CANADA ECONOMICS

THE WASHINGTON POST. Business. April 27, 2017. Trump says no plan to pull out of NAFTA ‘at this time’

By Damian Paletta and Todd C. Frankel

President Trump told the leaders of Canada and Mexico on Wednesday that the United States would not be pulling out of the North American Free Trade Agreement “at this time,” opening the door to future negotiations on the same day that Trump was considering signaling a strong intent to withdraw as a potential way of bringing the parties to the dealmaking table.

But Trump said NAFTA’s three-nation partnership could still hang in the balance if the talks do not produce “a fair deal for all.”

“If we do not reach a fair deal for all, we will then terminate NAFTA. Relationships are good — deal very possible!” Trump wrote in a tweet posted early Thursday.

Trump spoke with Mexican President Enrique Peña Nieto and Canadian Prime Minister Justin Trudeau late Wednesday afternoon after reports circulated during the day that the president was contemplating withdrawing from NAFTA.

“President Trump agreed not to terminate NAFTA at this time and the leaders agreed to proceed swiftly, according to their required internal procedures, to enable the renegotiation of the NAFTA deal to the benefit of all three countries,” the White House said in a statement late Wednesday.

News that Trump was weighing withdrawing from NAFTA drew sharp criticism from several Republican leaders, including Sen. Jeff Flake (R) and Sen. John McCain (R). McCain tweeted that Trump “shouldn’t abandon this vital trade agreement.”

Earlier, three people familiar with the matter said Trump is seriously considering signing a document within days that would signal his intent to withdraw the United States from the agreement within six months.

If signed, the letter would begin a formal process that could see the United States exit the 23-year-old trade pact with Canada and Mexico, ratcheting up tensions among neighboring nations.

Signing the document does not require Trump to withdraw from NAFTA after six months, but it is a required step if he plans to eventually do so. The White House is expected to soon take a separate step by signing a letter to Congress that would notify lawmakers of the administration’s intention to renegotiate NAFTA. By taking both steps, the White House would give itself more flexibility to choose a different outcome in several months.

Any move by Trump on NAFTA would not come as a surprise. The president made criticism of NAFTA one of the main topics of his campaign last year, calling the pact “a disaster for our country” and saying it “had to be totally gotten rid of.”

But the NAFTA issue did seem to lose some urgency after the first few weeks of Trump’s presidency as his administration focused on other topics.

“Some people were hopeful that just like he revised his views on NATO, he’d revise his views on this,” said Hoyt Bleakley, associate professor of economics at the University of Michigan. “But clearly he hasn’t.”

In recent days Trump also has taken a harder line with Canada, blasting a recent change in the dairy pricing policy there that mostly dealt with a cheese-making product called ultrafiltered milk. In Wisconsin last week, Trump called Canada’s dairy pricing scheme “another typical one-sided deal against the U.S.” Canada disputed that.

And the Commerce Department said Monday that it would begin charging a tariff on the import of softwood lumber from Canada into the United States, alleging Canada was improperly subsidizing its domestic timber firms.

But there was no panic over the fate of NAFTA in the Calgary offices of the Canadian Cattlemen’s Association, whose members sell and buy plenty of beef cattle across the border.

“This is his typical way of doing things — saying completely unreasonable things as a negotiating posture,” said John Masswohl, the trade group’s director of government and international relations.

Masswohl said he watched how Trump handled issues at the Carrier plant in Indiana and with Ford’s plans to build car models in Mexico. He sees similar rhetoric in Trump’s approach to NAFTA.

“I’ve got to believe this is a negotiating position,” Masswohl said, because the trade pact might need tweaking, but it has been good for both countries.

Separately, the Trump administration Wednesday made another move on trade that seemed aimed at China, launching an investigation into the effect of aluminum imports on U.S. national security interests.

A similar probe, known as a Section 232 investigation, was announced for foreign-made steel last week.

Commerce Secretary Wilbur Ross said Wednesday that Trump would be signing a directive today urging the inquiry.

Ross said aluminum was a national security interest because the metal in its high-purity form is used in military planes such as the F-35 and F-18, plus armor plating for military vehicles and combat vessels. Just one U.S. smelter makes high-purity aluminum, producing enough for peacetime military needs but not enough if the country enters into conflicts, he said.

“It’s very dangerous from a defense point of view to have only one supplier of an absolutely critical element,” Ross said.

Only two U.S. smelters are fully operational today, with eight others having curtailed operations or closed since 2015. Imported aluminum accounted for 55 percent of the U.S. market last year, the largest market share ever and a steep increase over recent years, Ross said.

The largest importers of aluminum into the United States are China followed by Russia, United Arab Emirates and Canada, Ross said.

