CANADA ECONOMICS

BOMBARDIER

The Globe and Mail. 18 Oct 2017. Bombardier’s surrender of C Series an act of desperation

KONRAD YAKABUSKI, Columnist

The only surprise about Bombardier’s move to surrender control of the C Series to one or the other member of the planet’s big-airplane duopoly is that it took this long.

During this nearly two-decadelong saga, the odds were always stacked against Bombardier. Its decision to try to take on Airbus and Boeing on their own turf – the 100plus seat jet category – always contained an element of sheer recklessness. Betting the house on a product that sought to eat into the market share of its rich and ruthless rivals was not the kind of provocation Bombardier could ever afford to make on its own. That is now painfully clear as Canada’s national aerospace champion hands the C Series controls to Airbus for not even so much as a symbolic $1.

Sure, it’s fine to celebrate Bombardier’s innovative spirit and sheer bloody-mindedness in pursuing the C Series dream. And from an engineering perspective, the C Series is a truly beautiful machine. But its move to cede control of the C Series now for zero cash seems like an act of desperation. Airbus’s undertaking to keep the C Series program and the current jobs associated with it based in Quebec is, like most such agreements, unenforceable.

If C Series sales fail to take off, or a downturn hits the entire aerospace sector, as it surely will at some point, guess which jobs will go first?

That it has come to this is hardly a shocker to industry experts. Many believe Bombardier was never on solid enough ground to make this plane a commercial success. The company first conceded that in 2000. That’s when, under CEO Bob Brown, it first abandoned plans to enter the 100-plus-seat market with a plane, then dubbed the BRJ-X, that it had introduced at Britain’s Farnborough Air Show in 1998.

It took a second go at Airbus and Boeing a few years later by restarting the program – with a new name, the C Series – and hiring former Boeing executive Gary Scott to pilot the design and commercialization. It bet on Airbus and Boeing being too busy focusing on bigger planes to even notice.

It was dead wrong. While Boeing and Airbus did opt to simply overhaul their respective families of single-aisle jets with new engines, rather than design entirely new plans like Bombardier, they were not about to cede the lower end of the market to this Canadian upstart. Especially when Bombardier, which had never fully recovered from the post-2001 downturn of the airline industry, looked as vulnerable as it did.

Bombardier put the C Series program on hold again in 2006. But Laurent Beaudoin, scion of the Bombardier-Beaudoin family that controls the company, could never give up the dream. Within a year, the C Series was back on the agenda and governments in Canada and Britain stepped up with cash.

Only company insiders know how seriously Mr. Beaudoin or his successor as chief executive officer, son Pierre Beaudoin, pursued a partnership with Boeing or Airbus back then.

But it’s clear now that such a move would have been much smarter than trying to go it alone. By developing a new plane in partnership with either of its bigger rivals, Bombardier may have been able to negotiate from a stronger position. By the time it tried to lure Airbus into a deal in 2015, it was no longer in a position to call the shots.

As for Bombardier’s vaunted research and development division, the biggest in Corporate Canada, much uncertainty remains. What’s left to develop after the C Series? Will Airbus give Bombardier the green light to proceed with the design of an even bigger version of the C Series? Or will it protect the market for its own A320neo, the closest plane to the C Series in the Airbus family of jets?

If there is any consolation for Canadians in this deal, it is that Boeing appears to have been hoisted with its own petard. After Bombardier’s 2015 flirtation with Airbus, Boeing may have undertaken its trade complaint against the C Series in the expectation that some kind of tie up between Bombardier and Boeing’s European nemesis was inevitable. Ironically, a partnership between Bombardier and Boeing arguably made more sense, since Boeing’s 737 MAX (its closest rival to the C Series) has had limited success compared with the runaway success of A320neo.

By launching its trade case, Boeing ended up driving Bombardier into Airbus’s arms. And this time, Bombardier was in an even weaker negotiating position than in 2015. With Airbus now in control, not only has Boeing failed to neutralize its Canadian upstart. It risks seeing Airbus control an even bigger share of the 100- to 150-seat plane market.

Somebody’s dream is coming true. Just not Bombardier’s.

The Globe and Mail. 18 Oct 2017. EDITORIAL. Your money is now airborne

On Monday night, the Bombardier-Boeing trade fight was decided by technical knockout, with victory going to a boxer who wasn’t even in the ring.

Developing Bombardier’s C Series jet may have cost north of $6-billion (U.S.), with a chunk of that backstopped or borne by Ottawa and Quebec City. But for the low, low price of zero dollars and zero cents, Europe’s Airbus Group SE has now taken a controlling stake in the project.

That makes Airbus the clear winner in this transaction. For Canadian and Quebec taxpayers, in contrast, the story is a very mixed bag.

The Canadian government has financially supported Bombardier on numerous occasions, including with two “repayable contributions” to the C Series. The Quebec government for its part bailed out Bombardier last year, giving the company a $1-billion lifeline – sorry, we mean investing $1-billion – in return for a 49-per-cent stake in the C Series.

That investment, at least according to Monday’s sale price, is worth nothing.

But the takeover of the C Series by the European consortium means that Bombardier and its flagship jet are no longer in imminent danger of financial collapse. And that makes it less likely that the plane’s manufacturers will be coming cap in hand to taxpayers.

Wait, sorry, we just realized that we have to add two caveats to the above statements.

As everybody knows, aerospace is a subsidy-nourished industry, so let’s not start peddling illusions now. Of course the new Bombardier-Airbus tag team will soon be making its pitch to you, the taxpayer. Yesterday’s prospectus said, “Invest now, or we’ll go under”; tomorrow’s sales sheet will no doubt say, “Invest now – things have never been better!”

And as for that bit about the C Series being Bombardier’s flagship product? Not anymore. The folks from Toulouse, France, now own 50.01 per cent of the project and its fruits. Whether the plane will be officially rebranded as an Airbus remains to be seen but by whatever name, the C Series is the property of Airbus.

Bombardier may have created it – allow us to once again mention those $6-billion (U.S.) in development costs – but it’s now the minority shareholder, and effectively somebody else’s chief subcontractor.

And what does that make Bombardier? Under the circumstances, a winner. Big time.

The C Series’s startup costs and poor sales threatened to sink the company. And Boeing’s trade complaint, resulting in the United States Commerce Department imposing absurd duties of nearly 300 per cent, meant that selling planes in the U.S. would be difficult, if not impossible.

What’s more, Bombardier, which has 360 orders for the jet, hasn’t sold a new one since last year. New orders weren’t coming in because of the fear that Bombardier might shut down production due to a lack of orders; that lack of orders was making it likely that C Series production would have to be shut down.

The project was in a stall, which threatened to become a death spiral. The Airbus takeover changes all that. The C Series is now going to be offered as part of Airbus’s lineup, and sold by the Airbus sales team. If necessary, Airbus says planes could even be assembled at the company’s Alabama manufacturing facility, as a way of getting around the American tariff.

None of that means that C Series sales are about to take off. They might; they might not. But the deal puts some lift under Bombardier’s wings, and gives it the kind of time and space it was running out of. The company’s shares surged on Tuesday, closing up nearly 16 per cent, to their highest level since early 2015.

The loser? Boeing. It asked the U.S. government to hit the C Series with prohibitive penalties, not because the plane was harming its business – Boeing doesn’t even have a jet that competes with the C100 models sold to Delta Air Lines – but because it said it was afraid that, if a subsidized Bombardier got a foot into the market, it would soon land more and more sales, and eventually become a true competitor to Boeing.

The American company said that what it feared was the creation of another Airbus. And now, thanks to Boeing, the C Series is an Airbus.

Boeing wanted to stifle competition; instead, it has forced a sale, at rock-bottom prices, to Boeing’s chief competitor. Boeing got a black eye; Airbus got a brand new product, for free. Not exactly the art of deal. Speaking of which, the final winner is: Donald Trump. Maybe. Airbus says that, if the U.S. penalties on the C Series are upheld, it can get around them by assembling the jets at an Airbus plant in Alabama. Which is a fine outcome if you’re Airbus, but not if you’re Ottawa or Quebec City. What were all those taxpayers dollars supposed to have bought? Their only argument is that they were buying jobs.

But when Mr. Trump’s government threatened to block the import of a product, the company behind it raised the possibility of moving production to the U.S. – exactly what a protectionist threat is designed to encourage.

This week, Bombardier dodged a bullet, Airbus won the lottery, Boeing got kicked in the shins – and Canadian taxpayers were handed a new flight plan, to destinations unknown.

