CANADA ECONOMICS

STATISTICS

StatCan. 2017-05-23. Wholesale trade, March 2017

Wholesale sales — Canada

$60.2 billion, March 2017

0.9% increase (monthly change)

Source(s): CANSIM table 081-0011.

Wholesale sales rose 0.9% in March and surpassed the $60 billion mark for the first time. Gains were recorded in four of seven subsectors, accounting for 60% of total wholesale sales, and were led by the building material and supplies subsector.

In the first quarter of 2017, wholesale sales were up 3.6% from the fourth quarter of 2016. This was the highest quarterly change since the second quarter of 2008.

In volume terms, wholesale sales increased 0.6% from February to March.

Chart 1 Chart 1: Wholesale sales increase in March

Wholesale sales increase in March

Higher sales in four subsectors

The building material and supplies subsector recorded the largest increase in dollar terms, as sales rose 3.9% to a record high $8.4 billion on the strength of higher sales in the lumber, millwork, hardware and other building supplies industry (+5.7%) and the metal service centres industry (+8.2%). Exports of lumber and other sawmill and millwork products rose 6.0% in March.

Sales in the miscellaneous subsector rose 2.2% to $7.9 billion, following a 0.2% decline in February. Four of five industries contributed to the gain in March, with the chemical (except agricultural) and allied product industry contributing the most.

The food, beverage and tobacco subsector posted a second consecutive increase with sales growing 1.1% to $11.6 billion. Gains in the food industry (+1.1%) led the increase.

Sales were up 0.5% in the personal and household goods subsector, to $8.3 billion. While gains were widespread across the industries within the subsector, the personal goods industry (+5.0%) contributed the most.

The machinery, equipment and supplies subsector decreased 0.5% to $11.6 billion, following five months of increases. The construction, forestry, mining, and industrial machinery, equipment and supplies industry (-3.6%) contributed the most to the decline.

Sales in the motor vehicle and parts subsector edged down 0.2% to $11.6 billion as sales in the motor vehicle industry declined 0.5%. This was a second consecutive decline for both the subsector and the industry.

The farm product subsector (-1.6%) also declined in March.

Sales up in nine provinces

Wholesale sales were up in nine provinces in March, representing 97% of total wholesale sales. In dollar terms, British Columbia, Quebec, and Newfoundland and Labrador led the gain.

Following two consecutive declines, sales in British Columbia rose 1.9% to $6.3 billion, the second-highest sales level on record, primarily on higher sales in the building material and supplies subsector.

In Quebec, sales increased 1.1% to a record high $10.8 billion, led by the food, beverage and tobacco subsector. This was Quebec's third monthly increase in the past four months.

Newfoundland and Labrador recorded its first gain in four months, with sales jumping 29.3% to $489 million, the highest since November 2016. The miscellaneous subsector was the largest contributor to the increase.

Sales in Alberta rose 1.5% to $6.4 billion, a sixth consecutive increase. Gains were recorded in four subsectors, led by the motor vehicle and parts subsector and the building material and supplies subsector.

Ontario posted a fourth consecutive increase, with sales up 0.3% to a record high $31.0 billion. Gains in three subsectors, led by the building material and supplies subsector, offset declines in the other subsectors.

In Saskatchewan, sales were up 1.4% to $2.2 billion, with only the miscellaneous subsector posting a gain while other subsectors declined.

Sales in Nova Scotia increased 1.8% to $808 million, led by gains in the motor vehicle and parts subsector.

In Prince Edward Island, sales rose 6.1% to $74 million on the strength of gains in five subsectors, mostly offsetting a 6.0% decline in February.

Sales in New Brunswick edged up 0.1% to $508 million, led by higher sales in the building material and supplies subsector.

Manitoba recorded the lone decrease in March, with sales edging down 0.1% to $1.6 billion. Declines were recorded in five subsectors.

Inventories edge down in March

Wholesale inventories edged down 0.3% to $77.8 billion in March. Lower inventories in two subsectors, representing 45% of wholesale inventories, more than offset higher inventories in others.

Chart 2 Chart 2: Wholesale inventories edge down in March

Wholesale inventories edge down in March

The machinery, equipment and supplies subsector (-3.7%) posted the largest decrease in dollar terms in March, the first decline in eight months.

Inventories in the personal and household goods subsector were down 2.4%, the first decline in four months.

Inventories in the miscellaneous subsector rose 5.7%, reaching their highest level on record in March.

In the building material and supplies subsector (+2.0%), inventories increased for the fourth consecutive month.

The motor vehicle and parts subsector posted its second consecutive increase, with inventories up 0.8% to their highest level on record.

Higher inventories were also reported by the food, beverage and tobacco subsector (+0.9%).

The inventory-to-sales ratio declined from 1.31 in February to 1.29 in March. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170523/dq170523a-eng.pdf

The Globe and Mail. The Canadian Press. May 23, 2017. Lumber exports help push wholesale sales above $60-billion for first time

OTTAWA — Statistics Canada says wholesale sales were up 0.9 per cent in March, surpassing the $60-billion mark for the first time.

Total Canadian wholesale sales for that month reached $60.2-billion as strength in lumber exports offset declines in motor vehicles and heavy machinery.

The gains were led by the building material and supplies subsector, which set a record high $8.4-billion in March – up 3.9 per cent from February and up 10.6 per cent from March 2016.

In total, there were increases in four of the seven subsectors tracked by Statistics Canada accounting for 60 per cent of wholesale sales.

For the first quarter of this year, wholesale sales were up 3.6 per cent from the fourth quarter of last year – the highest quarterly change since the second quarter of 2008.

StatCan. 2017-05-23. Natural gas transmission, storage and distribution, March 2017

Natural gas opening inventories

683.5 million gigajoules, March 2017

Natural gas closing inventories

608.1 million gigajoules, March 2017

Exports to the United States

306.7 million gigajoules, March 2017

Source(s): CANSIM table 129-0005.

Natural gas transmission pipelines received 569.6 million gigajoules of natural gas from fields, gathering systems and plants in March, a 5.8% increase compared to the same month in 2016. Seven provinces posted receipts, with Alberta (71.2%) and British Columbia (26.2%) holding the majority.

Natural gas transmission and distributions systems delivered 217.1 million gigajoules to industrial consumers, 94.3 million gigajoules to residential consumers and 76.7 million gigajoules to commercial and institutional consumers in March.

Provincial deliveries

In Alberta, March deliveries of natural gas amounted to 169.8 million gigajoules, an 18.3% increase compared to the same month in 2016. The majority (76.9%) were delivered to the industrial sector. Alberta industrial deliveries accounted for 33.6% of the natural gas consumed in Canada.

In Ontario, 115.7 million gigajoules of natural gas were delivered, a 5.9% increase compared to March 2016. The residential sector received 41.3% of these deliveries, while the industrial sector received 30.0% and the commercial sector received 28.7%.