Aluminum imports from China, in particular, have been a focus of the U.S. government for months. Late last year, a bipartisan group of 12 U.S. senators asked for a national security review of Chinese aluminum giant Zhongwang International Group Ltd.’s proposed $2.3 billion purchase of U.S. aluminum products maker Aleris, alleging the deal would damage the U.S. defense industry.

In January, days before leaving office, President Barack Obama launched a World Trade Organization complaint about Chinese aluminum subsidies that, the United States claimed, gave Chinese companies an unfair advantage.

And last month, U.S. producers of aluminum foil — including the kind used to wrap kitchen leftovers — filed an anti-dumping complaint against China, claiming the United States was being flooded with unfair, cheap imports. Foil prices have declined significantly in recent years “due to widespread and significant underselling of U.S. producers’ prices,” according to the complaint.

A couple of weeks later, Trump’s Commerce Department announced that it was investigating those and other unfair trade claims.

Global Affairs Canada. April 27, 2017. International Trade Minister concludes successful promotion of Canada’s forest industry during trade mission to China

Ottawa, Ontario - China’s growing middle class represents one of the most dynamic and promising new sources of demand for Canada’s high-quality goods and services. We know that when we expand and diversify our export markets, it creates good, well-paying jobs and opportunities for middle-class Canadians.

Chinese wood products importers in Shanghai, one of the most populous cities in the world, told a Canadian trade mission led by the Honourable François-Philippe Champagne, Minister of International Trade, that they were eager for greater government-to-government cooperation to facilitate their growing demand for Canada’s versatile and eco-friendly softwood lumber.

The six-day mission, which concluded yesterday, advanced an array of trade, educational, and investment opportunities with forestry front and centre. The delegation included industry representatives from the Quebec, New Brunswick, and British Columbia lumber sector, as well as industry group Canada Wood, Export Development Canada and the Canadian Commercial Corporation.

Canada is in the early stages of exploratory discussions with China to determine whether there is sufficient interest and economic benefits to pursue formal negotiations for a free-trade agreement. The Government of Canada is also undergoing consultations to ask Canadians for input in defining Canada’s interests in a possible free-trade agreement with China.

In Chongqing, also among the world’s 20 most populous cities, the Minister participated in a softwood lumber workshop, engaging with southwest China builders, developers and architects about ways to increase the presence of wood-frame housing, and grow Canadian wood exports to the region. He also met with municipal leaders and stakeholders driving education and innovation partnerships between Canada and China’s southwestern region, including with prominent francophiles, such as the Dean of Sichuan International Studies University and exchange students bound for HEC Montréal.

During his stop in Zhengzhou, Minister Champagne attended the 2017 China Green Companies Summit and reiterated Canada and China’s shared commitment to double trade by 2025. He met with Jack Ma, Executive Chairman of Alibaba Group, which launched the “Canada Pavilion” featuring Canadian products and services on the world’s largest e-commerce shopping site last September after Mr. Ma met Prime Minister Justin Trudeau. Mr. Ma is also Chairman of the China Entrepreneur Club (CEC), and he and Minister Champagne discussed connectivity and the future of small and medium businesses. He also met with other members of the influential CEC, including substantial buyers of wood products.

The Minister finished his trip in Beijing, where he met with his ministerial counterpart Zhong Shan, Minister of Commerce to discuss expanding the Canada-China bilateral trade and investment relationship.

Minister Champagne also met with Chen Zhenggao, Minister of Housing and Urban-Rural Development, on renewing the Canada-China Memorandum of Understanding on the development of eco-cities, which promotes Canadian wood-frame construction technology. The governments of Canada and China have been working together on an eco-district project in Tianjin Binhai, which incorporates Canadian-wood construction, green-building materials and energy efficient technologies, to build over 100 beautiful Canadian-style wood villas.

Additionally, in Beijing, Minister Champagne met with the State Forestry Administration and held roundtables with business representatives, including importers of Canadian wood, tourism operators and women entrepreneurs. He also attended the CNOOC-Nexen Business Mission—an inspiring example of leadership by the largest investor in Canada which brings Canadian SMEs in the oil and gas sector to China, helping to connect them to Chinese supply chains and highlighting Canada’s expertise in innovative fields such as energy efficiency, renewable energy, bioenergy, carbon capture and storage, alternative transportation fuels, and responsible resource extraction.

While in Beijing, Minister Champagne, with Finance Minister Bill Morneau, co-chaired the launch of the Canada-China Economic and Financial Strategic Dialogue, a key commitment made during the reciprocal official visits of the two countries’ leaders in fall 2016. The Dialogue covers a wide range of economic and financial issues, helping both countries unlock opportunities for the middle class through job creation and market diversification.

Quotes

“We actively explored new opportunities for Canada’s high-quality products, notably softwood, where we found eagerness in China to explore the sustainable, eco-friendly and safe softwood products where our industry excels. Expanding Canada’s economic relationship with China will benefit the middle class and our innovative export sector.”