The Globe and Mail. 18 Oct 2017. Boeing faces new pressure to find acquisition targets. Boeing: Plane maker may be forced to develop its replacement for the 737 earlier than planned

GREG KEENAN, AIRLINE INDUSTRY REPORTER

Boeing needs to resume thinking of itself as a global company. They might have spent the last year getting away from that important concept.

Richard Aboulafia Teal Group

Boeing Co. is the big loser in the deal between Bombardier Inc. and Airbus Group SE that provides new life and a brighter future to the Canadian company’s C Series airplane program, aviation industry analysts say.

The deal between Bombardier and the European giant gives Airbus a new, more fuel-efficient and technologically advanced aircraft in the 100-seat to 150-seat segment of the single-aisle airplane market and, for now, a plane that Boeing cannot match.

The Bombardier-Airbus transaction comes in the midst of a trade war launched against Bombardier by Boeing over the sale of C Series planes to Delta Air Lines Inc. that the U.S. aerospace giant said could not have been made without the help of generous government subsidies.

“It doesn’t look like there is any good that comes out of this for Boeing as the law of unintended consequences plays out,” said Addison Schonland, an industry analyst who is a partner in aviation consulting firm Air Insight.

The deal gives Airbus a full range of planes in the single-aisle segment. It can offer airlines the newest technology on the market between 100 and 150 seats or the larger A320 and A321 planes that compete directly against Boeing’s 737.

The C Series fits superbly beneath the A320, said a former Bombardier executive who spoke on condition that he not be identified.

The former executive noted that the A319, the Airbus plane that offered 100 to 130 seats, never made sense economically. That’s in part because it’s simply a shrunken version of the A320, while the C Series is purpose built for airlines that need a smaller plane.

The response by Boeing is likely to involve the Chicago-based manufacturer cozying up to

Embraer SA of Brazil, which has been developing single-aisle planes to compete with the C Series.

The pressure rises on Boeing to do a joint venture or alliance in the smaller segment of the singleaisle market, said Richard Aboulafia, vice-president of analysis of aviation consulting firm Teal Group Corp. of Fairfax, Va.

“Boeing needs to resume thinking of itself as a global company,” Mr. Aboulafia said Tuesday. “They might have spent the last year getting away from that important concept.”

Embraer and Boeing combined on the KC-390 military tanker program and an environmental demonstration aircraft.

But Boeing could also be forced to develop its replacement for the 737 earlier than planned, said Ernie Arvai, another partner in AirInsight.

The plane is scheduled to be replaced around 2030, but it likely will need to be available by 2025, he said.

Boeing said Monday evening after the deal was announced that the Airbus-Bombardier link-up appears to be “a questionable deal between two heavily state-subsidized competitors to skirt the recent findings of the U.S. government,” on Boeing’s trade complaint against Montreal-based Bombardier.

Embraer said in a statement that the deal validates its own development of a plane in the 100- to 150seat segment, saying its new E2 family will be the most efficient aircraft in the segment.

Some airlines that have been wary of buying the C Series for fear the program would not survive may now step up to the plate, including JetBlue Airways Corp. and Spirit Airlines.

JetBlue operates a fleet consisting of planes from the A320 family and E190s made by Embraer. Spirit’s fleet is all Airbus.

Other long-time Boeing customers might bolt, including UAL Corp., parent of United Airlines and American Airlines Corp., Mr. Arvai said.

United “has shown some interest in the C Series and they need an airplane in that size range,” he said. “With Airbus there and a stronger support network, stronger service network with Airbus’s essential endorsement of the airplane, they could be a candidate.”

The C Series disrupted the singleaisle market. New engines developed by Pratt & Whitney gave it a 20-per-cent fuel advantage over existing Airbus and Boeing offerings.

The Bombardier plane spurred Airbus to develop its NEO (new engine option) variants with more fuel-efficient engines than those on its existing planes, but the European aerospace company did not develop an entirely new plane. Boeing responded to the Airbus NEO with the 737 MAX, which also offered new engines only, not a new airframe.

The Globe and Mail. 18 Oct 2017. Bombardier CEO confident in Airbus deal

PAUL WALDIE, EUROPEAN CORRESPONDENT

Bellemare says new agreement will resolve the trade dispute with Boeing by skirting U.S. duties

Bombardier Inc.’s chief executive has expressed confidence that the deal to sell control of the C Series aircraft division to Airbus Group SE will resolve the trade dispute with Boeing Co.

The agreement with Airbus could see some C Series aircraft assembled at its plant in Alabama. That would skirt duties of nearly 300 per cent that the United States government is threatening to impose on C Series imports because of a complaint by Chicagobased Boeing that Bombardier has received substantial government assistance and is selling the planes at “absurdly low” prices.

“Assembly in the U.S. can resolve the issue,” Bombardier’s CEO Alain Bellemare told reporters on Tuesday during a news conference in Toulouse, France, where Airbus is based. “Airbus is the perfect partner for us.”

In the deal announced late on Monday, Airbus will acquire a 50.01-per-cent stake in the C Series division for no cash and incorporate the plane into its product lineup. The arrangement has won wide backing in the United Kingdom, where Bombardier employs roughly 4,500 people mainly at a plant in Belfast, which makes wings for the aircraft. Greg Clark, the Secretary of State for Business, Energy and Industrial Strategy, called the deal a “very big step forward” and said the government would continue to fight moves in the United States to apply the duties.

“Not only has Airbus committed to Belfast being the home of the wing manufacturer for the C Series, but they are pointing to the possibility of expanding the output and the order book,” Mr. Clark said Tuesday. He added that the British government would continue to work with the Canadian government “to ensure the unjustified case brought by Boeing is brought to a swift resolution.”

Labour leaders also praised the deal but some expressed caution that the new agreement could also face legal challenges.

“It’s obviously a good deal, and we welcome it in terms of C Series,” said Davy Thompson, a local organizer for Unite, the labour union which represents most of the Bombardier workers in Northern Ireland. “We believe C Series is there for the long-term, but we do work on a number of legacy contracts at the Belfast site and hopefully what’s happened today will allow C Series to increase and people to move from the legacy contracts across [to the C Series] as they start to dwindle down. They are really coming to the end of their lifespan.”

Mr. Thompson added that while the Airbus deal might allow Bombardier to get around the U.S. tariffs, that battle is far from over. “The reality for us is this was an attack on aerospace by Boeing. It doesn’t stop anybody from using the ITC to go in with what is really a spurious claim, get the right decision for their own company and then you have tariffs imposed and no one can actually appeal it or do anything against until further down the line.”

Ross Murdoch, national officer for the union GMB, which also represents some Bombardier workers, said he was concerned that the deal might raise more legal challenges. “It sounds potentially positive,” Mr. Murdoch said. “But there’s already rumblings coming out of America about two companies coming together to try and circumvent tariffs. We hope that both companies have actually taken pretty sound, cast-iron, legal advice to make sure they don’t get rid of one legal challenge only to replace it with another.”

Stephen Kelly, the chief executive of Manufacturing NI, said the Airbus deal is “very good news” as it will allow Bombardier to tap into the Airbus sales, marketing and supply chain. But he said it doesn’t end the battle with Boeing. “The deal doesn’t immediately change the challenges in the U.S. market brought about by Boeing’s absurd claim to the U.S. Department of Commerce, nor indeed their ridiculous response, but the world aviation market is a big place and there are lots of customers needing an aircraft like this,” he said. “Belfast workers were preparing to ramp up their production of C Series wings, so whilst nothing in this world is ever permanent, this looks like good news for the short and medium term.”

Boeing officials have already challenged the Airbus-Bombardier arrangement.

“This looks like a questionable deal between two heavily state-subsidized competitors to skirt the recent findings of the U.S. government. Our position remains that everyone should play by the same rules for free and fair trade to work,” Boeing spokesman Dan Curran said in a statement.

Phil Musser, Boeing’s senior vicepresident of communications, added on Twitter: “If @Airbus and @Bombardier think this deal will get them around the rules …# thinkagain”

Bombardier has faced a host of challenges over the C Series, which has cost around $6-billion (U.S.) to develop and involved subsidies from the Canadian, Quebec and British governments. Boeing has called the government assistance unfair and alleged Bombardier is selling C Series planes in the United States at low prices. The U.S. Department of Commerce agreed and has imposed preliminary duties of nearly 300 per cent on C Series imports. A final decision on the duties is expected early next year.