Chart 1 Chart 1: Canadian monthly natural gas inventories

Canadian monthly natural gas inventories

Opening and closing inventories

Opening inventories of natural gas in Canadian facilities totalled 283.5 million gigajoules. Inventories decreased 11.0% in March to close at 608.1 million gigajoules. This was the sixth consecutive month of net withdrawals from storage.

Opening to closing inventories in March saw Western Canada decrease 6.4% to 453.5 million gigajoules and Central Canada decrease 22.2% to 154.6 million gigajoules.

Closing inventories in Canada decreased 17.5% compared to the same month in 2016.

Exports and imports

Canada exported 306.7 million gigajoules of natural gas by pipeline to the United States in March, up 19.6% from the same month in 2016. Imports of natural gas from the United States rose 18.2% to 94.9 million gigajoules compared to March 2016.

Chart 2 Chart 2: Canadian imports and exports of natural gas

Canadian imports and exports of natural gas

Quarterly Review

Transmission pipelines received 1.6 billion gigajoules of natural gas from fields and plants in the first quarter of 2017, up 2.9% from the same quarter in 2016.

Transmission and distribution systems delivered 1.2 billion gigajoules to Canadian consumers, up 10.2% from the first quarter of 2016. Distribution systems accounted for 62.5% of these deliveries.

Pipelines exported 0.9 billion gigajoules of natural gas to the United States in the first quarter, up 9.1% from the same quarter in 2016.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170523/dq170523b-eng.pdf

StatCan. 2017-05-23. Refined petroleum products, April 2017

Data on the production, inventories and domestic sales of refined petroleum products for Canada and the regions are now available for April upon request.

Other selected data about these products are also available.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170523/dq170523c-eng.pdf

_______________

BOMBARDIER

REUTERS. May 23, 2017. In Bombardier fight, Boeing sees ghost of Airbus ascent

By Tim Hepher and Alwyn Scott

PARIS/SEATTLE (Reuters) - Two words underpin Boeing's BA.N decision to launch a U.S. trade complaint against Bombardier BBDb.TO, which plunged it into a row with Canada last week: "Never again".

Allegations that the Canadian firm dumped newly designed CSeries passenger jets in the United States at a steep loss have threatened a sale of F/A-18 warplanes to Ottawa, sending Boeing scrambling to save the deal.

Some analysts say Boeing carelessly put at risk billions of dollars of defense work or pandered to growing protectionism.

But decades after Boeing failed to prevent European upstart Airbus gaining momentum with early victories in the United States, people familiar with the company say the strategic importance of defending its core passenger jet business outweighs the diplomatic storm.

U.S. industry experts say Boeing and other jetmakers at the time did not take the European consortium seriously enough and allowed their future nemesis to poach U.S. airlines from 1978.

Again after the September 2001 attacks in the United States, when Boeing slashed production, Airbus AIR.PA filled the vacuum, building up market share and never looking back.

For years Boeing insiders have rued that decision, even while battling Airbus at the World Trade Organization (WTO) over mutual accusations of unfair subsidies.

While leading in widebody jets, it has seen the narrowbody market – where the industry makes most cash - slip away as Airbus grabbed some 60 percent of new-generation sales.

Such a significant imbalance in market share poses serious long-term risk to the loser in the Airbus-Boeing duopoly, because it creates a gap in costs that can't easily be bridged.

Now, Boeing sees a second rival entering its domestic market with what it sees as low prices and is determined not to underestimate the threat again, people close to the company say.

"It's a crucial entry market," said a person familiar with Boeing's strategy in taking on Bombardier. "This is the case Boeing might have brought against Airbus 40 years ago. Not taking action at the start led to consequences."

On the surface, Boeing's case is about the sale of jets to Delta Air Lines at what Boeing claims were unfairly low prices.

Bombardier denies Boeing's estimates of both the price and the cost at which it is able to make its new jet, while critics say Boeing accounting rules allow it to disguise weak pricing.

While the high-profile deal ignited Boeing's complaint, executives say Boeing's stance reflects a longer-term concern.

Although Bombardier's small narrowbody jet has so far barely scratched Boeing's larger 737 and has suffered a spate of financial problems, the all-new design disturbs a landscape made up mainly by makeovers of existing Airbus and Boeing models.

With Airbus still well ahead on narrowbody orders even after a recent lull, Boeing can ill afford to be squeezed on two fronts. Even less so with new players like China arriving.

A Boeing spokesman declined to comment.

PRECISION TRADE WEAPON

Boeing's response marries strategic worries about its narrowbody position with a legal tactic designed to exploit a vulnerability the CSeries has, but global rival Airbus did not.

The 110-130 seat CSeries relies mainly for now on the regional jet market, where North America is by far the largest single component and whose airlines therefore decide its future.

That hands Boeing the opportunity to make use of a domestic lawsuit ill-suited to its global confrontation with Airbus, but which if successful could deliver a hammer blow to the CSeries.

Trade sources see a second tactical motive for spurning the WTO and filing the industry's first such domestic U.S. case.

U.S. anti-dumping cases typically take a year - versus 13 years and counting in its trench warfare against Airbus.

That coincides with first delivery of a CSeries to Delta in April 2018. If Boeing succeeds, the jets could be hit from day one with extra duties, blunting Bombardier's competitiveness more quickly and more directly than normal trade sanctions.

Still, Boeing faces a headache over what to do about lost fighter sales if Canada makes good on a threat to drop a deal for F/A-18 warplanes in retaliation for Boeing's trade claim.

With Boeing's future fighter production in jeopardy as sales run dry, Boeing is anxious to keep its presence in that business long enough to compete for tomorrow's military programs.

But without stability in its narrowbody jetliner business, Boeing faces an even deeper concern, since this is the cash cow for many of the company's other activities.

Sources says Boeing's defense bosses signed off on bringing the trade case, highlighting the importance attached to the 737.

The broader stakes raised by Bombardier's foray into the U.S. market were underscored when China was reported to revive on-off talks to invest in Bombardier. Airbus itself weighed buying the CSeries before talks collapsed in 2015.

Whoever wins the trade spat between Bombardier and Boeing, one thing is clear: the small jet from Montreal has made its mark on the strategic calculations of all industry rivals, and now faces a battle for new sales.

(Additional reporting by Allison Lampert; Editing by Mark Potter)

________________

HOUSING BUBBLE

The Globe and Mail. May 22, 2017. Mortgage market in focus as Canadian banks set to report earnings

DAVID BERMAN

Canada’s biggest banks will start rolling out their second-quarter financial results this week, and investors are counting on executives to provide answers to a burning question: Is the country’s mortgage market okay?

Since Home Capital Group Inc. experienced a run on its deposits last month – sending the alternative mortgage lender’s share price sliding 65 per cent in a single day – observers have been concerned about the potential knock-on effects. Adding to the urgency is the fact that Home Capital’s challenges have arisen at a time when regulators are busy introducing measures to cool the real estate market, particularly in the Greater Toronto Area.