- François-Philippe Champagne, Minister of International Trade

"As China continues to grow and expand its economy, the Government of Canada believes that working together on priorities like trade and investment, and sharing important lessons in areas like the financial sector, can help bring stronger growth to citizens in both our countries. A strong economic relationship with China means more opportunities for middle class Canadians to succeed and prosper, and will help China meet its growing needs in sectors such as infrastructure, renewable energy, natural resources, agriculture and aerospace.”

- Bill Morneau, Minister of Finance

Quick facts

- Forest product exports contribute substantially to the Canadian economy. By value, Canada is the world’s fourth-largest forest product exporter, and the world’s leading exporter of softwood lumber and newsprint.

- Canada’s bilateral trade with China reached a value of $85 billion in 2016, and Canada and China’s two-way foreign direct investment reached $34.7 billion at the end of 2016.

- Canada’s merchandise exports to China in 2016 were worth $21 billion, up 4 percent over 2015, with the top exports being forest products, agricultural products, ores and motor vehicles.

Egg production rose 5.1% from February 2016 to 63.6 million dozen in February 2017.

In March 2017, placements of hatchery chicks on farms decreased 0.1% compared with March 2016 to 64.9 million birds.

Stocks of frozen poultry meat in cold storage decreased 4.3% from April 1, 2016, to 76 861 tonnes on April 1, 2017.

DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170427/dq170427g-eng.pdf

The Globe and Mail. Apr. 27, 2017. Trump says NAFTA deal with Canada, Mexico ‘very possible’

ADRIAN MORROW

WASHINGTON — U.S. President Donald Trump says a deal with Canada and Mexico to overhaul the North American free-trade agreement is “very possible,” but warned he would still “terminate” NAFTA if he couldn’t reach a deal.

Mr. Trump tried on Thursday to put a brave face on his abrupt climb-down the previous day from triggering the process of pulling the U.S. out of NAFTA. The President had reportedly been considering an executive order to start withdrawing from NAFTA. But he backed down after emergency telephone calls late Wednesday from Prime Minister Justin Trudeau and Mexican President Enrique Peña Nieto.

On Twitter Thursday morning, the President implied that his tough talk had brought Canada and Mexico to the table.

“I received calls from the President of Mexico and the Prime Minister of Canada asking to renegotiate NAFTA rather than terminate. I agreed subject to the fact that if we do not reach a fair deal for all, we will then terminate NAFTA,” Mr. Trump wrote. “Relationships are good-deal very possible!”

Ottawa and Mexico City, however, have always said they are ready to negotiate. Foreign Minister Chrystia Freeland reiterated earlier in the day Wednesday that Canada was prepared to sit down formally as soon as Washington was ready. In Mexico, meanwhile, Mr. Peña Nieto has undertaken extensive consultations with business to prepare for talks.

Canadian government sources have said that Ms. Freeland has been in regular contact with Commerce Secretary Wilbur Ross, Mr. Trump’s NAFTA point man. While Canada plans to hold the line on any demands from the U.S. for greater protectionism, sources have consistently said Ottawa is happy to make changes to the deal to further expand it, such as by increasing labour mobility and bringing the digital economy into the agreement.

The potential executive order was the culmination of a week of increasingly heated rhetoric from Mr. Trump. After previously saying very little about Canada for two years, the President last week slammed Canadian price-fixing on dairy last week as “very unfair,” called Canada’s treatment of the U.S. on softwood lumber “very rough” and repeatedly accused Canada of “taking advantage” of the U.S. by tricking its politicians into unequal trade deals. The President threatened to “get rid of NAFTA for once and for all” if Canada and Mexico didn’t agree to “very big changes” in the deal.

But for U.S. businesses and some senators from Mr. Trump’s own Republican party, the President’s contemplated executive order was a step too far. Arizona Senator John McCain warned in interviews Wednesday, and on Twitter, that a unilateral withdrawal from NAFTA “would be a disaster for Arizona jobs.” Tom Sleight, CEO of the U.S. Grains Council, said in a statement that his industry was “shocked and distressed” that Mr. Trump would consider such a move. “Our top grain market is not a negotiating tactic,” he said.

Such a move would also be divisive within Mr. Trump’s own administration. While his more nationalistic advisers – including National Trade Council director Peter Navarro and chief strategist Steve Bannon, who were said to have drafted the executive order – favour a harder line in trade, economic adviser Gary Cohn and Treasury Secretary Steve Mnuchin instead want to modernize NAFTA to open markets further.

Canada, however, chose to play it cool despite the heightened pressure. Both Mr. Trudeau and Ms. Freeland steered clear of firing back at Mr. Trump, simply reiterating that they were ready to talk whenever he was. One source confided Wednesday that Ottawa saw Mr. Trump’s potential executive order as posturing and that his escalating rhetoric appeared to merely by pre-negotiation bluster.