The Globe and Mail. 18 Oct 2017. Bombardier

With a file from Les Perreaux

And he quickly reached out to Airbus proposing a joint venture to spin off the C Series, Bombardier’s big bet to drive revenue in its commercial aerospace business over the next two decades.

Bombardier was in a bad place financially but wasn’t acting like it at the negotiating table with Airbus in 2015. Airbus executives had spent every opportunity they could mocking the C Series to keep Bombardier from winning sales and Bombardier wasn’t rolling over. Airbus “wasn’t the only thing in town” at the time, one source said. “We were looking at all the options.”

A French mergers-and-acquisitions executive who advised Airbus in 2015 on the negotiations confirmed Bombardier didn’t act as if it was desperate. On the contrary, it was demanding, he said.

Mr. Enders vetoed the deal in 2015 because he did not like the terms proposed and because Airbus had its own internal issues to contend with. Airbus liked the technologically advanced C Series as a potential small-product offering below its own A320 plane. But the C Series was not yet certified by regulators and not yet flying commercially, making it an unproven proposition at time Airbus was grappling with the production start of its bigger A350 aircraft, Mr. Enders told reporters.

Bombardier then turned to Quebec, which agreed to invest $1-billion in a C Series limited partnership for a 49.5-per-cent stake. Quebec’s motivation was always to protect jobs. It was fearful Bombardier would go under.

It survived and Mr. Bellemare started to gain ground with his turnaround plan for the company. But while the noose of an $8.7-billion long-term debt was slackened, it nevertheless put pressure on Bombardier in unseen ways. Behind the scenes, Bombardier continued having trouble selling the C Series to customers worried that the company would not be around to deliver and service the planes, sources said. The aircraft is a technological marvel. But there has been no significant sale in more than a year.

To find a more permanent solution that would resolve the market’s restlessness with the C Series, Mr. Bellemare still needed a strategic partner.

Sources say Bombardier approached Boeing. But then, in April of this year, the Chicago-based plane maker sued Bombardier using U.S. law, alleging it used unfair subsidies to sell the C Series at “absurdly low” prices. The relationship quickly turned adversarial. Boeing became enemy No. 1 to Bombardier, Quebec and Canada.

Over the summer, Ottawa entered into secret negotiations with Boeing to put an end to the trade dispute, sources say. Bombardier was interested in striking a deal with Boeing that would have created a strategic partnership at the same time as Boeing would have dropped its complaints, but the company refused. Bombardier also explored a C Series partnership with several Chinese state-owned enterprises, including Commercial Aircraft Corp. of China Ltd., according to separate sources. But Ottawa was not keen on a deal between the Canadian plane maker and a Chinese partner and federal officials made their views known to the company and facilitated discussions with Airbus, the sources said.

The Globe and Mail. 18 Oct 2017. For Airbus, the Bombardier deal is money for nothing – and it gets the C Series for free

ERIC REGULY, EUROPEAN BUREAU CHIEF

The optimistic case says it’s better for Bombardier and Quebec to own almost half of a plane that stands a good chance of selling, now that Airbus’s formidable global marketing, financing and servicing power is behind it, than 100 per cent of a plane that that was stuck in the hangar.

You’ve got to hand it to the brilliant, Machiavellian minds at Airbus.

In one fell swoop, like an eagle descending on a dove, Airbus Group SE has seized the world’s most technologically advanced small passenger jet, the Bombardier C Series, for nothing – as in zero, zilch, nada – even though Bombardier Inc., with a little help from its government friends, had sunk about $6-billion (U.S.) into developing the product. In doing so, Airbus has neutered a potentially strong competitor and dealt a blow to arch-rival Boeing Co., which does not have a plane that can compete with the C Series.

It gets better. Bombardier, not Airbus, is still on the hook for as much as $700-million in funding for the C Series. Airbus doesn’t even have to assume any of Bombardier’s debt, which has climbed in recent years to almost $9-billion (Canadian), nearly double its market value. For Airbus, the deal is money for nothing, C Series for free.

And by the way, Airbus, which is 11 per cent owned by the French government and touted as a European corporate champion, had the sweet joy of exposing U.S. President Donald Trump as a true chump. When the U.S. administration slapped preliminary import tariffs of 300 per cent on the C Series a couple of weeks ago, the plane was effectively shut out of the world’s biggest commercial jet market. Facing catastrophic losses on the slow-selling C Series, poor, hapless Bombardier had no negotiating power. Airbus could write the deal it wanted.

And yet, you could argue that Bombardier made the best of an impossible situation and that the Airbus deal actually presents good prospects for Bombardier, for Quebec and for Canada.

The C Series is to be owned 50.01 per cent by Airbus, 31 per cent by Bombardier and 19 per cent by the Quebec government, which in 2016 sunk $1-billion (U.S.) into the project after it was overwhelmed by delays and cost overruns.

The optimistic case says it’s better for Bombardier and Quebec to own almost half of a plane that stands a good chance of selling, now that Airbus’s formidable global marketing, financing and servicing power is behind it, than 100 per cent of a plane that that was stuck in the hangar. In theory, the C Series could sell a few thousand jets over its life span – the order tally so far is only 350 – allowing Bombardier and Quebec to recoup their investment, perhaps even earn a return on that investment.

The pessimistic case says that Bombardier and the taxpayers of Canada and Quebec, who have propped up Bombardier in general and the C Series in particular for years, got taken to the cleaners. This case is more compelling.

Remember, the C Series is to become an Airbus product owned by a European company with zero allegiance to Bombardier or Canada, even though it will be happy to take Bombardier’s $700-million to cover the C Series’ losses for the next two years. Might the Canadian or Quebec taxpayer be forced to cover some of these losses? That scenario cannot be ruled out, all in the name of protecting manufacturing jobs in Quebec.

Which leads us to Alabama, of all places. Airbus recently opened a plant in the state to assemble the company’s workhorse A320 jet for the North American market. Airbus intends to add a C Series assembly line in Alabama to serve the plane’s U.S. customers and circumvent the Commerce Department’s murderous tariffs. (Although Boeing, which called for the tariffs, is bound to use every one of its conniving ways to ensure any non-U.S. parts do not enter the country duty-free.)

There is a reason that Airbus chose Alabama for its assembly plant; it’s a cheap place to do business, where “right to work” laws discourage unions. You can bet that if Airbus finds it less expensive to pump out the C Series in Alabama than Quebec, it will do everything in its power to transfer production to Alabama, unless, of course, Quebec fights back. And how would it do that? By offering to subsidize production north of the border to keep Bombardier’s Quebec jobs from vanishing into the night. Bombardier is Quebec’s, and Canada’s, premier engineering and technology company. Quebec won’t let those jobs go easily.

Two years ago, Bombardier and Airbus spent months negotiating a deal that reportedly would have seen Airbus finance the remaining development costs of the C Series in exchange for a controlling stake in the project. Note the date: It was a year before anyone could imagine Mr. Trump and his “America First” agenda could take over the White House. (The deal went nowhere.)

At the time, Bombardier had some negotiating power. But as soon as the C Series got slammed with the tariffs, it was game over and Airbus was able to negotiate a sweet deal that will see Bombardier – and perhaps the Canadian and Quebec taxpayers – still write the cheques for a product over which it has lost control.

Airbus was brilliant. It owns the finest piece of Canadian aerospace technology on the market, and it got Bombardier to subsidize the deal.

The Globe and Mail. 18 Oct 2017. Investors, hold on to Bombardier. Montreal-based company’s rally is good news as its proposed deal with Airbus gives the firm a new lift

DAVID BERMAN

We view this agreement as a game-changing endorsement of the C Series platform – one that’s very likely to turn prospective customer heads around the world. Steve Hansen Raymond James analyst

Bombardier’s share price is rallying, the risks associated with the struggling Montreal-based company are subsiding and investors should be holding on to this stock for some time.

On Monday evening, Bombardier Inc. announced it had struck an agreement with Airbus Group SE, handing a controlling interest of Bombardier’s C Series airliner program to the European-based aerospace giant.

Quibble if you want about the terms of the deal, what it means for taxpayers, Quebec jobs and Canadian ownership of the 100-150 seat planes.

But for investors, this is good news. Very good news.

The agreement gives Bombardier access to Airbus’ manufacturing know-how, which should reduce the cost to produce the planes. The agreement may also remove a U.S. trade dispute driven by Boeing Co., given that Bombardier will shift some production to an Airbus facility in Alabama.