Stock prices of the Big Six banks are reflecting some unease. Collectively, they have fallen an average of more than 8 per cent from recent highs. The sector is now lagging the broad S&P/TSX composite index year-to-date – an unusual divergence that is calling for a response.

“Our expectation is that during earnings calls, bank managements will point to differences between Home Capital’s mortgage origination and funding structure, as well as the quality of the banks’ portfolios, as points of distinction,” Brian Klock, an analyst at Keefe, Bruyette & Woods, said in a note.

“The Canadian government has taken steps to cool off the housing market and we’ll look for bank managements to provide colour on the steps they’re taking to insulate their portfolios,” Mr. Klock added.

Despite the uneasy backdrop, analysts are relatively upbeat about the quarter. For one thing, they expect that Bank of Montreal and National Bank of Canada will hike their dividends. For another, profits should rise solidly over last year’s results. Darko Mihelic, an analyst at RBC Dominion Securities, expects profit will rise by an average of 6 per cent over the same period last year. Robert Sedran, an analyst at CIBC World Markets, expects profit will rise by an average of 8 per cent. Gabriel Dechaine, an analyst at National Bank Financial, expects profit growth of 14 per cent.

The results should reflect a trio of improvements. Banks stand to benefit from recent cost-cutting measures, margins on U.S. loans should expand with the two recent interest rate hikes by the Federal Reserve and credit conditions have been improving with the rebound in the price of crude oil since early last year.

These improvements should offset slower capital markets activity since last quarter, with debt and equity issuance volumes down, according to a report from RBC.

“While U.S. investment banks reported good investment banking results in their most recent quarter, we caution that we cannot necessarily infer good investment banking revenues for the Canadian banks based on historical experience,” RBC’s Mr. Mihelic said in a note.

But Home Capital, which neared failure last month before it secured a financial lifeline from a pension fund to offset fleeing deposits, will probably loom large in any discussions about financial results. While the lender specializes in non-prime loans, and therefore doesn’t compete with the major banks, it remains unclear whether its challenges will affect other lenders.

If Home Capital were to sharply curtail or stop originating loans, possibly making home purchases and mortgage reneweals more difficult for some buyers, then home prices and broader mortgage lending could also take a hit.

But most analysts believe the worries are overstated: “There may be a test for the housing market coming when the economy next enters recession, but the troubles faced by Home Capital Group this year are about Home Capital, not the housing market,” CIBC’s Mr. Sedran said in a recent note.

Even so, hearing that from a bank CEO could go a long way toward relieving investor anxiety.

“From 30 per cent housing price appreciation in Toronto that resulted in regulatory action by the Province of Ontario to the ongoing Home Capital drama, there has been no shortage of market developments,” National Bank’s Mr. Dechaine said in a note.

He added: “Outlook commentary from the banks will hopefully address a variety of investor concerns.”

The Globe and Mail. May 21, 2017. Bank of Canada rate change unlikely amid mixed signs

DAVID PARKINSON - ECONOMICS REPORTER

The Bank of Canada looks all but certain to stick with its cautious tune when it issues its latest interest-rate decision this week, as growing economic optimism should take a back seat to tepid inflation and worries on the housing and trade fronts.

Financial markets are pricing in a near-zero chance the central bank will change its key rate from the current 0.5 per cent when it announces its decision Wednesday, one of eight such rate announcements it issues annually. That would extend the bank’s stand-pat streak to 15 rate decisions spanning nearly two years.

This is one of the four rate decisions each year that lands in between quarterly Monetary Policy Reports, which means the announcement won’t be accompanied by an update of the central bank’s economic forecasts. The brief statement will, however, provide the bank’s assessment of the state of the Canadian economy, in general terms.

Last time out, in mid-April, the bank played down the economy’s strong start to the year, attributing much of the faster-than-expected growth to temporary factors. Since then, key economic indicators have, indeed, been more mixed; but some recent strong data have raised the possibility that first-quarter growth may have topped the 3.8-per-cent annualized pace that the Bank of Canada baked into its April projections. There were more than enough bright spots in March to suggest the economy entered the second quarter with decent momentum – but perhaps not enough to dissuade the Bank of Canada from its recent glass-half-empty leanings on the economic data.

Crucially for a central bank that uses a 2-per-cent inflation target as its formal guide for setting interest rates, last Friday’s consumer price index report for April showed an inflation rate of just 1.6 per cent, while the central bank’s core inflation measures sat near multiyear lows.

“Despite the many growing arguments for the Bank to turn more hawkish – solid GDP growth, a falling jobless rate, a hot Ontario housing market – subdued core inflation is their ace in the hole, arguing for a stand-pat stance,” Bank of Montreal chief economist Douglas Porter said in a research note.

Of more significance may be how the Bank of Canada characterizes the mounting uncertainties threatening the economic outlook.

The central bank has long identified overheated regional housing markets, and their associated heavy household debt burdens, as the key risk to Canada’s economic well-being; its focus in recent months has intensified on the runaway Toronto-area market. Those concerns have moved very much to the forefront of public imagination since the bank’s last rate announcement, amid the turmoil at mortgage lender Home Capital and Ontario’s unveiling of a new foreign-buyers tax to try to quell speculative pressures in the Toronto region.

For a long time, the Bank of Canada was silent on the Home Capital situation; it looked as though Governor Stephen Poloz might wait until this week’s rate announcement, if not longer, to talk about the risk the beleaguered lender might pose to the broader financial system. But the central bank chief decided to speak out on the issue in an interview with The Globe and Mail last week, saying that Home Capital’s case is “idiosyncratic” and there’s no evidence of contagion.

While those comments effectively pre-empted what might have been a key focus of the rate announcement, central bank watchers will still be looking to the statement for additional detail. Observers will also be keen for any glimpse into the bank’s currents views on the Toronto housing market, as recent signs have emerged suggesting the beginnings of a cooling.

Meanwhile, the outlook for Canada’s trade relationship with the United States, by far its most important market, has if anything darkened since the central bank’s last rate decision. President Donald Trump has stepped up his protectionist rhetoric aimed at Canada, while his administration has imposed new duties on Canadian lumber and launched a reopening of NAFTA negotiations that could begin as early as August.

BLOOMBERG. 2017 M05 23. In Home Capital’s Mortgage Mess, Blame the ‘Unlucky’ Brokers

by Katia Dmitrieva

- Mortgage brokers fudging figures draw parallels to U.S. crash

- Inflated incomes allow borrowers to enter soaring home market

- Home Capital Turnaround Seen as Perilous, Getting Harder

Home Capital’s troubles started with “unlucky” brokers. That’s what Canadian banks and insurers call the mortgage merchants who get caught submitting fraudulent loan documents.

Home Capital Group Inc. disclosed that 45 independent brokers submitted loan applications that misstated borrowers’ income and other details. A securities regulator accused the company of misleading investors about the fraud, and that sparked a run on deposits at the lender. Yet the brokers, whose names are now on databases maintained by lenders and mortgage insurers, can still win business since they haven’t been prosecuted for fraud. Unlucky doesn’t necessarily mean unemployed.