Trade experts and a Canadian government source pointed out that, under NAFTA rules, triggering the withdrawal process would not necessarily lead to a withdrawal. Under Article 2205, a country wishing to withdraw must give the other two countries six months’ notice that it plans to pull out. After the six months, that country can choose to withdraw at any time, but does not have to.

Such a move could also have been legally problematic for Mr. Trump. Whether the President can pull out of a treaty without the approval of the Senate is a grey area and could be subject to a court challenge, said Andrea Bjorklund, a trade-law expert at McGill University.

“It just isn’t really clear the President has the authority unilaterally to withdraw,” Prof. Bjorklund said.

Now, with the executive order off the table, attention will turn to the U.S. negotiating process, which has so far been the largest delay to getting formal NAFTA talks started.

The White House must consult with Congress and then give it 90 days’ notice before discussions begin. Some Democratic senators had help up the consultation process – as well as the confirmation of Mr. Trump’s trade czar, Robert Lighthizer – in order to extract concessions from the GOP on an unrelated bill providing health benefits to miners. The two sides reached a deal earlier this week that will likely see Mr. Lighthizer confirmed within the next two weeks and the 90 days’ notice shortly after that.

Talks could begin by August. They will unfold under a tight timeline: Sources in all three governments agree a deal must be hammered out well before Mexico’s presidential elections in June, 2018, lest an anti-NAFTA government come to power and scuttle the talks. This means the three sides will want something finished by the end of this year, compressing negotiations that would usually take years into a five-month time frame.

Some observers dismissed the possibility of the U.S. pulling out of NAFTA at all, meaning Washington will have to bargain with Canada and Mexico for anything it wants in a deal.

“Pulling out from a deal only works if 1) you don’t need the deal and 2) there are viable alternatives. Neither exist here,” tweeted Robert Holleyman, who was the U.S.’s second-highest trade official under former president Barack Obama.

The Globe and Mail. ANALYSIS. Apr. 27, 2017. If it looks like a trade war, swims like a trade war, quacks like a trade war

MICHAEL BABAD

Briefing highlights

- Trade tensions mount

- Companies, economies threatened

- Loonie below 74 cents

- Home Capital puts itself on the block

- Potash Corp. profit tops expectations

- Ford's quarterly profit slips

- Tit for tat

Presumably, you’ve got to have at least one return volley to mark the start of the war. And at this point, we’ve only had the tat in any tit-for-tat trade action between the United States and Canada.

If Christy Clark has her way, our volley would come next.

And, as they say, if it looks like a duck, swims like a duck and quacks like a duck, then it’s probably a duck.

So far, we’ve seen just one trade action, from the Americans on softwood lumber. Beyond that, there’s the bluster and the threats.

But all of this takes a toll on Canadian companies, and threatens to damage the economy even further.

“Tense negotiations will almost certainly hit investment spending from Canadian companies - already expected to be a drag on domestic growth for the year,” warned Bipan Rai, executive director of macro strategy at CIBC World Markets.

At this point, many observers say they don’t expect an all-out war, but they certainly point to that possibility.

And, of course, emotions are running high and politics are at play. Ms. Clark is in the midst of an election campaign, battling for re-election as British Columbia’s premier, and President Donald Trump appears desperate to show he has actually done something concrete, beyond a failed attempt at health care reform, in his first 100 days.

If it looks like a duck

Let’s start with softwood lumber. To recap, the U.S. has slapped preliminary countervailing duties on Canadian exports, with anti-dumping levies still to come.

As The Globe and Mails Sunny Dhillon and Wendy Stueck report, Ms. Clark is now pressing the Trudeau government to retaliate by banning thermal coal exports from B.C. ports.

To be sure, she cited environmental issues related to those shipments, but also brought the softwood lumber dispute into it.

“With the decision by the United States Department of Commerce to impose these unfair and unwarranted duties on Canadian softwood lumber exports, now is the time to align our shared values with our environmental policy,” she said in an open letter to Prime Minister Justin Trudeau.

This all sent the shares of Canada’s Westshore Terminal Investment Corp. and Cloud Peak Energy Inc. of the U.S. sliding on Wednesday. The Canadian dollar, too, has tumbled on the softwood duties.

If it swims like a duck

Ms. Clark, Mr. Trudeau and Quebec Premier Philippe Couillard are swimming against ever-rising floods (or whatever one has to say to make the analogy work).

Ms. Clark’s province has much at stake. Canadian softwood exports represent more than 30 per cent of the American market, and B.C. accounts for the lion’s share.

“Lumber and wood products account for over 3 per cent of Canadian international goods exports, with the U.S. tariffs applying to nearly half of these,” Toronto-Dominion Bank chief economist Beata Caranci, senior economist Michael Dolega and economist Dina Ignjatovic said in a report.