And it gives a terrific shot of confidence to the Bombardier planes, which will surely translate into additional sales to airlines in need of smaller, fuel-efficient planes.

“We view this agreement as a game-changing endorsement of the C Series platform – one that’s very likely to turn prospective customer heads around the world,” Steve Hansen, an analyst at Raymond James, wrote in a note.

The question, though, is how much upside is left in Bombardier’s share price?

The shares surged more than 20 per cent at the start of trading on Tuesday, sending them toward 2½ year highs, after investors began to digest the upbeat implications of the agreement with Airbus.

From the stock’s recent low point in late September, when the U.S. Commerce Department slapped massive duties on C Series planes imported into the United States, Bombardier’s share price has rallied more than 30 per cent.

The bullish case for Bombardier, which I outlined late last month prior to the rally, has relied on the success of the C Series platform.

This case looked risky just three weeks ago and was based mostly on upbeat feedback on the new planes; the fact that the planes tapped into a market underserved by Airbus and Boeing; and that Bombardier was ahead of competing planes from smaller aerospace companies in Russia, China and Brazil.

Now, the bullish case looks far easier to swallow – and it’s probably not built into Bombardier’s current share price yet.

That’s because the agreement with Airbus carries considerable uncertainty. It isn’t expected to close until the end of 2018, leaving a year of questions about the health of the global economy, the reaction from airlines (Bombardier’s customers) and the next move from the U.S. Commerce Department (don’t expect any cheering from Boeing).

For another thing, Bombardier believes that the backing from Airbus will double the value of the C Series platform, to at least $4-billion.

Sounds good, but the benefit to shareholders isn’t so simple. Chris Murray, an analyst at AltaCorp Capital, noted that Bombardier shifts from owning 62 per cent of a $2-billion platform to owning 31 per cent of a $4-billion plat-form.

The company gets less of a bigger thing and that suggests little change, from a cash-flow perspective, in the near-term.

It is not surprising, then, that most analysts are sticking with their previous views on the stock, even as it rallies. The consensus target price, according to Bloomberg, remained relatively unchanged on Tuesday afternoon, at $3.

That’s not significantly higher than Tuesday’s closing price of $2.73.

But, for longer-term investors, this near-term caution is good news.

It implies that the stock still has room to rise as the uncertainties are ironed out, the questions are answered and the agreement with Airbus translates into significant orders for C Series planes.

It could be a wild ride, but it’s worth hanging on.

REUTERS. OCTOBER 16, 2017. Boeing says Bombardier CSeries jets may face hefty duties despite Airbus deal

Allison Lampert, Tim Hepher

MONTREAL/TOULOUSE, France (Reuters) - Boeing Co said on Tuesday that Bombardier Inc’s CSeries jets could still be hit with high U.S. import duties, even if they are assembled in Alabama through an industry-changing deal with Airbus.

An Airbus A320neo aircraft and a Bombardier CSeries aircraft are pictured during a news conference to announce a partnership between Airbus and Bombardier on the C Series aircraft programme, in Colomiers near Toulouse, France, October 17, 2017. REUTERS/Regis Duvignau

The deal announced on Monday gives Airbus a majority stake in Bombardier’s troubled CSeries jetliner program, securing the plane’s future and giving the Canadian firm a possible way out of a damaging trade dispute with Boeing, in which the U.S. Commerce Department has threatened to impose a 300 percent import duties.

Boeing said that the announced deal has no effect on the pending U.S. Department of Commerce proceedings. “Any duties finally levied against the C-Series... will have to be paid on any imported C-Series airplane or part, or it will not be permitted into the country,” Michael Luttig, Boeing’s general counsel, said in a statement.

Investors cheered the winners of the deal that is set to shake up the $125 billion a year market for large jets. Bombardier shares jumped 15.7 percent on Tuesday, while shares in Toulouse, France-based Airbus rose 4.8 percent.

The transaction would give Airbus a 50.01 percent stake in an entity recently carved out of Bombardier to produce and market the CSeries, four years after it first flew with a goal to enter the large jets market.

But in a move emblematic of the huge risks of aerospace competition, Bombardier will get just one dollar for the majority stake in exchange for Airbus’s purchasing and marketing power to support an aircraft that has won fans for its fuel efficiency but had not secured a new order in 18 months for the 110-130 seat plane due to doubts over its future.

Bombardier’s strategy of performing final assembly in Alabama might allow the CSeries to avoid duties because the trade case targets partially and fully-assembled aircraft, said U.S. international trade lawyer William Perry.

Bombardier and Airbus could argue they are importing parts, like the wing from Northern Ireland, to be assembled in the United States.

“That may be the loophole Bombardier is hoping to use,” he said by phone.

‘ONE DOLLAR DEAL’

In reality, the terms of the deal mean Bombardier could pay Airbus to take over by agreeing to underwrite $700 million of risks related to cost overruns in coming years.

“It’s an unexpected move by Airbus but indicates they see good market potential for the CSeries. Neither they nor Boeing currently offer an aircraft in the regional jet market,” said aerospace consultant John Strickland of JLS Consulting.

The deal is similar to one that Airbus walked away from in 2015 when it decided the investment in a plane that had not yet entered service was too risky - with one major difference: that some of the jets will be produced in the United States.

That could change the power balance in Bombardier’s costly trade dispute with Boeing, though it is not the main reason why the two former rivals have come together, executives said.

“Assembly in the U.S. can resolve the (tariff) issue because it then becomes a domestic product,” Bombardier’s chief executive, Alain Bellemare, told reporters at Airbus’s headquarters in Toulouse.

Airbus CEO Tom Enders hailed the tie-up as “a win for Canada ... a win for the UK,” referring to Bombardier’s wing-making factory in Northern Ireland whose future had been threatened by the distant trade war.

He said it would also create new U.S. jobs.

The deal appeared to catch Boeing off guard. Locked in a separate 13-year trade dispute with Airbus, Boeing on Monday called it a “questionable deal” between two of its subsidized competitors.

CANADIAN APPROVAL

Bellemare said he hoped the deal would be approved within six to 12 months. Canadian Innovation Minister Navdeep Bains, who must officially decide whether to green-light the deal, said it looked like “Bombardier’s new proposed partnership ... would help position the CSeries for success”.

Bombardier said the partnership should more than double the value of the CSeries program.

While it will lose control of a project developed at a cost of $6 billion, the deal gives the CSeries improved economies of scale and a better sales network.

For Airbus, the deal strengthens the bottom end of its narrowbody portfolio after poor sales of its own A319 model and expands its global footprint, potentially opening up further deals in other sectors in Canada.

Tony Webber, a former chief economist at Qantas, said the CSeries could complement Airbus’s existing single-aisle models.

Bellemare said the deal was expected to close in the second half of 2018.

“We’re doing this deal here not because of this Boeing petition. We are doing this deal because it is the right strategic move for Bombardier,” he said, referring to Boeing’s complaint that the Canadian firm received illegal subsidies and dumped CSeries planes at “absurdly low” prices.

NO JOB LOSSES

Bombardier said the deal would not result in job losses and would keep the head office in Montreal. Unions said the deal could benefit workers.

The Boeing-Bombardier dispute has snowballed into a bigger multilateral trade dispute, with British Prime Minister Theresa May asking U.S. President Donald Trump to intervene to save British jobs.

Bombardier is the largest manufacturing employer in Northern Ireland and May’s Conservatives rely on the support of the small Northern Irish Democratic Unionist Party (DUP) party for their majority in parliament.

Business Secretary Greg Clark said Britain would work closely with the planemakers, while the DUP said the agreement was “incredibly significant news” for Belfast.

Talks for the deal between Airbus and Bombardier first started over dinner at the end of August.

Enders said the deal was different from an earlier round of talks in 2015, when he abruptly ordered an end to negotiations. He said the CSeries’ had since been certified, entered service and was performing well.

Some analysts said the deal could drive Boeing closer together with Brazil’s Embraer, with which it already cooperates.

Bombardier is in the middle of a five-year turnaround plan after considering bankruptcy because of a cash-crunch as it developed multiple planes simultaneously, including the CSeries.