The failure to stop such practices is exposing cracks in Canada’s vaunted regulatory structure, drawing parallels to the U.S. a decade ago. So-called Ninja loans -- an acronym for mortgages made to borrowers with no income, no job or assets -- helped sink the U.S. housing market and led to the worst financial crisis since the 1930s. Canada emerged relatively unscathed from the 2008 crash, with officials crediting tougher regulations and lending standards. Yet Home Capital’s experience shows that the system of rooting out brokers who submit false documents doesn’t even put those brokers out of business.

“The early days of growth in the subprime market in the U.S. were like this -- then it got out of hand," said Jim MacGee, an associate professor of economics at Western University in London, Ontario. “At some point, you’re going to have people who take short cuts. When people are facing pressure to get into a house, you have brokers who are facing pressure to get them in there. They just hear, ‘How can you get me in there?’"

Hamilton Case

Even when regulators do go after brokers, the process can take years. In one case, Hamilton, Ontario, broker Dinesh Khanna allegedly forged signatures on behalf of unwitting clients, charged them exorbitant fees and lined up family members as lenders, taking possession of the home when the clients couldn’t pay, according to court documents filed by the Financial Services Commission of Ontario. While some of the accusations of rule-breaking were as early as 2009, it wasn’t until 2015 that Khanna’s license was suspended, according to FSCO. Khanna’s lawyer declined to comment in an email.

“You will always be behind as a regulator," said Thorsten Koeppl, an associate professor in the economics department at Queen’s University in Kingston, Ontario. “You’re being outsmarted by the marketplace. We can’t avoid a crisis. But what we’ve learned from 2008 in the U.S. is how to deal with the crisis. And that’s what we can take away."

As the U.S. housing crash went global a decade ago, Canada largely avoided the pain because of the conservative lending of its largest banks, which originate most residential mortgages in the country. But after millions lost their homes or jobs in the U.S., and home-value declines decimated whole communities, Canadian policymakers wanted to ensure that never happened. They raised lending standards, targeting the over-leveraged homebuyer, who’s got an average C$1.67 in debt for every dollar made.

Regulators tightened mortgage rules a dozen times in the past five years, helping drive borrowers to alternative lenders including Home Capital, which picked up first-time buyers, immigrants, the self-employed and those with shallow credit histories who could no longer tap the banks. Business flourished for independent brokers, who submit applications across a range of lenders -- from shadow companies to companies like Home Capital as well as Toronto-Dominion Bank and Bank of Nova Scotia.

Broker Growth

In Ontario, which contains more than one-third of the country’s population and its fastest-growing housing market, independent brokers were responsible for C$142 billion in mortgages in 2015, a 21 percent jump from the prior year, according to the most recent FSCO data. The nation has about C$1.45 trillion in mortgage credit outstanding.

Canada’s 9,000 brokers and the taxpayer-backed housing agency’s exposure to them is tracked province-by-province. In Ontario, FSCO oversees them, the ministry of finance sets regulations including the law that governs brokers, and the federal Office of the Superintendent of Financial Institutions oversees some of the lenders these brokers work with. Canada Mortgage & Housing Corp., the nation’s housing agency, insures about half of the nation’s mortgages.

A FSCO spokesman declined to comment. Home Capital, through spokesman Boyd Erman, said it “keeps regulators appropriately advised of developments in its business.” An OSFI spokeswoman and Ontario ministry of finance spokesman directed questions on brokers and regulation to FSCO.

CMHC spokesman Jonathan Rotondo said in an email that the agency works “proactively with partners throughout the industry to combat mortgage fraud,” rarely sees fraud, and when there is reasonable evidence of it, the agency can declare coverage void.

The patchwork regulation makes it easier for brokers to fall through the cracks, according to Ben Rabidoux, founder of economic research firm North Cove Advisors Inc. As part of his research, he speaks almost daily with brokers.

“One thing that always surprises my U.S. clients is how prevalent these broker fraud examples are in Canada because it wasn’t until the crash when all the fraud was revealed in the U.S., and we’re not there yet in Canada," Rabidoux said by phone.

Lenders’ Lists

It’s why each lender and insurer that works with independent brokers has its own database of lawyers, brokers and agents tied to mortgage applications that contain misrepresentation -- anything from forged letterheads to inflated income, according to executives at three of the country’s lenders and insurers. Once added to the list, names are shared among institutions during regular meetings throughout the year, said the executives, who asked not to be named as they discuss the industry’s inner workings.

The system, started after 2008, alerts companies to more closely scrutinize documents submitted by those brokers. They’re called “unlucky" only because they can’t label them “fraudulent" in a landscape where regulators lack resources to investigate and prove fraud in every case, the executives said.

So far, the instances of fraud in Canada haven’t resulted in a surge in defaults. The parallels with the U.S. foreclosure crisis of a decade ago are also limited, because Canadian banks don’t offer exotic mortgages that include features such as introductory teaser rates that jump after a certain period.

In the U.S., the frauds were sometimes more brazen and extended beyond the brokers. Mortgage dealers using lax standards lined up the kinds of exotic mortgages now synonymous with the crisis. Hundreds of subprime lenders then packaged and sold the loans to banks, which turned them into securities and sold them to investors. When borrowers began to default, the failures spread quickly from subprime to prime mortgages. There’s no evidence to suggest this is happening north of the U.S. border.

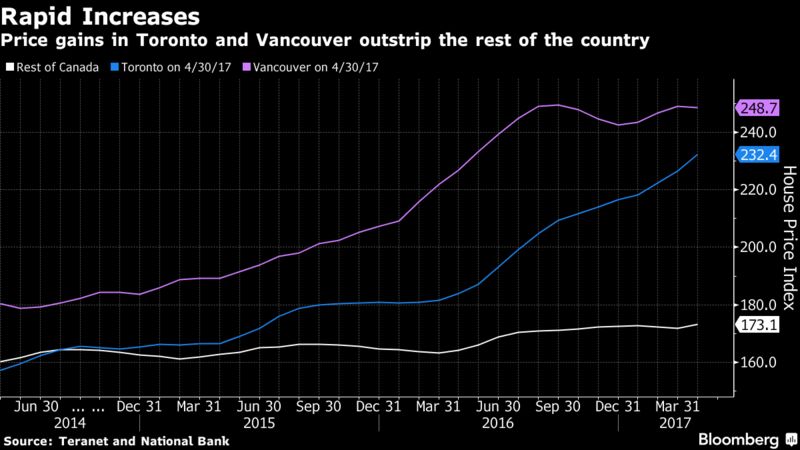

But there are some similarities. Mirroring the U.S. experience, prices in Canada’s largest cities have rallied at a record pace. Across Toronto, all housing types -- from condos to detached properties -- rose 25 percent in April from a year earlier, with homes selling in as few as three days. In Vancouver, still Canada’s priciest housing market, prices surged 11 percent to about C$940,000 in the same period.