“The majority of Canadian lumber exports come from B.C., where the industry’s exports to the U.S. account for 2 per cent of economic output - more than quintuple the national share,” they added.

“The industry is also a significant contributor to the economies of New Brunswick and Quebec.”

As for the latter, the Quebec government has already promised to come to the aid of its industry, to the tune of up to $300-million.

If it quacks like a duck

It sure does, and most of it’s coming from Mr. Trump.

Heading into his 100th day, Mr. Trump has spent much of the last couple of weeks blaming Canada for some of America’s woes, slamming its dairy, lumber and energy industries.

Then on Wednesday, there was widespread talk that he was preparing an executive order that would lead to the U.S. pulling out of the North American free-trade agreement.

But as our Washington correspondent Adrian Morrow reports, Mr. Trump backed off that late in the day, with the White House saying that he “agreed not to terminate NAFTA and this time” after speaking with Mr. Trudeau and Mexico’s Enrique Pena Nieto.

That put a spark in the Canadian dollar and Mexican peso, but the loonie still sits below the 74-cent U.S. mark after tumbling earlier in the week.

According to Mr. Trump, in two tweets this morning:

“I received calls from the President of Mexico and the Prime Minister of Canada asking to renegotiate NAFTA rather than terminate. I agreed ... subject to the fact that if we do not reach a fair neal for all, we will then terminate NAFTA. Relations are good - deal very possible!”

Of course, that came after he warned via Twitter that “we will not stand for” how Canada is harming Wisconsin dairy farmers.

Observers believe these are signals heading into NAFTA talks, as well as trying to make good on his campaign pledges.

“Despite this tariff on softwood lumber being preliminary, it represents a strong signal that President Trump is acting on his campaign promise to ensure better trade conditions for America,” the TD economists said.

“Canada’s dairy and energy sectors have also come under scrutiny recently, and [the softwood] announcement may be a sign of more to come.”

Mr. Trudeau and his right hand on trade, Chrystia Freeland, are saying all the right things heading into negotiations. But let’s close with this from Ms. Clark’s demand of Mr. Trudeau:

“I would hope that you will join me in this important initiative, but in the event that Canada does not consider this request appropriate, please be assured that British Columbia will use the tools we have at our disposal to discourage the shipping of thermal coal through British Columbia.”

REUTERS. Apr 27, 2017. Trump tells Canada, Mexico, he won't terminate NAFTA treaty yet: White House

By Steve Holland

WASHINGTON (Reuters) - U.S. President Donald Trump told the leaders of Canada and Mexico on Wednesday that he will not terminate the NAFTA treaty at this stage, but will move quickly to begin renegotiating it with them, a White House statement said.

The announcement came after White House officials disclosed that Trump and his advisers had been considering issuing an executive order to withdraw the United States from the trade pact with Canada and Mexico, one of the world's biggest trading blocs.

The White House said Trump spoke by telephone with Mexican President Enrique Pena Nieto and Canadian Prime Minister Justin Trudeau and that he would hold back from a speedy termination of NAFTA, in what was described as a "pleasant and productive" conversation.

"President Trump agreed not to terminate NAFTA at this time and the leaders agreed to proceed swiftly, according to their required internal procedures, to enable the renegotiation of the NAFTA deal to the benefit of all three countries," a White House statement said.

"It is my privilege to bring NAFTA up to date through renegotiation. It is an honor to deal with both President Peña Nieto and Prime Minister Trudeau, and I believe that the end result will make all three countries stronger and better," Trump was quoted as saying in the statement.

The Mexican and Canadian currencies rebounded in Asian trading after Trump said the U.S. would stay in NAFTA for now. The U.S. dollar dropped 0.6 percent on its Canadian counterpart and 1 percent on the peso.

The White House had been considering an executive order exiting NAFTA as early as Trump's 100th day in office on Saturday, but there was a split among his top advisers over whether to take the step.

During his election campaign Trump threatened to renegotiate NAFTA and in the past week complained bitterly about Canadian trade practices.

It was under an executive order signed by Trump on Jan. 23 that the United States pulled out of the sweeping Trans-Pacific Partnership trade deal.

News of the potential presidential action to withdraw from NAFTA earlier drove the Mexican and Canadian currencies lower.

NAFTA TRADE HAVOC

"To totally abandon that agreement means that those gains are lost," said Paul Ferley, an economist at Royal Bank of Canada.

Trump has repeatedly vowed to pull out from the 23-year-old trade pact if he is unable to renegotiate it with better terms for America. He has long accused Mexico of destroying U.S. jobs. The United States went from running a small trade surplus with Mexico in the early 1990s to a $63 billion deficit in 2016.

Details about the draft executive order on NAFTA were not immediately available.

Trump has faced some setbacks since he took office in January, including a move by courts to block parts of his orders to limit immigration.

Withdrawing from NAFTA would enable him to say he delivered on one of his key campaign promises, but it could also hurt him in states that voted for him in the election.

"Mr. President, America's corn farmers helped elect you,” the National Corn Growers Association said in a statement. "Withdrawing from NAFTA would be disastrous for American agriculture."

DIVERGING OPINIONS

The first administration source told Reuters that there were diverging opinions within the U.S. government about how to proceed and it was possible that Trump could sign the executive order before the 100-day mark of his presidency.

The source noted that the administration wanted to tread carefully. “There is talk about what steps we can take to start the process of renegotiating or withdrawing from NAFTA,” this source said.

Mexico had expected to start NAFTA renegotiations in August but the possible executive order could add urgency to the timeline.

The Mexican government had no comment on the draft order. The country's foreign minister said on Tuesday that Mexico would walk away from the negotiating table rather than accept a bad deal.

Trump recently ramped up his criticism of Canada and this week ordered 20 percent tariffs on imports of Canadian softwood lumber, setting a tense tone as the three countries prepared to renegotiate the pact.

Canada said it was ready to come to talks on renewing NAFTA at any time.

"At this moment NAFTA negotiations have not started. Canada is ready to come to the table at any time," said Alex Lawrence, a spokesman for Canadian Foreign Minister Chrystia Freeland.

(Reporting by Steve Holland; Additional reporting by Fergal Smith in Toronto, David Ljunggren in Ottawa,; Rodrigo Campos in New York and Julie Ingwersen in Chicago; Writing by Jason Lange; Editing by Tom Brown, Bill Rigby and Michael Perry)

REUTERS. Apr 27, 2017. Oil prices fall on oversupply

By Christopher Johnson

LONDON (Reuters) - Oil prices fell on Thursday, weighed down by oversupply, but losses were limited by expectations that major exporters would agree to extend production cuts to try to rebalance the market.

Benchmark Brent crude was down 60 cents at $51.22 a barrel by 0915 GMT, almost 10 percent below this month's peak. U.S. light crude was down 55 cents at $49.07.

Traders reported ample supplies in all key markets despite efforts led by the Organization of the Petroleum Exporting Countries (OPEC) and Russia to cut output by 1.8 million barrels per day (bpd) in the first half of the year to tighten the market and prop up prices.

OPEC is discussing extending its cuts into the second half of the year, but the group has an uphill task as oil inventories are near record levels in many parts of the world.

"It is clear that the world has plenty of oil in stock, making OPEC's life that much harder," said Jeffrey Halley, senior market analyst at futures brokerage OANDA in Singapore.

U.S. data on Wednesday showed a drop in crude oil stocks, but gasoline inventories surged as refiners produced more fuel than the market could consume.

"U.S. commercial stocks increased by more than 6.5 million barrels last week," said Tamas Varga, senior analyst at London brokerage PVM Oil Associates. "Stock rebalancing has been put on hold as U.S. commercial oil inventories have jumped."

U.S. crude oil production is also rising, up 10 percent since mid-2016 at 9.27 million bpd.

Rystad Energy expects U.S. shale oil output to grow by 100,000 bpd each month for the rest of this year and into 2018 if oil prices hold around $50-$55 a barrel, well above estimates by the U.S. Energy Information Administration for monthly gains of about 29,000 bpd in 2017 and 57,000 bpd in 2018.

"We see a risk for a weaker oil price towards the end of the year ... because shale is delivering so much oil," Jarand Rystad told Reuters.

Still, with an expectation that OPEC will extend its production cuts to cover all of 2017, analysts said there was support for prices around current levels.

"Brent oil looks neutral in a range of $51.30 to $52.32," said Reuters technical commodities analyst Wang Tao.

(Additional reporting by Henning Gloystein in Singapore; Editing by David Goodman)

BLOOMBERG.2017 M04 26. Trump Rules Out Swift Nafta Exit in Favor of Renegotiation

by Jennifer Jacobs and Andrew Mayeda

- U.S. to pursue talks with Mexico and Canada, White House says

- Trump aides said to be divided over how aggressively to move

President Donald Trump won’t immediately terminate U.S. participation in the North American Free Trade Agreement, the White House said, after he spoke with the leaders of Mexico and Canada about ways to renegotiate the accord.

“Both conversations were pleasant and productive. President Trump agreed not to terminate Nafta at this time and the leaders agreed to proceed swiftly, according to their required internal procedures, to enable the renegotiation of the Nafta deal to the benefit of all three countries,” the White House said in a statement late Wednesday. Mexico’s peso and Canada’s dollar jumped after the White House’s announcement.

Trump on the campaign trail last year made a hawkish vow to pull out of Nafta -- which he repeatedly called the “worst trade deal ever” -- if the U.S. didn’t get a better deal through immediate renegotiation. His decision Wednesday marks a continuing softening of his rhetoric on trade, after he recently said he would not declare China a currency manipulator, another campaign promise.

Trump said on Twitter on Thursday morning that he received calls from the leaders of Mexico and Canada, Enrique Pena Nieto and Justin Trudeau, “asking to renegotiate NAFTA rather than terminate.” Trump said he agreed, “subject to the fact that if we do not reach a fair deal for all, we will then terminate NAFTA. Relationships are good-deal very possible!”

Advisers’ Debate

Trump’s top advisers had been embroiled in a debate over how aggressively to proceed on reshaping U.S. participation in Nafta, with hard-liners favoring a threatened withdrawal as soon as this week and others advocating for a more measured approach to reopening negotiations with Canada and Mexico.

Some of Trump’s advisers wanted a dramatic move before Trump’s 100th day in office on Saturday to fulfill a key campaign promise, while others said he could let the milestone pass and revisit the issue later through more formal procedures, according to two White House officials who spoke on condition of anonymity to discuss internal deliberations.

The dispute played out in the media Wednesday, with several outlets saying Trump would take the most dramatic available option-- issuing an order declaring his intention to withdraw from the treaty. In this case, threatening to withdraw would have amounted to a formal step that started the process of giving Mexico and Canada six months notice that Trump intended to start negotiating.

Exactly who in the White House sparred over the decision wasn’t known, but one of the most prominent anti-trade hard-liners is senior counselor to the president Steve Bannon, and Trump’s decision is sure to be viewed as a defeat for Bannon and his views. Bannon already is seen as being on the outs with Trump over reportedly sparring with Trump’s son-in-law Jared Kushner.

New Talks

Instead of announcing his intent to withdraw from the agreement, Trump is asking the two other nations to open talks on ways to make the deal more balanced from the U.S. perspective, which is allowed within the framework of the treaty. His conversations with Pena Nieto and Trudeau took place late Wednesday afternoon, according to the White House.

“It is my privilege to bring Nafta up to date through renegotiation,” Trump said in the White House statement. “I believe that the end result will make all three countries stronger and better.”

Commerce Secretary Wilbur Ross told CNBC on Thursday that Mexico and Canada appear to be ready to start renegotiations of the trade pact. One of the issues he said the U.S. wants to target is the rules regarding country of origin of products sold under the deal. He said that Mexico’s trade deficit with China is approximately equal with their trade surplus with the U.S., indicating that products made in China are being sold under Nafta.

“The whole idea of a trade deal is to build a fence around participants inside and give them an advantage over the outside,” Ross said. “So there is a conceptual flaw in that -- one of the many conceptual flaws in Nafta.”

‘Bring Pressure’

Talk that Trump would revisit Nafta on Wednesday had caused Mexico’s peso, the Canadian dollar and shares of companies that rely on cross-border trade to plunge.

“Even if he notifies Mexico and the U.S. of his intentions, that doesn’t mean he has to leave,” said Beatriz Leycegui, who was Mexico’s deputy minister on foreign trade between 2006 and 2011. “This is a strategy to bring pressure on Canada and Mexico.”

Trump must give Congress 90 days notice that he seeks to renegotiate the accord. Ross said on Tuesday that the administration is busy working with lawmakers to kick start renegotiation of the deal, and that the U.S. was embarking on a more muscular strategy for trade-enforcement.

Trump has blamed Nafta for hollowing out America’s manufacturing sector by relocating jobs to lower-cost Mexico -- which his administration initially said was the main target of changes he was seeking to the accord.

‘Disastrously Bad’

Where Trump stands on Nafta has been hard to discern. After harsh rhetoric during the campaign, he has in recent weeks toned down his criticism, suggesting the relationship with Canada only needs tweaking. This week, he fueled trade tensions by imposing new duties on softwood lumber imports from Canada and vowing to defend U.S. dairy farmers against quotas imposed in Canada.

A number of Republicans are strong backers of free trade and have cautioned the administration against walking away from the free-trade deal.

“Scrapping Nafta would be a disastrously bad idea,” Republican Senator Ben Sasse of Nebraska, who was a Trump critic during the campaign, said Wednesday in a statement. “It would hurt American families at the check-out, and it would cripple American producers in the field and the office.”

Republican Senator Jeff Flake of Arizona also blasted the idea on Twitter, writing, “Increasing trade barriers with CAN and MEX will result in lost jobs and higher consumer costs in #AZ. Strengthen #NAFTA, don’t abandon it.”

Without Nafta -- which reduced or eliminated tariffs on most trade products after taking force in 1994 -- commerce ties between the nations would need to be reset, raising the specter of more frequent trade disputes and higher tariffs.

U.S. trade with its Nafta partners has more than tripled since the agreement took effect, rising to $1.1 trillion last year. Canada followed by Mexico ranked as the two biggest markets for U.S. exports, taking in a combined 34 percent of the total in 2016, according to a February paper published by the Congressional Research Service.