($1 = 1.2529 Canadian dollars)

Additional reporting by Ankur Banerjee in Bengaluru; Alana Wise in Atlanta; David Ljunggren in Arlington, Virginia; Michael Holden in London; and Richard Lough and Sudip Kar-Gupta in Paris; Writing by Denny Thomas, Guy Faulconbridge and Richard Lough; Editing by Mark Potter and Lisa Shumaker

BLOOMBERG. 18 October 2017. Bombardier Gives Up Jetliner Ambitions for Luxury Planes, Trains

By Frederic Tomesco

- Ceding control of C Series allows Canadian company to refocus

- Executive-jet business represents "upside" for stock: analyst

- Airbus Executive VP Says Right Time for Bombardier Deal

By relinquishing control of its C Series jets to longtime rival Airbus SE, Bombardier Inc. is scaling back its ambitions to build jetliners for the world’s airlines.

The deal marks a step away from what had been touted as the crown jewel of Canada’s biggest aerospace company before it was tarnished by cost-overruns and trade disputes. With the future of the C Series now up to Airbus, the Montreal-based manufacturer is likely to sharpen its focus on private jets and trains -– two businesses with higher margins.

“This is Bombardier opening the door to the transition away from commercial aviation,’’ Karl Moore, a professor of management strategy at Montreal’s McGill University, said in a telephone interview. “I’m not sure they had much of a choice. Surely they will have interesting opportunities in executive jets and trains, and they can reinvest in those.’’

Private business jets have been Bombardier’s most profitable division, while commercial aircraft –- weighed down by losses tied to the development of the C Series -– ranked among the company’s worst-performing. Bombardier’s commercial unit includes older products such as the CRJ regional jet and the Q400 turboprop.

The C Series is Bombardier’s biggest and most expensive commercial jet program, often billed by the company as a “game-changing’’ aircraft with superior economics and fuel efficiency. The deal with Airbus gives the European planemaker majority control with a 50.01 percent stake. Bombardier will retain about 31 percent, and the Quebec government will hold 19 percent.

Fizzling Business

Regional commercial jets contributed the bulk of Bombardier’s revenue during the 1990s, but orders eroded over the last decade as Brazilian rival Embraer SA captured market share with newer models. Sales have also slowed for turboprops as European rival ATR -– partly owned by Airbus -– offered cheaper and lighter products.

As business has lagged in commercial aviation, trains and business jets promise growth. Deliveries of luxury jets are forecast to rebound in 2018, and with Bombardier about a year away from starting shipments of its biggest-ever private plane, the Global 7000, prospects in that segment are rising, said Cam Doerksen, a National Bank Financial analyst in Montreal.

“The business jet market is at a cyclical low with deliveries, and Bombardier has a brand new aircraft coming to market in a year,’’ he said. “This constitutes upside for the stock."

Bombardier’s train segment is also poised for improvement. The manufacturing unit has been hobbled by well-publicized delays on major projects such as streetcar deliveries to Toronto. The company is now working to improve profits, in part through cost-cuts and more factory specialization. The train business bore the brunt of a company plan -– announced a year ago -- to eliminate 7,500 jobs globally.

Rail Deals

Bombardier also remains open to rail partnerships after missing out on a combination with Germany’s Siemens AG, which picked Alstom SA as its partner.

“We will continue to explore opportunities on the train side,’’ Bombardier Chief Executive Officer Alain Bellemare said late Monday on a conference call with analysts, after the announcement of the Airbus agreement.

“Rail is a core business for them,’’ said Doerksen, who sees opportunities for deals "at some point. In the meantime they will continue to work on margins.’’

Whether commercial jets also remain a core business is yet to be seen, he says. Regardless, Bombardier’s joint venture with Airbus allows the company to extract more value from its C Series jets by capitalizing on the marketing muscle and supply chain economics Airbus will bring.

The move prompted Doerksen on Tuesday to raise his 12-month target price on Bombardier stock to C$3.50 a share from C$3. The company’s widely traded Class B stock jumped 15 percent to C$2.73 in Toronto trading Tuesday, the biggest one-day increase since March 2016.

Doubling Value

Airbus’s involvement could more than double the value of the C Series program after the deal closes late next year, Chief Financial Officer John Di Bert said late Monday in the same conference call with analysts. The company currently values the business at $2 billion.

Airbus is paying no upfront cash for its majority stake, and will have the right to buy out its partners after 7.5 years -– an option the Toulouse, France-based company said it will probably exercise.

“Yes, Airbus is getting a great deal here, but the value for Bombardier could be much higher than if they continued to go it alone,’’ said Doerksen. “People viewed the C Series as an ongoing cash burn. This removes all of that uncertainty.’’

The jet program played a major role in recent years in saddling Bombardier with almost $9 billion of debt. The C Series entered service in July 2016, two and a half years late and more than $2 billion over budget. Bombardier’s most recent figure put the development cost at about $6 billion.

The deal with Airbus “does some good things for Bombardier,’’ said Chris Murray, an AltaCorp Capital analyst in Toronto. “Net net, you are trading a majority stake in a $2 billion pie for 31 percent of a $4 billion pie, and you have de-risked the company.’’

BLOOMBERG. 18 October 2017. Boeing's Attack on Bombardier Backfires

By Rick Clough

- U.S. planemaker’s biggest rival takes control of the C Series

- Deal follows trade spat that roiled U.S. ties to Canada, U.K.

- Airbus Executive VP Says Right Time for Bombardier Deal

Boeing Co.’s diminutive Canadian rival just found itself one heck of a wingman.

The world’s largest aerospace company tried to block Bombardier Inc.’s all-new C Series jet from the U.S. by complaining to the government about unfair competition. Now that move is backfiring as Boeing’s primary foe, Airbus SE, takes control of the Canadian aircraft -- with plans to manufacture in Alabama.

The deal leaves Boeing’s 737, the company’s largest source of profit, to face a strengthened opponent in the market for single-aisle jetliners, where Airbus’s A320 family already enjoys a sales lead. The European planemaker is riding to the rescue of a plane at the center of a trade dispute that soured U.S. relations with Canada and the U.K., where the aircraft’s wings are made.

“For Boeing, its decision to wage commercial war on Bombardier has arguably had some unintended negative outcomes,” Robert Stallard, an analyst at Vertical Research Partners, said in a report. “As well as damaging relations with the Canadian and U.K. governments and some major airline customers, it has now driven Bombardier into the arms of its arch competitor.”

Heavy Tariffs

Boeing on Tuesday held firm to its stance against the C Series, saying the deal with Airbus would have “no impact or effect on the pending proceedings at all” in the trade dispute. Boeing won a preliminary victory against Bombardier last month when President Donald Trump’s administration imposed import duties of 300 percent on the C Series.

Any duties “will have to be paid on any imported C Series airplane or part, or it will not be permitted into the country,” Michael Luttig, Boeing’s general counsel, said in a statement.

While some manufacturing work will stay in Canada, Airbus believes it will be able to get around the tariffs by opening a second assembly line at its factory in Alabama, said Patrick de Castelbajac, the company’s strategy chief.

That’s a risk to Boeing’s case.

“Clearly, the trade dispute is not on as firm a footing as we once thought,” Carter Copeland, an analyst with Melius Research, said in an interview.

Competitive Response

That leaves Boeing to consider whether a competitive response is needed, such as reevaluating its new-aircraft development plans or entering its own partnership. The company is facing increased pressure in the narrow-body market, where its 737 competes with the Airbus A320 family.

“Boeing is really in a box here,” said Nicholas Heymann of William Blair & Co.

| Boeing | Airbus |

| Bombardier C Series 100 / 300 Seats: 108-160 List price: $79.5m / $89.5m | |

| 737-700 / Max 7 Seats: 126-153 List price: $82.4m / $92.2m | A319 / A319neo Seats: 124-160 List price: $90.5m / $99.5m |

| 737-800 / Max 8 Seats: 162-178 List price: $98.1m / $112.4m | A320 / A320neo Seats: 150-180 List price: $99m / $108.4m |

| 737-900 / Max 9 Seats: 178-193 List price: $104.1m / $119.2m | A321 / A321neo Seats: 185-240 List price: $116m / $127m |

The Chicago-based company could explore options with Embraer SA, Heymann said. The Brazilian planemaker’s E2 jets are of similar size to the C Series. Embraer and Boeing already partner on the KC-390 military transport aircraft.

The Airbus-Bombardier deal “validates the huge opportunities in the 100-150 seats market,” Embraer said in a statement.

Boeing slid less than 1 percent to $258.62 at the close of trading in New York. The company is this year’s biggest gainer on the Dow Jones Industrial Average, with an advance of 66 percent. Embraer tumbled 5.4 percent to 16.07 reais Tuesday, the biggest drop in almost seven months. Bombardier surged 15 percent to C$2.73, the biggest gain in more than 18 months.

Trade Spat

The U.S. tariffs on the C Series stoked tensions between the Trump administration and two key allies, which are also significant Boeing customers. Canadian Prime Minister Justin Trudeau warned his government wouldn’t buy new military jets from the Chicago-based planemaker unless it dropped the case. His counterpart in the U.K., Theresa May, hinted that Boeing was risking future contracts.

The impact of the Airbus-Bombardier pact may ultimately be minor for Boeing, since its 737 has only limited overlap with the C Series at the smaller end of the market, said Douglas Harned, an analyst at Bernstein. Demand is growing for more mid-sized planes, he said. Boeing is studying whether to build a jet, sometimes nicknamed the 797, to fit between the biggest single-aisle planes and the smallest wide-bodies.

That aircraft would serve a “very different market” than the C Series, said Mike Sinnett, Boeing’s product-development head.

Modern Design

While Sinnett suggested “there isn’t a lot new” in the C Series, Airbus gains access to a plane featuring a high proportion of composite materials, a first in the narrow-body segment. The jet also has a more modern design than either the 737, which in its original form dates from the late 1960s, or Airbus’s own A320, which first flew in 1987.

When announcing the deal, Airbus Chief Executive Officer Tom Enders said it’s too early to speculate on whether the C Series will form the basis for the company’s next short-haul offering. He acknowledged that the Toulouse, France-based company is likely to take cues in areas such as the Canadian model’s cockpit design and advanced aeronautics.

Whatever the future development plans, Airbus’s embrace means the C Series is here to stay as a narrow-body option for airlines.

“It definitely extends Airbus’s advantage in the single-aisle front,” Richard Aboulafia, an aerospace analyst at Teal group, said in an interview. “Customers were very favorably impressed” with the C Series “but they were worried about ending up with an orphan jet.”

— With assistance by Christopher Jasper

NAFTA

The Globe and Mail. 18 Oct 2017. NAFTA renegotiations turn acrimonious

ADRIAN MORROW

The renegotiation of the North American free-trade agreement has exploded into open hostility, with Canada accusing the Trump administration of trying to “turn back the clock” by tabling illegal protectionist demands and the United States slamming Ottawa and Mexico City for taking “unfair advantage” of the world’s largest economy and refusing to agree to changes to the pact.

On the most acrimonious day of talks so far, U.S. Trade Representative Robert Lighthizer and Canadian Foreign Minister Chrystia Freeland publicly traded blows at a news conference closing the fourth round of negotiations.

In one glimmer of hope, however, the United States announced it would scrap its end-of-year deadline for an agreement and continue negotiating until at least the end of March – suggesting Washington may be serious about trying to reach a deal rather than pushing the entire agreement to unravel.

The standoff cranks up pressure on the three sides to break the deadlock at the next round and prove that NAFTA can be saved.

The three sides have now tabled all of their demands, including five U.S. proposals – on auto manufacturing, dispute resolution, public procurement, a sunset clause and supply management – that Ottawa has told Washington are complete non-starters.

“We are seeing proposals that would turn back the clock on 23 years of predictability, openness and collaboration under NAFTA,” Ms. Freeland told reporters in an auditorium of the General Services Administration building in Washington on Tuesday afternoon, as Mr. Lighthizer stood a few feet away.

Ms. Freeland warned a deal “cannot be achieved with a winner-take-all mindset or an approach that seeks to undermine NAFTA rather than modernize it.”

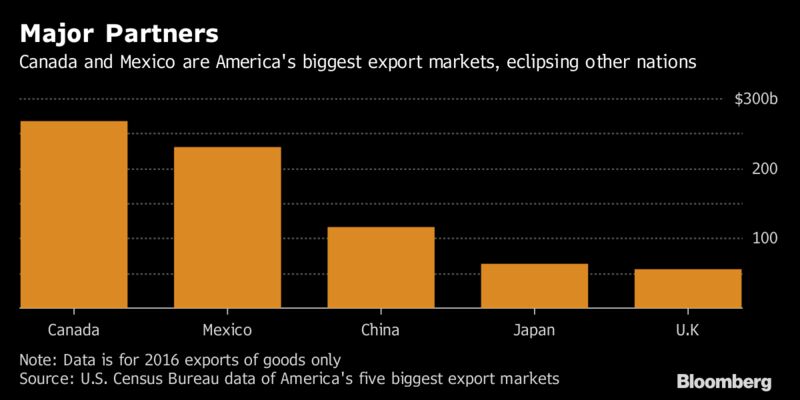

She said a U.S. demand that Canadianand Mexican-manufactured vehicles contain 50-per-cent U.S. content is “troubling” and would break World Trade Organization rules. Ms. Freeland also took aim at the Trump administration’s obsession with slashing the United States’ trade deficit, saying the balance of trade was “not a useful measure” of economic success.

Mr. Lighthizer hit back, accusing Canada and Mexico of intransigence at the bargaining table and describing NAFTA as a “lopsided” deal that favoured them over the United States.

“Frankly, I am surprised and disappointed by the resistance to change from our negotiating partners on both fronts,” he said. “We have seen no indication that our partners are willing to make any changes that will result in a rebalancing and a reduction in these huge trade deficits. … Countries are reluctant to give up unfair advantage.”

At one point, he turned toward Ms. Freeland, telling her “for us, trade deficits do matter,” as she smiled uncomfortably.

Mexican Economy Minister Ildefonso Guajardo struck a softer tone, but warned that without NAFTA all three sides would suffer. “We undertook this as a win-win-win negotiation and not to be in a loselose-lose situation. No one wants to end this process empty-handed, and there is no reason for that,” he said. Agitated Mexican officials could be seen huddling in the hallway with Mr. Guajardo after the standoff.

The three countries will slow down the negotiating schedule, with the next round convening Nov. 17 in Mexico – a change from the 10-day gaps between sessions to date. One source said Mr. Lighthizer surprised Canada and Mexico on Tuesday by proposing the longer timeline, which appeared to be a signal that there could still be a way to salvage the negotiations.

The fourth round was the most substantive to date, with the United States laying out all of its demands in detail. These include the U.S. content requirement on cars and trucks made in Canada and Mexico, severely limiting the amount of U.S. government contracts that Canadian and Mexican companies can bid on, gutting the mechanisms for settling trade disputes under the deal, slapping on a sunset clause that would automatically kill NAFTA in five years unless all three countries agreed to keep it, and dismantling Canada’s protected dairy, poultry and egg markets.

People with knowledge of the closed-door talks described tense scenes in the negotiating rooms – at a drab hotel next to an expressway in a Virginia suburb of Washington – where U.S. negotiators presented their demands only to be immediately told by their Canadian and Mexican counterparts that they will not agree to them.

Many sessions consisted of Canadian and Mexican negotiators trying to explain to the Americans why their proposals would hurt all three economies, and asking questions to clarify how the United States intended its demands to work. In many cases, the sources said, U.S. negotiators seemed uncomfortable with their own protectionist proposals and said they were merely passing on what had been handed to them by the White House.

No matter how badly things go, both Canada and Mexico have publicly vowed not to walk away from the negotiating table. One source said that, in the event of a complete impasse, Canadian negotiators will still keep showing up every day – even if it means sitting silently across the table from their U.S. counterparts.

Speaking with reporters at the Canadian embassy shortly after her showdown with Mr. Lighthizer, Ms. Freeland contemplated a doomsday scenario. “Look: Our approach to NAFTA – as to all issues – is to hope for the best and prepare for the worst.”

The Globe and Mail. 18 Oct 2017. Trump’s NAFTA plan is clear, now Canada has to ride it out

ANDREI SULZENKO, Former Canadian trade negotiator and current executive fellow at the School of Public Policy, University of Calgary A fter the latest round of NAFTA negotiations and Prime Minister Justin Trudeau’s visit to Washington, the jig is up.

The U.S. administration’s game plan is now clear: Make multiple outrageous demands that, even if partially accepted, constitute a huge “America First” victory; or, if rejected outright by Canada and Mexico, set up a failed negotiation and a messy denouement – also a win in terms of U.S. President Donald Trump’s public antipathy to the North American free-trade agreement.

What is now apparent about that prospective denouement is the likelihood of the United States promoting separate bilateral negotiations with Canada and Mexico after jettisoning three-way NAFTA talks. Mr. Trump clearly signalled this in his meeting last week with Mr. Trudeau. Not surprising, as the United States has always preferred the greater leverage of bilateral deals to multipartite ones such as the TransPacific Partnership (TPP).

In its current domestic political environment, it is improbable that Mexico will wish to pursue bilateral talks with the United States. Mexico will hold a presidential election next year, with high risk in the meantime of yielding no better – and maybe worse – trading terms with the United States.

Indeed, it would be politically toxic in Mexico to be seen re-engaging with a country that seemed to be negotiating in bad faith.

As for Canada, the original 1989 bilateral free-trade agreement with the United States still underlies NAFTA and there would be no apparent urgency in either country to reengage bilaterally if Mr. Trump’s political base already had its red meat. After all, Mexico has been the far larger source of American angst over its trade imbalance.

Furthermore, it will take some time for the dust to settle in the United States should the NAFTA talks fail, no doubt with recriminations blasting from Congress.

So what is a probable scenario following a U.S.-contrived failure of the current negotiations?

First, for maximum political impact, Mr. Trump will likely invoke the withdrawal clause from NAFTA, starting a six-month countdown.

Second, even if the United States then proposes to negotiate bilaterally with both Canada and Mexico, the triggering of a withdrawal from NAFTA will provoke a strenuous domestic debate over whether that is within the President’s prerogative. Such a debate will likely lead to court challenges that culminate in a Supreme Court review. (This is a wild card because the U.S. Constitution is unclear on whether the executive or legislative branch can abrogate treaties.)

Third, there will be major accompanying push back in Congress against withdrawal from NAFTA, invoking its legislative authority over trade-agreement implementation, aided and abetted by an overwhelmingly pro-NAFTA business community.

Fourth, the ill will generated by the trade debate will likely result in collateral damage to any remaining hopes for co-operation between Congress and the Trump administration on other major issues such as tax reform, thereby increasing policy gridlock.

Fifth, given the unreliability of our U.S. trading partner, Canada and Mexico, participants in the original TPP, will forge ahead with a revival of that agreement among the other parties, including Japan. Ironically, if TPP2 were to come to pass, the United States would have its export market potentially impaired by reciprocal preferential access among TPP2 partners.

Sixth, all this controversy will be rolled into U.S. midterm election campaigning, without much prospect for clarity on U.S. trade policy direction until after November, 2018. In this connection, Canada would be well advised to take a time out from bilateral talks until the United States sorts out the problems it has created and clarifies its real objectives.

A year is a very long time in politics, and the landscape may be quite different at that time. In this regard, there are many possible outcomes on the trade front. For example, it is always possible that NAFTA as we know it will remain intact and that negotiations can be resumed on a more pragmatic basis.

In light of that uncertainty, Canada should keep cool and let the turmoil south of the border play out.

Having said that, the United States will always be our No. 1 trading partner. But if the various elements of the scenario outlined above unfold, we can spend greater time and effort in the intervening months pursuing better access to other important foreign markets.

THE GLOBE AND MAIL. OCTOBER 17, 2017. Canada, U.S. clash over NAFTA as talks extended into 2018

ADRIAN MORROW, WASHINGTON

The renegotiation of the North American free-trade agreement has exploded into open hostility, with Canada accusing the Trump administration of trying to "turn back the clock" by tabling illegal protectionist demands and the United States slamming Ottawa and Mexico City for taking "unfair advantage" of the world's largest economy and refusing to agree to changes to the pact.

On the most acrimonious day of talks so far, U.S. Trade Representative Robert Lighthizer and Canadian Foreign Minister Chrystia Freeland publicly traded blows at a news conference closing the fourth round of negotiations.

In one glimmer of hope, however, the United States announced it would scrap its end-of-year deadline for an agreement and continue negotiating until at least the end of March – suggesting Washington may be serious about trying to reach a deal rather than pushing the entire agreement to unravel.

The standoff cranks up pressure on the three sides to break the deadlock at the next round and prove that NAFTA can be saved.

The three sides have now tabled all of their demands, including five U.S. proposals – on auto manufacturing, dispute resolution, public procurement, a sunset clause and supply management – that Ottawa has told Washington are complete non-starters.

"We are seeing proposals that would turn back the clock on 23 years of predictability, openness and collaboration under NAFTA," Ms. Freeland told reporters in an auditorium of the General Services Administration building in Washington on Tuesday afternoon, as Mr. Lighthizer stood a few feet away.

Ms. Freeland warned a deal "cannot be achieved with a winner-take-all mindset or an approach that seeks to undermine NAFTA rather than modernize it."

She said an American demand that Canadian- and Mexican-manufactured vehicles contain 50-per-cent U.S. content is "troubling" and would break World Trade Organization rules. Ms. Freeland also took aim at the Trump administration's obsession with slashing the United States' trade deficit, saying the balance of trade was "not a useful measure" of economic success.

Mr. Lighthizer hit back, accusing Canada and Mexico of intransigence at the bargaining table and describing NAFTA as a "lopsided" deal that favoured them over the United States.

"Frankly, I am surprised and disappointed by the resistance to change from our negotiating partners on both fronts," he said. "We have seen no indication that our partners are willing to make any changes that will result in a rebalancing and a reduction in these huge trade deficits. … Countries are reluctant to give up unfair advantage."

At one point, he turned toward Ms. Freeland, telling her "for us, trade deficits do matter," as she smiled uncomfortably.

Mexican Economy Minister Ildefonso Guajardo struck a softer tone, but warned that without NAFTA all three sides would suffer. "We undertook this as a win-win-win negotiation and not to be in a lose-lose-lose situation. No one wants to end this process empty-handed, and there is no reason for that," he said. Agitated Mexican officials could be seen huddling in the hallway with Mr. Guajardo after the standoff.

The three countries will slow down the negotiating schedule, with the next round convening Nov. 17 in Mexico – a change from the 10-day gaps between sessions to date. One source said Mr. Lighthizer surprised Canada and Mexico on Tuesday by proposing the longer timeline, which appeared to be a signal that there could still be a way to salvage the negotiations.

The fourth round was the most substantive to date, with the United States laying out all of its demands in detail. These include the U.S. content requirement on cars and trucks made in Canada and Mexico, severely limiting the amount of American government contracts that Canadian and Mexican companies can bid on, gutting the mechanisms for settling trade disputes under the deal, slapping on a sunset clause that would automatically kill NAFTA in five years unless all three countries agreed to keep it, and dismantling Canada's protected dairy, poultry and egg markets.

People with knowledge of the closed-door talks described tense scenes in the negotiating rooms – at a drab hotel next to an expressway in a Virginia suburb of Washington – where U.S. negotiators presented their demands only to be immediately told by their Canadian and Mexican counterparts that they will not agree to them.

Many sessions consisted of Canadian and Mexican negotiators trying to explain to the Americans why their proposals would hurt all three economies, and asking questions to clarify how the United States intended its demands to work. In many cases, the sources said, U.S. negotiators seemed uncomfortable with their own protectionist proposals and said they were merely passing on what had been handed to them by the White House.

No matter how badly things go, both Canada and Mexico have publicly vowed not to walk away from the negotiating table. One source said that, in the event of a complete impasse, Canadian negotiators will still keep showing up every day – even if it means sitting silently across the table from their U.S. counterparts.

Speaking with reporters at the Canadian embassy shortly after her showdown with Mr. Lighthizer, Ms. Freeland contemplated a doomsday scenario. "Look: Our approach to NAFTA – as to all issues – is to hope for the best and prepare for the worst."

REUTERS. OCTOBER 17, 2017. NAFTA negotiators trade barbs, indicate wide differences

David Lawder, Dave Graham

WASHINGTON (Reuters) - The top U.S. and Canadian and trade officials on Tuesday accused each other of sabotaging efforts to renegotiate the North American Free Trade Agreement, even as they and Mexico agreed to extend talks into the first quarter of 2018.

A seven-day round of talks in suburban Washington ended in acrimony over aggressive U.S. demands on autos, a five-year sunset clause on the pact itself and Canada’s dairy regulations, among other key issues. Canada’s foreign minister, Chrystia Freeland, accused Washington of pursuing a “winner take all” approach.

In a major setback, Freeland, U.S. Trade Representative Robert Lighthizer and Mexican Economy Minister Ildefonso Guajardo said they faced “significant conceptual gaps” in their views and agreed to stretch out the talks in search of solutions.

Lighthizer complained that the Mexican and Canadian sides showed no evidence of willingness to make changes that would “rebalance” NAFTA to shrink U.S. trade deficits.

He warned that U.S. companies could no longer count on NAFTA trade rules that since 1994 have encouraged investment in Mexico and Canada and that he views as primarily aimed at exporting to the United States.

“Everybody has to give up a little bit of candy, that’s really what this is about,” Lighthizer told a news briefing.

But the talks hit a wall on his proposals to radically reshape NAFTA, causing some observers to wonder whether the Trump administration intends to sink the trade pact.

PROPOSALS “WOULD TURN BACK THE CLOCK”

Washington’s demands, previously identified as red lines by its neighbors, include forcing renegotiation of the pact every five years, reserving the lion’s share of automotive manufacturing for the United States and making it easier to pursue import barriers against some Canadian and Mexican goods.

“We have seen proposals that would turn back the clock on 23 years of predictability, openness and collaboration under NAFTA,” Freeland said.

News of the talks’ extension through to the first quarter of next year, from the end of this year, lifted the Mexican peso MXN=D2 1.2 percent after a volatile day of trading. The peso has fallen 7 percent since July on expectations that NAFTA would not survive.

Mexico sends about 80 percent of its exports to the United States, and is home to a host of factories for U.S. companies that manufacture products there that are then sent to the United States for sale.

Guajardo avoided direct criticism of Lighthizer’s approach, but said Mexico would stand firm against the U.S. demands.

“A bad deal would be against the interest of Mexico itself, and therefore you have my guarantee that there will not be a bad deal,” Guajardo told reporters.

He added that rather than being intransigent, Mexico and Canada were taking a “good sense” approach to the talks.

Despite the tension, Mexican and Canadian officials have stressed that their governments will not walk away from the table. The talks are now scheduled to resume in Mexico City on Nov. 17-21, giving negotiators additional time to devise strategies.

While the NAFTA countries did close out a chapter on competition policy, Lighthizer said there were still deep differences on some issues such as digital trade, intellectual property rights and anti-corruption policies.

TERMINATION THREAT

U.S. President Donald Trump, who made trade a centerpiece of his 2016 presidential campaign, has repeatedly threatened to terminate NAFTA if Mexico and Canada refuse major changes.

Lighthizer said he was not focused on termination and wanted to negotiate a “good agreement,” but added that he had no plan should talks collapse.

“If we end up not having an agreement, my guess is all three countries would do just fine. We have a lot of trade, a lot of reasons to trade,” he said.

One person close to the process said there was now a real possibility that negotiations to modernize NAFTA, which underpins some $1.2 trillion in annual trade between the three countries, could collapse.

Any termination decision would now be postponed until March 2018, by which time Trump could be distracted by other developments such as his tax reform plan, said Gary Hufbauer, a senior fellow at the Peterson Institute for International Economics.

But it remained unclear how the talks regain momentum.

“Staggering talks could be the right description in the meantime,” Hufbauer said.

The Trump administration has also set out proposals that could impose fresh restrictions on long-haul trucking from Mexico, according to a person familiar with the matter. That too is likely to meet stiff resistance, Mexican officials say.

U.S. opposition to NAFTA’s dispute resolution mechanisms, plans to restrict outside access to government contracts and attacks on Canadian dairy and softwood lumber producers are all causing friction behind the scenes, officials say.

Additional reporting by David Ljunggren in Washington and Sharay Angulo in Mexico City; Editing by Jonathan Oatis and Leslie Adler

BLOOMBERG. 18 October 2017. Nafta Gets a Welcome Reprieve. The Trump administration needs to pause and rethink its approach to the agreement. Mexico, Canada Reject U.S. Demands in Nafta Talks

By The Editors

Good news: The North American economy has been granted a stay of execution. Negotiations to revise Nafta, which seemed close to collapse not so long ago, have been extended into next year.

The U.S. should use this pause to rethink its whole approach to the North American Free Trade Agreement.

President Donald Trump has been consistent, if nothing else, in attacking Nafta both during his campaign and in office. His analysis of Nafta's costs is all wrong -- the deal has been a boon to the U.S. and to North America as a whole.

That's not to say that the agreement can't be improved and updated; it can be. The most obvious and easy way would be to incorporate elements of the abandoned Trans-Pacific Partnership into Nafta. Doing so would allow Trump to win Mexico's and Canada's agreement, change and rebrand Nafta -- and mark the new pact as a notable Trumpian achievement.

Instead, the administration has underlined demands that are bad on their own terms and which Mexico and Canada will be hard-pressed to accept.

Trump wants to water down the pact's dispute-settlement procedures, which are vital to assure the smaller economies that their interests won't be trampled. He wants stronger local-content rules for Nafta trade, which would disrupt supply chains and discourage intra-regional trade. And he wants a sunset provision that would turn Nafta into a temporary arrangement liable to end at short notice, rather than the settled and predictable trading system that it is.

Canada and Mexico, as expected, appear to have balked at these demands. The resulting delay doesn't help companies impatient for clarity, which is a needless cost in its own right. Nevertheless, it's good that the talks, and Nafta itself, have not yet hit a wall.

The administration can change Nafta for the better, and take credit for doing so. But threatening to wreck the pact -- a danger by no means dispelled by the talks' extension -- is a grave disservice to the U.S. economy and its workers.

BLOOMBERG. 17 October 2017. Nafta Deadlock Dashes Hopes for a Quick Deal

By Eric Martin , Josh Wingrove and Andrew Mayeda

- Talks extended into 2018 with next round in Mexico Nov. 17-21

- U.S. ‘surprised’ by Mexico and Canada not backing its demands

- Lighthizer Says Nafta Has Caused Huge U.S. Trade Deficit

Nafta talks are switching gears and slowing down as key obstacles emerge, with Canada and Mexico rejecting what they see as hard-line U.S. proposals and negotiators exchanging their strongest public barbs yet.

U.S. Trade Representative Robert Lighthizer, Mexican Economy Minister Ildefonso Guajardo and Canadian Foreign Minister Chrystia Freeland wrapped up the fourth round of North American Free Trade Agreement talks in Washington on Tuesday and said negotiations will run through the end of March 2018, abandoning a December target. They also extended the time between negotiating rounds, giving themselves more space to consider proposals.

The ministers cast the longer timelines as a positive way to dig into tougher disputes, pledging to continue to work out a deal while acknowledging that strong differences remain. They next meet in Mexico Nov. 17-21.

“New proposals have created challenges and ministers discussed the significant conceptual gaps among the parties,” Lighthizer said, reading a joint statement at the close of the fourth round of talks. “Ministers have called upon all negotiators to explore creative ways to bridge these gaps.”

Their joint remarks to the press were the most heated since talks began in August. Lighthizer said he’s “surprised and disappointed by the resistance to change,” while Guajardo said Mexico has limits to what it can accept. Canada’s Freeland criticized a “winner-take-all mindset.”

Tuesday’s joint appearance capped talks punctuated by controversial U.S. demands on dairy, automotive content, dispute panels, government procurement and a sunset clause, which Canada and Mexico have rejected.

“Yes we want an agreement, yes we want to find a win-win situation, but this won’t be at the detriment to our national interests,” Guajardo told reporters after the trilateral news conference ended.

Freeland said a deal that benefits the three countries can’t be reached with “an approach that seeks to undermine Nafta rather than modernize it.” Still, she added that an agreement for an improved Nafta is “absolutely achievable.”

In her own news conference, she stressed that a longer timeline shows “a pragmatic approach and goodwill.” Later asked why she was optimistic given the impasses, she said in French: “I don’t think I’ve used the word ‘optimist.’”

The Mexican peso jumped more than 1 percent on news of the 2018 timeframe for talks, while the Canadian dollar rose 0.2 percent, as investors bet it decreased the odds that the deal would fall apart any time soon.

‘Good Agreement’

President Donald Trump has called Nafta a disaster and repeatedly threatened to withdraw the U.S. from the agreement, a step the White House can set into motion by giving six months’ notice to its partners. At stake is the $1.2 trillion in annual trade between the three countries, as well as the business models of companies such as Ford Motor Co. and General Motors Co. that have adapted their supply chains to take advantage of the trade zone.

Lighthizer told reporters he’s not focused on the possibility of the U.S. exiting the deal. “I’m focusing on trying to get a good agreement,” he said, though he added that the three countries would do “just fine” without Nafta.

“Right now, it’s a great deal for the Mexicans and the Canadians, in my opinion. It’s a great deal for businesses that have decided they want to take advantage of the situation,” Lighthizer said. "Everybody has to give up a little bit of candy. That’s really what this is about.”