As in the U.S. a decade ago, the high prices and low interest rates in Canada -- with the overnight lending rate floating below 2 percent for nearly a decade -- mask the potential fallout from lending to people who can’t afford it. They can always sell or refinance as their home values rise.

The lender risk system kicks in when regulation doesn’t.

In 2014, a whistleblower reported to Home Capital’s board of directors that some of their 4,000 independent brokers had submitted fraudulent documents. Once executives started digging, the company soon uncovered more and the investigation expanded. On Oct. 30 of that year, Home Capital flagged it to Canada Mortgage & Housing Corp., according to 390 pages of documents released by the agency under a freedom of information request.

Insurers immediately added the 45 brokers to their lists of unlucky brokers, but it was too late. They’d already backed about C$2 billion in loans submitted by these brokers, with rates and terms for some based on inflated income.

Although Canada’s regulator and housing agency knew of the mortgage fraud at Home Capital nine months before it was made public, it wasn’t until Home Capital issued a press release on July 29, 2015, to shareholders and borrowers that the agency’s internal communications revealed concern. The next day, a CMHC staffer flagged potential risk in an email:

“I’m wondering if we have done (or are planning to do) any analysis on our exposure to the Home Trust income documentation fraud," one email to internal insurance and operations executives from a CMHC spokesman said. The documents show Home Capital prepared a list for CMHC and OSFI of all mortgages related to the brokers. CMHC, OSFI and Home Capital declined to comment on the documents.

Home Capital has never disclosed how many fraudulent mortgages and what amount it found on its books, and CMHC has yet to disclose how many of those they’ve insured. About a fifth of Home Capital’s C$17.8 billion mortgage book is insured, as insurance is mandatory when a home buyer doesn’t have a 20 percent down payment.

Genworth MI Canada Inc., Canada’s second-largest mortgage insurer, after CMHC, said in April that Home Capital-originated loans make up only 1 percent of its business and the delinquency rate on those loans was below 0.2 percent as of March 31. Canadian lenders have an average arrears rate of 0.28 percent as of February, according to the Canadian Bankers Association.

According to Home Capital, the lender didn’t expect credit losses from the mortgages originated by the 45 brokers. In the CMHC emails obtained under the freedom of information request, CMHC staff say it appears the agency’s “risk is minimal."

Meanwhile, mortgage fraud in Canada may only be growing. Between 2013 and 2016, suspected instances of fraud among mortgage brokers jumped 52 percent in 2016 from five years prior, according to Equifax, a consumer credit and research firm. Nearly two-thirds were from Ontario.

James Thorne, a money manager at Caldwell Investment Management Ltd., doesn’t need to be convinced. He hasn’t held Home Capital stock for at least two years, when the firm first disclosed the broker fraud.

“You usually don’t find one cockroach. If you find one, there are many more,” he said by phone from Toronto. “We have a tendency to assume the negative event is a one-off. History suggests this assumption is incorrect.”

BLOOMBERG. 2017 M05 23. Canadian Real-Estate Sentiment Slips After Home Capital Meltdown

by Greg Quinn

- Share of people seeing higher prices drops for a second week

- Policy makers have sought to curb 30% rise in Toronto prices

- Home Capital Turnaround Seen as Perilous, Getting Harder

Canada’s exuberance with real estate is beginning to wane.

Weekly polling data show real estate price expectations have come down from record levels, in a sign that Canadians are anticipating housing markets in places like Toronto will finally cool. The share of people saying home prices will rise in the next six months fell for a second week to 46 percent, according to data compiled by Nanos Research Group for Bloomberg News. That’s down from 47.7 percent the previous week and below a record 50.1 percent two weeks ago.

While sentiment levels for real estate are still at historically high levels, the trend suggests confidence in the housing boom may be fraying amid troubles at Home Capital Group Inc. and the Ontario government’s introduction of new measures to cool speculation in Toronto’s housing market, including a foreign buyers tax.

“After hitting an eight year high on the perceptions of the future value of real estate in early May, perceptions are starting to normalize,” Nanos Research Group Chairman Nik Nanos said in a statement.

Policy makers including Finance Minister Bill Morneau and his Ontario counterpart Charles Sousa are seeking to bring about a smooth slowdown to Toronto home prices, which have been growing at a 30 percent annual rate. That’s come at the same time as strains have emerged in the country’s housing finance system after a run on deposits at Toronto-based Home Capital.

New Listings Soar

There is already evidence of a moderate slowdown in Toronto. Realtor figures for April released last week suggested transactions in Toronto are falling in response to Sousa’s 15 percent foreign buyer tax, while supply rose with a 36 percent jump in new listings to a record high.

Every week, Nanos Research asks Canadians for their views on personal finances, job security, the outlook for the economy and where real estate prices are headed. The responses are compiled into a gauge of consumer sentiment, the Bloomberg Nanos Canadian Confidence Index.

Overall, the index was little changed at 57.9 last week as improving perceptions of personal finances and job security offset worries about housing and a slight deterioration in the outlook for the economy.

The confidence index is based on telephone polling with a four-week rolling average of 1,000 respondents, and is considered accurate within 3.1 percentage points, 19 times out of 20.

BLOOMBERG. 2017 M05 23. Canada Must Deflate Its Housing Bubble. The central bank needs to raise interest rates, and soon.

By The Editors

Canada’s housing market offers a case study in a contentious economic issue: If a central bank sees a bubble forming, should it act to deflate it? In this instance, the answer should be a resounding yes.

A combination of foreign money, local speculation and abundant credit has driven Canadian house prices to levels that even government officials recognize cannot be sustained. In the Toronto area, for example, they were up 32 percent from a year earlier in April. David Rosenberg, an economist at Canadian investment firm Gluskin Sheff, notes that it would take a decline of more than 40 percent to restore the historical relationship between prices and household income.

Granted, the bubble bears little resemblance to the U.S. subprime boom that triggered the global financial crisis. Although one specialized lender, Home Capital Group, has had issues with fraudulent mortgage applications, regulation has largely kept out high-risk products. Homeowners haven’t been withdrawing a lot of equity, and can’t legally walk away from their debts like many Americans can. Banks aren’t sitting on the kinds of structured products that destroyed balance sheets in the U.S. Nearly all mortgage securities and a large portion of loans are guaranteed by the government.

That said, the situation presents clear risks. As buyers stretch to afford homes, household debt has risen to 167 percent of disposable income -- the highest among the Group of Seven industrialized nations. This is a serious vulnerability, and a big part of the rationale behind Canadian banks’ recent ratings downgrade. The more indebted people are, the more sensitive their spending becomes to changes in prices and interest rates, potentially allowing an otherwise small shock to result in a deep recession.

What to do? Administrative efforts to curb lending and tax foreign buyers have helped but haven’t solved the problem. That’s largely because extremely low interest rates are still giving people a big incentive to borrow. The Bank of Canada has held its target rate at 1 percent or lower since 2009, and at 0.5 percent since 2015, when it eased to counteract the effect of falling oil prices. That’s a very stimulative stance in a country where the neutral rate is estimated to be about 3 percent or higher. One can’t help but see a parallel with the low U.S. rates and the housing bubble of the early 2000s.

The oil shock is over and unemployment is at its lowest level in more than eight years: The economic rationale for keeping rates so low has faded. True, inflation remains subdued, but these are exactly the circumstances in which asset prices should guide the central bank. The Bank of Canada holds its next policy meeting on May 24. It should at the very least signal an intention to raise rates. The longer it waits, the worse the eventual reckoning will be.

BLOOMBERG. 2017 M05 23. Caution Pervades Ahead of the Bank of Canada’s Rate Decision

by Theophilos Argitis

- Recovering oil prices give life to energy producing regions

- But subdued inflation keeps the Bank of Canada on sidelines

Canada’s economy hasn’t looked so robust since the collapse of oil prices in 2014. It’s evident in gross domestic product data, job growth, retail sales and even the much maligned manufacturing sector.

So, if things are so rosy in Canada, why are investors so down on the country’s outlook?

With Bank of Canada Governor Stephen Poloz making a rate decision Wednesday, here are the latest developments in the Canadian economy and the key issues informing policy makers.

State of Play

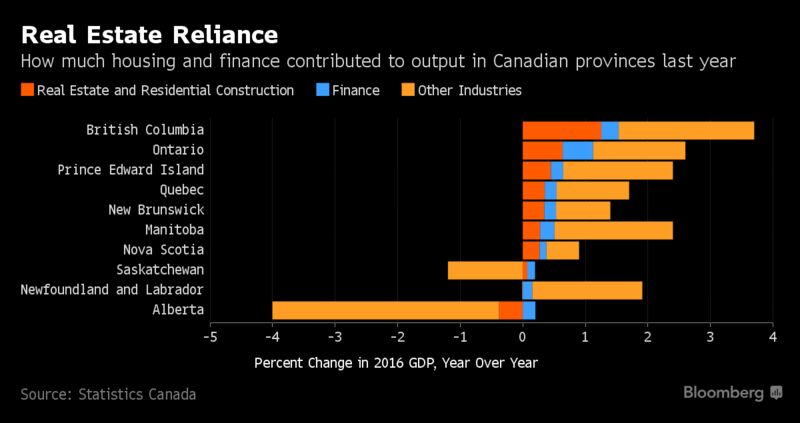

There are two key reasons why Canada’s economy is doing better. Oil prices have rebounded from last year’s lows and that’s giving energy-producing regions some life. Second, a housing boom in Vancouver and Toronto is fueling construction and creating billions in new found wealth for the city’s citizens.

Here’s the data:

The Bank of Canada is projecting output expanded at an annualized pace of 3.8 percent in the first quarter of this year, building off a 3.2 percent expansion in the second half of last year. These are heady levels of growth that are at the very high end of what Canada’s economy has been able to hit in the past 15 years. It’s also at the high end of growth for large rich nations.

The recent employment picture has been strong. The country has had positive job gains for six straight months, and since July has added 277,000 jobs. That’s almost as many jobs created as the previous two years. Other positive signs include hours worked numbers that show gains of 1.1 percent over the past 12 months and an unemployment rate -- at 6.5 percent -- that is the lowest since the recession.

Fueled by the job gains and feeling wealthier because of rising home values, Canadian households are spending. Retail sales in the first three months of 2017 were 6.3 percent higher than the same quarter last year. That’s almost double the pace of growth only a half a year ago. That’s a good sign for an economy in which consumption makes up 57 percent of output.

There are even signs of an improving picture for industrial Canada, the country’s weak spot for years. Factory shipments in March were up 8.2 percent from a year earlier, which was the fastest year-over-year pace since 2014.

Plenty of Buts

Investors haven’t been too impressed however. The Canadian dollar is only one of two major currencies that have declined against the U.S. dollar this year. The only country Canada has out-performed is Brazil, which is in the middle of a political crisis.

In part, people are taking their cue from the Bank of Canada. Policy makers have been highlighting the risks and weakness of the economy for months, even in the face of improving data, and downplayed chances of higher interest rates even as borrowing costs increase in the U.S.

That’s one reason why the Canadian dollar has been weak. Interest rate differentials matter for currencies and with the U.S. central bank in the middle of a rate hiking cycle, and rates flat in Canada, investors have found the Canadian dollar less attractive.

Of 23 economists surveyed by Bloomberg News ahead of this week’s rate decision, none are predicting a rate increase Wednesday. The next rate hike in Canada isn’t likely to happen until the second quarter of 2018, economists predict.

Rate Rationale

The central bank’s reluctance to raise rates and its analysis has raised some eyebrows, especially given Canada’s economy is currently outpacing the U.S.

Poloz has been arguing that despite the recent acceleration in growth, Canada is still playing catch up to the U.S. economy. Canada’s march to full capacity was delayed by the oil price collapse, he argues, so it makes sense that growth will pick up and even exceed the rate of U.S. expansion. But that doesn’t diminish the need for lower rates.

The governor has also been highlighting geopolitical uncertainties, and there is little evidence those are dissipating. There has been plenty for Canadians to chew over in the past week, including the start of the 90-day consultation period to renegotiate the North American Free Trade Agreement and a new spat with the U.S. over aerospace manufacturing.

The faster-than-expected growth in 2017, meanwhile, reflects temporary factors that won’t be replicated in the future, such as faster residential investment. The housing market is also the economy’s biggest source of financial stability risk, given elevated debt levels and all the trouble brewing over the situation at Home Capital Group Inc. Home-price growth slowed down in Toronto in the first two weeks of May, with sales falling 16 percent from last year amid a rush of new listings.

Plus, there is little evidence of inflation pressure, even with a pick-up in gasoline prices and the consistently elevated housing costs. The average of the central bank’s three core inflation measures -- which exclude volatile items like energy and are considered a better indicator of trends in prices -- declined to 1.4 percent in April, Statistics Canada said Friday.

While subdued price pressures are good for consumers, they also could reflect an economy with a lot of excess capacity where companies and workers have little scope to demand price increases or wage gains. That may provide central bankers with all the fodder they need to remain cautious in their statement Wednesday.

BLOOMBERG. 2017 M05 23. U.S. New-Home Sales Fall More Than Forecast

by Michelle Jamrisko

A larger-than-forecast decline in new-home purchases in April from the strongest pace in almost a decade indicates a pause in demand in the midst of the busy spring selling season, government data showed Tuesday.

HIGHLIGHTS OF NEW HOME SALES (APRIL)

- Single-family home sales decreased 11.4 percent to a 569,000 annualized pace (median forecast called for a 610,000 rate)

- The median sales price of a new house dropped 3.8 percent from April 2016 to $309,200

- Supply of homes rose to 5.7 months, the highest since September 2015, from 4.9 months; there were 268,000 new houses on the market at the end of April, most since July 2009

Key Takeaways

While new-home sales only account for about 10 percent of the residential market, the broader housing picture has remained bright with solid job growth and modest boosts to wages. A post-election surge in mortgage rates has subsided, allowing would-be buyers a little more breathing room while an increase in inventory gives them more options. The real pace of demand is probably in between the March and April rates.