BLOOMBERG. 2017 M04 26. Coal Caught in U.S.-Canada Lumber Trade War Sends Stocks Sliding

by Greg Quinn , Natalie Obiko Pearson , and Tim Loh

- Canadian province’s premier seeks ban in letter to Trudeau

- Clark says B.C. may act alone on U.S. coal shipments if needed

U.S. coal has become entangled in a trade war between the U.S. and Canada over lumber.

British Columbia Premier Christy Clark urged Canadian Prime Minister Justin Trudeau in an open letter Wednesday to ban U.S. coal shipments from the country’s westernmost province in retaliation for the Trump administration’s new tariffs on softwood lumber. The move sent Canadian export terminal operator Westshore Terminals Investment Corp. and U.S. miner Cloud Peak Energy Inc. plunging on Wednesday.

“I told British Columbians that I would use every tool at our disposal to ensure we get a fair deal on softwood lumber,” Clark said in the letter. “Friends and trading partners cooperate,” she said, and “clearly, the United States is taking a different approach.”

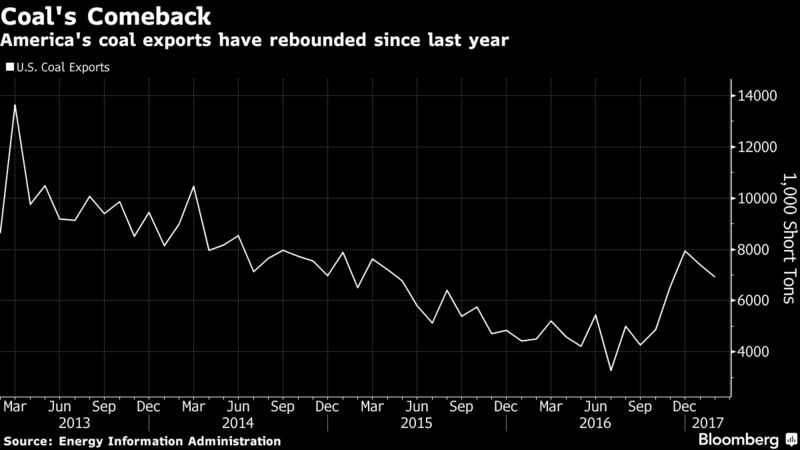

The call for a coal ban underscores the tensions flaring between the two governments over everything from lumber, to the North American Free Trade Agreement, to the dairy industry. It also comes at a time when Canadian terminals have grown in importance for U.S. miners looking to get their coal to Asian markets. Export projects on the U.S. West Coast have been stalled by environmentalists, limiting their options. President Donald Trump has repeatedly vowed to help revive the U.S. coal industry.

Clark said that, if Canada’s federal government doesn’t act on the request, she’ll take her own steps to discourage the trade. Some 6.2 million metric tons of U.S. thermal coal passed through Vancouver’s sea port last year, she said. Such a ban could hurt Cloud Peak and Lighthouse Resources Inc., which have both shipped coal through Westshore’s terminal south of Vancouver.

“Asking for the ban on U.S. coal exports through B.C. ports is probably more for show than for action,” said Ilan B. Vertinsky, an international business studies professor at the University of British Columbia in Vancouver. “It is also clear that the federal government is unlikely to comply.”

Carefully, Seriously

Cameron Ahmad, a spokesman for Trudeau, said by phone that his office considers any request from a premier “carefully and seriously.” The White House didn’t immediately respond to a request for comment.

Cloud Peak slid 6.6 percent to close Wednesday at $3.66, the lowest since September. The company “values our Canadian trading partners and hopes this matter is resolved to benefit all interests,” spokesman Rick Curtsinger said. Westshore fell 12 percent in Toronto, the biggest loss since December 2O15, to C$23.03.

Cloud Peak rivals Peabody Energy Corp. and Arch Coal Inc., which also mine coal in the Powder River Basin of Wyoming and Montana, won’t be as affected because they don’t ship much out of Canada, Jeremy Sussman, an analyst at Clarksons Platou Securities Inc., said by phone.

“For us to get excited about Cloud Peak’s shares, we’d need to get excited about the export market and this would make it impossible to do that,” he said.

‘Misguided’ Proposal

RBC Capital Markets equity analyst Walter Spracklin cut his rating on Westshore to the equivalent of hold from buy. Nick Desmarais, a Westshore spokesman, said by phone that Clark’s proposal is "misguided" and that she "doesn’t have the power" to carry it out.

U.S. producers have also used Ridley Terminals Inc. at Prince Rupert port in northern British Columbia.

On Monday, the U.S. Commerce Department announced countervailing duties of up to 24 percent on softwood lumber from Canada. The move intensified an already simmering dispute after Trump attacked the Canadian dairy industry last week and reiterated his misgivings about the benefits of the North American Free Trade Agreement.

________________

LGCJ.: