corporation (WA), Rex Lumber Company (FL), Seneca Sawmill Company (OR), Sierra Pacific Industries (CA), Stimson Lumber Company (OR), Swanson Group (OR), Weyerhaeuser Company (WA), Carpenters Industrial Council (OR), Giustina Land and Timber Company (OR), and Sullivan Forestry Consultants, Inc. (GA).

The antidumping duty and countervailing duty laws provide U.S. businesses and workers with an internationally accepted mechanism to seek relief from the harmful effects of dumping unfairly priced and unfairly subsidized imports into the United States.

Enforcement of U.S. trade law is a prime focus of the Trump administration. From January 20, 2017, through November 1, 2017, Commerce has initiated 77 antidumping and countervailing duty investigations – a 61 percent increase from 48 in the previous year.

AD and CVD laws provide U.S. businesses and workers with an internationally accepted mechanism to seek relief from the harmful effects of dumping unfairly priced and unfairly subsidized imports into the United States. Commerce currently maintains 412 AD and CVD orders which provide relief to American companies and industries impacted by unfair trade.

If the U.S. International Trade Commission (ITC) makes affirmative final injury determinations, Commerce will issue AD and CVD orders. If the ITC makes a negative final determination of injury, the investigation will be terminated and no order will be issued.

The U.S. Department of Commerce’s Enforcement and Compliance unit within the International Trade Administration is responsible for vigorously enforcing U.S. trade laws and does so through an impartial, transparent process that abides by international law and is based solely on factual evidence.

Foreign companies that price their products in the U.S. market below the cost of production or below prices in their home markets are subject to AD duties. Foreign companies that receive financial assistance from foreign governments that benefits the production of goods from foreign companies and is limited to specific enterprises or industries, or is contingent either upon export performance or upon the use of domestic goods over imported goods, are subject to CVD duties.

Fact sheet: https://www.commerce.gov/sites/commerce.gov/files/softwood_lumber_canada_ad_cvd_final_fact_sheet.pdf

Global Affairs Canada. November 2, 2017. Statement by Canada on U.S. Duties on Canadian Softwood Lumber

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, and the Honourable Jim Carr, Minister of Natural Resources, today issued the following statement in response to the final determinations by the U.S. Department of Commerce in the countervailing and anti-dumping duty investigations into imports of certain softwood lumber products from Canada:

“The Canadian forest industry sustains hundreds of thousands of good, middle class jobs across our country, including in rural and Indigenous communities. The Government of Canada will continue to vigorously defend our industry against protectionist trade measures. Our forest sector is innovative, environmentally responsible and globally competitive – and it represents 7 percent of our exports and contributes $22.3 billion to Canada’s GDP.

“The U.S. Department of Commerce’s decision on punitive countervailing and anti-dumping duties against Canada's softwood lumber producers is unfair, unwarranted and deeply troubling. That is why we announced an $867 million action plan to support affected workers and communities and to chart a stronger future for our workers.

“We urge the U.S. Administration to rescind these duties, which harm workers and communities in Canada. These duties are a tax on American middle class families too, whose homes, renovations and repairs will only be more expensive. Further, it is clear the tariffs are worsening the lumber supply problem in the United States and forcing U.S. home builders to look overseas to meet their demand for lumber.

“We will forcefully defend Canada’s softwood lumber industry, including through litigation, and we expect to prevail as we have in the past. We are reviewing our options, including legal action through the North American Free Trade Agreement and the World Trade Organization, and we will not delay in taking action.

“We remain in close and regular contact with the provinces, territories, Canadian industry and workers – and we continue to engage our American counterparts to encourage them to come to a durable negotiated agreement on softwood lumber. Minister Carr will also convene the Federal-Provincial Task Force on Softwood Lumber in the coming days to discuss developments.”

- Government of Canada Announces Support for Forest Sector Workers and Communities: https://www.canada.ca/en/natural-resources-canada/news/2017/06/government_of_canadaannouncessupportforforestsectorworkersandcom.html

- Government of Canada Announces Task Force on Softwood Lumber: https://www.canada.ca/en/natural-resources-canada/news/2017/02/government_of_canadaannouncestaskforceonsoftwoodlumber.html

THE GLOBE AND MAIL. NOVEMBER 2, 2017. TRADE. U.S. makes final finding on Canadian softwood imports, sets duties

BRENT JANG, VANCOUVER

ADRIAN MORROW, WASHINGTON

The U.S. Department of Commerce has imposed final tariffs averaging 20.83 per cent against Canadian shipments of softwood lumber into the United States.

The weighted average tariffs levied by the Trump administration consist of 14.25 per cent for countervailing duties and 6.58 per cent for anti-dumping levies. The preliminary tariffs had totalled 26.75 per cent.

"While I am disappointed that a negotiated agreement could not be made between domestic and Canadian softwood producers, the United States is committed to free, fair and reciprocal trade with Canada," Commerce Secretary Wilbur Ross said in a statement Thursday. "This decision is based on a full and unbiased review of the facts in an open and transparent process that defends American workers and businesses from unfair trade practices."

The Canadian government and forestry industry, however, say that the flow of lumber from Canada into the United States should be embraced and not feared by Americans.

"The U.S. Department of Commerce's decision on punitive countervailing and anti-dumping duties against Canada's softwood lumber producers is unfair, unwarranted and deeply troubling," said a joint release issued by Foreign Affairs Minister Chrystia Freeland and Natural Resources Minister Jim Carr.

"We urge the U.S. Administration to rescind these duties, which harm workers and communities in Canada. These duties are a tax on American middle-class families too, whose homes, renovations and repairs will only be more expensive. Further, it is clear the tariffs are worsening the lumber supply problem in the United States and forcing U.S. home builders to look overseas to meet their demand for lumber."

The 2006 softwood lumber agreement between Canada and the United States expired in October, 2015. A group led by the U.S. Lumber Coalition began flexing its muscles in November, 2016, after the expiration of a one-year litigation moratorium, petitioning the Commerce Department to impose preliminary countervailing and anti-dumping duties on Canadian lumber shipments into the United States. That move turned out to be successful in 2017, with the Commerce Department deciding to penalize Canadian producers, first with countervailing duties starting on April 28 and then anti-dumping duties beginning on June 30.

Lumber shipments are not part of North American free-trade agreement, though the long-running softwood fight factors into one of the most controversial elements of the bilateral agreement – NAFTA's Chapter 19, which sets up trade panels to settle disputes.

Last week, West Fraser Timber Co. Ltd. chief executive officer Ted Seraphim said the lack of progress in renegotiating NAFTA paints a gloomy outlook for reaching a separate softwood deal any time soon. He also said the U.S. lumber lobby is unwilling to compromise in the Canada-U.S. softwood dispute, a stand that points to a long impasse in the trade battle.

One source with knowledge of the softwood discussions said the impediment to a deal was the U.S. lumber industry, which appeared to prefer hitting Canada with tariffs than agreeing to a negotiated settlement.

Early in his tenure as Commerce Secretary, Mr. Ross proposed a deal based on stumpage fees, in which Canada would agree to a market mechanism for calculating what companies would pay to fell timber, the source said. But Mr. Ross swiftly dropped the idea after speaking with U.S. industry.

Instead, negotiations focused on a market-share arrangement, in which Canada would agree to cap its softwood sales to the United States at a specific quota. The two sides were close to an agreement over the summer. Under that arrangement, the source said, the Canadian quota would have been a little more than 30 per cent of U.S. market share to start, falling to slightly less than 30 per cent over five years, then holding steady for another five.

The talks, however, deadlocked over whether Canada would be able to exceed its cap in the event U.S. companies could not produce enough to meet the rest of the demand. Canada argued that such a "hot-market provision" would be better for the U.S. than importing the extra wood from Russia and Germany. But the U.S. would not budge.

Zoltan van Heyningen, executive director of the U.S. Lumber Coalition, denied that the American industry was the barrier to a deal. The real problem, he insisted, was that Canadian sector could not agree on a common position, with some companies favouring a market-share deal and others preferring an export tax.

"Such a claim by Canada would be ridiculous after all the efforts we and our government have put into realizing an agreement, and the inability of the Canadian industry to have a unified position on any agreement to this day," he wrote in an e-mail.

REUTERS. NOVEMBER 2, 2017. U.S. finds Canada dumped lumber, sets duties

Lesley Wroughton, Eric Walsh

WASHINGTON (Reuters) - The U.S. Department of Commerce on Thursday set final duties on Canadian softwood lumber after finding that imports were being unfairly subsidized and dumped in the United States, escalating a trade dispute with Canada in the midst of NAFTA trade talks.

The decision imposes anti-dumping and anti-subsidy duties affecting about $5.66 billion worth of imports of the key building material.

Canada called the measures “unfair, unwarranted and deeply troubling” and said it was considering its options, including legal action through the North American Free Trade Agreement (NAFTA) and the World Trade Organization (WTO).

The department said exporters from Canada have sold softwood lumber in the U.S. market at 3.20 percent to 8.89 percent less than fair value, and that Canada is providing unfair subsidies at rates of 3.34 percent to 18.19 percent.

The decision follows failed talks to end the decades-long lumber dispute between the neighbors.

“While I am disappointed that a negotiated agreement could not be made between domestic and Canadian softwood producers, the United States is committed to free, fair and reciprocal trade with Canada,” U.S. Commerce Secretary Wilbur Ross said.

“This decision is based on a full and unbiased review of the facts in an open and transparent process that defends American workers and businesses from unfair trade practices,” Ross said.

The disagreement centers on the fees paid by Canadian lumber mills for timber cut largely from government-owned land. They are lower than fees paid on U.S. timber, which comes largely from private land.

The Canadian government argues that its fees are fair and is prepared to litigate the matter if a settlement cannot be reached.

“We urge the U.S. administration to rescind these duties, which harm workers and communities in Canada,” Canadian Foreign Minister Chrystia Freeland said in a joint statement with Canadian Natural Resources Minister Jim Carr.

“We will forcefully defend Canada’s softwood lumber industry, including through litigation, and we expect to prevail as we have in the past. We are reviewing our options.”

Jason Brochu, co-chair of the U.S. Lumber Coalition and president of Pleasant River Lumber Company, said U.S. lumber companies can now expand production to meet U.S. demand.

“The massive subsidies the Canadian government provides to their lumber industries have caused real harm to U.S. producers and their workers,” said Brochu.

The decision is likely to further escalate tensions between the United States and Canada during difficult negotiations between the United States, Canada and Mexico to modernize the North American Free Trade Agreement.

In September, in the midst of the third round of NAFTA talks, the United States slapped preliminary anti-subsidy duties on Canadian jetmaker Bombardier Inc’s CSeries jets after rival Boeing Co accused Canada of unfairly subsidizing the aircraft.

Reporting by Eric Walsh and Lesley Wroughton; editing by David Alexander and Andrew Hay

IMMIGRATION

The Globe and Mail. 2 Nov 2017. Canada aims for immigration boost to buttress economy. Open-door policy would bring in 340,000 permanent residents in 2020, even as U.S. mulls tighter borders

DAKSHANA BASCARAMURTY

Canada will open its doors to a steadily increasing number of immigrants in the next three years in hopes of attracting 1 per cent of its population by 2020, an attempt to buoy the economy as the country faces a growing population of retirees.

The government says the plan will position Canada as a country that welcomes the world, particularly at a time when U.S. President Donald Trump is seeking to toughen immigration rules in America.

The plan is to bring in 310,000 new permanent residents in 2018, 330,000 in 2019 and 340,000 in 2020 – an increase from the Liberal government’s trend the past two years of 300,000 immigrants.

According to Statistics Canada projections, the proportion of working-age members of the population will continue to decline until 2036, by which point the number of seniors in the country will likely be more than double the figure in 2009.

“If we are going to be able to keep our commitments for health care and pensions and all our social programs and to continue to grow our economy and meet our labour market needs in the decades to come, we must respond to this clear demographic challenge,” said Immigration Minister Ahmed Hussen when revealing his government’s plan.

Of the nearly one million immigrants, 58 per cent will be economic class, 27 per cent will be family class and 14 per cent will be refugees.

As the U.S. tightens its borders, Mr. Hussen said Canada’s plan will be what defines it internationally.

“There are more and more countries that are closing their doors to people. They’re closing their doors to talent, to skills, and yes, to those who are seeking protection from persecution. We are emphatically and unapologetically taking the opposite approach,” he said.

Statistics Canada has projected that by 2036, immigrants could make up 30 per cent of the total population of the country. In a report released a month before Mr. Hussen delivered the government’s plan, the Conference Board of Canada estimated that by 2033, all of the country’s population growth would come from immigration.

While Mr. Hussen heralded the figures as “historic highs,” immigration levels in fact reached their peak in 1913, when the country admitted 400,000 new residents. The government’s own economic advisory council recommended a sharper increase, to 450,000 immigrants a year for the next five years. The Canadian Immigrant Settlement Sector Alliance released its own three-year plan this summer with figures that were also more ambitious than what the government revealed: a target of 350,000 for 2018, 400,000 for 2019 and 450,000 for 2020.

Still, the Conference Board of Canada lauded the government for introducing multiyear targets – traditionally, Ottawa’s immigration plan only looks ahead one year.

“Canada’s decision to increase immigration will help sustain longterm economic growth in light of its rapidly aging population and low birth rate,” said Craig Alexander, chief economist with the Conference Board of Canada. “Introducing a multiyear levels plan will improve the ability of governments, employers, immigrant-serving organizations, and other important stakeholders to successfully integrate newcomers into Canada’s economy and society.”

The government’s 2018 immigrant plan includes targets across the economic and family categories that are higher than they were in previous years, but refugee targets have decreased. The government had allowed more newcomers in this category than usual in the past two years due to the Syrian refugee crisis – in just the first five months of 2016, 25 per cent of the immigrants Canada received were refugees (typically, they make up 10 per cent of the total immigrant population). Now, the government is returning to more traditional proportional figures for this category.

The Immigration and Refugee Board has logged major backlogs in processing claims this year, and Mr. Hussen said the increased number of immigrants will help clear those backlogs.

“This will help us reunite families faster. It will help employers to be able to get the talent that they need here faster. And yes, it will also help us to provide more protection to the most vulnerable people in the world,” he said.

Conservative immigration critic Michelle Rempel questioned how the government will maintain its economic immigration targets (it aims to attract 195,800 in 2020) when it has struggled to match immigrants with the sectors where there are labour gaps, and increase the number of newcomers in lesspopulated parts of Canada.

“It’s about people, not numbers,” she said in a statement.

Mr. Hussen agreed that it is difficult to permanently sustain populations in the parts of Canada that need them – particularly Newfoundland, New Brunswick, Nova Scotia and Prince Edward Island. Many have found a new home in those provinces through the provincial nominee program, in which immigrants are assigned to regions of Canada where they might not typically settle. But after a few years, many end up moving to other parts of the country – such as Ontario or Alberta – where they see greater job opportunities.

“The problem in Atlantic Canada isn’t attracting skilled immigrants, it’s keeping them,” Mr. Hussen said.

He pointed to a pilot program the government is running in the Atlantic provinces, in which it waives the labour impact assessment an employer would typically need to prepare to hire an immigrant. In exchange, the employer agrees to be heavily involved in the settlement process for the new immigrant employee. The idea is this would make it harder for the immigrant to move elsewhere after settling in Atlantic Canada, Mr. Hussen said.

In its 2018-to-2020 plan, the government has put an emphasis on highly skilled immigrants, who will make up more than 40 per cent of all economic class immigrants in the next three years.

Jenny Kwan, the NDP’s immigration critic, said in a statement the plan should target immigrants of all skill levels.

“The current approach of only targeting the high skilled suggests that this government will continue to rely on temporary foreign workers instead of building our nation. It’s wrong that there are more TFWs than immigrants since 2006. It is time for Canada to act on the principle that if you are good enough to work, you are good enough to stay.”

The Globe and Mail. 2 Nov 2017. Trudeau rolls the dice on immigration. With many Canadians content with current numbers, the Liberals’ plan to bring in more newcomers is no sure thing

CAMPBELL CLARK, Columnist

Justin Trudeau’s Liberal government is doing something no Canadian government has done for decades: It is gambling on a lot more immigration.

There should be no doubt that it is a gamble. On the day that U.S. President Donald Trump was responding to a terrorist attack in New York by blaming the immigration system, exploiting resentment there, the Liberals were saying Canada needs more immigrants. And don’t think that’s because it’s a slam-dunk political winner with new Canadians: Polls show first-generation immigrants are not much keener on expanded immigration than those born here.

Mr. Trudeau’s government is making a statement that it is going in a different direction. In fact, that’s the statement that Immigration Minister Ahmed Hussen made. “We are emphatically and unapologetically taking the opposite approach,” he said at a news conference in Toronto.

The numbers that the Liberals are shooting for are nowhere near the massive, 450,000-a-year level proposed by the Liberal-appointed Advisory Council on Economic Growth headed by McKinsey and Co. guru Dominic Barton and backed by some big-business voices and the Conference Board of Canada. Mr. Barton had suggested more newcomers could foster economic growth and mitigate the aging of Canadian society. But that would be a huge expansion, and for politicians, that’s not just a gamble, but going all in.

Yet Mr. Hussen’s numbers are still large increases. Under Stephen Harper’s Conservatives, there were typically about 260,000 immigrants each year. The Liberals have increased the target to 300,000 this year, and will keep increasing to 340,000 by 2020 – that’s a 30-per-cent increase over a typical Conservative year, and a 21per-cent increase over the Conservative 2010 high mark. When compared with the size of the population, the Liberals are planning a rate of immigration not seen since Brian Mulroney was in power.

Immigration levels dropped substantially for two years under Jean Chrétien, and levels have fluctuated from year to year, but no government since Mr. Mulroney’s has made any sustained, substantive change to immigration rates – the number of immigrants as a percentage of the population. The Liberals plan to move the rate upward significantly.

It’s a plan to keep increasing immigration steadily. Mr. Hussen even revived the Liberal target of increasing immigration to 1 per cent of the Canadian population – a promise made by Mr. Chrétien in 1993 but ignored once he was in power.

Politically, it’s not the specific number that matters. The government has done polls that show that most Canadians don’t have the foggiest notion how many immigrants come to Canada. But Canadians still have opinions on whether there are too many immigrants, or too few.

A survey commissioned in March by the Association for Canadian Studies found that 38.4 per cent of Canadians think there are too many immigrants, while just 10.4 per cent said there are too few. But a lot, 41.1 per cent, said that the number’s about right. Perhaps that’s one reason recent governments haven’t risked changing things much.

Jack Jedwab, the association’s president, said the number of people who think there are too many immigrants is generally pretty stable, between 30 per cent and 40 per cent; it’s near the high end of the range now. (The March survey was conducted by a web panel that used a sample of 2,559 people.)

People born outside of Canada are a little less likely to think there’s too much immigration, but not much. There is a substantial political divide: People who consider themselves on the right are far more likely to think there are too many immigrants than left-identifying people.

That may be one reason Mr. Trudeau’s Liberals are willing to take a political gamble on immigration. It emphasizes a difference that plays better with left-leaning voters. And it represents a contrast with Mr. Trump. But it’s still a gamble.

Even Mr. Trump is calling for a “merit-based” immigration system, which sounds similar to Canada’s “high-skilled” class, rather than the United States’s current visa lotteries. He won’t end immigration; the Trump culture war is mostly about Mexicans and Muslims, and he has portrayed both as dangerous.

In Canada, Mr. Jedwab said, the resentment of immigration was once driven by economics – the sentiment that immigrants take Canadian jobs or cost the treasury – but now, it is clearly driven by perceived security concerns and fears immigrants are changing Canadian culture and values.

No wonder then, that Mr. Hussen emphasized the economic reasons for expanding immigration, saying, for example, that there will be fewer workers to support retirees in coming years. His plan also includes more family reunification, asylumseekers and resettled refugees. People like the notion of hard-working economic immigrants, but not everyone is as positive about the rest. That’s probably a very big reason why governments have not signalled a sustained change in immigration levels for a quarter century. Until now, they didn’t want to take a risk.

ENERGY

The Globe and Mail. 2 Nov 2017. Oil price surge boosts optimism, shares for Canadian producers. Oil: Crude in storage fell by 2.4 million barrels last week, U.S. EIA says

JEFF LEWIS, CALGARY

SHAWN McCARTHY, OTTAWA

Oil prices surged to their highest level in more than two years, propelling Canadian energy shares as optimism returns to the hard-hit sector.

U.S. benchmark West Texas intermediate oil has gained 8 per cent in the past month, as strengthening demand and slowing production in the United States help reduce stockpiles at the key storage hub of Cushing, Okla.

On Wednesday, WTI approached a two-year high of $55.22 (U.S.) before settling down 8 cents at $54.30. International standard Brent touched $61.70 in the session, its highest since July, 2015. The contract settled at $60.49, down 45 cents.

Prices for synthetic crude from the oil sands have climbed above $72 (Canadian) a barrel in recent weeks for the first time since last spring. That implies a value of about $56 (U.S.) for the light oil, based on the current exchange rate. Heavy crude from the region has also enjoyed relative strength against the American benchmark.

The gains point to big jumps in corporate revenues and have also rekindled interest in the industry among large investors, many of whom had shunned the sector through the downturn, Raymond James Ltd. analyst Jeremy McCrea said.

“It’s bringing back some definite optimism in the sector where guys are thinking they should really start adding back to their energy positions,” he said.

Since early October, the Toronto Stock Exchange energy subindex is up more than 3 per cent, with the bulk of the increase coming in the past week. Big gainers on Wednesday included MEG Energy Corp., Encana Corp. and Cenovus Energy Inc.

Several producers in the Canadian industry have posted thirdquarter results that reflect lowered costs and higher crude prices compared with the same time last year.

Nevertheless, companies will be reluctant to outspend cash flow, Mr. McCrea said.

Canadian synthetic crude traded at a $1.80 premium to WTI in the session, according to broker Net Energy Inc. But such gains are a result of temporary supply issues in the oil sands and are likely to be short-lived, GMP FirstEnergy analyst Martin King said.

Heavy crude prices are also forecast to weaken as big-ticket oil sands projects gear up, increasing supplies in a market already struggling with export constraints and mounting delays to proposed pipeline expansions.

Still, the overall market sentiment has been buoyed by falling U.S. crude stockpiles as well as the prospect of extended production cuts by major world producers.

“You’ve still got record-high exports, strong demand – the market’s calling for barrels and the last big place to get them from is the U.S.,” Mr. King said.

The U.S. Energy Information Administration said Wednesday that the amount of crude in storage fell by 2.4 million barrels last week. Stocks are now at their lowest level in two years, although they remain high compared with the five-year average.

Gene McGillian, manager of research at Tradition Energy, said the fall rally is a “delayed reaction” to the pact between the Organization of Petroleum Exporting Countries and Russia that took 1.8 million barrels per day of crude off the market earlier this year.

However, he said traders are nervous about a retrenchment, given the recent history of promising rallies giving way to significant price drops.

“I think we’re getting to an area where values are pretty lofty and we’ll have to see whether they can be sustained,” Mr. McGillian said. The market will be particularly susceptible to any sign of a rebound in U.S. drilling activity as WTI hovers in the mid-$50 price range.

U.S. drilling activity slumped since its recent highs in midsummer, with the number of active rigs down 5 per cent since July 28. In the past few years, as prices climbed into the mid-$50 range, the rig count also rebounded, putting more American crude on the market.

As well, Mr. McGillian noted the U.S. shale industry has a high inventory of drilled wells that have not been completed, and those can be brought into production fairly quickly as higher prices take hold.

Still, it is the discipline by OPECleader Saudi Arabia and Russia that is driving the global market; compliance with the production agreement is estimated to be more than 90 per cent.

As a result, the difference between the international benchmark, Brent, and North America’s WTI is the widest it’s been in two years, at nearly $6 a barrel, the EIA said Wednesday.

That spread reflects the fact that the United States and Canada continue to increase production while key OPEC and non-OPEC suppliers practise restraint, and provides incentive for North American refiners to process more Canadian and U.S. crude than water-borne imports.

________________

SPECIAL

BLOOMBERG. BUSINESSWEEK. 2 November 2017. The Global Economy Looks Good for 2018 (Unless Somebody Does Something Dumb). A key question is whether consumers and businesspeople will continue to shrug off some pretty scary geopolitical threats.

By Peter Coy

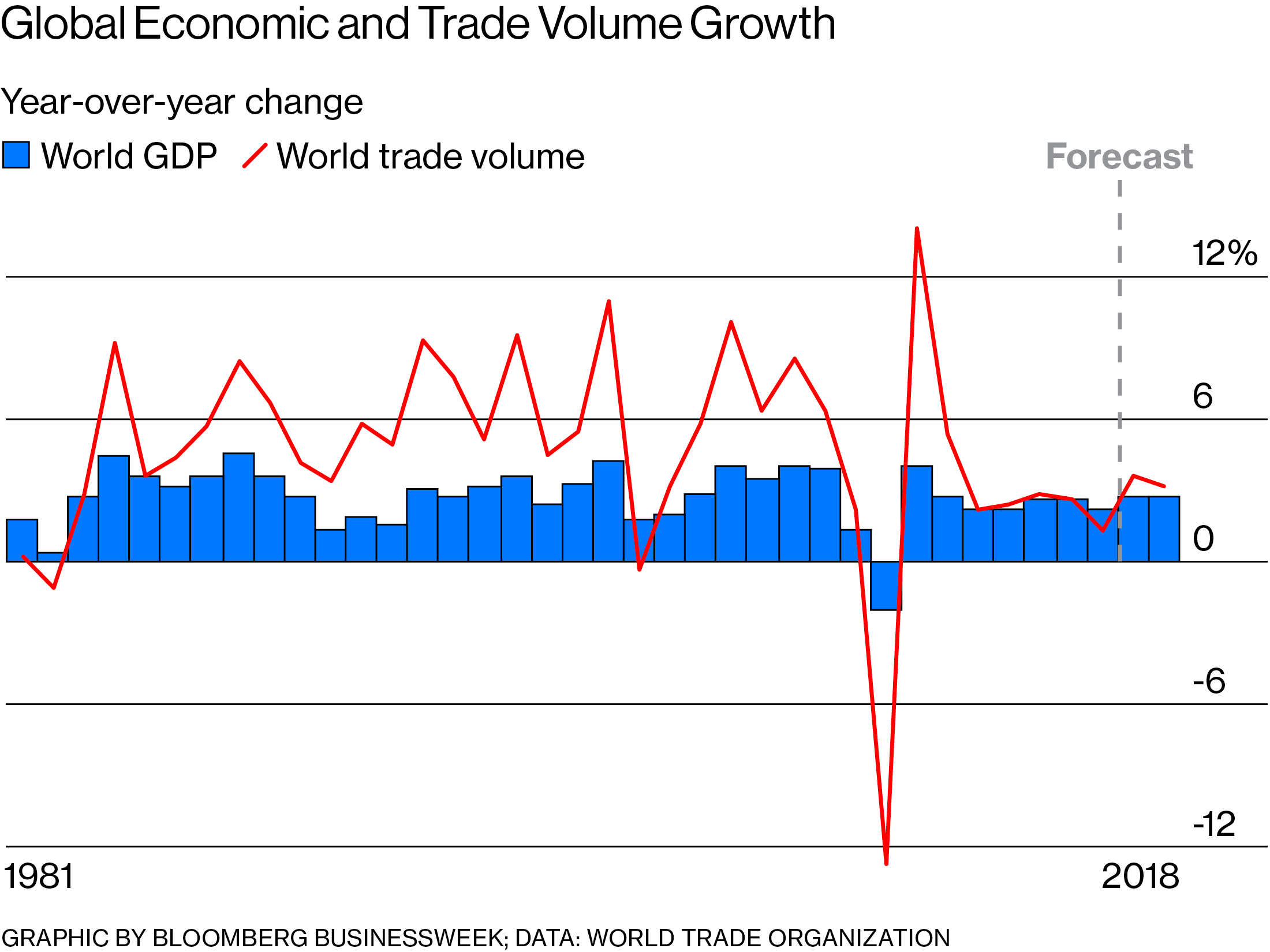

Everyone in the world—plus the two SpaceX customers who technically won’t be in the world when they do figure eights around the Earth and the moon for two weeks this coming year—can look forward to another year of healthy growth in 2018. We’ve gotten so used to complaining about sluggishness that it’s a shock to realize the global economy has quietly accelerated to a respectable and sustainable cruising speed. Market volatility is historically low. Even the skeptical Germans sound happy. “The data we get and the indicators we see are very positive,” says Clemens Fuest, president of the IFO Institute at the University of Munich. “There is no obvious obstacle.”

The big story for 2018 is likely to be how to manage the continued expansion. A turning point may come at the end of September, when the European Central Bank might stop or curtail monthly bond purchases. The central banks bought bonds to drive down long-term interest rates; while the Japanese will keep buying, the Americans and soon the Europeans are betting that the patient, the economy, is finally well enough to get along without life support.

The International Monetary Fund, which has reported subpar growth for years, now says “the global upswing in economic activity is strengthening.” In its World Economic Outlook, published in October, the IMF says now would be a good time to deal with issues that went unaddressed during the convalescence from the 2007-09 financial crisis, including sometimes-unpopular measures such as raising retirement ages and making it easier for companies to hire and fire.

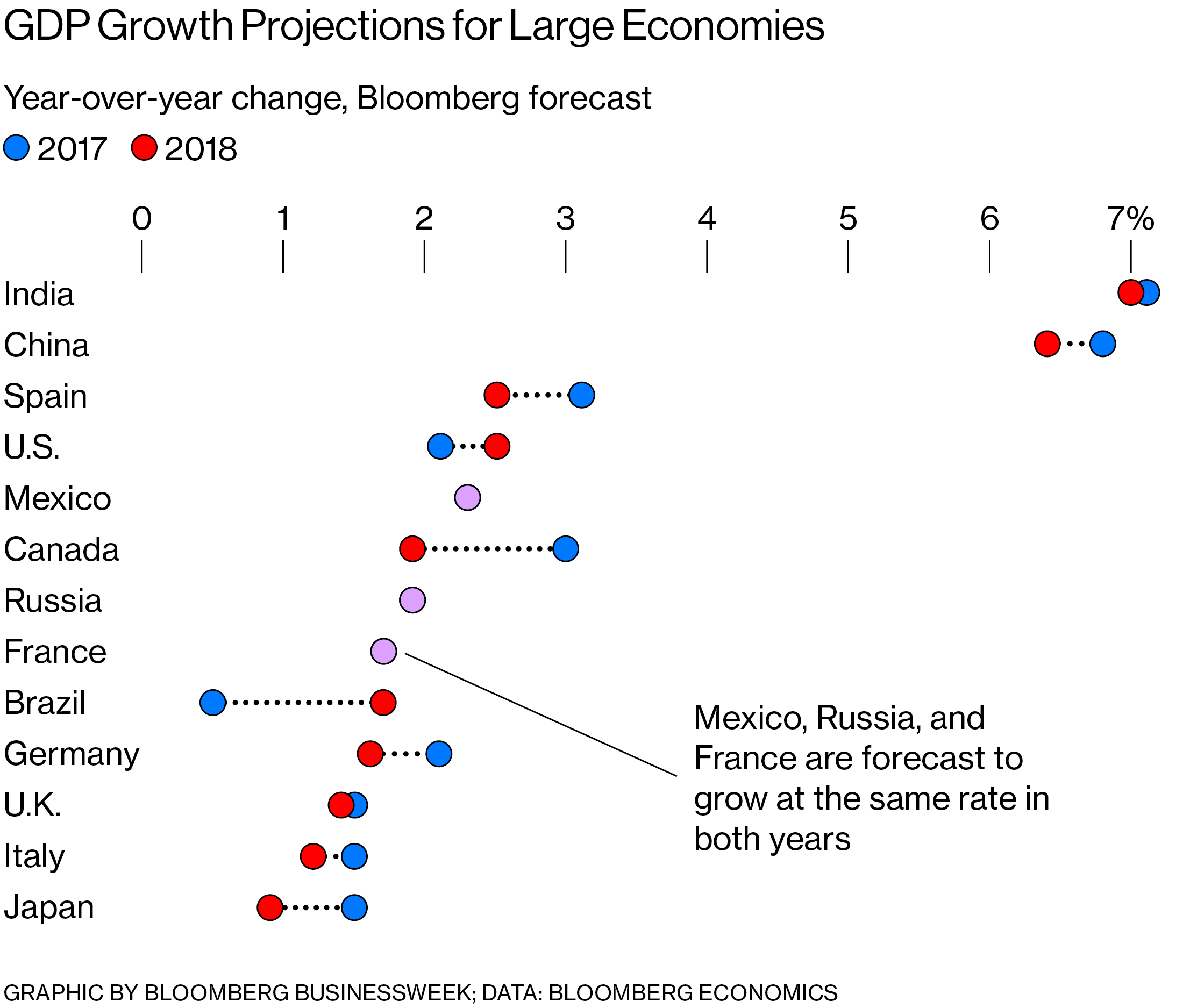

Bloomberg economists predict the U.S. will grow 2.5 percent in 2018; China, 6.4 percent; Japan, 0.9 percent; and Germany, 1.6 percent. In most cases those numbers are in line with the growth expected for 2017, which has turned out to be a better year than many forecasters expected.

The upswing hasn’t benefited everyone. The IMF points out that prospects are “lackluster” in many nations of sub-Saharan Africa, the Middle East, and Latin America. Even in wealthy nations, those at the bottom are hurting. In the U.S., wage growth remains anemic despite an unemployment rate in the low 4s.

Still, brisk growth that’s not shared by all is better than no growth at all. One reason for optimism about the outlook is that the global expansion seems to be based on strong fundamentals, not froth. In a virtuous spiral, confident consumers are spending, which allows employers to hire and invest, which leads to more consumer spending, and so on. Global spending by companies on plants and equipment is “in high gear with room to run” in the coming year, economists at JPMorgan Chase & Co. wrote on Oct. 25. The synchronized expansion reflects “a self-reinforcing turn in the global profit cycle that has boosted business confidence and spending in all corners of the world,” the economists said in an earlier note. To put it another way: “The expansion is not dependent on just one region or one sector,” says Richard Turnill, global chief investment strategist for BlackRock Inc. in London.

Healthy growth puts the world in a better position to deal with the next downturn, whenever it comes. Governments fight recessions by lowering interest rates, cutting taxes, and raising spending. Those tools are blunted if interest rates are already low and government debt is so high that governments can’t get away with bigger budget deficits. Policymakers’ goal for now is to normalize interest rates and repair their countries’ finances, gaining altitude so the next downdraft can’t plunge them into a hillside.