Other Details

- New-home sales report includes annual revision of data going back to January 2015

- Drop in demand was led by a 26.3 percent slump in the West, the most since October 2010, after an 11.8 percent jump in March; sales fell in other three regions as well

- March reading for U.S. was revised to a 642,000 pace, the strongest since October 2007, from a previously estimated 621,000

- Commerce Department said there was 90 percent confidence that the change in sales last month ranged from a 0.9 percent drop to a 21.9 percent decrease, underscoring the volatility of the data

- New-home sales are tabulated when contracts are signed; existing-home sales are based on contract closings, for which April data are due for release Wednesday from the National Association of Realtors

- Data released jointly by the Census Bureau and Department of Housing and Urban Development in Washington

________________

ENERGY

The Globe and Mail. Reuters. May 23, 2017. U.S. plan to sell oil reserves undermines OPEC efforts

HENNING GLOYSTEIN

U.S. President Donald Trump’s proposal to sell half of the United States’ strategic oil reserve surprised energy markets on Tuesday since it counters OPEC’s efforts to control supply in order to boost prices.

The White House requested in its budget released late on Monday gradually selling off the nation’s Strategic Petroleum Reserve (SPR) starting in October 2018 to raise $16.5-billion. The U.S. SPR holds 688 million barrels, making it the world’s largest reserve, and a release of half over 10 years averages about 95,000 barrels per day (bpd), or 1 per cent of current U.S. output.

The plan came out just a day after Trump left Saudi Arabia, the de-facto leader of the Organization of the Petroleum Exporting Countries (OPEC), as part of his first overseas trip.

The U.S. has more leeway to release the SPR crude as its own production has surged 49 per cent over the past five years. But the move undermines OPEC’s efforts to tighten global oil markets by cutting their output this year and likely into 2018.

“It will complicate the OPEC efforts to stabilize the market,” said Anas Alhajji, an independent oil analyst and economist in the Reuters Global Markets Forum following the announcement.

The announcement pulled down front-month crude futures prices.

However, the budget is not fixed since Congress has the final say and has rejected many White House proposals in the past.

COMPETING WITH SAUDI, RUSSIA

Following the oil shocks of the 1970s after the Arab oil embargo, members of the Organization for Economic Co-operation and Development (OECD) started building SPR sites to hold the equivalent to 90 days’ worth of a country’s daily demand.

The U.S. released supplies from the SPR amid supply concerns at the start of the Gulf War in 1991 and after Hurricane Katrina disrupted Gulf of Mexico output in 2005, and again 2011 amid concerns about lost Libyan supply.

In December, Congress approved the sale of $2-billion of crude from the SPR to pay for maintenance and repairs. The U.S. Department of Energy sold 6.4 million barrels in January and another 10 million in February.

The White House proposal would also open areas of Alaska’s arctic region to exploration. That could raise production above 10 million bpd, up from 9.3 million bpd currently, putting the U.S. in competition with Saudi Arabia and Russia for the world’s biggest oil producer.

Analysts say that soaring U.S. shale output is the reason for the greater security in its supply.

“The U.S. has likely become more sanguine when it comes to having a very large SPR holding, given lofty medium term forecasts for the Permian basin,” said Virendra Chauhan, oil analyst at consultancy Energy Aspects, referring to a large U.S. shale oil field.

REUTERS. May 23, 2017. OPEC set to prolong oil cuts as delegates predict smooth meeting

By Alex Lawler and Rania El Gamal

VIENNA (Reuters) - OPEC will likely agree to extend production cuts for another nine months, delegates said on Tuesday as the oil producer group meets this week to debate how to tackle a global glut of crude.

OPEC's de facto leader, Saudi Arabia, favors extending the output curbs by nine months rather than the initially planned six months, as it seeks to speed up market rebalancing and prevent oil prices from sliding back below $50 per barrel.

On Monday, Saudi Energy Minister Khalid al-Falih won support from OPEC's second-biggest and fastest-growing producer, Iraq, for a nine-month extension and said he expected no objections from anyone else.

The Organization of the Petroleum Exporting Countries meets in Vienna on Thursday to consider whether to prolong the deal reached in December in which OPEC and 11 non-members, including Russia, agreed to cut output by about 1.8 million barrels per day (bpd) in the first half of 2017.

The decision pushed prices back above $50 per barrel, giving a fiscal boost to major oil producers. But it also spurred growth in the U.S. shale industry, which is not participating in the output deal, thus slowing the market's rebalancing.

Saudi Arabia's Gulf ally Kuwait said on Tuesday not every OPEC member was on board for an extension to March 2018, but most delegates in Vienna said they expected a fairly painless meeting on Thursday.

"The Saudi oil minister's view seems accurate and no serious objection is expected if at all," said one delegate, who asked not to be identified as he is not allowed to speak to the media.

"No surprises," said a second delegate.

A third source added: "I think it will be a smooth meeting to extend through until March 2018, and see what happens with U.S. shale. It will grow but there are limits."

Algerian Energy Minister Noureddine Boutarfa said on Tuesday that OPEC was discussing a possible nine-month extension, with curbs kept at the same level as under the group's existing deal.

"Right now we are talking about nine months," Boutarfa told reporters soon after arriving in Vienna.

Two OPEC sources said a one-year extension was also an option, though others said most discussions were centering on nine months due to weak seasonal demand in the first quarter.

"The longer the commitments by OPEC and non-OPEC for stabilizing the market, the more certainty there is in the market, which is good for all the stakeholders. If the need arises for any correction, this can be done in coming ministerial conferences," the first OPEC delegate said.

Another delegate, however, said a one-year extension was unlikely to garner wide support.

Oil prices initially fell 1 percent on Tuesday LCOc1CLc1 after U.S. President Donald Trump proposed to sell half of the United States' Strategic Petroleum Reserve (SPR) in the next 10 years as well as to speed up Alaskan exploration.

By 1415 GMT, Brent crude was trading flat.

The SPR sales would not start until October 2018 and would amount to just 95,000 bpd, or 1 percent of current U.S. output.

DEEPER CUTS UNLIKELY

The first OPEC delegate said he did not believe OPEC would deepen existing cuts, unless Saudi Arabia and its Gulf allies offered to take the bulk of the hit: "I still believe it is unlikely at this point."

Saudi's Falih said on Monday he expected the new deal to be similar to the old one, "with minor changes".

"He (Falih) has talked to several countries including Norway, including Turkmenistan, including Egypt, and they have made signs of their willingness to join the collaboration," Kuwait's oil minister Essam al-Marzouq said on Tuesday.

Norway's oil ministry said later on Tuesday it had no plan to join cuts but had a good dialogue with OPEC.

Deutsche Bank said the market had priced in a nine-month extension.

"The inclusion of smaller producing non-OPEC countries such as Turkmenistan, Egypt and the Ivory Coast would be a negligible boost, in our view," Deutsche said. "A deepening of cuts, though, has more potential to provide an upside surprise."

(Additional reporting by Ahmad Ghaddar and Ernest Scheyder; Writing by Dmitry Zhdannikov; Editing by Dale Hudson)

REUTERS. May 23, 2017. Oil prices rise as expected decision to extend cuts nears

By Stephen Eisenhammer

LONDON (Reuters) - Oil rose on Tuesday as expectations of an extension to OPEC-led supply cuts supported prices, reversing losses earlier in the session after a White House proposal suggested selling off half the country's huge oil stockpile.

Brent crude LCOc1 traded up 7 cents at $53.94 per barrel at 1348 GMT (9:48 a.m. ET), after a low of $53.20.

U.S. light crude CLc1 was up 10 cents at $51.23.

The Organization of the Petroleum Exporting Countries, led by Saudi Arabia, and other producers including Russia meet on May 25. They are expected to extend a pledge to cut output by 1.8 million barrels per day (bpd), possibly until March 2018.

The cuts were initially agreed to last six months until the end of June.

Kuwaiti Oil Minister Essam al-Marzouq said on Tuesday not all OPEC countries and its allies supported a nine-month extension and producers would discuss this week whether to extend output cuts by a six or nine months.

But other delegates told Reuters they predicted a smooth meeting with a nine-month extension likely to be agreed.

"OPEC meets on Thursday amid increasing optimism that the production cuts agreed last November will be rolled over and most likely to the end of 1Q18," Colin Smith, analyst at Panmure, said in a note on Tuesday, adding he expected a rollover would "likely deliver a significant tightening of the market."

Earlier in the session oil prices dropped on the White House plan to sell off half of the nation's 688 million-barrel oil stockpile from 2018 to 2027 aims to raise $16.5 billion and help balance the budget.

The budget, to be delivered to Congress on Tuesday, is only a proposal and may not take effect in its current form.

"Congress needs to agree to this which is rather uncertain," said Carsten Fritsch, commodity analyst at Commerzbank. "But of course, it could weigh on the back end of the forward curve."

Oystein Berentsen, managing director for oil trading company Strong Petroleum in Singapore, said the White House proposal was a surprise, but that over a 10-year period the sales would only average around 95,000 bpd.

"It's not huge, but it won't help Saudi efforts," he said.

Releasing reserves would add supplies to already high and rising U.S. production C-OUT-T-EIA.

Goldman Sachs has already warned of "risks for a renewed surplus later next year if OPEC and Russia's production rises to their expanding capacity and shale grows at an unbridled rate."

(Additional reporting by Henning Gloystein and Florence Tan in Singapore; Editing by Edmund Blair and Louise Heavens)

_________________

US-CANADA DISPUTE SETTLEMENTS

DAIRY

BLOOMBERG. 2017 M05 23. Why Milk Creates Anger Across U.S.-Canada Border: QuickTake Q&A

by Jen Skerritt

- Trudeau Says Canada Not the Challenge for U.S. Dairy

Canada’s dairy industry, which receives tariff and quota protections from its government, has drawn the ire of U.S. President Donald Trump, who blames Canada for millions of dollars in lost sales for U.S. milk producers. In this, Trump isn’t alone. Other nations also worry that Canada may start dumping low-cost milk products on the international market, exacerbating a global glut that’s weighed on prices and led to losses all over the world.

1. What got Trump’s goat?

Canada rolled out a new policy that makes it cheaper for Canadian processors to buy domestic supplies of ultra-filtered milk, which is used in cheese and yogurt. Some U.S. dairy companies, mostly in New York and Wisconsin, say they’ve lost all their Canadian sales of that product as a result. Trump called the move “a disgrace” and wrote on Twitter, "Canada has made business for our dairy farmers in Wisconsin and other border states very difficult. We will not stand for this. Watch!"

2. What is ultra-filtered milk?

Commercial dairies started making it in the mid-1990s. Milk is pushed through a membrane to filter out proteins and fat molecules, making it more concentrated and easier to transport. The protein concentrate is used in various food products like cheese and yogurt and specialty items such as infant formulas and low-fat spreads. In order to stem losses from rising U.S. exports of the proteins into Canada, the government-owned Canadian Dairy Commission introduced a new pricing formula designed to help its dairy farmers and processors.

3. How does Canada explain its actions?

The country’s dairy industry argues the way it manages its supply helps stave off the types of gluts that can strike U.S. milk producers. Since the 1970s, Canada has operated its dairy industry under a system known as supply management: It sets production quotas meant to match domestic output with demand and there are tariffs on imports. So even during a global glut, as is happening now, income for Canada’s milk producers has remained stable. The average net operating income per dairy farm in 2016 was C$151,309 ($111,420), up 2 percent from a year earlier.

4. Why is the U.S. stressed out over dairy?

Americans are drinking less milk: Total consumption has tumbled for six straight years and is forecast to drop again in 2017, according to the U.S. Department of Agriculture. Meanwhile, growing demand for butter and cream has resulted in excess supplies of skim milk that are left over when butterfat is removed. There’s so much extra skim milk that some processors have dumped it into holes used for livestock manure. Farmers across the globe are struggling with low prices and excess supply. Benchmark Class III milk futures, a type used in cheesemaking, declined 12 percent in the first four months of 2017. Cheese futures tumbled 14 percent on the CME during the same period.

5. Can’t the U.S. just produce less milk?

Better technology has increased milk output per cow, and government subsidies meant to avert price fluctuations have encouraged farmers to keep churning out more milk. The U.S. has a margin protection program that compensates dairy farmers when falling prices or rising feed prices squeeze margins. The program paid out $124 million last year, according to the Congressional Budget Office. The government also announced it would buy 11 million pounds, or about $20 million, of cheese stockpiles in a move to eat away at excess supplies.

6. What’s the impact on trade?

In 2016, Canada imported C$557 million ($408 million) in dairy products from the U.S., while just C$113 in milk products crossed the border in the opposite direction, equal to a trade deficit of about C$445 million, Canadian government data show.

7. Could this be addressed in Nafta talks?

Canada’s dairy industry wasn’t part of the North American Free Trade Agreement. That could change, given Trump’s intentions to renegotiate that 1994 accord among Canada, the U.S. and Mexico. The U.S.-Canada spat over softwood lumber.

8. Is this just a Canada-U.S. fight?

The dairy industries in Australia, the European Union, Mexico and New Zealand have also asked government authorities to initiate a dispute through the World Trade Organization to challenge Canada’s new pricing formula. They argue more ultra-filtered milk and other similar products from Canada, including skim milk powder, will leak onto the world market and depress prices. Between January and March, Canada shipped 9.3 million kilograms of skim milk powder worldwide, up 300 percent from the same time period a year earlier, government data show. Canadian-sourced skim milk powder products are now undercutting global prices by about $200 a metric ton in Mexico and Southeast Asia, according to The Milkweed, an industry publication.

________________

LGCJ.: